Background

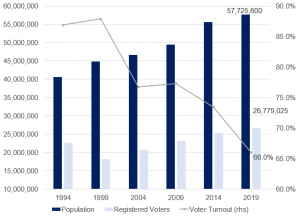

South Africa (SA) voted on Wednesday, 8 May, in what was probably the most important general election since the dawn of democracy. In what follows, we look at the results provided by the Independent Electoral Commission (IEC). We note that despite some issues (voters’ indelible ink being easily removed, a few reports of double voting etc.) the IEC has declared the election as being “free and fair”. Surprisingly, from the data, voter turnout was very low with 17.7mn total votes (65.99% of the 26.8mn registered voters- see Figure 1). There were 235,449 spoilt ballots.

Figure 1: Voter turnout: 1994-2019

Source: News24.com, Wikipedia, Stats SA, Anchor

Voter turnout

The voter turnout of 65.99% was far lower than expected and is below the 73.5% recorded in the 2014 election, with the Southern African Development Community (SADC) election observers raising concern over the poor youth voter turnout. Julius Malema’s Economic Freedom Fighters (EFF) has become the official opposition in three provinces and grown to 10.8% nationally. However, with the ANC garnering a majority nationally as well as in all provinces except the Western Cape, the EFF’s mooted pre-election role as kingmaker and the likelihood of EFF party members entering government posts by coalition agreements is no longer relevant. While its numbers swelled in the national assembly its performance does nevertheless seem lower relative to what some pollsters and the party itself had predicted. A possible reason being the lower-than-expected youth turnout (the EFF’s biggest support base) vs older voters. It could also indicate that a smaller-than-expected number of voters support some of the EFF’s more radical ideas, and it would seem from these election results that, in general, South Africans reject the more radical left and right, instead preferring more centrist parties (ANC and the DA). The c. 58% performance from the ANC and the party retaining Gauteng with a majority of 53.2%, is likely to be positive for the country (and the JSE) and is a sign that voters are giving Ramaphosa the required mandate to effect change.

ANC election performance and the Ramaphosa effect

Although there was little doubt before the election that the ANC would emerge victorious, the margin of victory was unclear. Several political commentators argued that should President Cyril Ramaphosa not lead the ANC to a substantial victory (c.55%-60% of the national vote), it would weaken his position within the ruling party and, eventually, could lead to his downfall as the so-called Zuma faction saw themselves strengthened. However, Ipsos polls before the elections showed unprecedented support for Ramaphosa both in terms of popularity and competency, while the ANC did not fare anywhere near as well. Susan Booysen, director of research at the Mapungubwe Institute for Strategic Reflection, told BusinessTech recently that since Ramaphosa assumed office (on 15 February 2018), “the ANC has experienced a resurgence.” According to Booysen, in the last month of Zuma’s rule (January 2018), the party “had slipped below the 50% mark, …”. We agree and believe that had Zuma still been the face of the ANC, the party would have easily dropped below the 50% mark and lost Gauteng.

Ramaphosa has proven to be extremely popular with voters (more so than his party) and has even led to people not usually aligned to the ANC contemplating voting for him to strengthen his so-called reform agenda. This, as he promises to root out corruption and “renew” the ANC. While it has since worn off, the initial bout of ‘Ramaphoria’ during the first few months of his presidency took the wind out of the sails of the major opposition parties (the DA and EFF – as can be seen from the election results vs the local elections), for whom Zuma was a blessing in disguise.

The key now is for Ramaphosa to show leadership with the appointment of his new cabinet, which is expected to be the first key message he sends to global and local investors. In terms of the Constitution, the President has absolute power to appoint the deputy president and ministers and to dismiss them. Ramaphosa is expected to announce the make-up and size (which by all accounts is set to be cut from the bloated cabinet of the Zuma years) of his new cabinet by around 21 May, as the presidential inauguration takes place on 25 May. His cabinet appointments should tell us more about his intentions (and whether he has been able to sideline the so-called Zuma-aligned party members). More importantly, it will be a truer test of his ability to execute on his promises to rid the country of rampant corruption.

The hope is that he will remove tainted and controversial Zuma-era cabinet ministers such as Bathabile Dlamini, Mosebenzi Zwane, Malusi Gigaba, Nomvula Mokonyane, former state security minister David Mahlobo and his successor, Bongani Bongo (all of whom appear high on the lists the party submitted to the IEC). The chances of all these names falling are, however, slim. Most are quite high in the ANC NEC but, even if Ramaphosa is able to remove half of these individuals from cabinet, it will likely be seen as a victory, not only for SA but also for him and his position in the party.

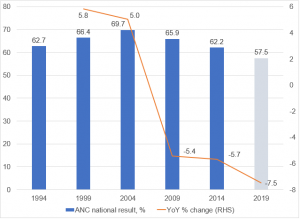

Our base case comes to fruition

Our own base-case scenario for a relatively strong ANC election win (ANC gets 58% or more of the vote nationally) has materialised with the ANC winning 57.5% of the vote nationally. We view the result as providing a mandate for Ramaphosa to continue his reform and anti-corruption drive, which is positive for SA investor confidence. Even though the ANC’s national majority has been reduced to below 60% for the first time, and is down 7.5% from 2014, we highlight that it is significantly higher (by 6.7%) vs the ANC’s performance in the local government elections when it garnered 53.9% support overall.

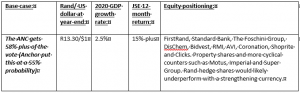

These results should, in turn, see strong inflows into the SA equity market. Recent market performance has indicated support for this view, although we repeat that Ramaphosa will need to show strong leadership and take meaningful actions in order to reinforce confidence. In Figure 2 below, we highlight our base-case scenario as it appeared in our initial election note entitled, Elections 2019: How to position your portfolio.

Figure 2: Our base-case scenario on the 2019 general election

Source: Anchor

To summarise, Anchor’s base-case scenario (at a 55% probability), expected the ANC to get 58%-plus of the vote. With the final tally within a whisker of this scenario, we believe that the current ‘repair’ scenario should maintain its momentum, with Ramaphosa emboldened and seen as having received the required mandate from voters to solidify his position and to steer ahead unfettered with his anti-corruption and growth agenda. Ramaphosa is expected to assemble a new cabinet, with few Zuma cronies or compromised individuals. He is also expected to make headway in managing divisions within the ANC, gaining the support of the ANC caucus and the NEC, as he intensifies the fight against corruption and state capture.

This, in turn, will be positive for the local economy and we are likely to see more inflows of foreign direct investment (FDI) and local investment into SA as ANC policies are (hopefully) clarified, especially those related to expropriation without compensation (EWC), the nationalisation of the SA Reserve Bank (SARB) etc. A more certain future overall, with Ramaphosa perhaps serving two terms, boosting the JSE (bar any external offshore factors) and the rand strengthening. Here we recommend high exposure to SA Inc. shares (see Figure 2 above), especially the quality counters where foreigners take their exposure.

Hence, we are maintaining meaningful exposure to SA Inc. shares, but retaining a diversified portfolio. Importantly, investors should be ready to react as the SA political drama unfolds. SA has serious structural issues and the advances made in solving these are equally important. It should also be borne in mind that many of the factors impacting equity markets are global in nature and the SA political outcome is just one of the contributors.

The ANC cabinet – revamped?

With the ruling party having experienced a serious credibility crisis over the past few years and being deeply divided between the so-called Ramaphosa (constitutionalists, reformist, anti-corruption) and the Zuma factions (now seemingly headed by ANC Secretary General Ace Magashula), a strong victory was not at all a certainty, although Ramaphosa’s charisma seems to have carried the ANC through.

However, the Herculean task of getting SA’s economy back on track now starts officially and it will be interesting to see the make-up of Ramaphosa’s cabinet once that announcement is made. With a clear ANC election win on a national level, it is Ramaphosa’s prerogative to appoint a cabinet (in consultation with the ANC and its alliance partners) and who he chooses may well give South Africans a better idea of the ANC’s commitment to rooting out corruption.

Ramaphosa is, by all accounts, the complete opposite when compared to Zuma in terms of his governing style – he is a modern leader for whom the rule of law is paramount. Following years in the trade union movement and in business, Ramaphosa is an astute negotiator and a cautious strategist who wants to unify a divided ANC and tripartite alliance. If Ramaphosa, the constitutionalist, reformist (and one of the authors of our constitution), emerges victorious, with a strong mandate (which seems to now be the case), political commentators believe he can continue “gloves off” with his current reform agenda.

By quickly consolidating his power after his election victory, Ramaphosa might be able to rid the once-proud liberation movement of those individuals implicated in State Capture and their “fightback” campaign. This, in turn, will be positive for SA, and the country might finally see renewal and growth again, having left the disastrous 9 years of ex-President Jacob Zuma’s rule behind it.

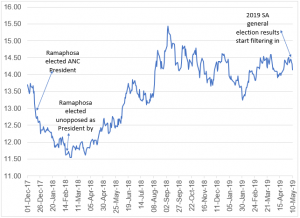

We note that the rand exchange rate posted gains against a strong dollar for the third day in a row on Friday (10 May) as the ANC seemed set for a convincing victory nationally, whist also maintaining majority control over SA’s economic hub of Gauteng.

Figure 3: Rand vs US dollar exchange rate: December 2017-10 May 2019

Source: Bloomberg, Anchor

The 2014 election vs 2019 election

In the last general election (2014), the votes received by the top-5 political parties are shown in Figure 4 below. The ANC earned 62% of the national vote vs 65% in 2009. ANC support further dwindled in the 2016 municipal elections – it received only 53.9% of the national vote and lost key metropolitan municipalities (Johannesburg, Tshwane and Nelson Mandela Bay). Of the total 25.39mn voters in 2014, 73.48% voted with 18.4mn valid votes cast. Spoilt votes totaled 252,274 (these were likely disillusioned ANC voters spoiling their ballots instead of voting for another party). According to the IEC, this year’s voters roll contains 26.8mn voters, higher than in 2014 but, nevertheless, indicating 10mn-plus citizens of voting age have chosen not to register to vote in this election. Of these, 65.99% actually voted (see Figure 1), with spoilt votes at 235,472.

Figure 4: ANC historical performance nationally

Source: elections.org, Anchor

As can be seen from Figure 4 above, prior to this year’s election, the ANC posted its worst YoY election losses, down 5.4% and 5.7% YoY in 2009 and 2014, respectively, during the Zuma years. We note that following the “recall’ of Thabo Mbeki in 2008, a faction split from the ANC to form COPE, while the EFF was formed in July 2013, less than a year before the 2013 election, when Malema was kicked out of the ANC.

Recent poll data indicated that the ANC was likely to win with a 55%-60% majority, which Anchor and many other political commentators saw as the required percentage for Ramaphosa to lead in a less constrained way. Our base case of the most likely outcome was for the ANC to get 58%-plus of the vote (we put this at a 55% probability). The strong Ramaphosa/ ANC win could see the market rally on expectations of greater policy certainty, improved state-owned enterprises (SOE) leadership and a better growth outlook.

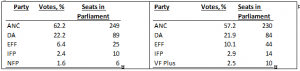

In terms of parliamentary seats, there are 400 seats in total (MPs serving in parliament) during a five-year term. With voter turnout standing at c.17.4mn or 65.99% of the 26.8mn registered voters, IEC officials will have to divide the total number of actual votes (17.4mn) by the number of Parliamentary seats (400). So, in order to earn a single seat for an MP, a party would have to secure c. 43,500 votes. Below, we highlight the seats received by the top-5 parties in 2014 and the top-5 parties in the 2019 election – giving readers an idea what our sixth democratic Parliament will look like. The national assembly now has 14 political parties represented, with the ANC and the DA losing 19 and 5 seats each, respectively, and the EFF and VF Plus gaining 15 and 6 seats each, respectively.

Figure 5: 2014 (LHS) and 2019E (RHS) general elections: Top-5 parties’ seats in Parliament

Source: IEC, Anchor

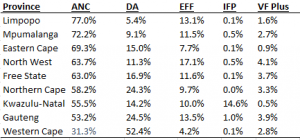

The Provinces:

Figure 6: 2014 (LHS) vs 2019 (RHS) provincial election winners, %

Source: elections.org, Anchor. *Note Western Cape is DA stronghold

In terms of the provinces, while all eyes have been on Gauteng as the major battleground, it is also interesting to see the ‘messages’ provincial voting outcomes have sent especially in the Supra and Ace tainted provinces of the North West and the Free State – both have seen gains for the EFF (17.1% vs 12.53% in 2014) and the DA (16.9% from 16.2%), respectively, although the ANC remains the majority party by a significant margin in both.

In terms of Gauteng, the retention of which was of critical importance for the ANC, the party received 53.2% of the vote (retaining the province with a majority), while the DA disappointed vs projections and coming in at 24.5%, with the EFF at 13.5%. A concern going into the election was that the EFF would secure enough Gauteng votes to derail Ramaphosa’s reform momentum. However, this has clearly not materialised. In addition, there was also the risk that the ANC would need the EFF to form a ruling coalition in the province, making the EFF so-called kingmakers in Gauteng. As highlighted above, this notion too has now likely disappeared.

Nevertheless, the EFF have done well in the following provinces where it will be the official opposition – Limpopo (13.1%), Mpumalanga (11.5%), and the North West (17.1%), while the IFP has emerged as the official opposition in KwaZulu-Natal with 14.6% of the vote. In the Western Cape, the DA will hold onto the province with a 52.4% victory, although we note here that Patricia de Lille’s GOOD party (with c. 2.2% of the vote) has definitely attracted a number of ex-DA voters.

Likely the biggest surprise contender of this election was not, as many thought the EFF, but rather the Freedom Front Plus (2.4% of the vote nationally), which cemented its position among the top-five parties in parliament, while also improving significantly in most provinces. This again is likely a result of the more conservative DA voter base moving to the FF-Plus, another reason the DA’s performance disappointed.

Figure 7: Votes by province: Top-5 parties nationally, 2019

Source: elections.org, Anchor

Conclusion

SA turned a corner when Cyril Ramaphosa was elected ANC president at the party’s elective conference in December 2017. Many positive moves have been made since as discussed in our report entitled Investment scenarios for the SA general election. However, not surprisingly, there is strong opposition within a faction of the ANC against moves by Ramaphosa to curb corruption and revive embattled SOEs. Our base case is for this direction to be sustained and this could see underweight foreign fund managers direct financial flows back into the SA market. The offshore component of the JSE should provide support and, since our base case of a positive SA scenario has unfolded (with Ramaphosa being given the required mandate to pursue his reform agenda), we could see a material bounce in local equities. However, our bets are measured, and we are managing portfolios with one eye carefully on the risks.

Jobs will be created by the private sector only within a favourable investment environment and not with policy uncertainty, corruption, doublespeak and EWC hanging over our collective heads. No-one will invest if they believe their money or investment isn’t safe. The ruling party needs to send clear messages after this election regarding its policies and we need a renewed collaboration between government, business and labour in order to place the country on a renewed growth path – away from conflict to joint goals around growth that will, in turn, create jobs and a thriving economy.

While we continue to have a positive stance on local equities, the future is far from certain despite our base-case scenario unfolding with the ANC election outcome. Being nimble is as important as it has ever been, and we will be quick to act in the best interests of our clients. Investors in the SA market have been going through emotional turmoil for a while now, with worsening local news and a difficult operating environment for businesses (although the global backdrop had proved supportive). Hence, sectoral exposure is increasingly critical, and these could be materially differentiated over the coming months. However, we believe as it currently stands an emboldened Ramaphosa could lead to more certainty as well as more definitive policy measures which are likely to boost the flagging SA economy.