It is important to emphasise that, in this note, we only consider the impact of various ANC-win scenarios on SA and we do not examine the possible performance of any other political party, due to the size of the ANC and its dominance of the SA political landscape over the past 25 years. We highlight that the report which follows does not endorse the ANC or any political party but is purely a possible future-scenario exercise for investors.

Summary

Our base case is for a relatively strong ANC election win in May and a mandate for President Cyril Ramaphosa to continue with his reform and anti-corruption drive. This will improve investor confidence and should see strong inflows into the South African (SA) equity market. Recent market performance has indicated support for this view. However, this is by no means a certainty and risks are elevated. In addition, Ramaphosa will need to show strong leadership and take meaningful actions in order to reinforce confidence. Different election outcomes could have vastly different equity market, growth and currency consequences. We are hence maintaining meaningful exposure to SA Inc. shares but retaining a diversified portfolio. Importantly, investors should be ready to react as the SA political drama unfolds, with a close eye on the balance of power in the provinces. SA has serious structural issues and the advances made in solving these are equally important. It should also be borne in mind that many of the factors impacting equity markets are global in nature and the SA political outcome is just one of the contributors. However, various segments of the SA market could perform very differently in the varying scenarios. At the end of this document we outline our expected outcomes for different election results.

Background

South Africans will be voting on Wednesday, 8 May, in what is probably the most important general election since the dawn of democracy in 1994. While there is little doubt that the ANC will emerge victorious, a more important question for SA and for investors is the margin of that victory. Below, we discuss the current state of the ruling party since Cyril Ramaphosa’s ascendancy to the presidency and we dissect various possible scenarios related to the ANC’s performance in the upcoming election. With the ruling party experiencing a serious credibility crisis and being deeply divided between the so-called Ramaphosa faction (constitutionalists, reformist, anti-corruption) and the Zuma faction (now seemingly headed by ANC Secretary General Ace Magashula), the size of an ANC election victory is likely to have consequences for ordinary citizens for decades to come.

Where are we currently?

Ramaphosa is, by all accounts, the complete opposite when compared to Zuma in terms of his governing style – he is a modern leader for whom the rule of law is paramount. Following years in the trade union movement and in business, Ramaphosa is also an astute negotiator and a cautious strategist who wants to unify a divided ANC and tripartite alliance. If Ramaphosa, the constitutionalist, reformist (and one of the authors of our constitution), emerges victorious, with a strong mandate (c. 58%-60% of the vote), political commentators believe he can continue “gloves off” with his current reform agenda. By consolidating his power, Ramaphosa might be able to rid the once-proud liberation movement of those individuals implicated in State Capture and their “fightback” campaign. This, in turn, will be positive for SA, and the country might see renewal and growth once again, having left the disastrous 9 years of ex-President Jacob Zuma’s rule behind it.

In contrast, a marginal ANC victory could lead to Ramaphosa’s detractors blaming him for the party’s losses with some opposition parties and political commentators already claiming that dissident ANC factions plan to remove him as ANC president. Should that happen it will set the reformist, anti-corruption agenda (which has been ongoing since February 2018) back decades, if not completely smothering it. Recalling a sitting president is not as easy to do (as we saw with Zuma’s presidency) and although the National Executive Committee (NEC) can, according to the ANC constitution, “recall any public representative”, the ANC has in the past been reluctant to recall a party president without consulting wider structures as it undermines the will of the delegates expressed at an electoral congress (we note ex-President Thabo Mbeki resigned when it was clear the ANC didn’t want him as president). The NEC can, however, convene a Special Conference of the ANC “at any time … at the request of the majority of the provinces”, but has to give at least one month’s notice and branches have to be represented “in proportion to their membership”. Would the ANC really want the embarrassment of a third SA president not serving out his term?

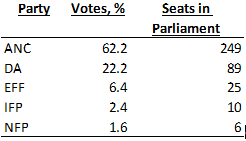

Looking back, in the last general election held in 2014 the votes received by the top-5 political parties are shown in Figure 1 below. The ANC received 62% of the vote vs 65% in 2009. ANC support further dwindled in the 2016 municipal elections – it received only 55% of the national vote and lost key metropolitan municipalities (Johannesburg, Tshwane and Nelson Mandela Bay).

Of the total 25.39mn voters in 2014, 73.48% voted with 18.4mn valid votes cast. Spoilt votes totaled 252,274 (these were likely disillusioned ANC voters spoiling their ballots instead of voting for another party). According to the Independent Electoral Commission of South Africa (IEC), this year’s voters roll contains 26.77mn voters, higher than in 2014 but, nevertheless, indicating 10mn-plus citizens of voting age have chosen not to register to vote in this election.

Figure 1: 2014 general election results (top-5 parties):

Source: elections.org, Anchor

How did the SA economy fare under various ANC presidents?

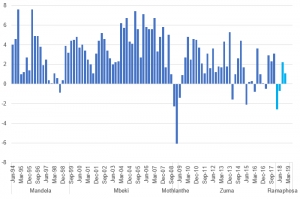

During the Nelson Mandela (1994-1999) and Thabo Mbeki (1999-2008) presidencies, SA’s economy thrived as government adopted austere economic policies and the country moved from bankruptcy (under apartheid, pre-1994) to a budget surplus. However, Zuma’s disastrous tenure dragged SA back to pre-1994. As Figure 2 below shows, under Mbeki, the local economy entered negative territory in only one quarter (4Q08), which was likely due to the global financial crisis (GFC). The average GDP growth rate was at 4.2% for Mbeki’s presidency with the country recording 37 consecutive quarters of positive economic growth (Trevor Manual was Mbeki’s finance minister). After Mbeki resigned (effectively recalled), and Kgalema Motlanthe was placed in the position of interim president, SA posted its first recession (1Q09 and 2Q09 saw negative growth) since the advent of democracy. During the Zuma years, average GDP growth slowed to c. 1.8% for the period of his presidency (which ended in February 2018). While this was also due to some extraneous factors, policy uncertainty, corruption on an unprecedented scale (Guptas, Bosasa etc.), a revolving door of finance ministers etc. kept investment (both foreign and domestic) away.

Figure 2: GDP (QoQ annualised growth) under each of the democratic presidents

Source: Bloomberg, Anchor

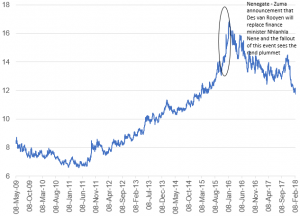

Looking at the rand vs US dollar exchange rate, when Zuma took office (9 May 2009), it stood at c. R8.27/$1. However, the average exchange rate for 2017 (the last year of Zuma rule – he left office on 14 February 2018) was at R13.31/$1 – a c.61% depreciation for the period he was president vs a c. 30% decline in the rand during Mbeki’s presidency. When Mbeki took over from Mandela, the unemployment rate stood at c. 22% – according Stats SA’s latest Quarterly Labour Force Survey (4Q18) it is currently at 27.1%.

Figure 3: Rand vs US dollar exchange rate – Zuma years

Source: Bloomberg, Anchor

The fragility of the SA economy (with opposing forces in the ANC making the right economic outcome difficult to achieve) is underscored by the fact that Moody’s may downgrade SA’s sovereign credit rating to junk in November (or before), joining Fitch and S&P, which already have SA at sub-investment grade. Moody’s is the only major ratings agency that has SA at ‘investment grade’ – one notch above junk (with a stable outlook). If Moody’s decides to downgrade the country, it will results in SA falling out of key gauges such as the Citigroup World Government Bond index, which may in turn prompt investors to dump as much as R100bn of SA assets, increasing the cost of debt and putting more pressure on the rand.

Structural issues facing the country

Debt (a combined c. R1.6trn) and corruption at state-owned enterprises (SOEs), such as Eskom, SAA, Transnet, SABC etc., spiraled out of control during Zuma’s tenure. Eskom’s debt alone is now c. R420bn (15% of all sovereign debt), and the situation is so dire the entity has to borrow funds to pay interest on this debt and to try keep the lights on. Thus far, Ramaphosa has been carefully walking a tightrope – at ease with having the law take its course, while at the same time careful to “appease” the so-called Zuma faction of the ANC. Ramaphosa’s December 2017 elective conference victory as ANC president, was clinched by a very slim margin (less than 200 votes out of the c. 5,000 cast by delegates), indicating a questionable command of the party’s reins. The composition of the 86-member NEC is also reportedly split virtually 50/50 in terms of Ramaphosa supporters and those in the Zuma camp. Ramaphosa, it would seem, is trying to prevent a split in the party similar to what happened when ex-president Mbeki resigned, and Cope was formed. By all accounts, he wants to negotiate a path forward with what is a divided organisation.

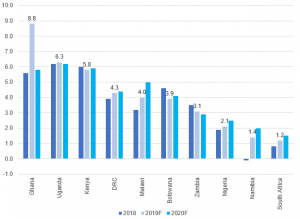

While winning (or losing) elections are one thing, SA has numerous structural issues facing the country (some already mentioned above), which Ramaphosa has to address before the situation becomes even more untenable with Eskom and the continued possibility of loadshedding the largest threat to the economy. Despite SA’s economy being the second-biggest in Africa (after Nigeria), it cannot seem to rid itself of the deep-rooted structural inequalities that are holding back growth and development due to the rampant corruption that has plagued the country over the past decade. SA’s economic performance has been one of the weakest in sub-Saharan Africa (SSA), with the IMF recently lowering its 2019 forecast for real GDP growth to 1.2% (from 1.4% in February).

Figure 4: IMF GDP growth data (select African countries)

Source: IMF, Anchor

Note sorted according to 2019 forecast GDP growth of each country

Last year, Stats SA said that there are 13.5mn South Africans living below the food poverty line. We have a high unemployment rate, with a vast imbalance between unemployed blacks and whites (including graduates). So, unless there’s considerable economic growth, it will prove difficult for government to achieve its 15% unemployment reduction goal. There are also challenges facing the healthcare system, which is confronting a massive disease burden, while the quality of school education for most is substandard. The legacy of corruption is not only undermining the legitimacy of the state, but, tragically, impacting service delivery to voters, especially the most vulnerable.

The IMF’s recent downgrade of SA’s growth to 1.2% means, in context, that our growth rate is far below the emerging market (EM) average (4.4%), the global average (3.3%), and is also lower than that of SSA (+3.5%). March data from the South African Chamber of Commerce and Industry (SACCI) showed that business confidence was at its lowest level this year, with the index dropping to 91.8 in vs 95.1 in January and 93.4 in February. In March 2018 it stood at 97.6.

Jobs will be created by the private sector only within a favourable investment environment and not with policy uncertainty, corruption, doublespeak and expropriation without compensation (EWC) hanging over our collective heads. No-one will invest if they believe their money or investment isn’t safe. The ruling party needs to send clear messages regarding its policies and we need a renewed collaboration between government, business and labour in order to place the country on a renewed growth path – away from conflict to joint goals around growth that will, in turn, create jobs and a thriving economy.

What has Ramaphosa achieved thus far?

While Ramaphosa has made some commendable decisions and changes, many commentators have highlighted that it will take years for him to address the problems facing SA due to the destroyed administration he inherited from Zuma. To make matters worse, he also has to watch his back in terms of those above-mentioned Zuma allies within the ANC, who do not want their patronage network/s dismantled.

Despite the challenges, we view Ramaphosa as a far wilier politician than most expect (he did after all negotiate at CODESA, spent years in the National Union of Mineworkers [NUM], was elected ANC secretary-general and headed the ANC team that negotiated SA’s transition to democracy). By allowing the law to take its course, he is not taking it upon himself to act against “comrades” and risking the ire of some in the ANC, but rather doing it ‘by the book’. Unfortunately, as the saying goes the wheels of justice turn slowly (but grind exceedingly fine). A punch-drunk SA public is on a weekly basis being bombarded with more revelations around corruption and no arrests but, unlike under Zuma’s tenure, there does seem to be consequences. Ramaphosa’s attempted clean-up has seen several commissions being set up by the president and a number of initiatives launched by Minister of Public Enterprises Pravin Gordhan, including new boards at SOEs, lifestyle audits and difficult questions being asked around the financial (mis)management of SOEs.

In terms of just some of his achievements in his c. 14 months in office, while critics have accused him of being slow to act and keeping corrupt Zuma-era cabinet members, Ramaphosa has, in addition to the above, overseen the release of a new, more business friendly, Mining Charter, and given attention to issues at SOEs. He has also been on a charm offensive to boost SA’s investment profile, charming global business leaders in Davos and assuring them the country is open for business (although we note that 10 consecutive days of power cuts implemented by Eskom in March may have given some investors second thoughts). Last year, Ramaphosa announced he is targeting $100bn in investment to SA by 2023 and, at the end of an investment conference held in October, he had received combined investment pledges of R290bn. According to the latest SA Reserve Bank (SARB) data, foreign direct investment (FDI) more than doubled in 2018 (R70.7bn vs 2017’s R26.8bn), reaching its highest level in five years.

In our view, criticism that Ramaphosa is moving too slowly against those implicated in corruption is to a large degree unfounded. The public don’t seem to appreciate what he has accomplished in a short space of time since his inauguration (February 2018), especially considering the opposing forces at work within the ANC and the Zuma faction making his reform agenda extremely difficult. Since his inauguration four commissions of inquiry have started their work. One commission’s report is public (the SARS commission, which resulted in the firing of compromised SARS boss Tom Moyane), while another is with the president (the Mokgoro commission into the fitness to hold office of Zuma-aligned National Prosecuting Authority [NPA] advocates Nomqcobo Jiba and Lawrence Mrwebi). Two commissions (the State Capture commission and the Public Investment Corporation [PIC]) are ongoing.

In addition, Ramaphosa has replaced the previous (compromised) head of the NPA (Shaun Abrahams) with Shamila Batohi. She is, by all accounts, an excellent choice for the role of national director of public prosecutions (NDPP) at the NPA. Ramaphosa has also allocated prosecutorial resources to her to focus on those cases arising from the various commissions’ proceedings and has gazetted a special unit in the NPA for this, which will study offences arising from the various inquiries listed above and will also deal with common-law offences such as fraud, forgery, theft etc.

With a clear ANC election win on a national level, it will be Ramaphosa’s prerogative to appoint a cabinet (in consultation with the ANC and its alliance partners) and who he chooses may well give South Africans a better idea of the ANC’s commitment to rooting out corruption.

What the polls and experts are saying about potential outcomes

Ramaphosa has proven to be extremely popular with voters (more so than his party) and has even led to people not usually aligned to the ANC contemplating voting for him to strengthen his agenda. This as he promises to root out corruption and “renew” the ANC. While it has since worn off, the initial bout of ‘Ramaphoria’ during the first few months of his presidency has also taken the wind out of the sails of the major opposition parties (the DA and EFF), for whom Zuma was manna from heaven. After all, their whole being seemed for so many years to revolve around the removal of Zuma.

In a March Ipsos poll (also mentioned below), Senior client officer at Ipsos, Mari Harris told 702 that Ramaphosa is a big reason the ANC is doing well in the polls, noting that the trust index “from all registered voters for Ramaphosa is 45% but if we just look at the registered voters for the ANC the trust index is 83%.” Harris added that “both Maimane (DA) and Malema’s (EFF) trust index is negative if we look at all voters in the country but if we look at supporters of their own party, the trust is very high.” Meanwhile, senior researcher and political analyst at the University of the Western Cape’s Centre for Humanities Ralph Mathekga believes that Ramaphosa runs the risk of “falling from grace” should the ANC underperform in the upcoming elections.

Several polls have come out over the past few months predicting election results. An October 2018 survey by Afrobarometer showed 48% of South Africans said that if the election was held at that stage‚ they would vote ANC. The DA and EFF were set to tie for second place with 11% each‚ according to the poll (vs the DA’s 22% and the EFF’s 6% in 2014).

In December 2018, a SA Institute of Race Relations (IRR) snap poll suggested the ANC’s position had strengthened and, based on voter turnout of 69%, it could get as much as 59% of the vote. The DA could get 22% on that same basis, with the EFF coming in third at 10%. However, the IRR noted that a strong turnout among ANC supporters would give Ramaphosa a solid mandate, “strengthening his grip on the ruling party.” This is important, since he won the December 2017 elective conference by only a razor-thin margin, leaving him unable to push through definitive reforms.

Meanwhile, according to the March 2019 Ipsos poll, the ANC is expected to get 61% of the vote, followed by the DA with 16%, while 9% of voters are likely to choose the EFF (vs the 6% it received in 2014). The latest projected figures are based on “a medium voter turnout scenario – if about 80% of those registered to vote go to the polls”.

The impact of controversies and recent revelations –political manoeuvering or a reality check?

More recently, besides the continuous flow of mind-blowing Bosasa revelations (courtesy of Agrizzi et al.) at the State Capture commission, several controversies have erupted around the ANC and the president. Perhaps most harmful to Ramaphosa himself relates to his son, Andile Ramaphosa, who admitted in late-March that Bosasa did, in fact, pay him R2mn for a business deal, which he now says he regrets. Andile reportedly signed an advisory mandate with Bosasa, earning the business a fee of R150,000/month. This revelation came after Ramaphosa backtracked from his initial Parliamentary Q&A session reply several months back, when he said the Bosasa payment was a donation towards his ANC presidential campaign. The DA has laid a complaint against the president with the public protector, saying that Ramaphosa misled Parliament.

In March, the inclusion of controversial candidates (such as Bathabile Dlamini, Mosebenzi Zwane, Malusi Gigaba, Nomvula Mokonyane, former state security minister David Mahlobo and his successor, Bongani Bongo) on the lists the party submitted to the IEC, once again raised eyebrows around the ANC’s true commitment to cleaning up governance.

However, more noteworthy than the above are revelations contained in a book by investigative journalist Pieter Louis Myburgh released in April. Gangster State: Unravelling Ace Magashule’s Web of Capture revolves around the massive corruption during ANC Secretary General (SG) Ace Magashula’s tenure as Free State Premier detailing his “murky dealings” for close to a decade. The book’s release saw disruptions at a book launch and threats of book burnings by the Free State ANCYL (later called off on orders of the mother body, perhaps indicating some leverage on the side of the Ramaphosa faction). Political analyst Stephen Grootes believes these events “reveal more about the levels of support Magashule enjoys than he would have liked”. Grootes postulates that no one in the ANC seems to be publicly supporting Magashule, with the ANC issuing a statement condemning both the launch disruption and the pledge to burn the book. By all accounts, Magashule seems to be on his own. The book is likely to benefit the Ramaphosa camp as it could see Magashule stripped of his SG position for bringing the party into disrepute. We note Magashule said he would be pursuing legal action, but as of this writing nothing has come of this threat.

Possible outcome-scenarios and your investment portfolio

Grootes further notes that this election sees the highest proportion of so-called floating voters ever – those that have, as yet, not made a final decision as to which party they should support, and these could go any way. While many voters would likely want to give Ramaphosa a chance to run the country with a resounding mandate, these same voters could also be reluctant to give the ANC another five years at the helm.

Below, we look at Anchor’s four possible election-outcome scenarios for the ANC and the best investment portfolio for each outcome:

The ANC gets 58%-plus of the vote (55% probability): In our view, the most likely outcome and also our base case. If this happens the current ‘repair’ scenario maintains momentum, with Ramaphosa emboldened and seen as having received the required mandate from the voters to solidify his position and steer ahead with his anti-corruption and growth agenda unfettered. Ramaphosa assembles a new cabinet, with few Zuma cronies or compromised individuals. He makes headway in managing divisions within the ANC, gaining the support of the ANC caucus and the NEC, as he intensifies the fight against corruption and state capture. This, in turn, will be positive for the local economy and we are likely to see more inflows of FDI and local investment into SA as ANC policies are (hopefully) clarified, especially those related to EWC, the nationalisation of the SARB etc. A more certain future overall, with Ramaphosa perhaps serving two terms, boosting the JSE (bar any external offshore factors) and the rand strengthening.

Rand vs US dollar at year-end: R13.30/$1

2020 GDP growth rate: 2.5%

JSE 12-month return: 15%-plus

Equity positioning: High exposure to SA Inc. shares, especially the quality counters where foreigners take their exposure: FirstRand, Standard Bank, The Foschini Group, DisChem, Bidvest, RMI, AVI, Coronation, Shoprite and Clicks. Property shares are likely to do well. The more cyclical counters such as Motus, Imperial and Super Group could also rise materially as expectations of economic growth improve. Rand-hedge shares would likely underperform with a strengthening currency.

The ANC receives 50%-58% of the vote (30% probability): If this happens, we expect pressure on Ramaphosa from his detractors within the governing party. There will likely also be a push for more radical ideas (aligned with some of the EFF’s views) from within the ANC. In this scenario, Moody’s is likely to downgrade SA, certain Zuma-aligned individuals remain in cabinet and Ramaphosa does not have the entire ANC caucus behind him. Zuma-aligned individuals remain strong enough to veto any radical changes Ramaphosa plans to make in order to give the economy a kickstart. In this case, we would expect the following scenario:

Rand vs US dollar at year-end: R14.50/ $1

2020 GDP growth rate: 1.5%

JSE 12-month return: 5-10%

Equity positioning: A weaker currency would benefit many of the rand-hedge shares on the JSE, so ironically there could still be a reasonable performance from the JSE. We would limit SA exposure to high-quality shares that are less sensitive to economic growth, with their own individual growth stories, such as DisChem, Bidvest, RMI and Discovery. Our portfolio would be weighted to rand-hedge and offshore shares such as Sasol, Bidcorp, Reinet, Naspers, offshore property companies (Nepi Rockcastle, EPP and MAS) and resource counters.

The ANC gets less than 50% of the vote (10% probability): This will be a shock result and, in this scenario, the EFF (Julius Malema) will likely emerge as Kingmaker. Moody’s downgrades SA’s sovereign credit rating to junk, Ramaphosa becomes a toothless, lame-duck president and his job to turn SA around will be arduous, if not impossible. The likelihood of attempts to remove him by the Zuma faction (which emerges stronger), come the 2020 ANC national general council, rises. Our political landscape changes as coalitions become the order of the day, resulting in parties having to compromise on key issues.

In the event of this happening, we expect to see property and banking counters come under renewed pressure. The performance of the property sector has not been encouraging for quite some time now, with the head of the country’s biggest listed real estate company, Growthpoint, saying that potential tenants were unwilling to make long-term commitments, leading to landlords cutting prices. In the event of the ANC getting less than 50% of the vote we also expect the EFF to have more leverage when it comes to EWC. In this case, we would recommend the following outcome:

Rand vs US dollar at year-end: R16.00/$1

2020 GDP growth rate: 1%

JSE 12-month return: 0%-5%

Equity positioning: We would expect SA-Inc shares to fare poorly and weigh heavily on the JSE. Offshore and rand-hedge shares would perform well as a result of the weaker currency.

The EFF wins over 25% (5% probability) and the ANC gets less than 50%: The Black Swan outcome. While 5% is probably too high a probability for this outcome, we have included it as there have been numerous shocks globally over the past few years as global populism prevails – for example Donald Trump and Brexit. A coalition government would become a reality and policy would become much less market-friendly. Investor confidence could be shaken and the rand would likely take a tumble, leading to higher inflation, a possible increase in interest rates and a sharp decline in SA-Inc. shares. This would potentially be very negative for economic growth and job creation.

Rand vs US dollar at year-end: R18.00/$1

2020 GDP growth rate: 0%

JSE 12-month return: -10%

Equity positioning: While rand-hedge shares would benefit from a weaker currency, this would be offset by a sharp decline in shares that generate their profitability in SA. Our SA weighting would be very low and the portfolio would be weighted to rand-hedge and offshore shares such as Sasol, Bidcorp, Reinet, Naspers, offshore property companies (Nepi Rockcastle, EPP and MAS) and resource counters.

Conclusion

SA turned a corner when Cyril Ramaphosa was elected ANC president at the party’s elective conference in December 2017. Many positive moves have been made as discussed earlier but, not surprisingly, there is strong opposition within a faction of the ANC against moves to curb corruption and revive embattled SOEs. Our base case is for this direction to be sustained and this could see underweight foreign fund managers direct financial flows back into the SA market. However, one needs to watch the balance of power very carefully and we would act quickly to pull back from SA-Inc. shares if we observe strong signs of a reversion to the politics of the past nine years under ex-President Jacob Zuma.

The offshore component of the JSE should provide support and, if our base case of a positive SA scenario unfolds (Ramaphosa being given the mandate to pursue his reform agenda), this could see a material bounce in local equities. However, our bets are measured, and we are managing portfolios with one eye carefully on the risks.

We continue to have a positive stance on local equities, but the future is far from certain and, as seen above, various scenarios are possible following the outcome of the May general election (and we will be observing these closely). Being nimble is as important as it has ever been, and we will be quick to act in the best interests of our clients. Investors in the SA market are going through emotional turmoil at present, with local news getting worse, although the global backdrop is proving to be supportive. Hence, sectoral exposure is increasingly critical, and these could be materially differentiated over the coming months. However, an emboldened Ramaphosa could lead to more certainty as well as more definitive policy moves which is likely to boost a flagging SA economy.