South Africa’s (SA) precarious fiscal situation will again come under the spotlight, with the upcoming Medium Term Budget Policy Statement (MTBPS) looming on Wednesday, 1 November. It is one of the year’s more prominent macroeconomic events. Whilst the MTBPS typically serves as an update on the primary budget set in February, this year, it carries added significance due to the substantial deterioration in the country’s fiscal health. The broader investment community anticipates (or at least remains hopeful) that Finance Minister Enoch Godongwana’s address will provide reassurance of the government’s commitment to addressing the looming challenges in its finances and the mismanagement of state-owned enterprises (SOEs) in particular.

The substantial rise in SA’s fiscal risk premium and the notable steepening of the SA government bond (SAGB) yield curve throughout 2023 are clear indicators of SA’s declining fiscal health, in addition to the prevailing global headwinds. Domestically, the two primary factors driving this decline are the energy and transport logistics crisis (which hinder potential economic growth) and the negative feedback loop involving underperforming SOEs and government bailouts. Additionally, international factors, including falling commodity prices and increasing US Treasury yields, have served to intensify the pressure on an already fragile fiscal situation further.

From a long-term perspective, the root causes of SA’s fiscal woes are long-standing and relatively familiar to most investors – persistently low growth, inefficient and misaligned policy, poor performing SOEs, political instability in key metropoles, chronic underinvestment by the state in key infrastructure projects, and poor decision making on government expenditure (particularly during the state capture years), to name a few. However, from a more near-term perspective, a variety of other factors have compounded SA’s fiscal challenges, such as lower commodity prices, lower revenue collection, Eskom and public sector wage increases, the expected continued roll-over of the Social Relief of Distress (SRD) Grant and rising borrowing costs.

Whilst the consensus is that SA’s fiscal story is indeed deteriorating at pace this year, it is unlikely that we will get the complete picture in November’s MTBPS – that will only become fully clear in the main budget, to be presented in February 2024. Regardless, the finance minister must convince the market in November’s MTBPS that a credible rebalancing process is indeed plausible. The socio-political landscape in SA does, however, present significant hurdles for the National Treasury (NT) to implement spending reforms. There is a sense of doubt regarding the revival of structural growth soon, especially given the sluggish pace of reforms. Nevertheless, there has been a recent uptick in momentum, notably with the private sector’s participation in the National Energy Crisis Committee (NECOM) and the National Logistics Crisis Committee (NLCC).

Given all the abovementioned factors, the latest estimates point to this year’s revenue shortfall amounting to c. R50bn-R60bn. This predicted undershoot in revenue receipts will likely stem from:

- structural economic factors manifesting in corporate income underperformance (CIT); and

- cyclical factors (including the decline in global commodity prices and the effect of higher interest rates on household spending manifesting in lower domestic VAT receipts).

On the personal tax front, payment streams have remained resilient. Whilst most SA households remain under pressure due to the rising cost of living and higher interest rate burdens, SA’s employment rate has remained relatively stable (albeit still unacceptably high). Moreover, the SA Revenue Service (SARS) initiatives to boost tax compliance since 2019 have significantly bolstered revenue over the past four years by expanding the tax base. Significant progress was achieved during the fiscal years of 2020/2021 and 2021/2022, with enhanced compliance contributing an additional R43.5bn (+55.8%) and R43.8bn (+21.0%) in increases to overall revenue, respectively. The improved operational efficiencies at SARS have also played a pivotal role in elevating the tax-to-GDP ratio to 25.4%, surpassing the historical average of 22.1%.

CIT payments, on the other hand, have historically been volatile and remain a key factor in budget targets, either under or overshooting. For the 2023/2024 fiscal year, so far, CIT revenue has suffered from the underperformance of the mining sector, which has suffered from a mixture of subdued trading partner growth, moderating commodity prices, and local logistics bottlenecks. As a result, CIT revenue collected from April to August 2023 was 15.1% lower than over the same period last year, falling from R142.9bn to R121.4bn. Considering SA’s logistical issues in particular, as it stands, Transnet reforms are roughly two years behind those of Eskom. Positively, however, a draft logistics roadmap recently presented to the government indicates a welcome and broadly positive attitudinal shift in the state’s willingness to encourage private sector participation to remedy SOE breakdowns. Which reforms exactly come to fruition, however, remains to be seen.

Regardless of this latest shift in positive reform momentum, the usual lineup of non-performing SOEs (with unsustainable business models and weak management and skills) looking for cash bailouts remains. These include the Post Office (which requires a further R3.8bn on top of the R2.4bn allocated in FY23/FY24), the SABC (with a loss of R1.1bn) and Transnet (a loss of R5.8bn in F22/FY23 which could deteriorate in FY23/FY24 if urgent interventions are not forthcoming). In addition to these usual suspects, the Gauteng Provincial Government still needs to pay R12.9bn to settle the SA National Roads Agency Limited’s (Sanral) Gauteng Freeway Improvement Project (GFIP) debt and interest rate obligation, with the government paying R23.0bn.

The key risk for the fiscus is more fiscal slippage arising from increased social spending, driven by increased politicking as the 2024 National and Provincial Elections draw closer. With the election season looming, there is pressure to increase spending already. The SRD grant (which offers R350 per month to about 8.6mn jobless adult South Africans) will likely be extended again beyond the current fiscal year. The SRD grant amounts to R36.1bn for FY23/FY24, but it is not budgeted for beyond this fiscal year. As such, the NT has proposed funding options for the SRD grant, which include terminating some programmes and increasing VAT by 1%-2%, which would generate an estimated R25bn–R50bn. Neither of these is particularly politically palatable for the ANC, given the upcoming elections.

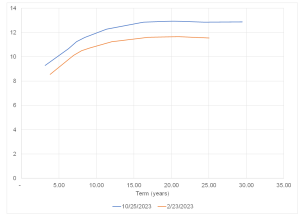

Since the February 2023 Budget announcement, there has been a significant uptick in SAGB yields. This increase can be attributed to a combination of factors, including the rise in US Treasury yields, the depreciation of the rand, escalating power outages, and the nation’s fiscal difficulties. These factors have led to a notable rise in yields across all SAGB maturities. Long-term bond yields have surged by over 100 bps since the February Budget, while short-term bond yields have seen an increase of nearly 40 bps. This steepening of the yield curve underscores the market’s apprehension regarding the potential further deterioration of the country’s economic prospects and fiscal challenges. In this climate, it is understandable that investors are cautiously approaching SAGBs. The elevated yield curve is likely to persist until the market sees clear signs of improved fiscal sustainability. The NT’s initial estimate of the FY23/FY24 main budget deficit at 3.9% of GDP will likely be overshot – the extent of which will be telling regarding market direction. A deficit under 4.5% will be viewed as broadly positive by the market, whereas anything over 6% will illicit a broadly negative reaction. Anything around the 5% mark will likely be considered neutral.

Figure 1: The SA yield curve evolution since the February 2023 Budget, %

Source: Reuters, Anchor

Overall, the market focus will be honed on how NT plans to finance the more significant (and largely expected) budget deficit. The prospect of an enhanced energy supply in 2024, marked by the reactivation of four Kusile units, one Medupi unit, and both Koeberg reactors by mid-2024, holds the potential for a recovery in corporate earnings within SA. As per Eskom’s latest assessments, households have collectively invested in 4.4 gigawatts (GW) of solar energy, encompassing solar panels, batteries, and inverters – an equivalent of 1GW of continuous baseload power. Moreover, private sector investment projections, currently in the budget quotation stage, indicate an additional 9GW of renewable energy capacity expected to come online within the next 18-24 months, contributing another 3GW of baseload power. This suggests that households and businesses may experience a potential reduction of loadshedding by up to four stages in the next 18-24 months.

In terms of expenditure, the finance minister has highlighted the challenging fiscal situation. Specific directives to government departments regarding spending restraint for the remainder of the current fiscal year and policy priorities in light of worsening fiscal metrics, especially in the lead-up to the 2024 Elections, will only become apparent in February 2024 when the full budget review is presented. Still, beyond the upcoming budget reviews, SA’s medium- to long-term fiscal trajectory requires a credible economic growth reform agenda, without which fiscal sustainability will not be possible. Much rests on the hope of forming a coherent and stable government after the 2024 Elections.