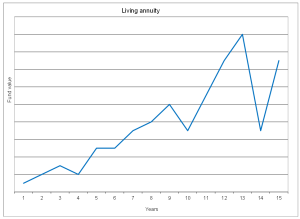

Option 1: Living Annuity

The annuity is investment-related and consists of underlying funds. Your money is invested in unit trusts that match your risk profile and income requirements. Income is derived by selling units and using the cash values as income. A living annuity has the highest probability of steady income and capital appreciation if used correctly (where you draw less than 6% p.a. to preserve capital).

It is important to note that because the annuity is invested in unit trusts, the individual units’ values are extremely important, as they will directly affect the capital invested (and, therefore, the income you derive). A drastic fall in the unit price of the underlying portfolio will severely affect your income at retirement. Similarly, an increase in the unit price will positively affect the capital and income derived. Any money remaining after your death may be distributed to your beneficiaries.

Figure 1: An example of a living annuity linked to underlying unit trusts

Source: Anchor

Advantages

i. You have the flexibility of income choice – you can choose between 2.5% to 17.5% p.a. as an income.

ii. Money within the living annuity grows tax-free. You are only taxed on the income you withdraw every year.

Disadvantages

i. There is no guarantee on your capital. If you draw too much income, you risk depleting your capital (hence running out of income).

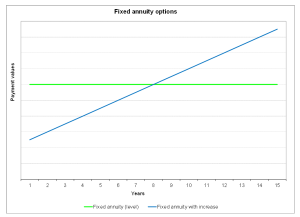

Option 2: Fixed Annuity

A fixed annuity will provide a set income for life or until an agreed-upon date, after which the money invested will be forfeited, and all capital will be lost. The annuity will pay a set amount every month for life (level annuity) or increase the payments yearly by an agreed-upon percentage (e.g., a 5% p.a. increase). If an increasing annuity is chosen, the initial income will be lower.

Figure 2: An example of a fixed annuity (level) and fixed annuity (with increase)

Source: Anchor

Advantages

i. Income is guaranteed for life. There is no risk of running out of income during your lifetime.

Disadvantages

i. Capital is forfeited on death. You can guarantee the income for a period of time (e.g., ten years), but then the capital will cease. Including your spouse in the policy is possible so that income is guaranteed for both of your lives, but this will reduce the initial income amount.

Option 3: One-third cash, two-thirds annuity (for pension funds)

The retiree can take up to one-third of the value of the retirement fund in cash (with a pre-defined tax-free portion). The remaining two-thirds must be used to purchase an annuity (fixed or living annuity as above).

Option 4: Take the cash.

The entire amount may be withdrawn in cash if the retiree has money in a preservation or provident fund. This is not recommended as no money is used to provide an income. Once the capital is used, there is no further opportunity to create a retirement income. In such a scenario, assets must be sold or mortgaged to generate capital and income.

Advantages

i. You have complete control of the money and can invest how/when/if you wish.

Disadvantages

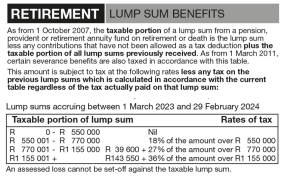

i. You will pay tax on the amount taken in cash according to the Retirement Tax Tables. This is very punitive on higher amounts taken in cash.

Retirement Tax Table:

Please note that all graphs are for illustrative purposes only and should not be viewed as a promise of performance. The retiree should seek the services of a qualified financial advisor. However, all responsibility rests with the retiree to ensure that they understand the implications of all their financial decisions.