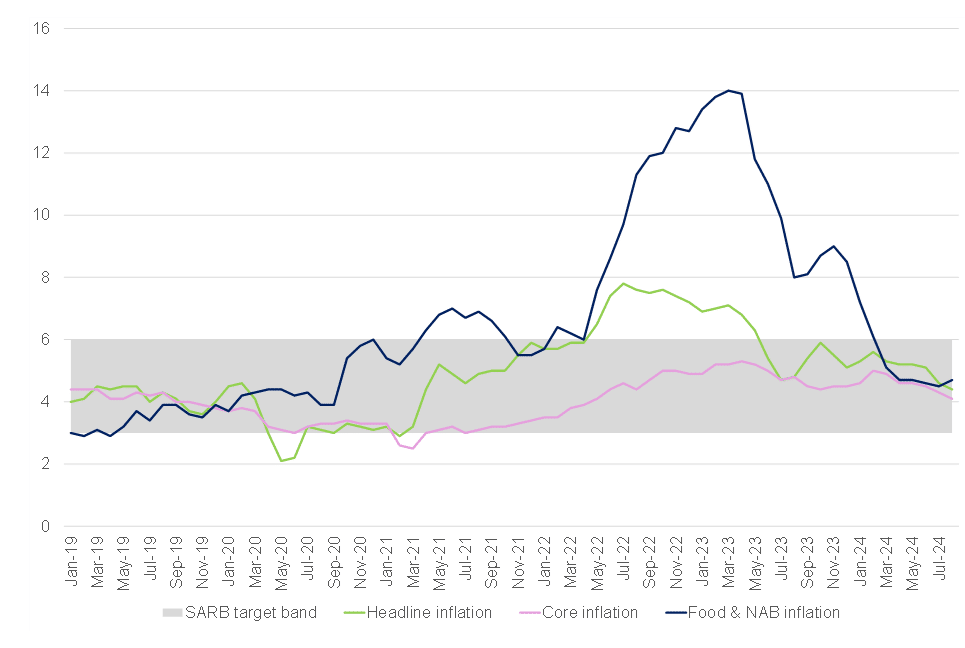

Amid a streak of positive developments for South Africans, August inflation, as measured by the Consumer Price Index (CPI), revealed a continuation of the disinflationary trend, with headline inflation decelerating further to 4.4% YoY from 4.6% YoY in July. In addition, the print came in slightly below consensus economists’ expectations and is the lowest inflation rate since April 2021, when it also printed at 4.4%. The easing of price pressures appears widespread, with a notable slowdown in energy prices, which fell from 12.1% YoY in the previous month to 11.5%. However, inflationary pressures persist in certain areas, as seen in the slight uptick in categories such as food and alcoholic beverages and tobacco products. Core inflation, which excludes the more volatile food and energy prices and serves as a key indicator of underlying price pressures, moderated to 4.1% YoY in August, down from July’s 4.3% YoY print. This marks the lowest level for core inflation since May 2022 and points to a continued easing in inflation pressures.

The broad-based moderation in core inflation was partly driven by a decrease in housing utilities, which dropped to 4.8% YoY from 5.3% YoY in July. The decline was primarily due to lower inflation in water and other services. Additional relief in core inflation came from household contents and equipment. Car purchases also contributed to the slowdown, and restaurants and hotels experienced a second consecutive month of deceleration. These trends in core components reflect the strain on household finances and weak demand in the economy. A stronger rand exchange rate likely reduced the pass-through of imported inflation, while improved electricity availability may have lessened the impact of infrastructure costs. Additionally, logistics pass-through is likely subdued, given the low-demand environment.

Figure 1: SA inflation, YoY % change

Source: Stats SA, Anchor

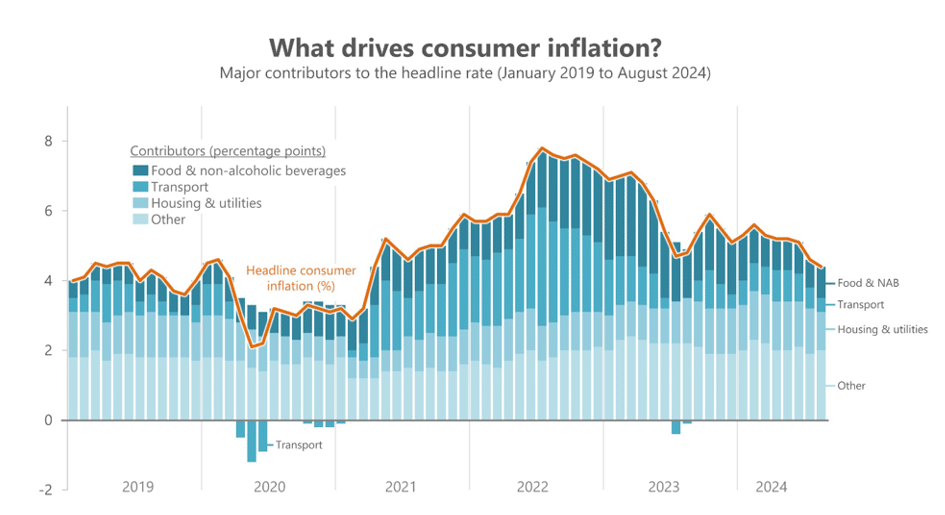

All transport-related products saw softer annual rates in August. Fuel prices continued their downward trend, falling for a third consecutive month. The fuel index dropped by 0.5% MoM, lowering the annual rate to 1.8%. The average price for a litre of diesel in August was R23.23, compared to R23.35 in July. Transport’s impact on overall inflation has diminished since mid-2022, when it was the main driver of rising living costs, accounting for 44% of overall inflation in July of that year. By August 2024, transport’s contribution had fallen to 9%, with housing & utilities and food & non-alcoholic beverages (NAB) taking the lead. Housing & utilities made up a quarter of the total inflation rate in August. Meanwhile, after an eight-month decline, annual food & NAB inflation rose to 4.7% in August from 4.5% in July, putting upward pressure on the headline inflation rate. Most food categories saw higher annual rates, including bread & cereals, meat, fish, milk, eggs & cheese, oils & fats, and vegetables. In contrast, lower rates were recorded for fruit, sugar, sweets & desserts, and hot and cold beverages.

Figure 2: Major contributors to the headline inflation rate

Source: Stats SA

Looking ahead, high interest rates are suppressing demand and slowing core inflation, particularly for core goods, which helps to mitigate exchange rate risks. Retailers are hesitant to pass on costs due to weak consumer demand. While fuel inflation remains a concern amid tensions in the Middle East, a stronger rand provides some relief. Food price risks are heightened by climate change, but the effects of El Niño are expected to peak soon and then ease. As such, we believe this progress will be sustained, with inflation contained below the 4.5% midpoint of the South African Reserve Bank’s (SARB) target range through the medium to longer term. In the near term, we continue to see a dip in headline inflation, with it remaining below 4% into 1Q25, supported by the stronger exchange rate and lower oil prices.

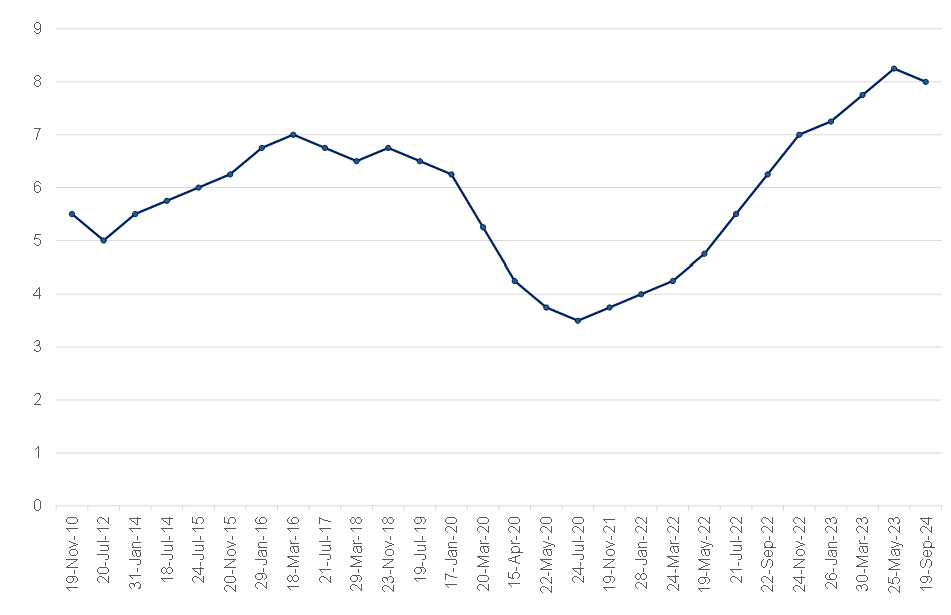

Against this backdrop, as expected, the SARB’s Monetary Policy Committee (MPC) decided to reduce the repo policy rate by 25 bps to 8% p.a., with the prime lending rate now sitting at 11.5%. In deliberating the policy stance, the MPC weighed three options – leaving rates unchanged, a 25-bp cut, and a more aggressive 50-bp cut. Ultimately, the committee reached a consensus on a 25-bp reduction, concluding that a slightly less restrictive stance aligned with the goal of achieving sustainably lower inflation over the medium term. This decision reinforced our long-held view that the MPC would avoid a sharp 50-bp cut, as the SARB typically favours gradual reductions to maintain market stability and predictability.

This cautious approach reflects the SARB’s commitment to managing expectations and avoiding sudden market shocks. The central bank can adjust based on evolving economic conditions by opting for a data-dependent, incremental strategy. This method minimises the risks associated with large, rapid cuts, such as heightened market volatility or misaligned signals. It also ensures smoother transitions in financial markets, allowing for a more measured and adaptive response to inflationary pressures and economic performance.

Looking ahead, one key point from the latest SARB MPC statement is that its forecast sees rates moving towards neutral next year, stabilising slightly above 7%. This confirms our base case of 100-125 bps of cuts this cycle. It is worth noting that the SARB’s Quarterly Projection Model (QPM) previously saw the repo rate ending at 7.25% but now signals a further 25-bp cut in 2025/2026. This will take the repo rate to a steady state of 7%, which aligns with our stated base case. Regarding market reaction, the specific timing or structure of these rate cuts seems relatively unimportant. Assuming the full magnitude of the cuts is ultimately delivered, markets are likely to respond in a relatively neutral manner, similar to Thursday’s (19 September) reaction after the MPC announcement. This suggests that investors are more focused on the overall trajectory of monetary policy rather than the nuances of individual rate decisions.

If the central bank stays on course with its broader policy goals, markets will maintain stability with limited volatility. Predictability and clarity are key in this context, as they help prevent abrupt shifts in sentiment or sharp market adjustments. Markets tend to price in anticipated moves well in advance, which dampens the impact of specific rate cut announcements if they align with expectations. Therefore, provided that the overall policy direction remains clear and consistent, timing becomes less of a factor in driving market responses.

Figure 3: The history of the SARB MPC’s repo rate changes, %

Source: SARB, Anchor