Historically, the start of the US holiday season (November), has typically been a strong month for Wall Street. However, this year markets were choppy, starting off relatively strong, then coming under pressure towards the middle of the month, before ending November with a decidedly risk-off tone after US inflation came in ahead of expectations and fears around the new COVID-19 variant (Omicron) saw US counters drop sharply on Black Friday (26 November) – a shortened trading day because of the US Thanksgiving holiday. The Omicron variant was first identified by South African (SA) scientists and the news triggered a global shift away from risk assets (and a knee-jerk reaction towards SA by several countries). The Dow Jones Industrial Average (Dow) dropped by 2.5% on the day, its worst day of the year, while the S&P 500 lost 2.3% and the Nasdaq slipped 2.2% on the day. The VIX or CBOE Volatility Index, Wall Street’s “fear gauge,” rose to 28 – its highest level in two months. Deadline writes that the performance of the three major indices combined for the worst Black Friday for the US stock market since 1950.

Global markets were further rattled on Tuesday (30 November) by concerns that the variant could possibly evade vaccines, after Moderna’s CEO told the Financial Times that he expected them to be less effective against the new strain, resulting in fresh selling across asset classes. In addition, comments by newly renominated US Federal Reserve (Fed) Chair Jerome Powell in his testimony to the Senate Banking Committee, that the risk of higher inflation has increased and that it was appropriate to consider wrapping up tapering of bond purchases a few months sooner, weighed on markets on the last day of trading. Earlier in the month, the Fed had committed (at its November meeting) to leave rates near zero and said that it would be winding down its monthly asset purchases later in November at a pace of US$15bn/month (with a plan to end purchases altogether by mid-2022), thus starting the withdrawal of last year’s emergency pandemic support. Powell had then said that he expected US inflation to recede over the next year (US inflation is currently registering more than double the Fed’s 2% target) as supply chain bottlenecks, which have contributed to the higher prices, eventually ease. There have been some indications that the worst of these disruptions are clearing up, with Reuters writing that cargo shipping costs are down by one-third MoM and the prices for commodities such as iron ore and lumber are declining.

In the US, two of the three major indices closed November in the red, with the blue-chip S&P 500 down 0.8% MoM (+21.6% YTD) and the Dow losing 3.7% MoM (+12.7% YTD). The tech-heavy Nasdaq (+0.3% MoM/+20.6% YTD) managed to post a small MoM gain. In terms of US economic data, the second estimate of 3Q21 GDP slowed sharply (to 2.1% QoQ), although it was ahead of the first estimate of a 2.0% QoQ gain. However, the revision was still well below the solid gains of 6.3% growth achieved in 1Q21 and the 6.7% growth for 2Q21. On the positive side, Reuters writes that economists are expecting a solid GDP rebound in the current quarter (4Q21) “as long as rising inflation and a recent uptick in COVID cases do not derail activity.”

In Europe’s largest economy, Germany, the DAX fell 3.8% MoM (+10.1% YTD), while the eurozone’s second-biggest economy, France’s CAC Index retreated by 1.6% MoM (+21.1% YTD). On the economic data front, the new wave of the COVID-19 pandemic is only having a limited impact thus far on eurozone economies, with IHS Markit’s headline purchasing managers’ index (PMI), which measures the health of the economy, unexpectedly rising to a two-month high of 55.8 in November after slipping to a half-year low of 54.2 in October. IHS Markit’s chief business economist said last month that November’s stronger expansion of business activity “… defied economists’ expectations of a slowdown but is unlikely to prevent the eurozone from suffering slower growth in 4Q21, especially as rising virus cases look set to cause renewed disruptions to the economy in December,”. November headline eurozone inflation rose to 4.9% (vs October’s 4.1%, which was already the fastest since the 2008 global financial crisis). This latest print is the fastest pace since the establishment of the single currency union over 20 years ago and is likely to place pressure on the European Central Bank (ECB) to reduce its monetary stimulus programme.

The UK’s FTSE 100 Index ended November 2.5% lower (+9.3% YTD), while on the economic data front, UK GDP growth slowed sharply in 3Q21 to 1.3% vs 5.5% in 2Q21. This as surging COVID-19 infection rates, rising prices, and global supply constraints, were worsened in the UK by post-Brexit trade restrictions.

In Asia, worries over the Omicron variant, Chinese regulatory crackdowns, and ongoing concern around that country’s property sector weighed on stocks. China’s Shanghai Composite Index closed marginally up (+0.5% MoM) and is now 2.6% higher YTD, while Hong Kong’s Hang Seng Index plummeted 7.5% MoM (-13.8% YTD).

In economic data, retail sales in China rose 4.9% YoY in October, beating Reuters consensus expectations of a 3.5% YoY gain, while industrial output also grew (+3.5% YoY) beating consensus expectations for a 3% increase. Nevertheless, China’s economy continued to slow last month, with car and homes sales dropping once again as the country’s housing market crisis dragged on. As power shortages eased in November, it led to improved manufacturing production, and China’s official manufacturing PMI rebounded slightly to 50.1 in November – the first expansion in manufacturing activity for two months (it was at 49.2 in October and at 49.6 in September), albeit still the third-lowest level in 21 months. The 50-point mark separates expansion from contraction.

Japan’s Nikkei closed 3.7% lower MoM (+1.4% YTD) and in Japanese economic data, preliminary estimates released this week showed GDP growth declining by an annualised 3% in 3Q21 – far below the median Reuters forecast of an 0.8% contraction.

On the commodity front, the rally in benchmark Brent crude oil prices came to an abrupt halt with the announcement of the new variant and the Brent crude oil price was down 16.4% MoM (+36.2% YTD), ending November at c. US$70.57/bbl. After gaining 1.5% in October, the gold price retreated again last month – down 0.5% MoM. Iron ore fell by c. 18.6% MoM (-41.3% YTD), while platinum and palladium prices also retreated – down 8.1% and 13.1% MoM, respectively.

Surprisingly, and in stark contrast to major global markets, SA’s FTSE JSE All Share Index (+4.5% MoM/+18.6% YTD) closed the month in the green, with mining shares once again accounting for the bulk of gains. Commodity, platinum group metals (PGMs), and industrial counters were the star performers with the Resi-10 jumping 6.8% MoM (+16.8% YTD), the Indi-25 rising by 6.4% MoM (+19.5% YTD) and the SA Listed Property Index up 2.1% MoM (+18.5% YTD). However, financial counters underperformed for a second month, with the Fini-15 losing a further 2.6% MoM (+12.7% YTD). Highlighting the JSE’s biggest shares by market cap, Naspers and Prosus’ performances disappointed, with Prosus, the biggest share on the JSE, falling 2.9% MoM, while Naspers closed 5.1% lower MoM. Among the largest resources counters on the exchange, Anglo American Platinum (Amplats) gained 10.2% MoM, BHP Group rose an impressive 8.5% MoM, Anglo American jumped 3.4% MoM and Glencore was up 2.1%. Rand hedge, Compagnie Financière Richemont SA (Richemont) soared 26.4% MoM. The local unit closed the month 4.2% weaker against the greenback and on a YTD basis, the rand has declined by 8.1% against the US dollar.

In local economic data, October annual headline inflation, as measured by the consumer price index (CPI), came in at 5% YoY – unchanged vs September. Core CPI (excluding the volatile categories of food and energy costs) remained steady at 3.2%, and services inflation stood at just 3% YoY – both indicative that demand-pull inflation remains subdued. Food prices have been a key driver of SA’s higher inflation prints over the past few months but, for October, the food and non-alcoholic beverages inflation categories eased for a second-consecutive month to a seven-month low of 6.1%. Unfortunately, its disinflationary impact on the headline print was offset by the higher fuel price inflation. At its November meeting, the SA Reserve Bank’s (SARB’s) Monetary Policy Committee (MPC) raised the repo rate by 0.25% to 3.75% – in line with market expectations. November also saw further rolling blackouts courtesy of Eskom, with the lack of power continuing to negatively impact local businesses and SA’s economic growth. In the local government elections (LGEs), the ANC secured 10.7mn votes, driving it below the 50% mark (to 46%) for the first time in democratic SA history. The LGEs have resulted in an unprecedented number of hung councils, leading to coalitions across metros (the ANC took full control of only 2 metros) and municipalities around the country.

This year’s Medium Term Budget Policy Statement (MTBPS) was presented by Finance Minister Enoch Godongwana last month and, overall, his maiden budget amid SA’s increasingly complex fiscal environment hit the right tone and incorporated all the ‘keywords‘, the market was hoping for. Godongwana reiterated the government’s commitment to fiscal consolidation via expenditure restraint, combined with structural reforms to lift trend growth and, in turn, fiscal revenues. As expected, the key fiscal ratios benefited materially from upward revisions to GDP estimates and a sizeable revenue overrun, while markets were likely relieved at the policy continuity and a strong intent of becoming more pro-growth via collaboration with the private sector through public-private partnerships, etc. Nonetheless, we believe the fiscal risks remain elevated, with plenty of execution risk. The repeatedly announced growth initiatives are still lacking in detail and, overall, debt stabilisation remains distant. Encouragingly, however, government’s medium-term revenue projections appear slightly conservative and have correctly budgeted the windfall from elevated commodity prices as temporary, thus avoiding a repeat of the costly mistake to anchor expenditure on overly optimistic revenue assumptions.

On the pandemic front, the big news was the new Omicron strain of the virus identified by SA scientists, with fears of a resurgence or fourth wave in December as daily cases suddenly rose. The latest Department of Health data show that, as at 30 November, c. 25.6mn vaccines have been administered (vs 22.4mn as at 31 October), while the total number of confirmed COVID-19 cases since the start of the pandemic now stands at 2.97mn vs 2.92mn as at 31 October.

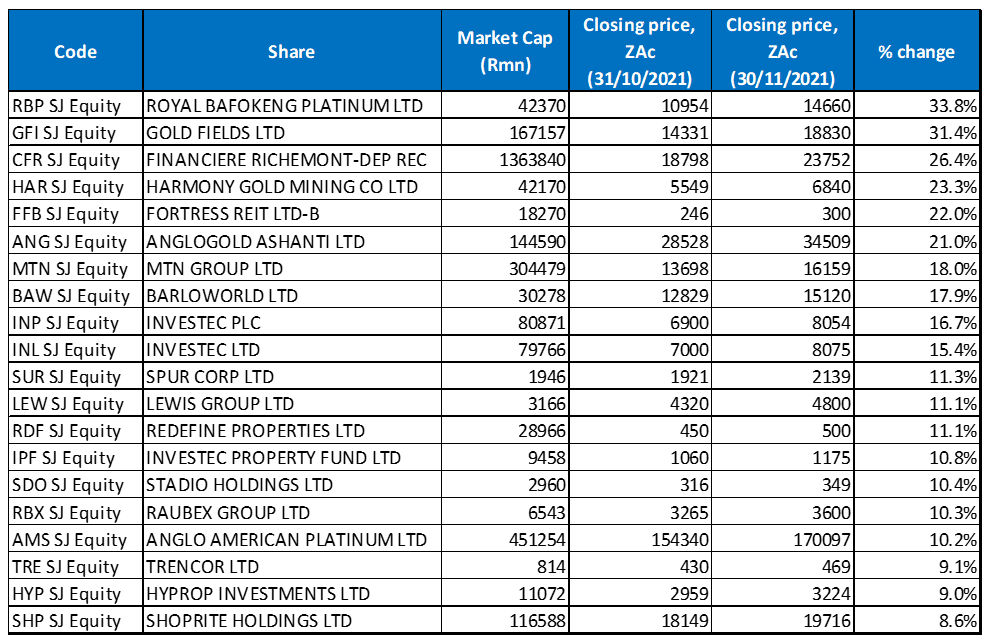

Figure 1: November 2021’s 20 best-performing shares, MoM % change

Source: Anchor, Bloomberg

Commodity, material, and resources counters pushed the JSE higher in November and it is no surprise that these counters featured prominently among the month’s best performers. Royal Bafokeng Platinum (RBPlat) was November’s best-performing share, jumping 33.8% MoM. On 29 November, Impala Platinum (Implats) re-entered the ring in a bid to buy out RBPlat, by offering R150 in cash and shares (a cash amount of R90 and 0.30 ordinary shares in Implats) to RBPlat shareholders. This move comes after Northam Platinum had offered to pay R180/share for a c. 33% stake in RBPlat. Implats currently owns 24.5% of the RBPlat shares in issue.

RBPlat was followed closely in the second spot by Gold Fields, which recorded a 31.4% MoM share price gain. The gold miner released its 3Q21 operational update earlier in November, where it stated that its attributable gold equivalent production was 606.00 koz – up 9.0% YoY. Gold Fields singled out its South Deep mine as having an especially good quarter, with South Deep’s production jumping 30.0% QoQ. Gold Fields also remained in a strong financial position – during 3Q21 its net debt balance (including leases) declined further to US$1,037mn, translating into net debt to earnings of 0.44x, vs 0.49x in 2Q21. Its net debt balance, excluding leases, fell to US$620mn from US$663mn as at end-June.

Richemont was November’s third best-performing share, with a MoM share price gain of 26.4%. The company posted better-than-expected first-half (1H22) earnings on 12 November and confirmed that it is in talks to divest control of its struggling e-commerce platform, Yoox-Net-A-Porter (YNAP). Richemont’s 1H22 sales jumped, reaching EUR8.91bn (US$10.2bn) – up 20% vs 1H19 (the comparable period prior to the COVID-19 pandemic), while Group operating profit surged to EUR1.95bn. The share had run hard (up by 28% in US dollar terms since the start of October to before the results announcement and the ensuing share price rise following the results announcement), largely on the back of expectations that its loss-making online division would be spun out (which was effectively confirmed by Richemont, although the terms, timing, etc. remain uncertain).

Richemont was followed by another gold miner, Harmony (+23.3% MoM), with Fortress REIT -B- (+22.0% MoM) and AngloGold Ashanti (+21.0% MoM) in fifth and sixth positions, respectively. In its 1Q22 operational update, released last month, Harmony reported a 4.0% QoQ higher gold price received and a 1.0% increase in gold production (to 413,714 oz). This resulted in a 3.0% QoQ growth in gold revenue to R10,959mn from R10,531mn in the previous quarter, allaying investors’ concerns that gold production would falter in the coming quarters. Management also reiterated its 2022 gold production guidance in a range of 1.54mn oz to 1.63mn oz.

MTN followed AngloGold Ashanti to take seventh spot with a 18.0% MoM gain. Early in November the share rallied as investors cheered the company’s decision to sell down its stake in its Nigerian unit in a deal worth R4bn. The company also released results that showed robust growth in its service, data, and fintech divisions.

Shares in Barloworld (+17.9% MoM) surged after the company reported strong FY21 results and declared an ordinary and a special dividend for the year. Barloworld said that its revenue from continuing operations rose by 22.5% YoY to R41.6bn from R33.9bn posted in the previous year, while headline EPS increased to ZAc1,195 from a ZAc268/share loss in FY20. A total final ordinary dividend of ZAc437/share was declared, with the total final special dividend coming in at ZAc1,350/share.

Rounding out November’s top-10 best performing shares were Investec Plc and Investec Ltd with share price gains of 16.7% and 15.4% MoM, respectively. Investec reported strong interim results (1H22) in November, announcing a c. 31% YoY jump in revenue (to GBP951mn) and EPS soaring by an impressive 135% YoY.

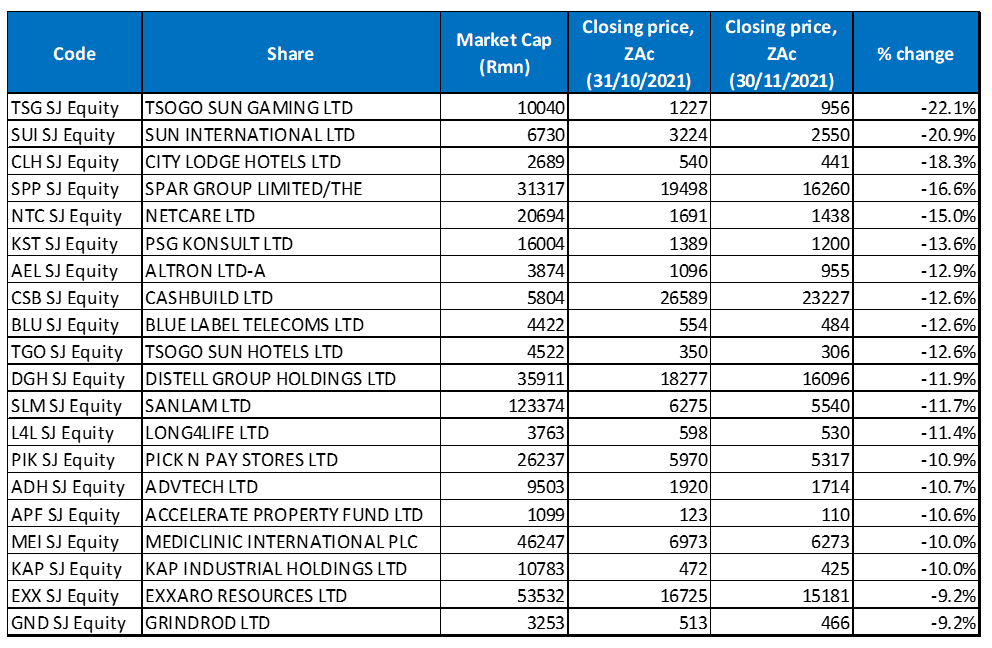

Figure 2: November 2021’s 20 worst-performing shares, MoM % change

Source: Anchor, Bloomberg

Local hotel, leisure, and gaming counters recorded impressive share price gains in October but, unfortunately, most of those gains were reversed last week. This came as fear around the new COVID-19 variant sparked renewed travel curbs as the UK and other countries frustratingly put SA (and other Southern African countries) back on their red list, with flights being temporarily banned. These latest restrictions come just two months after the UK had removed SA from its travel red list, following intense lobbying by the local tourism sector. The renewed travel restrictions and yet another COVID variant placed significant pressure on the share prices of the hotel and leisure shares, resulting in Tsogo Sun Gaming (-22.1% MoM) emerging as November’s worst-performing share. It was followed closely by Sun International (-20.9% MoM) in the second spot and City Lodge Hotels (-18.3% MoM) in the third position.

Ironically, in its 1H22 results, released just one day earlier (on Thursday, 25 November), Tsogo Sun Gaming had reported that its income rose to R3.82bn from the R1.57bn posted in 1H21, while diluted EPS increased YoY to ZAc31.1. The recovery in the Group’s first half was well received by the market and the share price rose on the day. Unfortunately, Friday (26 November) brought the bad news and with it a wipeout of the previous day’s gains as investors digested news of the new COVID variant and its possible implications for the busy December holiday season. By the JSE’s close on Friday, City Lodge’s share price was down 15.1%, Sun International had lost 7.5%, Tsogo Sun Hotels had declined by 14.2% and Tsogo Sun Gaming had dropped by 7.11%. The only glimmer of good news for SA was the 11.41% drop in the oil price, which means the weaker currency may not translate to higher local fuel prices and faster inflation.

Spar Group (-16.6% MoM) followed in fourth position, with the retailer seeing a decline in its share price after declaring a lower dividend of ZAc816/share for the year to 30 September 2021. Spar reported a 5.5% YoY rise in diluted headline EPS to ZAc1,193.7, while its turnover increased by 2.9% YoY to R127.9bn. The Group said that it had delivered a robust performance, despite numerous challenges including COVID-19 trading restrictions in all its markets. Spar was also negatively affected by the July civil unrest – the wholesale turnover loss from this was an estimated R638.4mn across its grocery, liquor, and Build-it businesses.

Netcare Ltd (-15.0% MoM), the third-largest private hospital Group in SA, released FY21 results last month which showed that its revenue increased to R21.2bn from R18.8bn posted in FY20, while diluted EPS rose 93.2% YoY to ZAc54.3. Although these results were a marked improvement vs 2020, profitability was still meaningfully below its 2019 financial year (pre-COVID).

Netcare was followed by PSG Konsult, Altron Ltd -A-, and Cashbuild, which recorded MoM share price declines of 13.6%, 12.9%, and 12.6%, respectively. Rounding out November’s ten worst-performing shares were Blue Label Telecoms and Tsogo Sun Hotels – both also down 12.6% MoM.

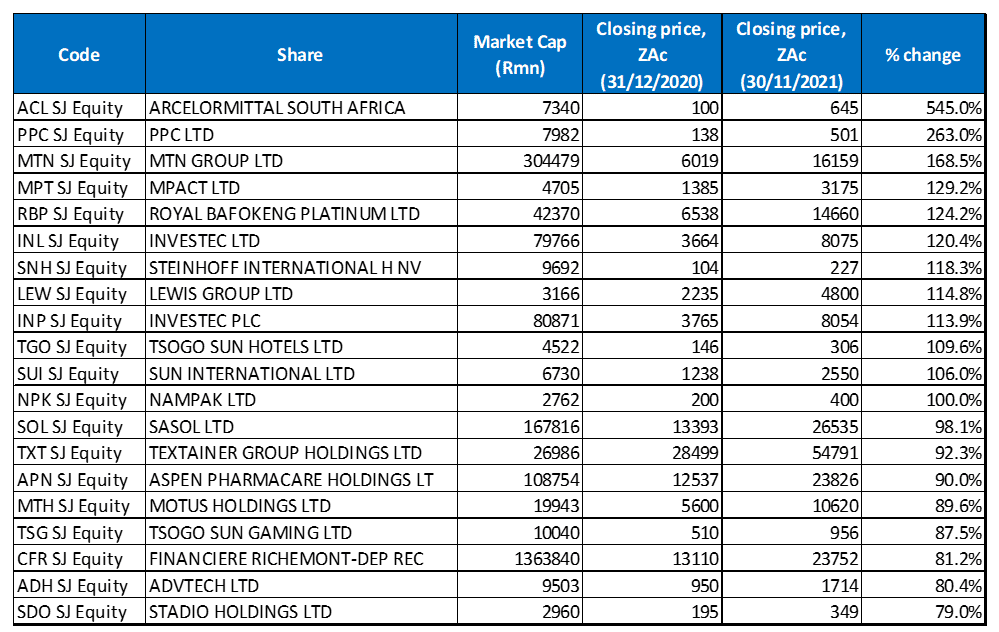

Figure 3: Top-20 November 2021, YTD

Seventeen out of November’s top-20, YTD best-performing shares were unchanged from those in the year to end October, with RBPlat (+124.2% YTD), Richemont (+81.2% YTD), and Stadio Holdings (+79.0% YTD), replacing City Lodge, Accelerate Property Fund, and Distell in November.

Arcelor Mittal SA (+545.0% YTD) remained by far the best-performing share YTD, although its share price was down slightly in November (-1.2% MoM). Arcelor Mittal was once again followed by PPC (+263% YTD) in the second spot. PPC recorded a disappointing share price performance in November (down 6.2% MoM) despite reporting good results. PPC said that it had lifted profit from continuing operations to R969mn in the six months to 30 September compared with R396mn in the previous half-year, after a restructuring and good demand in its major markets drove its performance. The Group’s revenue grew 20% YoY to R5.1bn, following a 12% increase in cement sales volumes, and the positive impact of hyperinflation accounting on PPC Zimbabwe’s financials. Excluding PPC Zimbabwe, revenue grew 12% YoY and, relative to the same period in 2019, there was a 7% increase in revenue.

Sun International (+106.0% YTD) was bumped from its third spot in the year to end October, to the eleventh position as travel and leisure counters came under pressure in November. It was replaced by MTN Group (+168.5% YTD) in third spot. Sun, discussed earlier, was one of the locally listed hospitality stocks (including Tsogo Sun Gaming, Tsogo Sun Hotels and City Lodge Hotels) that were negatively impacted by the new COVID-19 variant ahead of the important December holiday season.

MTN was followed by SA’s largest paper and plastics packaging and recycling business, MPact (+129.2% YTD), RBPlat (+124.2% YTD), Investec Ltd (+120.4% YTD), Steinhoff (+118.3%YTD), Lewis Group (+114.8% YTD), Investec Plc (+113.9% YTD), and Tsogo Sun Hotels (+109.6% YTD), which rounded out the top-10 performers YTD for November.

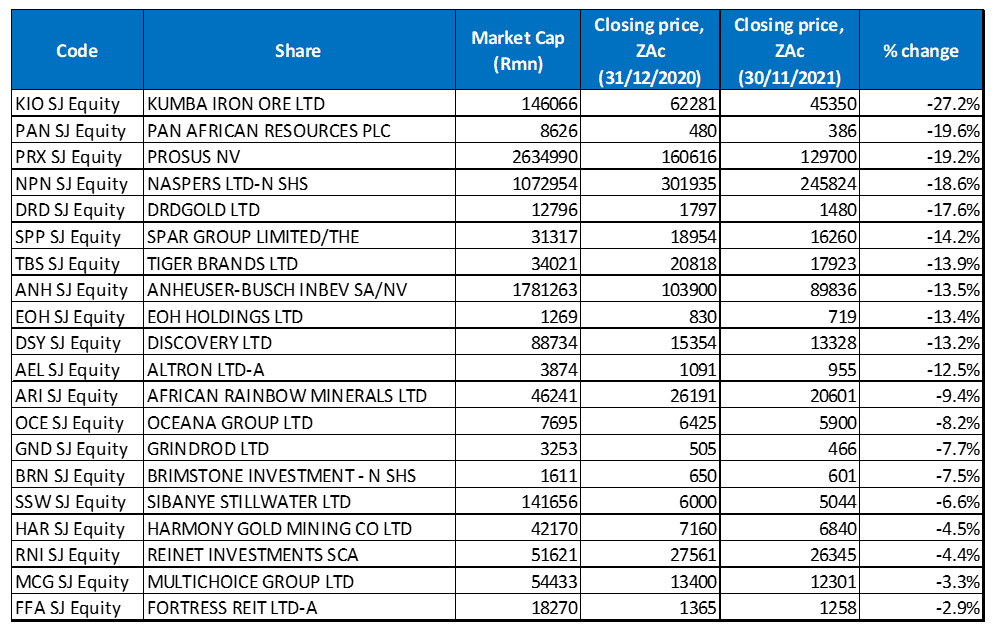

Figure 4: Bottom-20 November 2021, YTD

Source: Anchor, Bloomberg

Looking at the YTD worst performers, 17 of the 20 worst-performing shares for the year to end October again featured among the 20 worst performers for the year to end November. Newcomers in the YTD worst-performing category were Spar Group (-14.2% YTD), Altron Ltd -A- (-12.5% YTD), and Reinet (-4.4% YTD), which bumped AngloGold Ashanti, JSE Ltd, and Santam out of the November YTD worst-performers list.

Kumba Iron Ore (-27.2% YTD) took the title of worst-performing share YTD for the second month running and was again followed by Pan African Resources (-19.6% YTD) in the year to end November. However, gold tailings retreatment specialist, DRD Gold’s 7.9% MoM share price gain in November saw it move from third worst-performer spot YTD and being replaced by Prosus (-19.3% YTD). Prosus and Naspers (-18.6% YTD) reported strong e-commerce revenue for 1H22 in November, despite widening trading losses. Prosus’ e-commerce revenue growth jumped 53% YoY to US$4.2bn, while Naspers said that its e-commerce revenues were up 52% YoY to US$4.6bn, outpacing revenue growth at Tencent, the Chinese internet gaming and social media group in which Prosus owns a minority stake. According to Naspers, its economic-interest share in Tencent’s revenue grew 24% – up from 23% in the previous period. Naspers described it as an “impressive performance given the size of its base”.

Naspers N was followed by DRD Gold (-17.6% YTD), Spar Group (-14.2% YTD), Tiger Brands (-13.9% YTD), Anheuser Busch (-13.5% YTD), EOH Holdings (-13.4% YTD) and Discovery (-13.2% YTD).