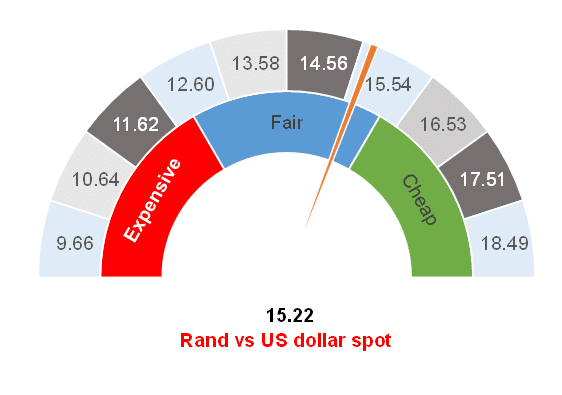

Figure 1: Rand vs US dollar

Source: Anchor

Since our last Anchor rand view, which was published on 28 September 2021, the rand has been subjected to numerous competing forces, which have largely cancelled each other out, with the local unit trading in a relatively narrow band against the US dollar. The local currency has been dropping to our fair-value range of R14.50 to R15.00/US$1 for a few days, before moving again to trade just above that range. As at Monday (15 November), the rand is trading at R15.22 against the US dollar, which is 1.5% above our fair-value band.

Globally, the weaker US dollar that we were anticipating has not yet materialised. Instead, the US dollar has strengthened from US$1.1610 to US$1.1450 against the euro over the past 30 days. The stronger US dollar has been a major contributor to the rand trading toward the weaker side of our fair-range estimate. The debate around US inflation rages on as factors such as air tickets, energy (petrol prices), and used car prices continue to push US inflation higher. These factors are, however, expected to be temporary. It is also a fact that base effects will start pulling YoY inflation data lower from about April next year. This gives much credibility to the argument that inflation is transitory and will, realistically, decline somewhat in 2022.

The other side of the argument is that the cost of shelter (home rentals) in the US went up by 0.5% in October (+6% annualised), while US wages have, over the last few months, been rising by an annualised 5% as businesses compete for staff. US food prices are also seeing upward pressure. All of these factors are considered more structural drivers of long-term inflation, thus giving some credence to the narrative of higher-for-longer US inflation. The eventual outcome of this is likely to be a blend of the narratives where inflation declines somewhat, but probably not all the way to the US Federal Reserve’s (Fed’s) long-term target of 2%. At its meeting in early November, the US Fed initiated the tapering of its bond-buying programme. The idea is that each month the amount of bonds the Fed purchases will be reduced, until the programme comes to an end in June 2022. We then expect a seamless transition into a first-rate hike by around July 2022, with a second rate hike in November 2022. Currently, we anticipate that the Fed will then proceed with two rate hikes per year for a couple of years, gradually raising US interest rates.

There are two points that we should take away from this. First, this is a Goldilocks trajectory whereby the Fed is able to smoothly raise rates, while financial markets and the economy play along. While this profile of rate hikes would be good for investments, it is likely that, over time, shifts to the policy will be necessary. The second point, however, is that, for now, the Fed is locked in autopilot mode. The hurdle for changes to the tapering process and the timing of the first- and second-rate hikes are quite high. Therefore, over the next year, we have a reasonably solid expectation of how US monetary policy will develop. The low likelihood of surprises means that the importance of US monetary policy on the value of the US dollar and its exchange rate with the rand should decline, perhaps contributing to a more stable exchange rate. Longer-term, we think that the dollar is slightly overvalued, however, it is unlikely to influence exchange rates in the near term.

Turning our attention toward SA, the main event recently has been Finance Minister Enoch Godongwana’s maiden Medium Term Budget Policy Statement (MTBPS), which was presented to Parliament on 11 November. At the time that the minister took over from his predecessor, there was negative market reaction. A risk premium was priced into the new finance minister, who was relatively unknown to financial markets at the time. Since then, Godongwana has been very cautious to make market-friendly comments and proposals and the MTBPS was his first opportunity to present in Parliament. By and large, we have seen that the minister is an astute politician and that he is prepared to spend some political capital in his budget statement. There was a clear continuity of policy, giving the market some comfort. The minister delivered what the market needed and the risk premium for the uncertainty around the minister’s appointment has now been priced out of the market. Both the rand and bonds rallied on the day of the MTBPS presentation.

Looking at the MTBPS itself, relatively little was said that we did not already know. The national deficit numbers have declined due to the combination of a boon in taxes from platinum group metals (PGMs) miners and from a rebasing of our economy’s GDP. SA got lucky over the past twelve months, and this has improved our deficit numbers. Unfortunately, the government continues to spend more than it can generate, and therefore SA’s debt continues to pile up. The government also continues to target a primary surplus (where income is more than non-interest expenditure) in 2024/2025 (there is some relief that this has not been pushed out). Government’s estimates of economic growth and tax collection seem reasonable and it all comes down to its ability to rein in spending. The minister seems to be pushing to remove the COVID-19 grant (that was extended) and to, once again, give civil servants an annual increase of close to zero. The next twelve months are going to be interesting, while government further addresses its overspending problem.

Still, the reality is that SA cannot save its way out of the hole that we are in. The only long-term solution is economic growth. Eskom has again proven that it is unable to keep the lights on, even in the most critical week heading into the local government elections. This was also in the middle of summer when energy demand is usually lower, so clearly the rot at Eskom is far worse than we had previously thought. The SA response has now shifted from a curious horror towards frustration with government.

Speaking about growth, we note that the finance minister discussed the spectrum auction as an unlock for growth. We have been hearing about this, the unbundling of Eskom, allowing private trains on SA’s rail infrastructure, and sourcing alternate supplies of electricity for several years now. These have become a political bone, that gets flashed to Parliament at the time of the MTBPS or the State of the Nation address, but is then buried and forgotten until they are once again dug up and flashed to Parliament as exciting initiatives or ideas six months later. It is time to see action on these and other points if SA is to unlock its true growth potential.

Looking ahead, the short-term value of the rand is dependent upon what the SA Reserve Bank (SARB) does at its Monetary Policy Committee (MPC) meeting on 18 November. If you look at the factors driving SA inflation, they are primarily petrol and food prices. We certainly do not see the runaway wage growth and rental growth that are signs of a structural inflation problem in other countries. Therefore, we think that the SARB should hold back on an interest rate hike until next year. This is, however, a finely balanced decision and a rate hike is certainly plausible and could be justified. Should the SARB decide not to hike rates now, then we would expect a slightly negative reaction on the part of the rand.

Overall, the local currency was trading at R15.22/US$1 on 15 November, which is just above our fair range. We continue to hold that the fair range is R14.50 to R15.00/US$1, although there is a risk that the local unit may remain above our fair range for a while. Looking at our portfolios, we are maintaining current currency positioning and we have made relatively few changes to currency exposure over the past month.

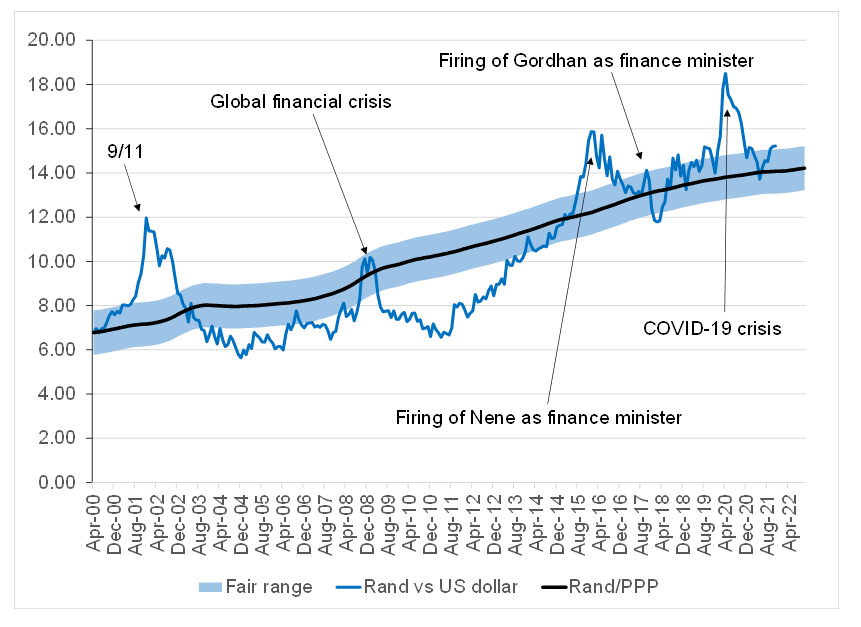

Figure 2: Actual rand/US$ vs rand PPP model

Source: Thomson Reuters, Anchor