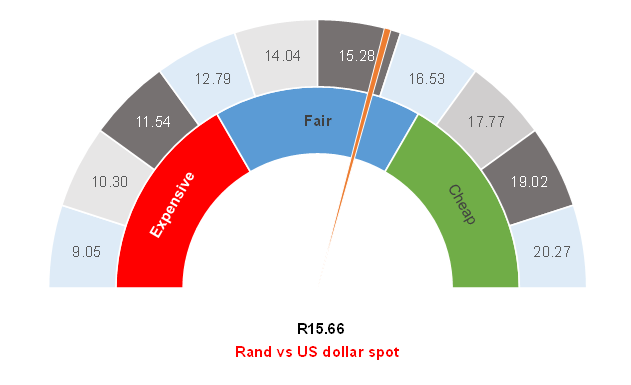

Figure 1: Rand vs the US dollar

Source: Anchor

The rand broke through the psychological R15.70/US$1 level on 29 January, with the local unit strengthening by c. 5.5% against the greenback YTD and moving closer to our modelled fair value in the R13.73-R15.73/US$1 range. This appreciation has been driven primarily by broad-based US dollar weakness, supported by surging commodity prices (notably gold and platinum, up 22.1% and 28.3% YTD, respectively) and, to a lesser extent, improving investor sentiment towards South Africa (SA) Inc.

Record gold and platinum prices, heightened US policy uncertainty, and growing expectations of further US Federal Reserve (Fed) rate cuts (under pressure from US President Donald Trump) have weighed on the US currency. The US Dollar Index, which tracks the value of the greenback against a basket of six major global currencies, has declined by c. 11% YoY (to 28 January 2026) and was down 9.4% in 2025. This as markets and investors reassess the sustainability of US growth, the inflationary implications of the Trump regime’s on-again, off-again tariffs, Trump’s erratic behaviour on the global stage (in addition to his fixation with acquiring Greenland, his cognitive functions and health have also been a source of concern, and a incoherent, rambling speech at the World Economic Forum in Davos was widely ridiculed), and the likelihood that US interest rates have peaked. The Fed cut rates by 25 bps in December, citing a softening US labour market. However, Fed Chair Jerome Powell subsequently signalled a possible pause in further easing unless incoming economic data justifies more accommodation (as expected, the Fed did not cut rates at its meeting on 28 January).

Recent developments have further unsettled confidence in the US dollar. Worryingly, in early January, in a startling revelation, Powell said that he faced a criminal investigation from what has become an increasingly hostile administration towards the Fed. Some commentators have described this as an effort to undermine the central bank’s independence. In addition, civil unrest, sparked by heightened federal immigration enforcement under the Trump administration and aggressive ICE raids, has resulted in two highly publicised fatal shootings and has added to perceptions of policy unpredictability. Against this backdrop, investors have increasingly sought alternative safe havens, pushing gold prices to record highs.

While the weakness in the US dollar exchange rate has been driven mainly by global spillovers from the uncertainty created by an erratic Trump administration, domestic developments have become increasingly supportive of the rand. Lower oil prices (-18.5% in 2025) and elevated gold and platinum exports have materially improved SA’s terms of trade, boosting the fiscus. SA’s November trade surplus rose to R37.7bn, the largest since March 2022, reflecting a strong export performance. Improved electricity supply, better logistics outcomes (improved rail performance, increased container volumes, and stronger public-private collaboration), and the resilience of the Government of National Unity (GNU) have also helped lift business confidence.

The stronger rand provides a double benefit for SA: higher US dollar receipts from record gold and metals prices and improved tax revenues from the mining sector. While the recent moves in the currency have been sharp, we believe that the underlying trend may well continue during 2026, albeit at a more measured pace.

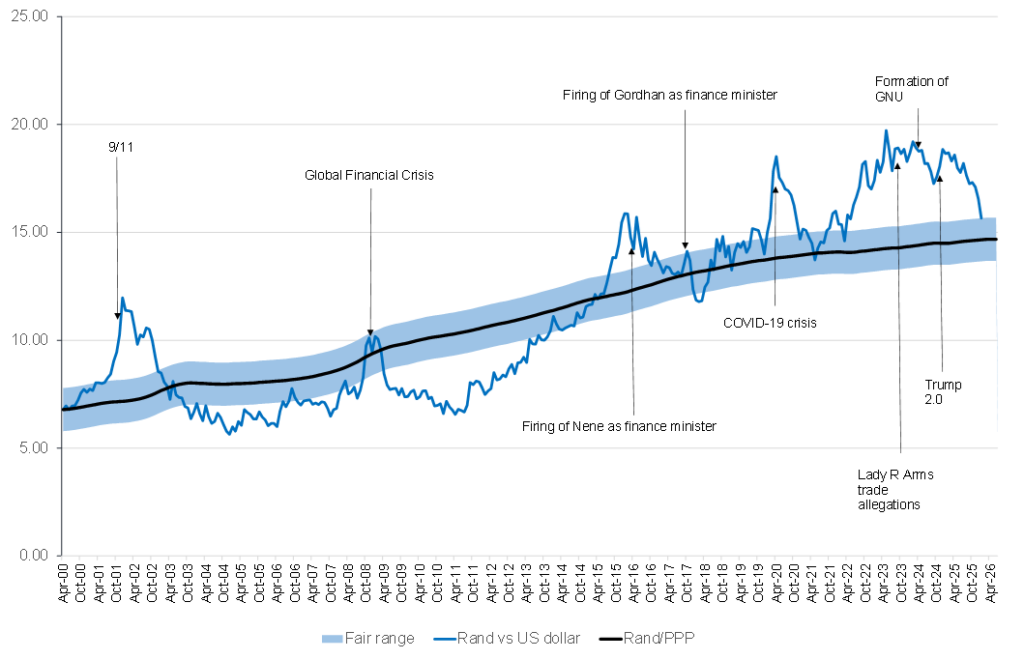

That said, with the rand trading closer to its fair value, it has also become more vulnerable to adverse shocks, which are inherently difficult to predict. US trade and foreign-policy developments under the Trump administration, along with SA’s 2026 Local Government Elections, remain potential sources of volatility. Any negative surprises on these fronts could have a more pronounced impact on the local currency.

Figure 2: Actual rand/US$ vs rand PPP model

Source: Thomson Reuters, Anchor