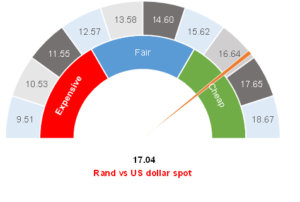

Figure 1: Rand vs US dollar

Source: Anchor

The South African rand continues to be whipsawed by global events. Much of what we have seen this quarter (3Q22) is more a function of the strong US dollar than domestic weakness. It is increasingly apparent that the UK is in for some difficult times, with a recession inevitable and US bank Citi even suggesting that UK inflation will peak at 18% later this year – nine times the Bank of England’s target. Europe is not faring much better, and expectations are that high oil and gas prices, coupled with rising interest rates, will also see the eurozone enter a recession shortly.

In contrast, the US economy is expected to grow by 1.2% YoY in 3Q22, giving the US Federal Reserve (Fed) scope to hike rates further. Peak rates were expected to be about 3.5% in the US, but recent events will likely give the Fed space to hike beyond this towards c. 4.0%. The strong US earnings season, coupled with a more robust economy and higher interest rates, have made this a more attractive investment destination. The US dollar has strengthened by about 5% since the start of 3Q22. This, on its own, is enough to account for nearly ZAc80 of weakness in the rand vs US dollar exchange rate.

We continue to hold that the long-term fair value of the rand is around R15.00/US$1. The point is that global recession fears and Russia’s war on Ukraine will likely see the rand weaker than its fair level for a while. Our perspective is that if everything returns to ‘normal’, the rand will trend back towards R15.00/US$1. Equally, if we see recessions spread, a Fed-induced hard landing in the US and perpetual Russian warmongering, the rand will weaken towards R18.00/US$1 as a strong risk-off environment dominates. It is too early to conclusively say whether we will avert a US hard landing, and good arguments exist for either possible outcome. We maintain our view expressed at the beginning of this quarter that it is a 50/50 chance as to which scenario eventually wins out.

Pricing financial assets in the current environment is difficult. We have a decent estimate of the rand’s long-term fair value, but how much credence do we give to the possibility of a bad outcome, and how much do we adjust the fair value to reflect this risk appropriately? For now, we think that a good outcome sees the rand at R15.00/US$1, and a bad outcome sees the rand at R18.00/US$1. At a 50% chance of each outcome, the midpoint of the range is R16.50/US$1. We know that the market tends to overprice the risk of negative outcomes slightly, so R16.50-R17.00/US$1 in the near term seems about right while we wait for direction on how this situation resolves itself. Markets will be particularly volatile as investors try to interpret each economic data print for indications as to how this plays out.

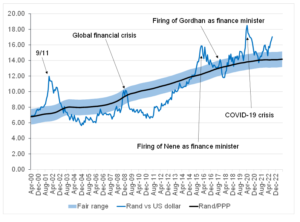

We are maintaining our purchasing power parity (PPP) model for the rand, although, for the next year, we expect the rand to trade well away from our fair value because of the risk factors we have outlined.

Figure 2: Actual rand/US$ vs rand PPP model

Source: Thomson Reuters, Anchor

If you have any questions or would like to discuss the subjects raised in this article with someone at Anchor please email us at info@anchorcapital.co.za.