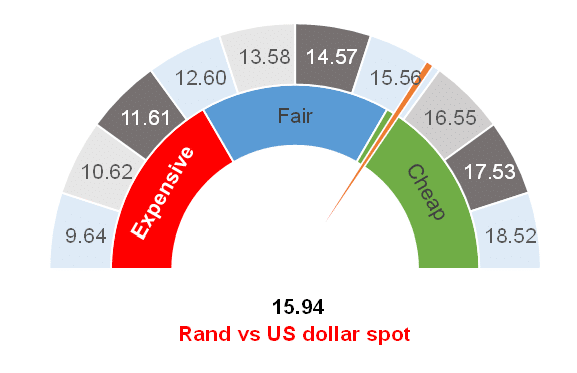

Figure 1: Rand vs US dollar

Source: Anchor

Currently, the rand seems to be bouncing around at the R16.00/US$1 level. However, markets remain jittery, and we believe that the rand could quite easily weaken or strengthen by ZAc20 without warning. The local unit is now (7 December 2021) trading at around R15.94/US$1, which is about 6.3% weaker than our fair-range value of R14.50-R15.00/US$1. We ascribe most of the rand’s apparent weakness to the strong US dollar, which is trading about 6.2% stronger than our expected level of US$1.20/EUR1.

Domestic news has been mixed. Economists had been battling to incorporate estimates of the impact of the July civil unrest (in KwaZulu Natal and Gauteng) into their forecasts for South Africa’s (SA’s) 3Q21 GDP growth rate. There was a wider-than-normal range of expectations from about -3% to about -0.5% QoQ. The eventual GDP data release of -1.5% QoQ was close enough to the middle of the forecast range and market reaction has been muted. Although the market impact was minor, this data print serves to remind us of the risks and social costs of unrest as well as the extreme inequality in the country. SA has continued to see its unemployment numbers creeping higher, while economic growth rates remain insufficient to make a meaningful dent in unemployment. State-owned enterprises (SOEs) remain a drag on potential economic growth, labour markets remain rigid and investor confidence remains low. SA’s economic potential remains weak in this environment.

On the positive side, the steps taken by government to bring its finances under control seem credible as tax collection remains robust and SA continues to benefit from stronger terms of trade. We continue to see a positive trade balance, even though it is likely to gradually decline as commodity prices soften. Local bonds screen as incredibly attractive on a real yield basis, which is attracting some foreign interest. The likely three, or four, local rate hikes which we expect in 2022 will also be supportive of the rand.

It turns out that SA scientists are too good at their jobs as they were the first to announce a new strain of COVID-19 dubbed Omicron. Omicron has financial markets on edge as we do not have answers to the important questions related to the new virus yet. It is apparent that this variant does transmit far more easily than previous variants, however, the extent to which it can evade immunity from prior infections or vaccinees remains uncertain. There appears to be anecdotal evidence that infections are less severe, although the currently low numbers and the fact that it initially spread through the younger population, which has previously been more resistant to COVID, means we cannot reach any conclusions as yet. The next week or two will be telling for the direction of the pandemic and our economy.

There is a definite risk-off sentiment as people wrestle with Omicron questions. This has in part helped to strengthen the US dollar and weaken the rand. The dollar strength, however, has more to do with the shifting monetary policy stance in the US where the US Federal Reserve (Fed) is reducing the amount of bonds that it buys every month. At the current pace of reductions, the Fed’s bond buying programme will end in June 2022. Recently, however, several key Fed officials have strongly suggested that in light of the recent economic data the pace of the bond reductions should speed up. The market has shifted its expectations from a US$15bn/month reduction in bond purchases to a US$30bn/month reduction in bond purchases. This means that the bond buying programme would now end in March 2022, leaving time for three US interest rate hikes of 0.25% each next year. We have seen the US dollar strengthening as the market has accelerated its expectations of rate hikes. This stronger dollar is accounting for most of the rand weakness over the last few weeks. We await the December Fed meeting, where more detail around a possible accelerated wind down of the bond buying programme is expected to be announced.

The rand will continue to be volatile as these events unfold. However, at R16.00/US$1 it seems a little oversold and we think that, over the near term, it will bobble around a level slightly stronger than R16.00/US$1. The recent slide in oil prices from US$85/bbl toward US$65/bbl have helped SA’s trade balance. Nevertheless, there is a risk that if oil prices recover, the rand could come under pressure again. Failing this, we think that the rand will continue to trade at current levels with a slight strengthening bias.

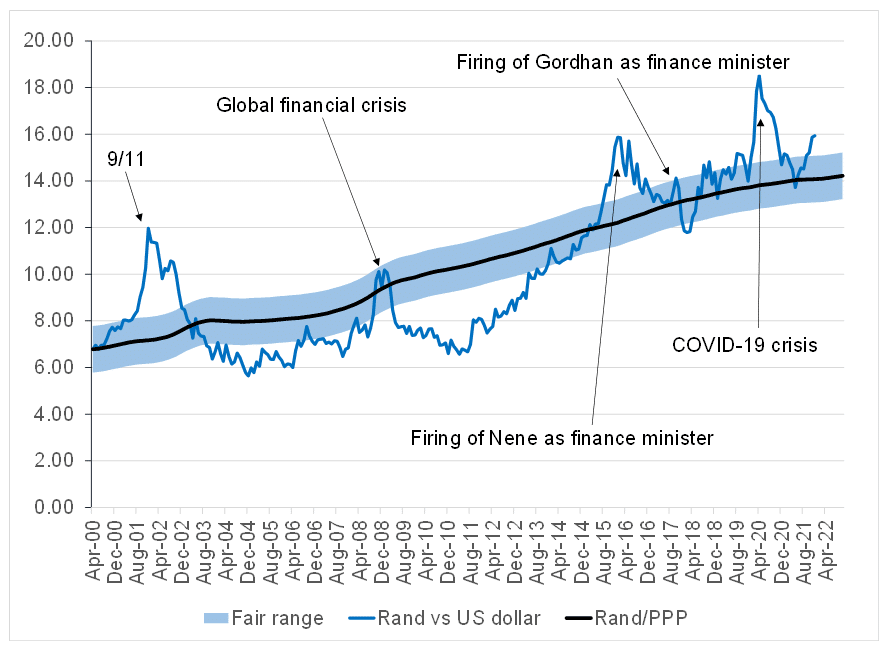

Looking at the longer-term picture, the rand has moved to trade weaker than our purchasing power parity (PPP) model would imply. We think that the rand could remain above the PPP model for a while before drifting back into our R14.50-R15.00/US$1 range.

Figure 2: Actual rand/US$ vs rand PPP model

Source: Thomson Reuters, Anchor