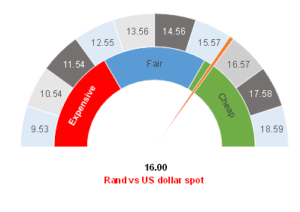

Figure 1: Rand vs US dollar

Source: Anchor

Over the past few years that we have been writing the Anchor rand view, local politicians seem to have slowed the pace at which government shoots itself in the foot, commodities are supportive, rating agencies are mildly positive on South Africa (SA), and the rand is somewhat range-bound between R15.00-R16.00 to the US dollar, while the greenback continues to strengthen (making the pound sterling look weak and pummeling the yen). Well-behaved local politicians, a positive current account, and the improving SA fiscal situation are leaving us with very little to complain about. Instead of an in-depth dive into recent currency movements, in this Anchor rand view, we have decided to take a step back and focus our discussion on markets in general and what we expect to happen. Some guesswork based on experience and a fresh look at the current global investment landscape.

At the moment, it is all about inflation. US inflation, as measured by the consumer price index (CPI), is at a record 8.6% making headlines as being its highest level since January 1981. High inflation has largely been driven by the price of oil, food prices, shelter costs (owners’ equivalent rent), and used car prices all pushing higher. The US Federal Reserve (Fed) has made it clear that it intends to crush US inflation by tightening financial conditions. The Fed’s primary tools to tighten financial conditions are quantitative tightening ([QT] essentially the opposite of quantitative easing [QE]) and raising interest rates. This is somewhat ironic because the most significant factor tightening financial conditions currently is the immense negative wealth effect as investors’ savings are reduced by the crypto meltdown and the stock market crash. Even bonds, generally considered to be safer investments, have brought about investor pain.

In contrast to financial market losses, QT is a toothless beast. The Fed has communicated that it will likely reduce its balance sheet by c. US$4trn. We have a useful roadmap showing how this will take place – it is already underway and is essentially on autopilot. There is a set quantity of US dollars floating around in the US economy and when banks have more US dollars than they need, they deposit these excess dollars with the Fed by way of a structure known as the reverse repo. These reverse repo balances are currently at approximately US$2.2trn. Simply put, the Fed is merely removing excess US dollars, that the US economy does not need, from the system. At its current pace of QT, the Fed will be removing unneeded dollars from the market until mid-2024 at which point its QT might actually become restrictive for the US economy. Until then, it is a bit of a red herring.

Financial markets have been repricing rates higher for a while, essentially saying that the Fed funds rate urgently needs to get to the 3.00%-3.25% range. Markets are also saying that rates need to increase to about 3.75%-4.00% for a period before dropping back to a neutral level later in the cycle. The two-pronged approach of the Fed’s dual mandate (these being maximum employment and managing inflation to an average of 2%) have been at odds. The Fed needs to raise rates to reduce inflation but doing so will necessarily result in higher unemployment and thus it cannot achieve both of its objectives at present. The Fed has spent much of 2021 and 2022 dealing with this conflict by living in a fairytale world where rate hikes do not need to be too high, time will fix transitory inflation, and rising interest rates will not result in the US economy contracting nor destroy jobs. The US Fed’s 0.75% rate hike on 15 June is, in our view, a seismic shift where the Fed has finally caught up with financial markets’ thinking. We also saw clear projections that the US unemployment rate is set to increase. The Fed has correctly prioritised taming inflation over maintaining full employment. The market reaction was essentially neutral as these events were already priced in and really what we saw was the Fed signaling that it was moving from being behind the curve to being where it needs to be. This dose of reality from the Fed was somewhat tempered by Fed Chair Jerome Powel emphatically keeping one foot in dreamland by asserting quite strongly that the US economy will not be flirting with a recession. Honestly, it is going to be closer than he wants to acknowledge, and US job losses are likely to be higher than the Fed is forecasting.

The above-detailed sequence of events is good for bond markets. The SA adage has always been more rate hikes now so that we have fewer rate hikes later. The Fed’s belated actions should start to see inflation calming, though we must be aware that monetary policy actions today only impact the economy in 6 to 12 months. This lag effect means that inflation will likely remain hot for a while, however, we maintain our view that inflation will be broadly flat for a spell before starting the slow march lower toward the end of 2022. The Fed’s announcement on 15 June was an acknowledgement that economic growth rates will be lower in the US for a while yet. Long-dated bonds (such as 30-year bonds) are highly sensitive to economic growth rates, while short-dated bonds (2-year bonds) are highly sensitive to inflation expectations. Slowing growth rates should see longer-dated bond yields come down, while the likely persistence of inflation will see 2-year yields rise. A yield curve inversion is on the cards, while long-dated bonds offer some value. Long-dated offshore bonds have become attractive investments.

Commodities were already seeing price inflation before Russia’s war on Ukraine exacerbated the global shortage of various commodities. Basic economics tells us that when demand for a commodity exceeds supply, the price of that commodity will rise towards a new equilibrium price where the demand and supply match off. To bring the price of the commodity down again, we need to either reduce the demand or increase the supply. Strict lockdowns in China (due to that country’s zero-COVID policy), only recently lifted, and a global economic slowdown (perhaps even recession) will reduce demand and result in lower prices. The problem here is that neither lockdowns nor a global recession is a permanent solution. Instead, we need to look at the supply side. New projects often have a multi-year delay before supply comes online and right now our resources specialists are not even talking about investments in new projects yet. It is, therefore, reasonable to expect that commodity prices will remain high for some time – quite likely for multiple years.

Most Russian commodities have been rerouted to countries that are accepting them and even SA is considering importing Russian oil to combat soaring fuel prices locally. An end to the war in Ukraine will not see Russia being welcomed back to the global economy with open arms, and meaningful increases in global supply would thus be unlikely anyway. A structural shortage of commodities means that neutral interest rates will necessarily be higher this cycle than in any of the cycles over the past ten years when commodities were in oversupply. Market behaviour seems to be triangulating toward US 10-year yields of around 3.00%, although this remains fluid. If the past 10 years were characterised by a turbocharger in the form of stimulus packages and artificially low rates, then the next cycle might feel like driving with the handbrake on in the form of a higher neutral rate and the absence of central bank stimulus packages. The global equity market is wrestling with this at the moment as price action reflects the stagflation debate of slower growth and higher yields. We believe that it is premature to say where equity prices will settle.

If the US Fed is like Alice emerging from Wonderland, then the UK and Japan’s central banks remain seated at the Mad Hatter’s tea party. As these central banks deny the need to act, we see rising inflation and weakening currencies. The European Central Bank (ECB) has at least started to leave the tea party and is following the Fed out of the rabbit hole although it remains a few steps behind the US central bank. Leaving the rabbit hole will see a country’s monetary policy normalise and its currency appreciate. The US is the first major economy stepping back into reality and we have seen the US dollar strengthen by about 14% against the euro over the last year. This strong US dollar looks like a weakness of the European, British, and Japanese currencies. As each of these economies follows the US out of the rabbit hole with the necessary rate hikes, we expect to see their currencies regain some lost ground. This means that the US dollar will remain strong for a while yet, although we think it is close to peak strength and we see a gentle weakening of the greenback from here on out.

The SA Reserve Bank (SARB) was one of the first central banks out of the rabbit hole and it is sitting firmly in reality, waiting to see how much damage other central banks will do to the global economy before the inevitable policy swing towards rate hikes. It is difficult to argue for a near-term end to the commodity cycle that is rescuing SA through blind luck. At the same time, our monetary policy is sensible, and our interest rates are about where they should be. If we are approaching peak US dollar strength then, over time, we should see the rand recoup some of its recent losses against the US dollar. Expectations of a slowdown and a possible recession in the US are bad news for the rand, so recovery from these levels will likely be erratic and slow. Still, the local unit remains well supported by coal and other exports (just imagine how much stronger the rand would be if Transnet got its act together and offered commodity exporters a consistent and reliable performance). Likely we are range-bound in the R15-R16/US$1 range with a longer-term propensity for the rand to strengthen.

Domestically, we believe that rate hikes will continue. We think that the SARB’s Monetary Policy Committee (MPC) needs to raise rates by 0.25% at its next meeting in July and by c. 0.75% by year-end. SARB Governor Lesetja Kganyago does tend to be trigger-happy when it comes to raising rates and more aggressive rate hikes certainly cannot be ruled out. We note that Kganyago was talking about bringing the SARB’s target inflation rate down to 3.0% from the current effective 4.5%. We believe that this is lunacy and SA enterprises need policy stability and predictability of inflation more than higher rates and the promise of 3% inflation. Let us hope that sensibility prevails. We think that global factors make for an ambiguous outlook for domestic bonds but improving fundamentals and continued commodity support in a relatively benign domestic inflation environment should see local bonds well supported in the long run. In the short term, there are concerns around the slowing global economy and rising global rate backdrop. Overall, we think that bond prices are flat for now, with some prospect of capital gains next year. Double-digit yields on the bond fund and mid-to-high-single-digit yields on the Flexible Income Fund with a longer-term prospect of capital gains. Nice!!

The macro-outlook for domestic equity is equally ambiguous. Historically, a strong commodity cycle has been good for the JSE, but much has changed, and the prospect of slower global growth and higher global rates seem to be souring near-term sentiment. Still, the equity team believes that good opportunities are appearing and that the macro environment should be supportive of domestic equities for a while.

So, where does this leave us on our Anchor rand view? The best guess is sideways for now at around R16.00/US$1, while we wait for the murkiness to dissipate. There is a slight strengthening bias, but slow and erratic is to be expected and we are therefore maintaining the current exposures in our portfolios. Over the longer term, R14.50/US$1 still feels plausible to us, just not for a while. We think that, in time, the local currency will strengthen towards our fair band.

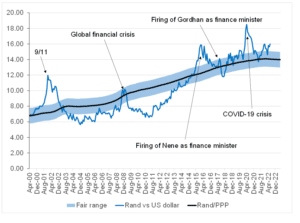

Figure 2: Actual rand/US$ vs rand PPP model

Source: Thomson Reuters, Anchor