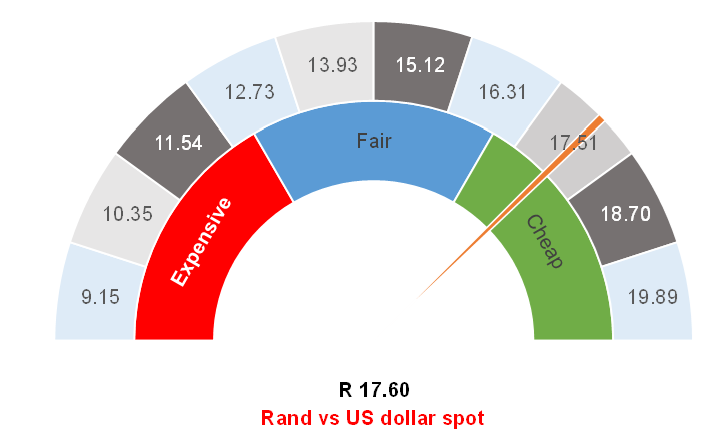

Figure 1: Rand vs the US dollar

Source: Anchor

We typically do not publish an Anchor Rand View just before releasing Anchor’s latest quarterly Navigator: Anchor’s Strategy and Asset Allocation report, which should be available early next week. It is, however, fair to say that the rand has been trading with a weakening bias for the past ten days. A week ago, the rand was testing R17.05/US$1, but now it is pushing towards R17.65 to the greenback. This gives reason for some introspection as our view of a strengthening rand is being challenged. As you will see below, we retain our perspective that the longer-term trend is likely to be a strengthening of the South African (SA) currency and that it should trade somewhat stronger than R17.00/US$1 in the next year or so.

The media is focusing on atrocities and the war in the Middle East. Investors are wrestling with whether the war will be contained or escalated. Further escalation risks disruptions of global oil supplies. Of key concern is the Strait of Hormuz, a narrow channel separating Iran from the Arabian Peninsula countries (Oman, Qatar, and the United Arab Emirates [UAE]) and a vital oil transport point. Approximately 20% of the world’s oil and c. 30% of its natural gas supply passes through the Strait. Iran potentially being involved in a war with Israel risks the closure of the Strait and a major disruption of global oil supplies. It seems that Iran wants to avoid an all-out war, and we are hopeful of a de-escalation. However, uncertainty remains, and in times of uncertainty, investors seek shelter in the relative safety of the US dollar, resulting in the dollar gaining some strength due to its status as a currency of refuge.

The second important point is that the US Federal Reserve (Fed) responded to weak US employment data by cutting interest rates by 0.50%. The press conference and information released following its rate-cut announcement seemed to indicate that it was in a sprint to bring interest rates down from 5.25% toward the 3.25% neutral rate. A weak US labour market meant that the Fed had to act sooner rather than later. However, on 4 October, the latest US Jobs data were released. These data painted a very different picture and were relatively robust in all facets, making the US Fed’s sprint to lower rates a little awkward since it was now met with data supporting a protracted marathon at a much slower pace. If the Fed had known this positive data was coming, it would not have cut rates by 50 bps. So yes, the Fed was a little quick out of the starting blocks, and now markets are betting it needs to slow the pace of rate cuts to a more appropriate level. We still think the Fed will lower rates to 3.25%; it will just take more time. If it takes longer to cut US interest rates, then it takes longer for the US currency to weaken. We still believe the rand can trade down to R16.20/US$1, but it will take longer.

With all this happening, people are not discussing Europe as much. European economic data have been relatively soft lately, and there is a decent expectation that the European Central Bank (ECB) will bring its rate cuts forward by a meeting or two. It is now entirely plausible that the ECB will be cutting rates at its meeting this month – a move that was off the cards until recently. This will also spark some short-term US dollar strength.

Meanwhile, China has whipped out a fiscal stimulus bazooka, announcing rate cuts, fiscal transfers, and major projects to achieve its economic growth target of 5% this year. With a stimulus package that is large enough, the country can probably buy its way to 5% YoY GDP growth. The initial market reaction was extremely positive, and we saw significant rand (and emerging market) strength following the announcement. However, this strength has dissipated as markets have assessed the longer-term implications. Over the longer term, this bazooka-sized stimulus package looks more like a pea shooter in the face of an oncoming hoard of barbarians. I listened to a recent Goldman Sachs podcast, which estimated that addressing China’s property market conundrum will require around CNY5trn to CNY6trn (c. US$850bn). Exact details of the recent stimulus package have not been announced yet, but we estimate that China will allocate c. CNY1.5trn (c. US$212bn) to the property problem. About five times the size of this bazooka is needed to address China’s trillion-dollar problem. Our assessment is that China should, therefore, get close to its growth target and that some of the measures announced will support Chinese equities; however, a lot more is required for China’s economy to turn the corner. Still, each future bout of stimulus out of China should be rand-supportive.

In summary, we think that the path of least resistance is for rand strength as the domestic reform agenda takes hold. While global factors may have turned against the rand in the past week or two, we believe it is temporary. When looking through all the noise, there is scope for the rand to trade with a R16/US$1 handle in the next year.

Figure 2: Actual rand/US$ vs rand PPP model

Source: Thomson Reuters, Anchor