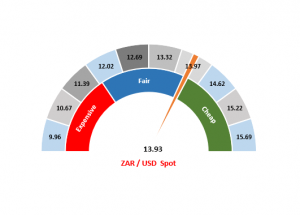

Figure 1: Rand vs US dollar gauge

Source: Anchor

We awake today (11 April) to news that Brexit has been kicked down the road with European leaders giving UK Prime Minister Theresa May a reprieve until 31 October, with a review of the UK’s progress to be held in June. Pushing this out removes the risk of a cliff event that was scheduled to occur on 12 April. The market can breathe a sigh of relief – for now. At the same time, European Central Bank (ECB) president, Mario Draghi, signaled growing concerns about the persistence of euro-area weakness following the ECB meeting on Wednesday (10 April). This could mean that interest rates stay lower for longer in Europe. Overall, we take this (and US President Donald Trump’s tweet that the US Federal Reserve [Fed] made a mistake hiking rates) as further signs that the search for yield might become the new normal. This would be good news for emerging markets (EMs), commodities and South Africa, with foreigners buying R6.8bn of South African bonds month to date.

The forgiving global environment is masking the fact that, on the ground, the situation in South Africa is tough. Yesterday’s slumping business confidence data release confirmed what many of us already know. Data from the South African Chamber of Commerce and Industry (SACCI) showed that business confidence was at its lowest level this year, with the index dropping to 91.8 in vs 95.1 in January and 93.4 in February. In March 2018 it stood at 97.6. In reality, the market is looking towards the election next month and looking through the events and data that arise before 8 May.

This puts the rand at R13.93/$1 this morning (11 April), although the local currency has recovered to be just inside of our fair range. We think that foreigners are likely to support the currency for a while yet.

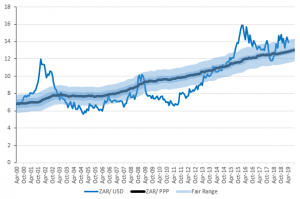

Figure 2: Actual ZAR/$ vs rand PPP model

Source: Bloomberg, Anchor