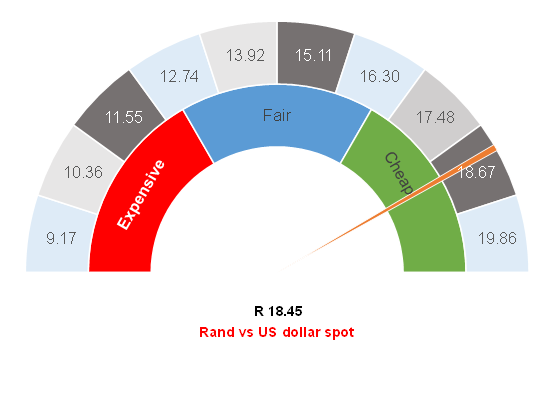

Figure 1: Rand vs the US dollar

Source: Anchor

Today reminds me of the classic 2009 comedy, The Hangover. After a legendary night out, a bunch of guys wake up in a wrecked Las Vegas hotel room with Mike Tyson’s tiger in the bathroom, a random baby on the bedroom floor, missing a couple of friends and a few teeth. No one is quite sure what happened yesterday, but they can all agree it was rather stupid. It sounds a lot like financial markets on Monday (5 August) – no one is sure what happened, but it probably was rather stupid.

One reason touted for Monday’s volatility is the weak US jobs report released on Friday (2 August). While this assertion is true (the report was weak), the US is still adding just over 110,000 jobs. This is undoubtedly softer than expected but hardly represents the catastrophic loss of jobs we saw heading into previous financial crises. This view also ignores that the ISM Services Index, released on 5 August, was stronger than expected. Yes, anecdotal evidence indicates that the US economy is slowing down, but the US Federal Reserve (Fed) has been engineering a slowdown for the past four years and seems to have at last achieved this goal. The point is that it is very difficult to read into one soft jobs report and one robust services report that the US economy is headed for a recession. Yet here we are, with futures markets pricing in a more drastic series of emergency interest rate cuts than we saw in the 2008 global financial crisis (GFC). US fundamentals indicate a slower economy and a softer landing but not an all-out economic crash. In our view, the price action on global bonds, domestic bonds, and the rand was too extreme in this regard.

The other reason touted for the volatility of 5 August 2024 is the Bank of Japan (BoJ) hiking interest rates by 0.25% and sounding somewhat hawkish in the minutes of the BoJ meeting, which were released on Monday. Again, the reaction on the day seems to be overblown in the context of the Japanese central bank hiking rates, maybe once or twice more. We understand that Japanese hikes will weaken the rand exchange rate slightly; we know they will result in slight upward pressure on SA yields, yet it is difficult to explain why the US went from expecting maybe 0.5% of rate cuts before Christmas to now expecting 1.25% of rate cuts. All in the space of a few hours!

So perhaps monetary policy is working the way it should; maybe we are not falling off a cliff nor looking at a possible recession. The US Fed will have to start cutting rates, with September’s Federal Open Market Committee (FOMC) meeting almost certainly bringing a rate cut. The Fed will remain vigilant and may need to cut faster and further than initially anticipated. Still, we are yet to be convinced that the global economy is in a hard-landing scenario. We think that, while bonds are pricing in a full-blown crisis, it may never occur, and there is more upside than downside potential ahead for financial assets. We are also positioning domestic bonds and the rand for a slight bounce back from Monday’s lows, while US bonds will probably give up a little of Monday’s gains.

The rand traded up to R18.68/US$1 on 5 August, and we have already seen some recovery. The fundamentals for the rand remain on the upside as the view for domestic politics remains positive (following the more investor-friendly outcome of the National and Provincial Elections [NPEs]). In time, the positive trade balance and lower global yields will also support the currency. We think the path of least resistance is for rand strength – back towards R18.00/US$1. While risks have clearly increased and economic growth shocks abroad could see further bouts of weakness, for now, negative sentiment dominates financial markets, and unexpected events can occur.

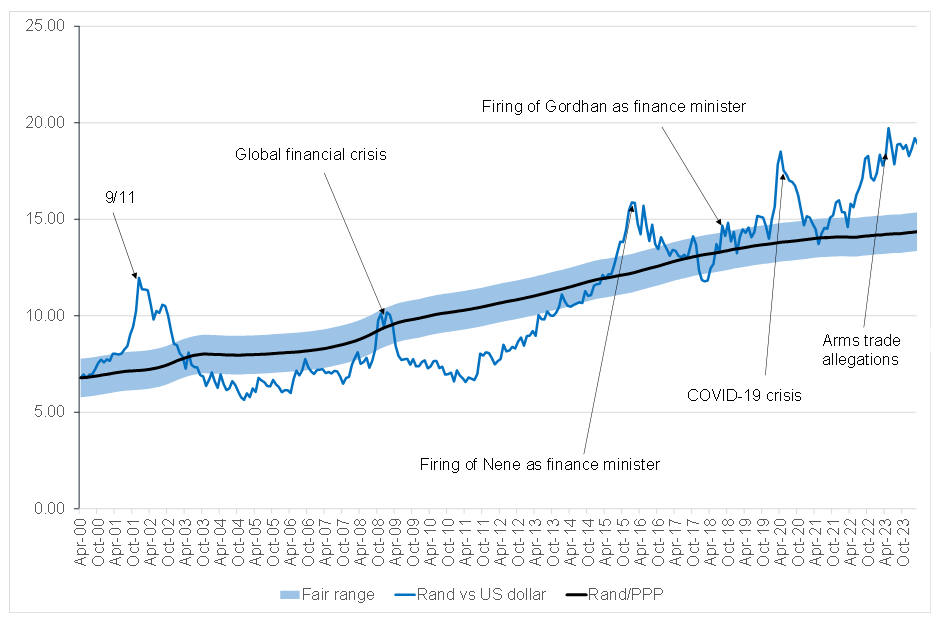

We continue to subscribe to our Purchasing Power Parity (PPP) view of the rand, which continues to indicate that the local unit is unduly weak at present. We expect it will stay this way for a while and, therefore, only expect a muted recovery towards R18.00/US$1 for now.

Figure 2: Actual rand/US$ vs rand PPP model

Source: Thomson Reuters, Anchor