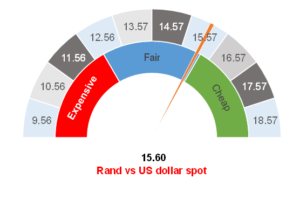

Figure 1: Rand vs US dollar

Source: Anchor

We have previously stated in The Navigator: Strategy and asset allocation report, 2Q22 dated 12 April 2022, that we expected the rand to weaken during April. However, we were surprised by the extent of the weakness which saw the local unit push towards R16.10/US$1. The market narrative for 1Q22 has been that of runaway inflation, with March US inflation, as measured by the consumer price index (CPI), reaching 8.5% YoY. The inflation frenzy was brought about by escalating commodity prices with oil, coal, iron ore, copper, and the like reaching their highest prices in decades. South Africa (SA), as a commodity-exporting nation, has benefitted massively. In December 2021, the SA Reserve Bank (SARB) was projecting a current account deficit for 2022 but now it is apparent that the current account will show a significant surplus. The SA Revenue Service (SARS) has claimed its share of the commodities boom and the debate is now around how large the tax collection overrun will be for the current year. SA financial assets (bonds, the rand, and equities) were bolstered by the commodity boom. The rand, which started the year at c. R16.00/US$1 was trading stronger than R14.50/US$1 during 1Q22.

However, April saw the market narrative shift, with the focus now firmly on US interest rate hikes. Analysts have been contorting themselves to price-in the most aggressive rate-hiking cycle and, inevitably, there has been a realisation that the US economy will slow down from its current pace. In fact, the US economy, which was growing at around 6.9% p.a. a few quarters ago might well slow towards a growth rate of 1% by the end of this year – a significant deceleration. China, meanwhile, has been battling the pandemic with a zero-COVID strategy, which entails draconian lockdowns. We believe that it is now bordering on the impossible for China to achieve its 5.5% growth target this year. Getting China to even a 4.5% growth rate is probably going to require some aggressive stimulus once the country’s lockdowns end. A slowing US economy and a disappointing China had analysts slashing their economic growth forecasts. Bank of America, Deutsche Bank and a few other investment banks grabbed media attention by talking about a US recession. Although it was for technical reasons, the US economy unexpectedly shrinking in 1Q22 (real GDP shrank at an annual rate of 1.4% vs an increase of 6.9% YoY in 4Q21) did not help markets. Slowing growth expectations are bad for equities and for the rand and we saw the local unit snap towards R15.57/US$1 in mid-April.

The US Federal Reserve (Fed) began preparing markets for rate hikes in early May as we had several Federal Open Market Committee (FOMC) members talk about expeditiously hiking towards the neutral rate. The Federal Reserve Bank of St Louis President James Bullard is a Fed committee member known to be hawkish. He started talking about rate hikes of 0.75% increments in the US. Meanwhile, Fed Chair Jerome Powell, made it clear that the US central bank was going to act expeditiously to curb inflation expectations. The market priced-in the worst from the Fed and we saw further pressure on equity markets and the rand, with the local currency testing R16.10/US$1 toward the end of April.

However, Wednesday’s (4 May) statement from the FOMC and Powell’s subsequent press conference has calmed market fears. It is clear that US rates will rise toward 2.25% this year and probably to 3.25% next year and that we will see rate-hiking increments of 0.5% at the Fed’s June and (probably) July meetings. The balance sheet runoff (quantitative tightening) will also start as expected. The Fed is targeting a balance sheet wind-down of US$95bn/month (although we note that this is dependent on the pace at which its bonds mature – we will likely see a slower actual runoff). This is all summed up in the Fed’s lurch towards hawkishness, as expected. The point is that the Fed prepared the market for the worst and then delivered something slightly softer than the worst. The market cheered when Powell stated that the FOMC is not actively considering a 0.75% rate increase and the knee-jerk reaction to this was for markets to rally. We see equities a little stronger and the rand back to around R15.60/US$1 following the Fed’s statement. The market has calmed down and we now have a sense of direction from the Fed again, which should see volatility decrease for a period. Smoother waters would certainly be welcome for investors at this stage.

Looking toward the SARB’S next meeting, we expect that the Monetary Policy Committee (MPC) will hike rates again at its meeting later this month. The debate is whether to expect a hike of 0.25% or a hike of 0.50%. Market pricing seems to be leaning toward a hike of 0.50%. We think that with March SA inflation, released in April, of 5.9% YoY touching the upper-end of the SARB’s target range (of 3%-6% YoY), with petrol prices likely to increase further and considering recent rand volatility, the SARB will be justified in hiking rates by 0.5% at its May meeting. We maintain our view that the repo rate will likely increase from the current 4.25% toward 5.25% at year-end and to 5.75% next year. However, we note that the timings of these hikes remain a little uncertain.

The commodity support has not gone away, and SA reported a healthy trade surplus of R45.9bn in March. Rate hikes will also continue to bolster the case for the rand, and we maintain our view that the local currency might be able to creep stronger again. Looking ahead toward our purchasing power parity (PPP) model in Figure 2, you can see how the rand has pushed above our fair band. We are maintaining our target level of R14.50-R15.00/US$1 that we have been speaking about for the past year. We have taken advantage of rand weakness in April to hedge out some of our US dollar risk positions at higher levels.

Figure 2: Actual rand/US$ vs rand PPP model

Source: Thomson Reuters, Anchor