If you’re interested in investing in these funds please email us at sales@anchorcapital.test or click here to fill in your details if you would like someone in the Anchor team to contact you.

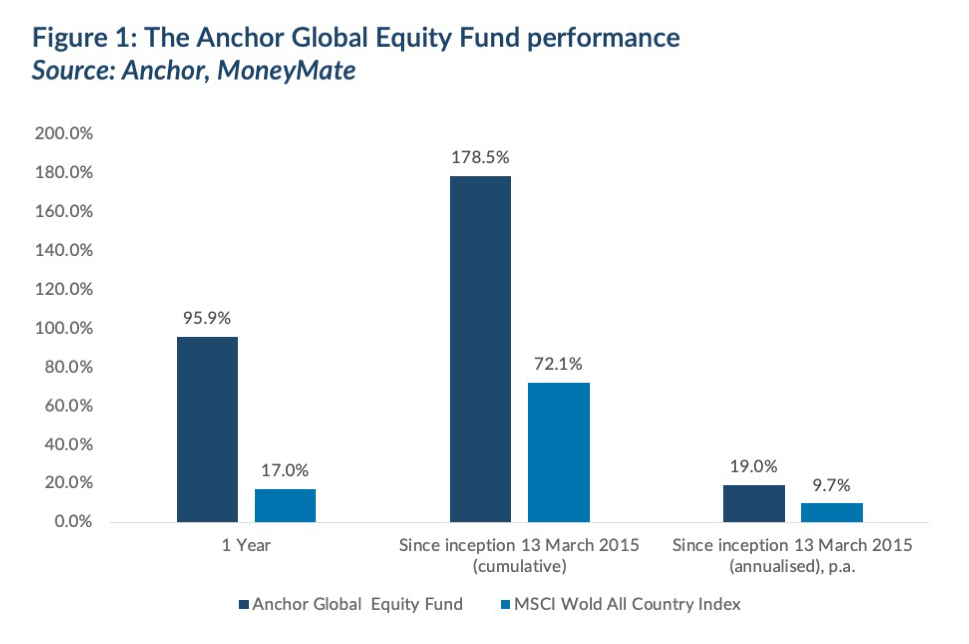

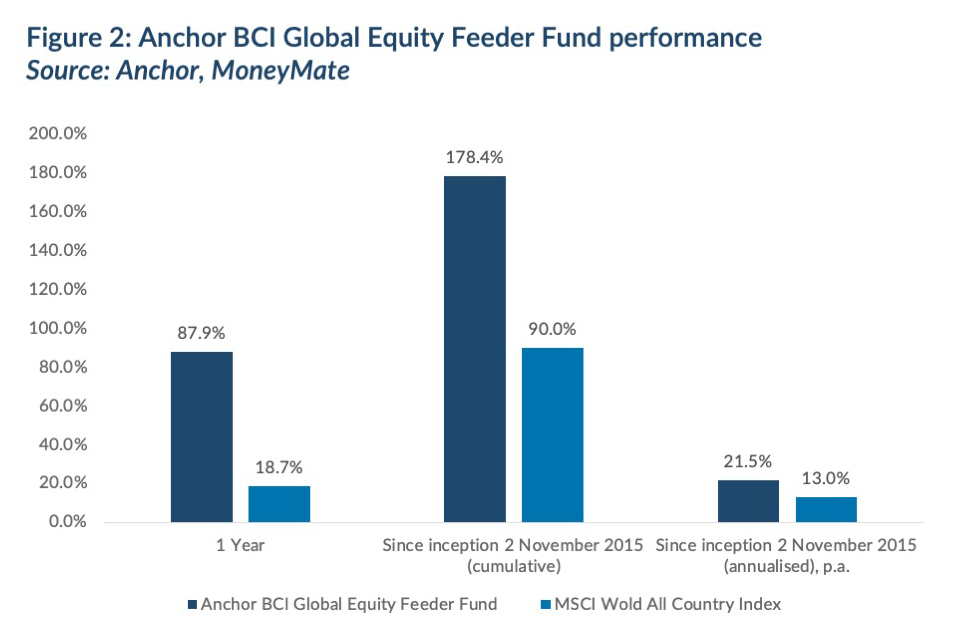

I am absolutely delighted that two of our funds won Raging Bull Awards for 2020. The Anchor Global Equity Fund won Best Financial Sector Conduct Authority (FSCA)-approved Offshore Global Equity Fund and the Anchor BCI Global Equity Feeder Fund, won Best (SA-Domiciled) Global Equity General Fund on a Risk-adjusted Basis.

I am resolutely focused on finding “multibaggers”. These are companies (and shares) with the potential to increase by multiples of their current size over the next five to 10 years. These are usually young, innovative, founder-run businesses solving important problems in huge markets and are built on the foundation of a great product; one that is typically cheaper, more convenient, and offers customers greater choice and flexibility. COVID-19 was a catalyst in exposing more people to superior products (from e-commerce to streaming) and the fund’s holdings benefited significantly from that shift. Two examples are Sea Limited and Etsy, which rose 395% and 302% respectively in 2020. Sea is a gaming and ecommerce company which operates predominantly in South East Asia, while Etsy is a US-based online marketplace for handmade and craft goods.

The inevitable question which arises is “What next?” I believe we are in the early stages of a second Cambrian explosion – of ideas, innovation, new business models, and multibaggers – driven by the democratisation of technological tools which were previously limited to the largest corporates. Today, it is possible to create a business and reach a level of scale that was previously unthinkable, at a speed that is barely conceivable. COVID-19 was not the genesis of this emerging phenomenon, but it has certainly been a critical accelerant. There is every reason to believe we are in the midst of a golden age for stock pickers.

While I attempt to understand the broad forces at play in the world, portfolio decisions are made based on bottom-up criteria. I seek to invest in companies that are drivers of change, rather than victims of it. I seek to invest in businesses that build great products and have the potential to become multibaggers. In this context, I am as optimistic as ever about the fund’s outlook.

Source: Anchor, MoneyMate as at 31 January 2021. Inception date: 13 March 2015.

Highest and lowest calendar year performance since inception High 90.9 % and low -13.6 %.

Source: Anchor, MoneyMate as at 31 January 2021. Inception date: 2 November 2015.

Highest and lowest calendar year performance since inception High 91% and low -11.3%.

If you’re interested in investing in these funds please email us at sales@anchorcapital.test or click here to fill in your details if you would like someone in the Anchor team to contact you.

Disclaimer

A schedule of fees, charges, and maximum commissions are available on request. Investment performance is for illustrative purposes only and calculated by taking actual initial fees and ongoing fees into account for the amount shown with income reinvested on reinvestment date. Past performance is not necessarily an indication of future performance. Annualised return is the weighted average compound growth rate over the period measured. Actual annualised figures are available to the investor on request. The forecast or commentary isn’t likely to occur.

Anchor BCI Equity Feeder Fund is a portfolio that invests in a single portfolio of a collective investment scheme, which levies its own charges, and which could result in a higher fee structure for the feeder fund. Boutique Collective Investments (RF) (Pty) Ltd (“BCI”) is a registered Manager of the Boutique Collective Investments Scheme, approved in terms of the Collective Investments Schemes Control Act, No 45 of 2002.

Anchor Global Equity Fund, a sub- fund of the Sanlam Universal Funds PLC (USD). The Fund is managed by Sanlam Asset Management (Ireland) Limited, which is authorised by the Central Bank of Ireland; as a UCITS Management Company; and an Alternative Investment Fund Manager; and is licensed as a Financial Service Provider in terms of Section 8 of the South African FAIS Act of 2002.

Please refer to the Minimum Disclosure document for the full Disclosure document https://anchorcapital.co.za/downloads/#factsheets