Recent weeks have been dominated by a softening of the initial tariff stance taken by the US and calming of geopolitical tensions that had been quite severe over the past quarter. Volatility is lower than a quarter ago (2Q25), but an uncertain world persists, and surprises will happen. Overall, investors who can look through this will most likely find that this is a good time to hold risk assets. You will see that we favour equities both domestically and abroad.

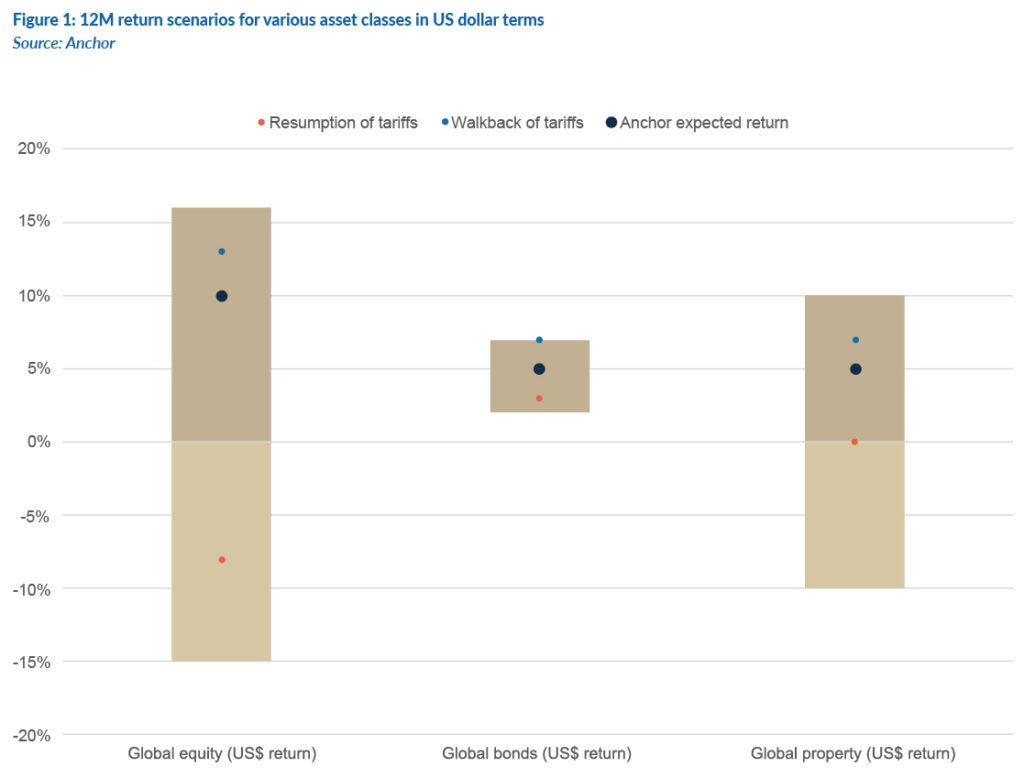

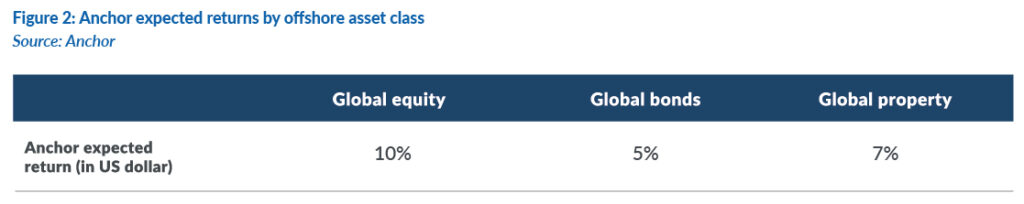

Figure 1 below highlights the US dollar return outlook for the various global asset classes. The bar in Figure 1 represents the reasonable range of possible outcomes, with the dots representing our estimate of the outcome in the various scenarios. All asset class returns show a narrower range of potential outcomes than previously. All asset classes have attractive expected returns, reflecting the more positive outlook.

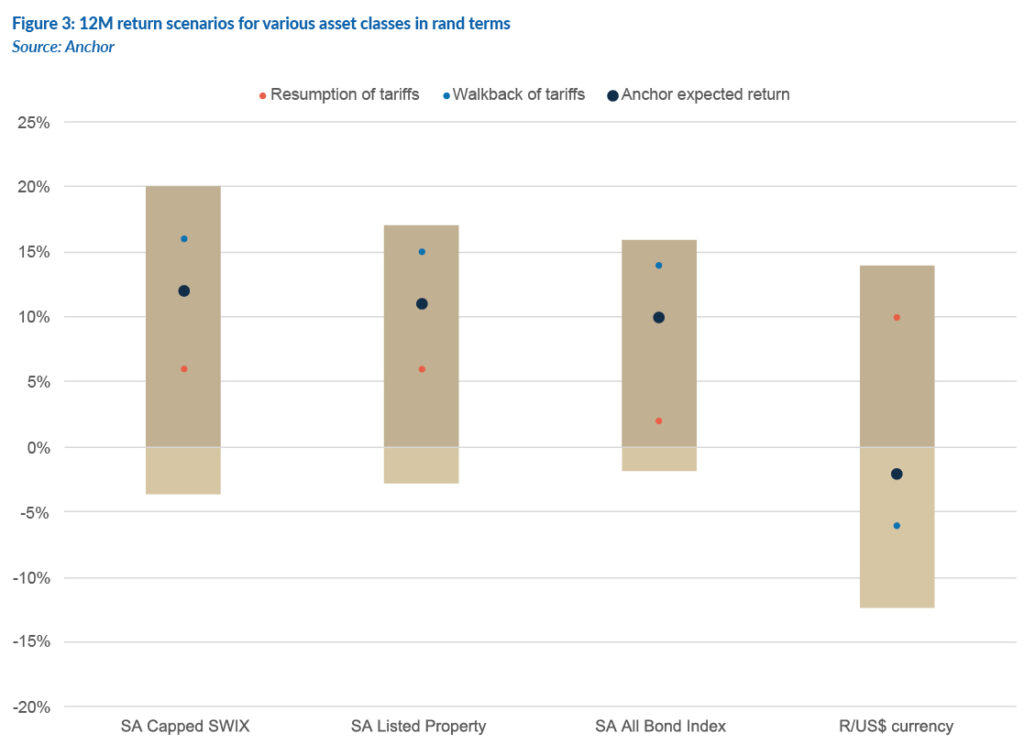

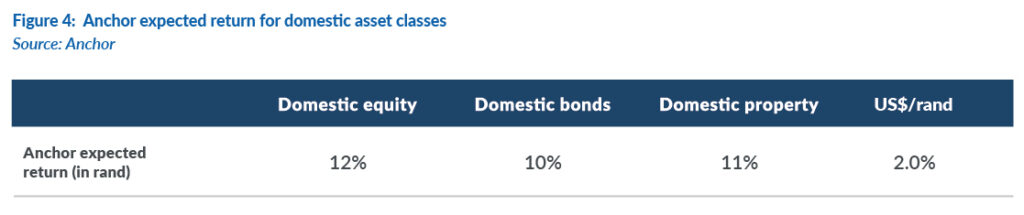

Figure 3 below highlights the rand return outlook for several domestic asset classes. The bar represents the reasonable range of possible outcomes, with the dots representing our estimate of the outcome under various scenarios. From a domestic perspective, we see some slight recovery in the rand from stressed levels as the US dollar weakens a little further. We are most positive on equities which show a decent prospect of continued gains.