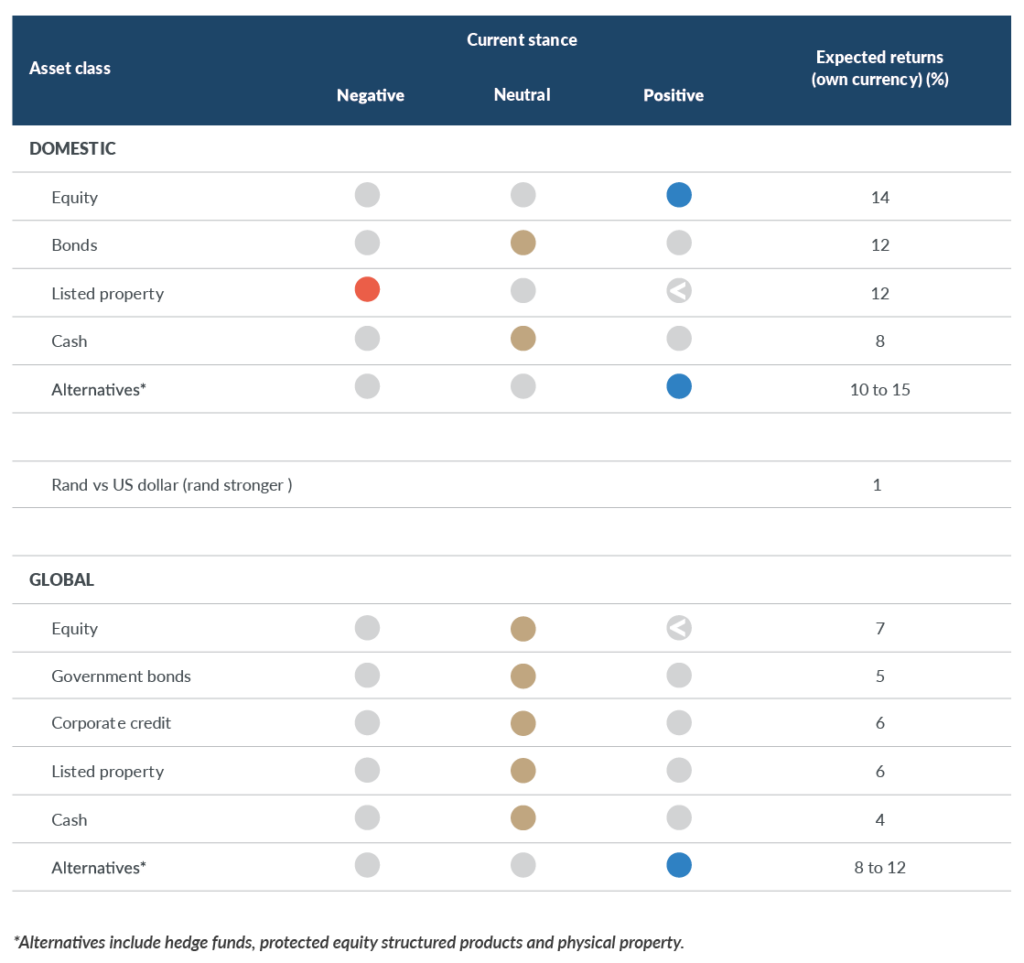

The following table illustrates our house view on different asset classes. This view is based on our estimate of the risk and return properties of each asset class in question. As individual Anchor portfolios have specific strategies and distinct risk profiles, they may differ from the more generic house view illustrated here.

The most recent quarter (2Q24) was dominated by the positive response to the outcome of the National and Provincial Elections (NPEs). This provided a solid boost for domestic investments while global equity markets powered on with stellar returns. Our return expectations for the various asset classes have shifted to reflect different starting prices of assets, a more positive outlook for South Africa (SA) and a slower interest rate-cutting cycle.

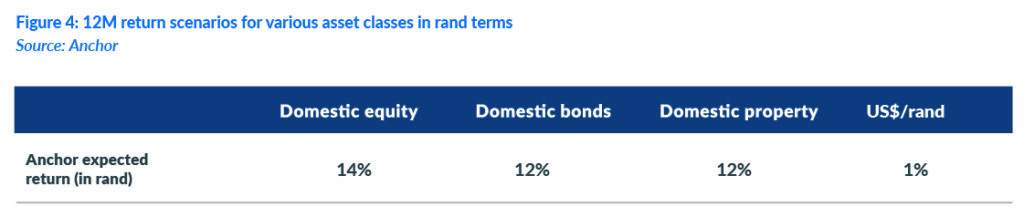

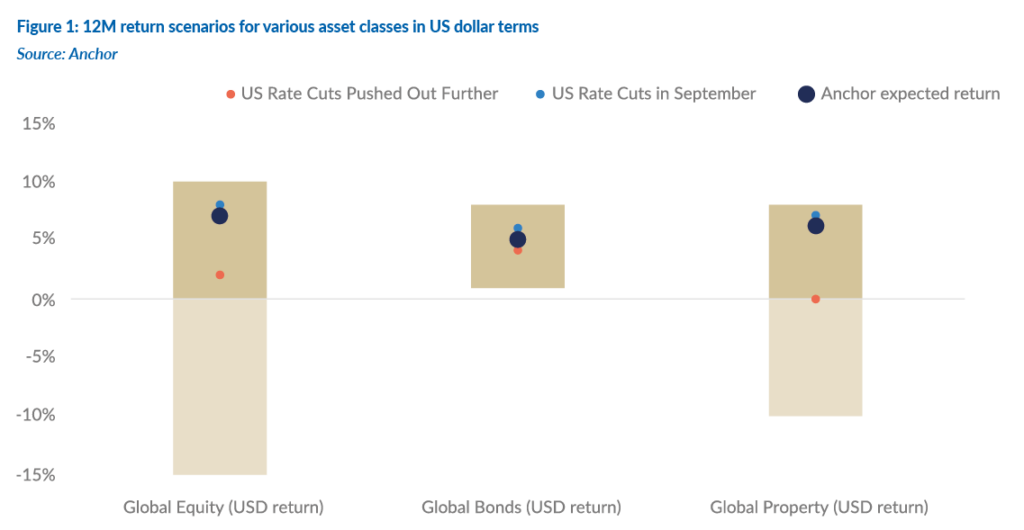

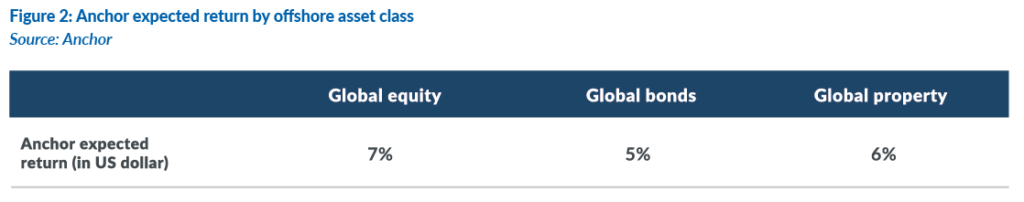

Figure 1 below highlights the US dollar return outlook for the various global asset classes. The bar in Figure 1 represents the reasonable range of possible outcomes, with the dots representing our estimate of the outcome in the various scenarios. We think global equities (particularly US equities) are likely to perform best; however, downside risks are growing. Global bonds and cash also remain compelling.

Figure 3 below highlights the rand return outlook for several domestic asset classes. The bar represents the reasonable range of possible outcomes, with the dots representing our estimate of the outcome under various scenarios. From a domestic perspective, we believe the worst is likely behind us. We anticipate less loadshedding, improved governance and slightly positive steps being taken by the government. There is still a significant political risk premium in the price of domestic assets, and we believe the country may become attractive to foreign investors if the reform narrative takes hold in time to come. We are optimistic that domestic factors should continue improving as we progress further into 2024.