Recent weeks (early April 2025) have been dominated by the more aggressive-than-expected approach taken by Trump towards implementing tariffs and the fractures within SA’s GNU following Treasury’s bungled attempt at a VAT hike. This has resulted in a volatile backdrop for investments and severe daily price swings for financial assets. The outlook remains uncertain for all asset classes, and we do not believe we are at the end of the Trump-induced turmoil. Some thought and planning have gone into your long-term asset allocation, and investors should let that do its work. In the longer run, markets have always recovered, and risk assets have paid off. We are therefore taking a neutral stance on asset allocation at this stage, essentially saying that one should stick with one’s long-term plan.

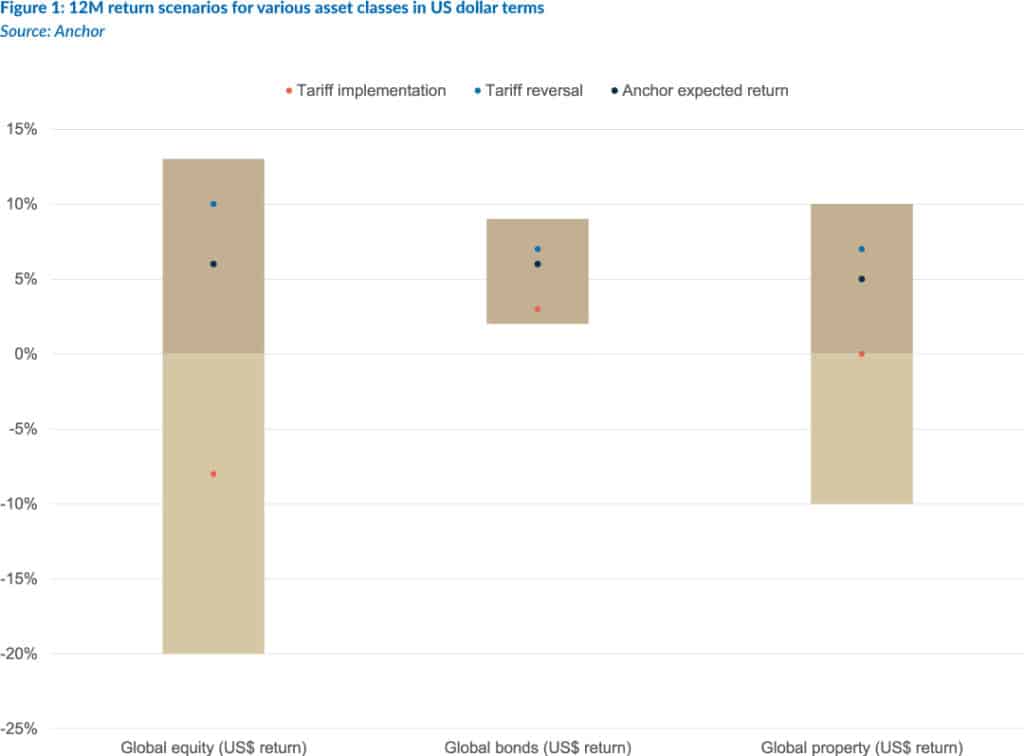

Figure 1 below highlights the US dollar return outlook for the various global asset classes. The bar in Figure 1 represents the reasonable range of possible outcomes, with the dots representing our estimate of the outcome in the various scenarios. All asset class returns show a wider range of potential outcomes than previously. All asset classes also have slightly lower expected returns, reflecting the impact of deglobalisation, reduced confidence levels and overall market uncertainty.

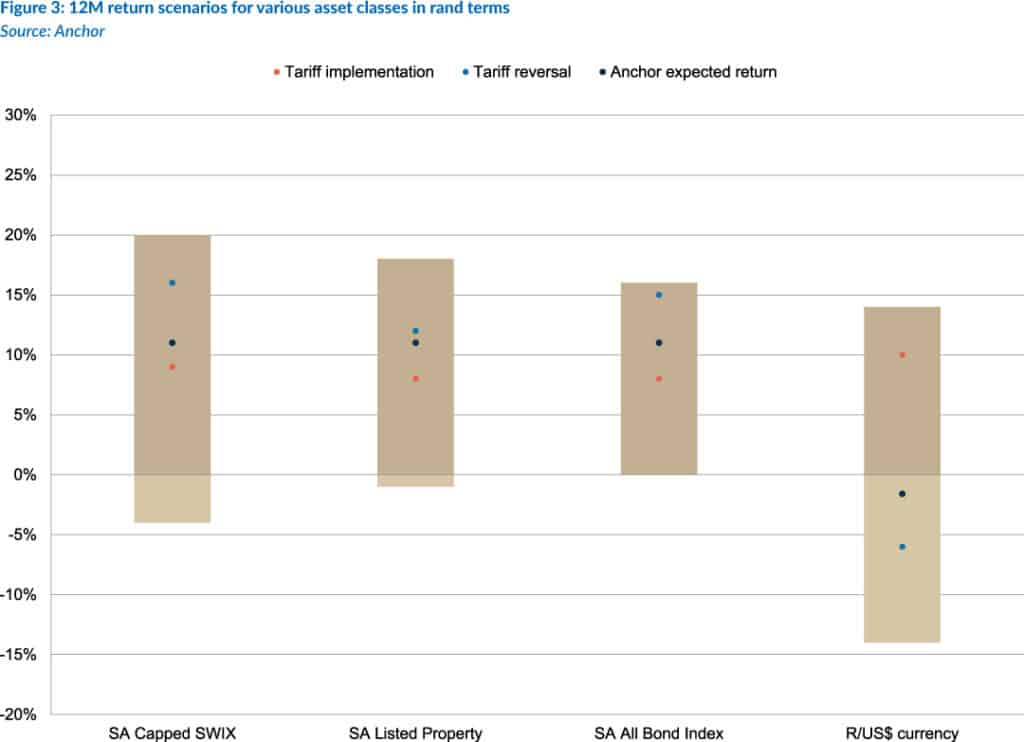

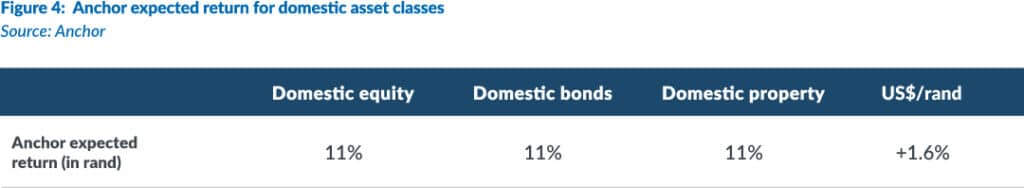

Figure 3 below highlights the rand return outlook for several domestic asset classes. The bar represents the reasonable range of possible outcomes, with the dots representing our estimate of the outcome under various scenarios. From a domestic perspective, we have become less enthusiastic about our expectations for economic growth, now around the 1% level. This, coupled with continued domestic political strife and global tariff pressure, sees our expected outcomes for asset classes lowered again, with increased ranges of possible outcomes. We see some slight recovery in the rand from stressed levels.