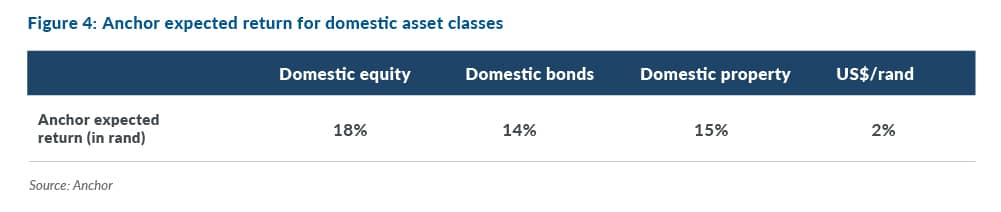

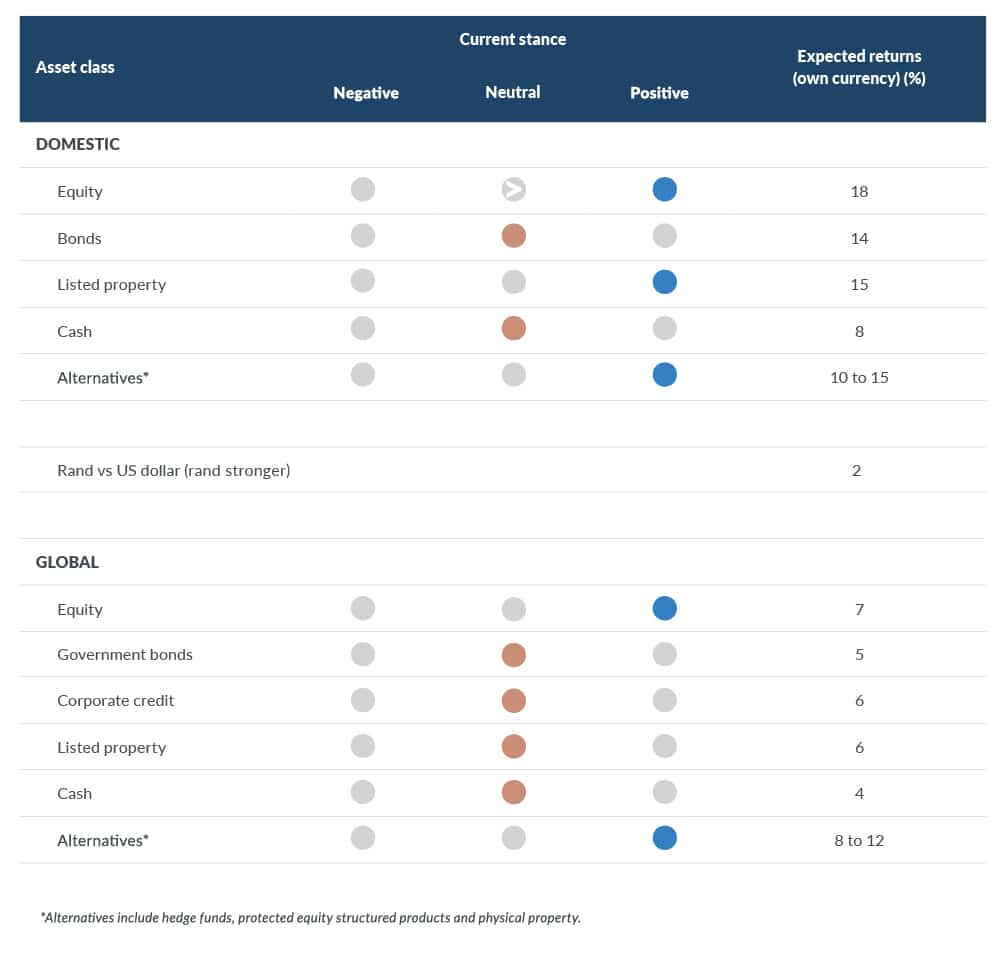

The following table illustrates our house view on different asset classes. This view is based on our estimate of the risk and return properties of each asset class in question. As individual Anchor portfolios have specific strategies and distinct risk profiles, they may differ from the more generic house view illustrated here.

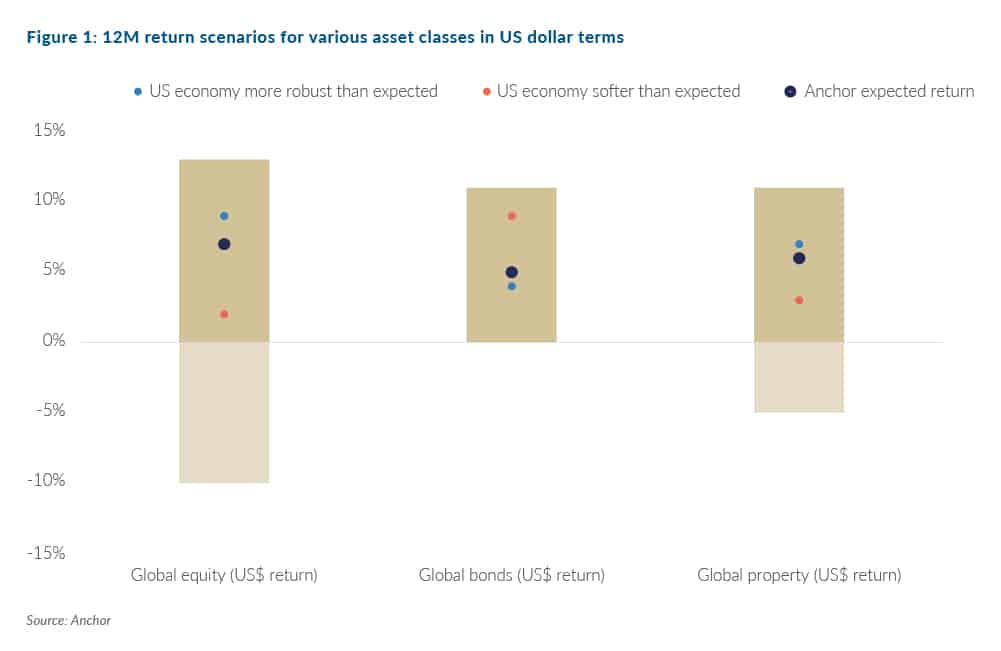

The most recent quarter (1Q24) was dominated by market participants pushing the timing of the first interest rate hike out further into the future and shifting market expectations towards a shallow interest rate-cutting cycle. This shift proved negative for interest rate-sensitive investments, while US equities benefited from the stronger-than-expected US economy.Our return expectations for the various asset classes have shifted to reflect different starting prices of assets and a slower interest rate-cutting cycle.

Figure 1 below highlights the US dollar return outlook for the various global asset classes. The bar in Figure 1 represents the reasonable range of possible outcomes, with the dots representing our estimate of the outcome in the various scenarios. We think global equities (particularly US equities) will likely outperform in this environment as they continue their strong momentum. Global bonds and cash remain compelling.

Figure 3 below highlights the rand return outlook for several domestic asset classes. The bar represents the reasonable range of possible outcomes, with the dots representing our estimate of the outcome under various scenarios. From a domestic perspective, the weak economy, failing state-owned enterprises (SOEs), and the poor state of the government’s finances are a few of the factors that detract from our outlook. We think South African society is learning to cope with electricity disruptions and that private generation will lessen the blackouts. There is already much negativity in the price of domestic assets, and we believe there is a decent prospect of some recovery in asset prices from current levels. We think domestic factors should improve into 2024, though there is much uncertainty around this view, with the national election likely to keep markets on edge for 2Q24.