ASSET ALLOCATION SUMMARY

Financial markets appear increasingly desensitised to political noise, with events such as the US’s midnight raid on the Venezuelan president and the Department of Justice (DoJ) launching a criminal investigation into US Fed Chair Jerome Powell having a minimal impact on asset prices. Risk assets continue to perform strongly, supported by robust corporate earnings growth, fuelled in large part by AI-related investment spending. Domestically, commodity prices remain elevated, contributing further to positive market momentum. Against this backdrop, we still favour risk assets as the strong earnings and price momentum look set to continue. You will see that we continue to favour equities both domestically and abroad.

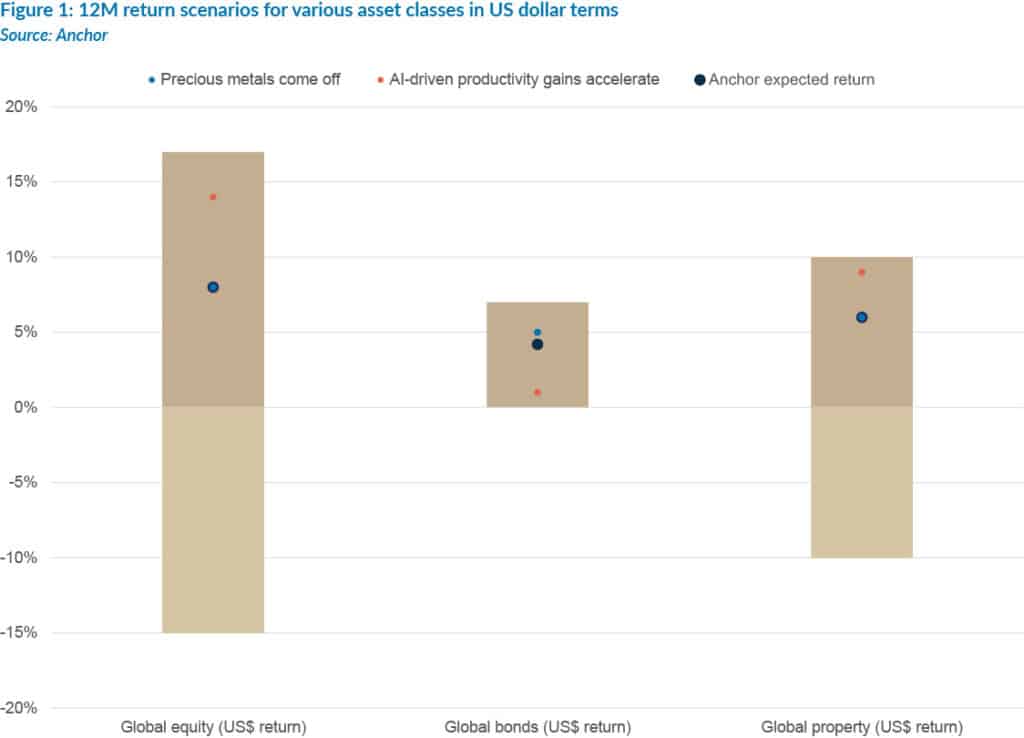

Figure 1 below highlights the US dollar return outlook for the various global asset classes. The bars in Figure 1 represent the reasonable range of possible outcomes, with the dots indicating our estimated outcomes under various scenarios. All asset classes have attractive expected returns, though we find global equities to be the most appealing.

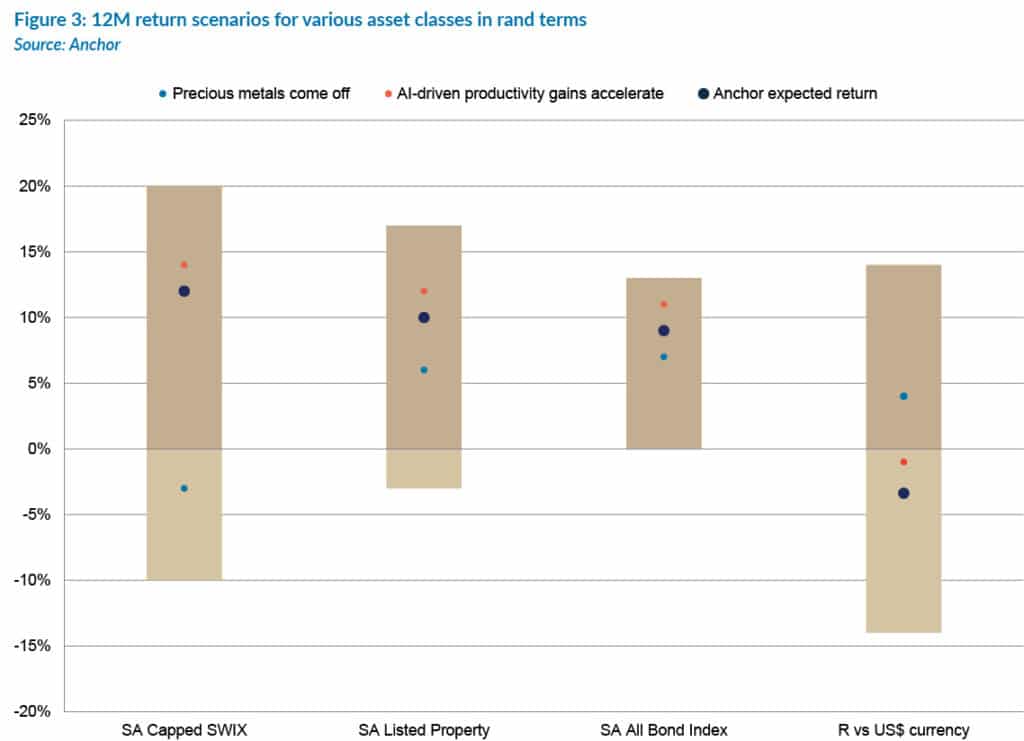

Figure 3 below outlines the rand return outlook for several domestic asset classes. The bar represents the reasonable range of possible outcomes, with the dots indicating our estimate of the outcome under various scenarios. From a domestic perspective, we anticipate a modest recovery in the rand as it approaches its fair value. We are most positive on equities, which show a promising prospect of continued gains and potential upside surprises.