The most recent quarter (4Q24) was dominated by the response to the re-election of Donald Trump as US president and anticipation of his economic policies, which are seen as somewhat inflationary and supportive of a stronger US dollar. US exceptionalism is expected to continue as regulations are relaxed in the US. This has provided a solid boost for equity investments, but the rand and bond asset classes have weakened. Our return expectations for the various asset classes have shifted to reflect different asset starting prices and a continued positive outlook for SA and the global economy. The interest rate-cutting cycle is expected to be shallower than previously thought, and bond yields will remain high.

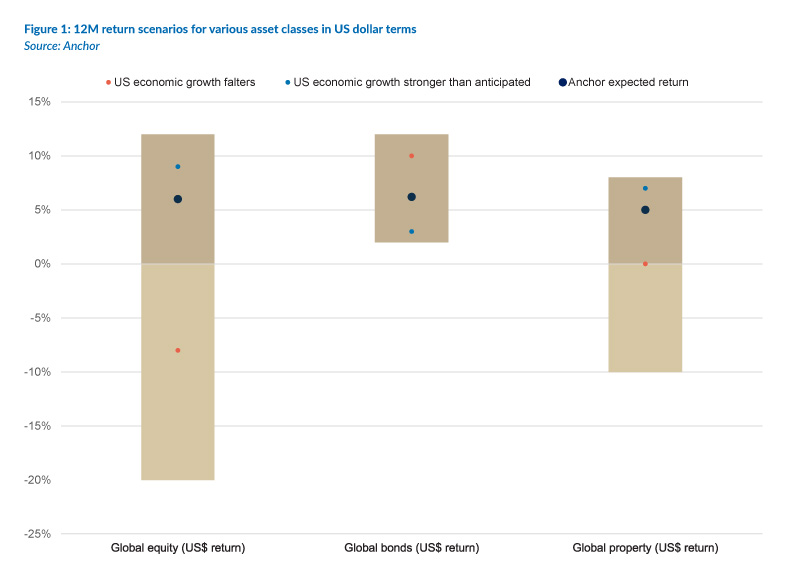

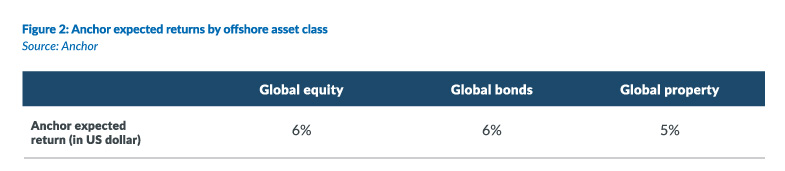

Figure 1 below highlights the US dollar return outlook for the various global asset classes. The bar in Figure 1 represents the reasonable range of possible outcomes, with the dots representing our estimate of the outcome in the various scenarios. We think global equities (particularly US equities) are likely to perform best; however, downside risks are growing. Global bonds also remain compelling. On an absolute level, we think equity returns will be slightly lower going forward while the market absorbs the higher starting prices.

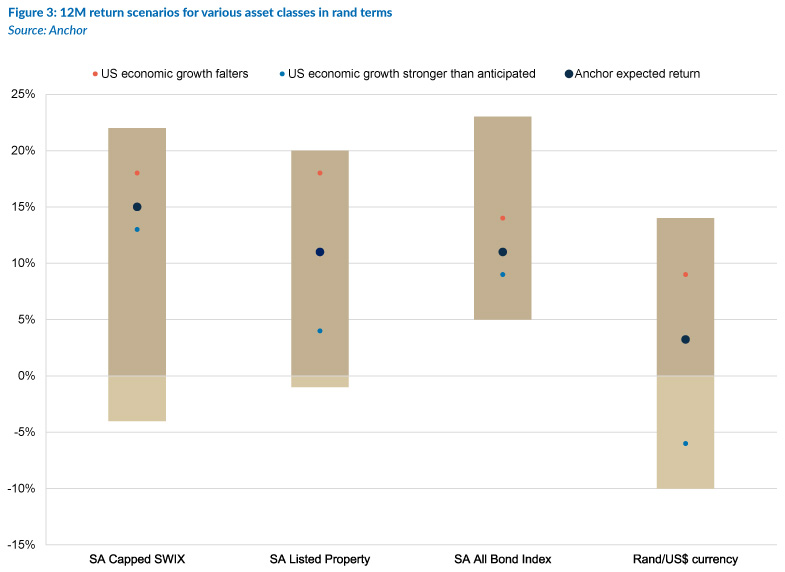

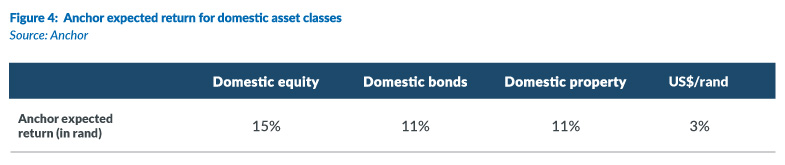

Figure 3 below highlights the rand return outlook for several domestic asset classes. The bar represents the reasonable range of possible outcomes, with the dots representing our estimate of the outcome under various scenarios. From a domestic perspective, we believe that there is more opportunity ahead. We anticipate declining interest rates, improving sentiment, improved governance, and slightly positive steps being taken by the government. We are optimistic that domestic factors will continue improving as we progress into 2025.