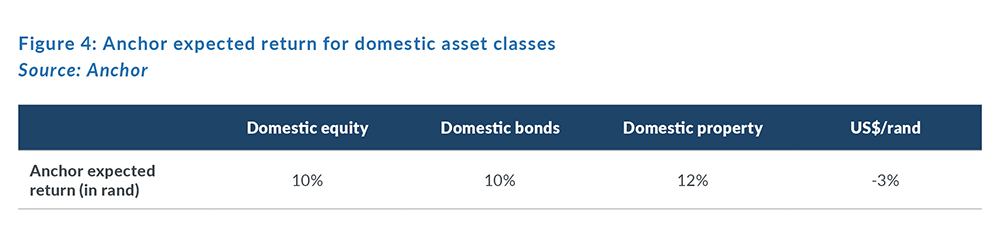

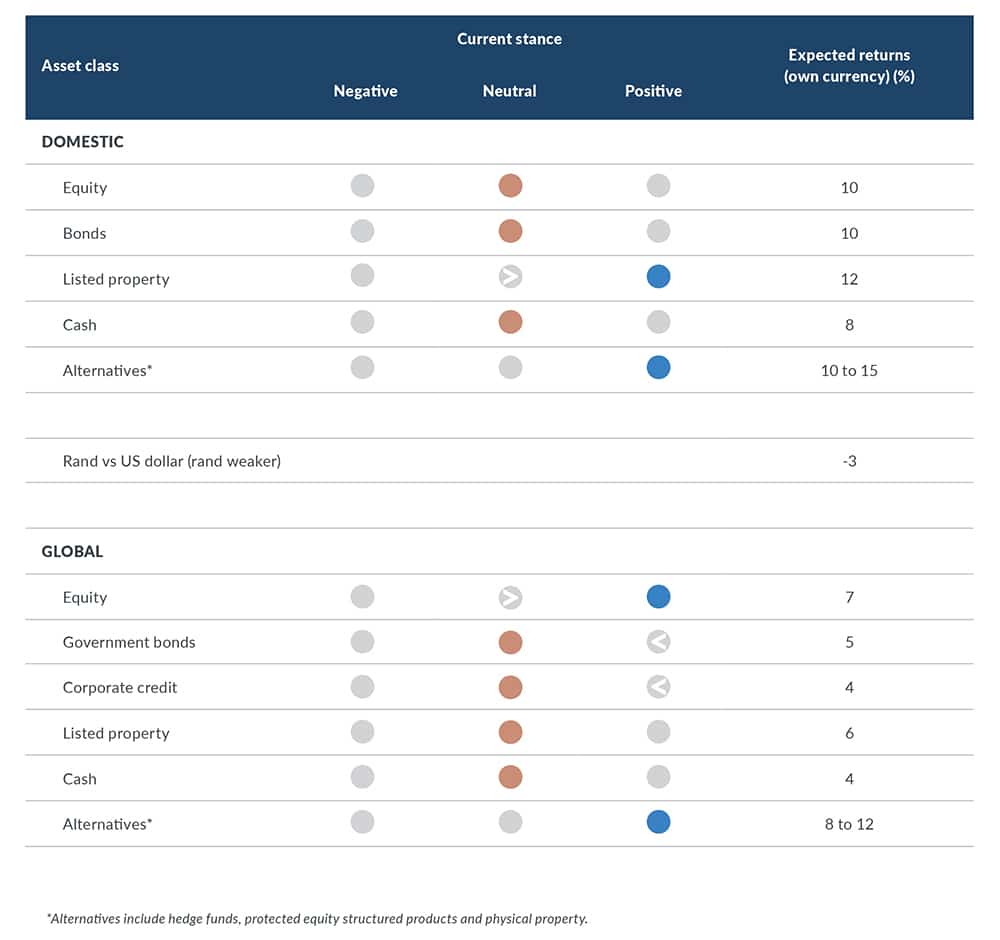

The following table illustrates our house view on different asset classes. This view is based on our estimate of the risk and return properties of each asset class in question. As individual Anchor portfolios have specific strategies and distinct risk profiles, they may differ from the more generic house view illustrated here

The most recent quarter (4Q23) was dominated by the US Fed pivoting its narrative from rate hikes and fighting inflation toward considering when the first interest rate cuts will be appropriate. This shift provided a significant boost for risk assets languishing under the rate-hiking regime of the past two years. Our return expectations for the various asset classes have shifted as we have much higher starting prices for most assets. At the same time, earnings growth is likely to be positive but pedestrian as the global economy continues to cool off. We think lower interest rates will benefit more leveraged companies, with listed property in particular looking appealing for the first time in years.

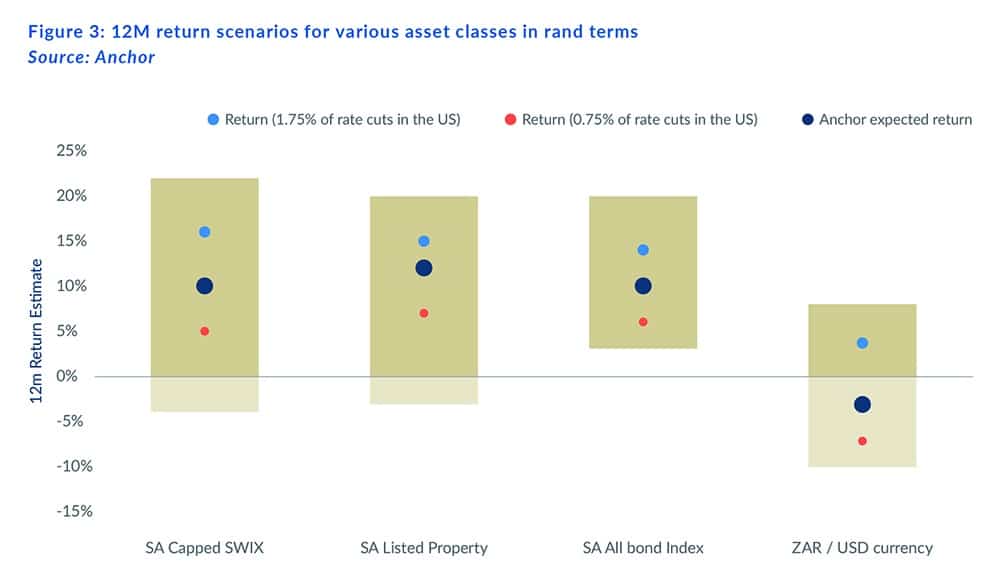

Figure 1 below highlights the US dollar return outlook for the various global asset classes. The bar in Figure 1 represents the reasonable range of possible outcomes, with the dots representing our estimate of the outcome in the various scenarios. We think global equities (particularly those in the US) will likely outperform in this environment. Global bonds and global cash remain compelling.

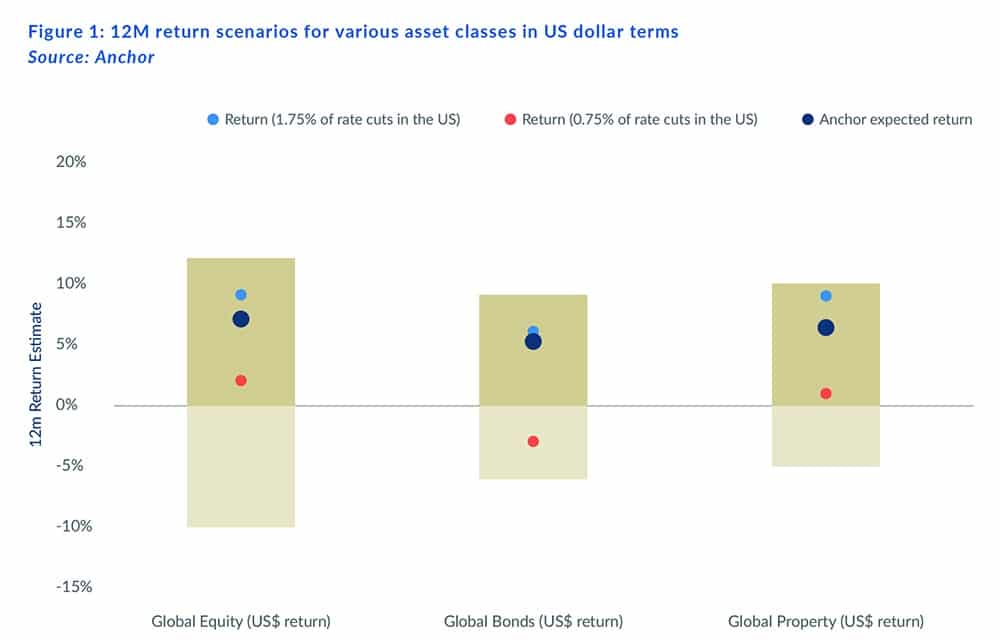

Figure 3 below highlights the rand return outlook for several domestic asset classes. The bar represents the reasonable range of possible outcomes, with the dots representing our estimate of the outcome under the various scenarios. From a domestic perspective, the weak economy, failing state-owned enterprises (SOEs) and the poor state of government finances are a few of the factors detracting from our outlook. We think South African society is learning to cope with electricity disruptions and that private generation will lessen the blackouts. There is already much negativity in the price of domestic assets, and we have shifted domestic listed property to a positive stance as this asset class is relatively cheap, and earnings should benefit from interest rate cuts over this year. We think domestic factors should improve into 2024, though there is much uncertainty around this view, with the national election likely to keep markets on edge for the first half of 2024.

Against this backdrop, we are modelling the rand weakening by 3% over the year ahead.