Amid an increasingly challenging global operating environment, the Agricultural Business Chamber (Agbiz)/IDC Agribusiness Confidence Index (ACI) deteriorated further by 7 points to 53 in 3Q22. This follows a 2-point decline in 2Q22. The key factors behind the decline include higher input costs, friction in certain export markets, persistent animal disease challenges, rising interest rates, intensified geopolitical risks (which disrupted supply chains), and ongoing weaknesses in municipal service delivery and network industries. Importantly, however, the index remains above the neutral 50-point mark, implying that agribusinesses remain cautiously optimistic about operating conditions in South Africa (SA). Therefore, the 3Q22 result still reflects broadly favourable agricultural conditions, albeit not as strong as the previous seven quarters.

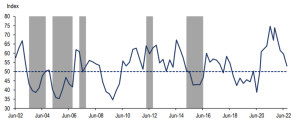

Figure 1: The Agbiz/IDC Agribusiness Confidence Index performance, June 2002-June 2022

Source: Agbiz

*The shaded areas indicate periods when rainfall across SA was below the average level of 500ml.

The ACI comprises ten sub-indices, and seven of these declined in 3Q22. Nevertheless, the underlying numbers reveal interesting dynamics that are worth highlighting. Whilst the turnover sub-index fell by 14 points to 79, the current level remains well above the long-term average, signalling that many farmers and agribusinesses continue to benefit from strong crop prices. Furthermore, the sub-index measuring the volume of exports sentiment moderated by just one point from 2Q22 to 70. Given the market access challenges which the SA citrus industry experienced in the EU, the temporary ban of wool exports to China, a temporary stoppage of livestock product exports to some markets (due to the outbreak of foot-and-mouth disease), and the expected summer crop and wine grape harvests decline, a level of 70 actually indicates robust export conditions despite these various challenges currently at play.

Most interesting, however, were the subindices of the debtor provision for bad debt and financing costs. These indices are interpreted differently from the abovementioned indices as a decline is viewed as a favourable development, with an uptick signalling growing financial strain. In 3Q22, the subindex for debtor provision for bad debt fell by 3 points to 39 – indicative of a generally improving financial health state for farmers across the board, albeit marginally. The financing costs subindex increased by 7 points to 11 in 3Q22, and while this is still low, the increase is consistent with the current environment of rising interest rates.

Overall, the Agbiz/IDC ACI’s 3Q22 results indicate a sector that remains on a sound footing, despite the current challenging global operating environment. Whilst this moderation in sentiment may suggest that 2022 could show a contraction in SA’s agriculture gross value added, the sector remains robust.

Looking ahead, the SA Weather Service (SAWS) sees a strong likelihood of a weak La Niña state, bringing moderate rains favourable for agricultural production. The SAWS says the weak La Niña state will likely remain for the rest of 2022, and the weather is expected to return to a neutral state in early 2023. Essentially, this forecast is comforting and points to a season of above-average rainfall but within the levels at which agricultural activity could continue. The weather service states that “rainfall conditions are predicted to improve further during the early summer into the start of the midsummer months”. This is a conducive time for summer grains and oilseeds planting, as these crops typically need high moisture levels from October to February. After that, the warmer weather conditions naturally aid crop maturation. These are also ideal and favourable conditions for the livestock industry, which depends on natural grazing.

However, this positive outlook is notwithstanding the lingering challenges of higher prices of critical farm inputs such as fertiliser, agrochemicals, and fuel, which will pressure farmers’ and agribusinesses’ finances when the summer crop season starts in October. For sustainable long-term growth in the agricultural sector, the need for government and the private sector to prioritise improving SA’s port efficiency, water and electricity supply and biosecurity remains as important as ever.