Whilst the Food and Agriculture Organization of the United Nations (FAO) Food Price Index (FFPI), which measures the monthly change in the international prices of a basket of food commodities, tracked 13.1% higher YoY in July 2022, the index actually declined for the fourth consecutive month (decreasing by 8.6% from June 2022). This was driven by a significant price decline for vegetable oils and cereals, with less severe declines observed for sugar, dairy and meat. These declining commodity prices have been primarily driven by the recent agreement between Ukraine and Russia to unblock Ukraine’s main ports in the Black Sea, combined with subdued demand from China.

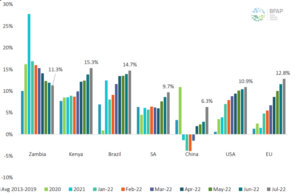

However, it is important to bear in mind that further declines in global commodity prices could be halted by uncertainty around weather conditions in the Northern Hemisphere, amongst many other variable global factors currently at play. Interestingly, Figure 1 below indicates that South Africa (SA) remains somewhat of an exception from the rest of the world, with food price inflation contained at relatively lower levels than most regions of the world. However, SA food inflation showed the second highest MoM increase after China (followed by Kenya and the EU), which might signal a continued ‘catching-up’ scenario, as was the case in June 2022.

Figure 1: International food inflation comparison, YoY food inflation rate

Source: BFAP

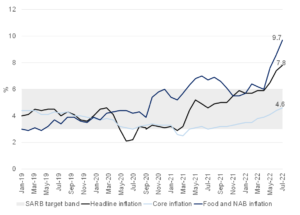

Printing directly in line with expectations, SA’s July annual consumer price inflation, released on 24 August, came in at 7.8%, up from 7.4% in June 2022. Once again, the main contributors to the higher annual inflation rate were food and non-alcoholic beverages, housing and utilities, and transport categories. Thus, high food and petrol prices are still stinging consumer pockets. However, bear in mind that fuel prices increased by 9.9% MoM in July, and the higher food inflation reflects the delayed effects of sharply higher crop prices. The introduction of higher electricity rates from municipalities – which took effect in July – also contributed to the higher number. Notably, July’s core CPI has crept up to 4.6%, from 4.4% the month before, as second-round effects start pulling through to the greater CPI basket.

Figure 2: SA inflation, January 2019 to date (YoY % change)

Source: Thomson Reuters, Anchor

SA’s food inflation reached 9.7% in July – comparable to levels last recorded in 2016/2017 during the widespread drought in SA. These comparatively high levels of local inflation continue to be driven by the culmination of numerous factors in both global commodity and financial markets. For example, the effect of the Russian invasion of Ukraine in late February (which caused prices for grains and oilseeds to surge during March and April) is still feeding through to local bread and cereal prices, which recorded inflation of 13.4% YoY in July. Empirical research indicates that local grain and oilseed market price shocks take approximately 3 to 4 months to fully transmit to retail prices. Although global prices for these commodities have eased over the past weeks, a weaker exchange rate and persistently high international shipping costs are sustaining local commodity prices at elevated levels. The weaker rand is mainly driven by high inflation, the subsequent hawkish monetary policy across global central banks, and increased and intensive loadshedding during June and July.

Continued high grain prices also affect prices in the meat industry (where feed is a significant cost driver), with inflation recorded at 9.4% YoY for meat. Here, slaughter numbers for June are down almost 3% YoY for cattle, which occurred from a base that already recorded low slaughterings in 2022. Whilst July slaughter statistics are not available yet, this trend is expected to have continued. Poultry prices have also continued to rise, following global markets, where persistent supply constraints in the Northern Hemisphere amid the continued spread of avian influenza have pushed the FAO Poultry Price Index to an all-time high. Vegetables also recorded substantial inflation of 8.3% YoY in July, driven by two factors currently at play in SA. The first is wet and cool weather which affected yields for key vegetables over the past months. Second, consumer demand is also firm as certain vegetables serve as a possible substitute for high staple food costs, such as maize meal.

If one considers all of the abovementioned factors, our view is that food inflation is close to peaking – if the July figures were, in fact, not at the peak already. Consider that commodity prices were higher in the latter half of 2021, resulting in lower base effects. This, combined with easing global commodity prices, could result in food prices losing momentum. Naturally, there are a few important upside risks to consider with regard to this outlook, the chief of which is the ban on cattle transport to curb the spread of foot-and-mouth disease (FMD), which was instituted in the third week of August. Any extension of the initial three-week period could limit red meat availability towards the end of the year and during the festive season. If this is the case, meat prices will likely be a pivotal contributor to food inflation during November and December, thus potentially driving inflation momentum again. Crop quality issues and possibly lower yields due to hot and dry conditions in the Northern Hemisphere also remain a concern and could add to global price pressures towards the end of the year. This is, however, a developing issue and should be monitored closely over the coming months.

Looking past the July food inflation print for SA, the FAO Food Price Index fell for the fifth consecutive month in August, coming in 1.9% lower than in July. All five sub-indices fell moderately last month, with the most significant decline being in vegetable oil prices (-3.3% MoM) and the smallest drop in cereal prices (-1.4% MoM). The continued decline in the index reinforces the narrative that global food prices may have peaked. The main factor in declining food prices has been increased grain exports from Ukraine. Vegetable oil prices, meanwhile, have fallen as more palm oil supplies from Indonesia and seasonally rising outputs in Southeast Asia have pushed prices down.

Looking ahead, while it is encouraging that global food prices fell for a fifth straight month in August, the risks to the outlook for world food prices remain tilted to the upside. Nonetheless, SA will likely remain an exception from the rest of the globe, with food price inflation contained at relatively lower levels than most other regions. Importantly, the coming months will likely show moderation from the heightened levels we saw in July.