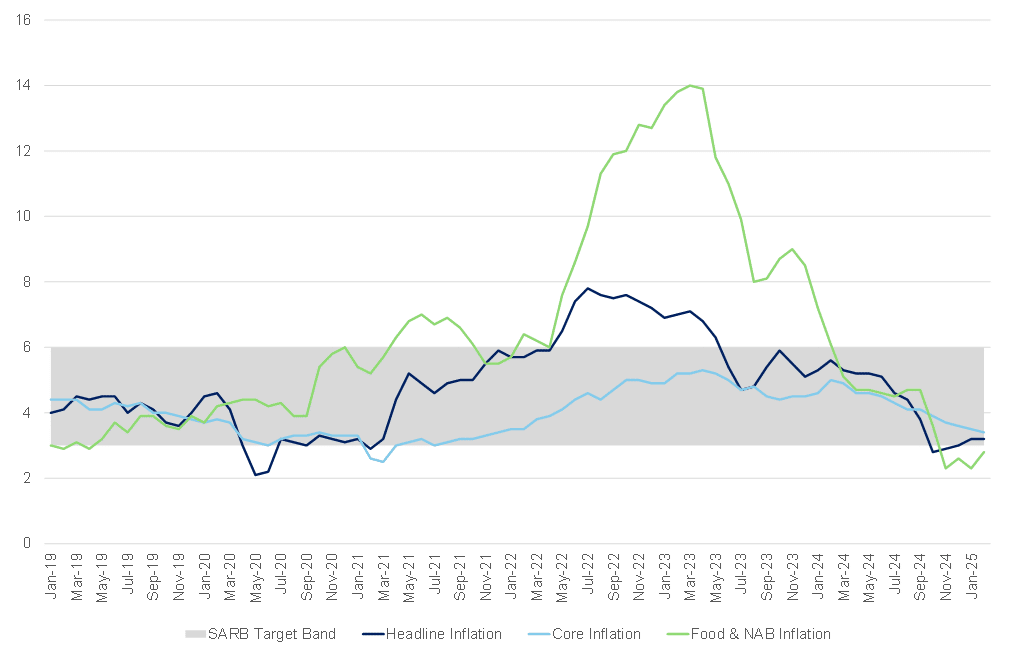

Headline Consumer Price Index (CPI) inflation was unchanged at 3.2% YoY in February, with a MoM increase of 0.9%. This figure remains well below the South African Reserve Bank’s (SARB) target midpoint of 4.5% YoY but reflects a relatively high-pressure month for surveyed price increases. A key factor in February’s inflationary pressure was the annual survey of medical insurance costs conducted by Stats SA during the month. Medical aid premiums, which hold a 6.2% weight in the CPI basket, saw a notable increase of 10.5% MoM, aligning closely with expectations of a 10.6% rise. On a YoY basis, health insurance inflation rose to 10.5% in February from 10.3% in January, marking a significant contributor to overall inflation trends.

Core inflation, which excludes volatile food and energy prices to provide a clearer measure of underlying inflationary pressures, is showing signs of moderation. This is evident from the negative output gap in the economy, reflecting subdued consumer demand and limited pass-through from exchange rate fluctuations. In February, core CPI inflation rose by 3.4% YoY and 1.1% MoM, a slight deceleration from January’s 3.5% YoY (0.2% MoM). This slowdown underscores a continued softening in consumer demand, aligning with expectations of a disinflationary trend in the broader economy.

Notably, core inflation continues to display a stark divergence between services and goods. In February, core services inflation increased by 1.4% MoM, significantly outpacing core goods inflation, which rose by only 0.5% MoM. This contrast highlights an evolving inflationary landscape where price pressures are increasingly concentrated in the services sector. Unlike goods that are more sensitive to consumer demand fluctuations and exhibit slower price growth, services inflation remains persistent due to structural factors and inelastic demand. Market rigidities and limited competition in certain service industries allow for sustained price increases, even as overall demand remains subdued. Consequently, this shift suggests that services inflation may remain resilient even in periods of broader disinflation, posing a challenge to achieving more balanced price stability.

Despite headline inflation holding steady at 3.2% YoY in February, consumers faced renewed financial strain as food and non-alcoholic beverages (NAB) inflation accelerated to a four-month high, rising to 2.8% YoY from 2.3% in January. This uptick was primarily driven by a surge in maize prices, a staple in South African (SA) households. Maize meal inflation reached a 17-month peak, while samp prices hit a 19-month high. The maize meal price index climbed by 10.6% YoY, with samp experiencing an even sharper increase of 18.7%. On the retail front, a 5kg bag of maize meal cost R74.91 in February, up from R68.52 a year earlier, while a 1kg pack of samp rose to R22.86 from R19.28. The primary driver behind these increases was a prolonged regional drought, which constrained maize harvests and led to higher import demand from neighbouring countries, exacerbating price pressures. However, recent rainfall has helped alleviate some supply concerns, contributing to a moderation in maize prices.

On the global front, international food prices declined by 4.6% MoM in February, while the rand appreciated by 1.3% MoM. These factors provided some relief, counterbalancing the upward pressure on local food prices. Nonetheless, domestic food inflation remains sensitive to weather conditions and global price movements, suggesting that further volatility is possible in the coming months.

Looking ahead, while inflation remains comfortably within the lower half of the SARB’s target range, it has shown a slight upward trend over the past few months. Goods inflation is currently low, but this trend may be temporary as supply-side shocks subside. Meanwhile, services inflation remains relatively higher despite being below the 4.5% target midpoint. Inflation expectations are stabilising close to the midpoint, suggesting that inflationary pressures, for now, remain contained. However, persistent services inflation and potential external shocks, such as currency volatility or commodity price fluctuations, warrant close monitoring in the months ahead.

Figure 1: SA inflation, YoY % change

Source: Stats SA, Anchor

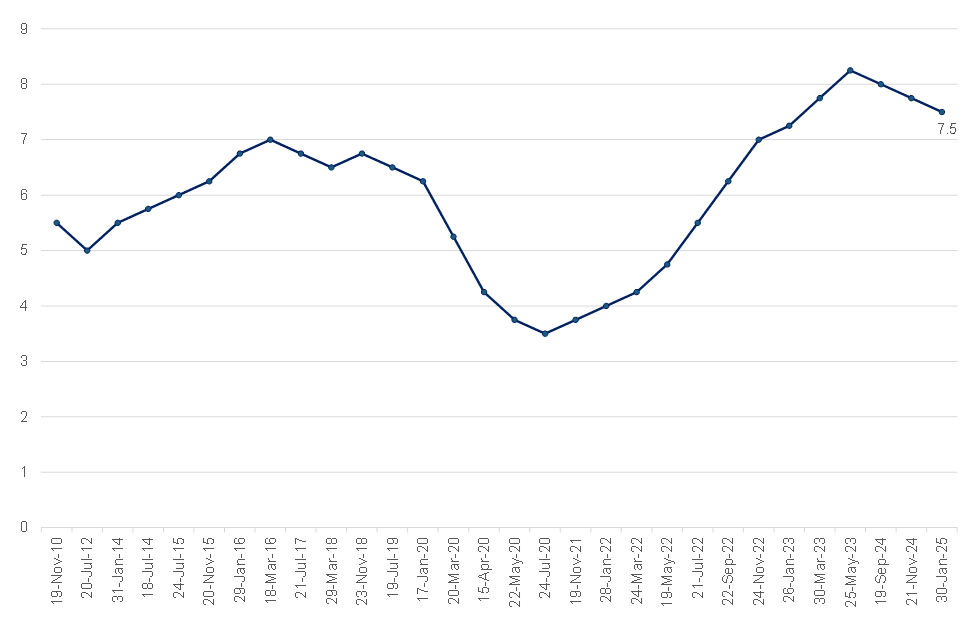

Against this backdrop, in line with expectations, the SARB’s Monetary Policy Committee (MPC) decided to keep the repo rate unchanged at 7.5%, with the prime rate remaining at 11%. It is worth noting that the decision to hold rates was not unanimous, with four members of the MPC choosing to hold rates steady, while two favoured a cut of 25 bpts. Similar to its January statement, the SARB placed considerable emphasis on the ongoing volatility in the global economic environment. The SARB highlighted several major economies where headline and core inflation remain persistently above the 2% target, reinforcing the expectation that interest rates will likely remain elevated for an extended period despite some anticipated adjustments. While domestic inflation remains contained “for now,” external risks continue to be pronounced.

Regarding economic growth, the SARB revised its 2025 gross domestic product (GDP) growth forecast downward to 1.7%. The medium-term outlook, however, is unchanged, with growth projections of 1.8% in 2026 and 2.0% in 2027. Nevertheless, after maintaining a balanced assessment for some time, the SARB now perceives the risks to growth as tilted to the downside. SARB Governor Lesetja Kganyago reiterated the necessary conditions to enhance economic growth, emphasising the importance of “achieving a prudent public debt level, further strengthening and modernising network industries, reducing administered price inflation, and aligning real wage growth with productivity gains.”

Meanwhile, the inflation outlook was revised slightly lower, with the SARB now expecting inflation to average 3.6% in 2025. However, the central bank noted that this forecast is subject to a higher degree of uncertainty than usual. While the SARB had adopted a highly hawkish stance on inflation risks in January, its near-term outlook has now shifted to acknowledge both upside and downside risks. Despite this, the central bank maintained a strong focus on the medium-term trajectory, repeatedly highlighting that inflation tends to trend higher over time, with potential price pressures building in the third and fourth quarters of 2025. The SARB forecasts an average inflation rate of 4.5% in both 2026 and 2027 and assesses medium-term risks as skewed to the upside.

Figure 2: The history of the SARB MPC’s repo rate changes, %

Source: SARB, Anchor

Looking ahead, the MPC continues to anticipate that interest rates will stabilise at a neutral level of approximately 7.25%. This implies the possibility of a further 25-bp rate cut in 2025 (in addition to the 25-bp cut in January), followed by a prolonged period of stability through 2027. Consequently, the SARB’s latest decision appears to be a temporary pause in the current shallow cutting cycle rather than a definitive end. However, the scope for substantial further easing remains limited.