With the inflation outlook remaining elevated, as expected, the South African Reserve Bank (SARB) cautiously kept the repo rate on hold at 8.25% at its third Monetary Policy Committee (MPC) meeting for this year, with the prime rate remaining at 11.75%. Crucially, the SARB now forecasts inflation stabilising at its 4.5% objective in 2Q25. Whilst this is an improvement on its March forecast (which only reached the target at the end of 2025), average inflation for 2025 is only one-tenth of a percentage point lower. Consequently, the SARB remains clear in its communication that the task of achieving its inflation objective has not yet been completed, and thus, it remains steadfast in its pursuit.

Looking ahead, we expect inflation to remain subdued, albeit at levels higher than initially envisioned at the start of this year. Core inflation (particularly that of goods) will likely remain subdued as consumer demand continues to be constrained by the pressures of elevated interest rates. Risks to the outlook appear more entrenched on the supply side – particularly regarding electricity, fuel, and other administered prices. Whilst food inflation has declined significantly over the past two months, the rising costs of maize and wheat (coupled with the effects of a drier season in certain key production regions) could potentially stall this momentum. As a result, we continue to view food prices as a key upside risk given the various ongoing supply shocks, particularly amid the current El Niño weather pattern.

Given that the market all but priced in the decision to hold, the key to the May statement was the overall tone, which was closely watched by market participants across the board to better understand the conditions under which the SARB may consider easing monetary policy. Whilst SA had a more gradual acceleration in inflation than many peer countries (with a lower peak) since COVID-19, the return to the 4.5% midpoint of the SARB’s target band has been slow and remains at a distance. Although the MPC assesses the inflation forecast risks to be broadly balanced at present, the central bank maintains that high inflation expectations require it to deliver on its target sooner rather than later in order to re-anchor expectations. After three years of inflation being above 4.5%, few survey respondents, especially from businesses and trade unions, now believe that inflation will be at 4.5% in two years.

Regarding the growth outlook, overall, the latest round of economic activity indicators for 1Q24 have printed worse than expected, despite the low levels of loadshedding. However, it is worth remembering that these higher-frequency data can be volatile. Overall, the SARB forecasts slightly weaker first-quarter growth, which will then be offset by better second-quarter growth. The central bank maintains its previous GDP growth forecast of 1.2% this year. The growth numbers for the outer years are also unchanged, improving to 1.6% YoY by 2026. These projections remain better than the 2023 outcome but below longer-run averages of around 2%.

Overall, at the current level of rates, the policy stance is considered restrictive, consistent with the inflation outlook and the need to address elevated inflation expectations. Thus, we maintain that the SARB’s MPC will not rush to cut the repo rate. Any possible interest rate cuts will likely only materialise towards the end of 2024 and depend on the inflation outlook (locally and abroad) and global interest rate developments as we progress further into this year. Current market sentiment suggests only one interest rate cut of 25 bps this year in SA, possibly two, with the second cut almost fully priced out per our expectations. Over the longer term, we expect the SARB to gradually cut rates from 8.25% to 7.5% through three 0.25% cuts, reflecting the theme of higher interest rates globally.

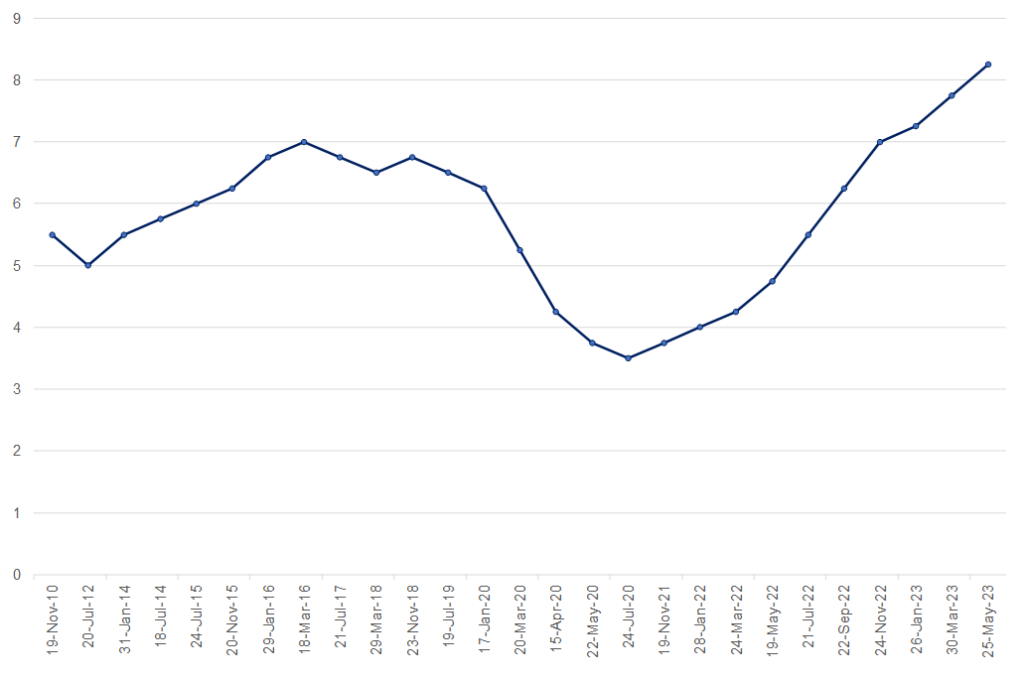

Figure 1: The history of the SARB MPC’s repo rate changes, %

Source: SARB, Anchor