The recent market turmoil has once again highlighted one of the biggest risks to those individuals who diligently provide for a predictable retirement. Although prudent, the allure of enhancing one’s retirement pot with significant risk exposure can be mistimed because of unpredictable markets. This is where correctly assigned alternative investments such as hedge funds may offer investors the opportunity to earn real returns in rising and falling equity or bond markets. This asset class can provide unique risk and return opportunities as standalone investments and diversifiers in multi-asset balanced portfolios.

Many advisors and investors have overlooked these assets due to a lack of understanding, previous legislation or, in some cases, a lack of access to their current investment platforms. The legislation was changed in 2015 to correct the lack of transparency, improve regulation, and allow daily pricing, making alternative investments more attractive.

These legislation changes include:

- Hedge funds were declared collective investment schemes (CIS) under the CIS Control Act, 2002 in 2015.

- Retail hedge funds now provide daily pricing, greater liquidity, and lower minimum investments and are strictly regulated with improved risk management controls.

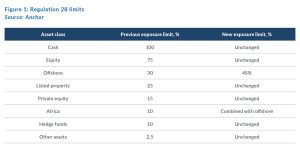

- Regulation 28 restrictions allow retirement funds to invest 10% in hedge funds – 2.5% per fund and 5% in a fund of funds.

- These changes have facilitated access for retail investors via retirement funds, living annuities and discretionary portfolios across a wide range of investment platforms.

How to pick a hedge fund strategy for your portfolio?

A key determinant of which hedge fund is suitable for your pre-or post-retirement portfolio involves understanding the strategy employed by the manager to generate returns or reduce risk. The fund’s strategy must complement your existing portfolio of assets.

The most popular strategies are:

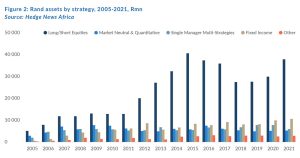

- Long/short equity: This strategy looks to exploit profit opportunities on both the potential upside and downside. It takes long positions in stocks identified as being relatively underpriced while selling short stocks deemed overpriced. In SA, the long/short equity strategy has seen the most inflows.

- Global macro strategy: This strategy takes a big-picture position on the economic and, in some cases, political views of various countries or their macroeconomic principles. Holdings may include long and short positions in equity, fixed income, currency, commodities, and futures markets.

- Equity market neutral: In this investment strategy, the intention is to exploit differences in stock prices or valuations by being long and short in equal measure in closely related stocks. These shares may be within the same sector, industry, and country or share similar characteristics such as market capitalisation or are historically correlated.

- Fund-of-funds approach: These are multi-manager funds with different styles. Managers get picked by the fund-of-funds manager. These funds are very attractive diversifiers in that they allow investors to benefit from a best-of-breed combination of different managers spreading investment risk across strategies.

So, what is the ideal hedge fund allocation for your pre-and post-retirement portfolio?

Pre-retirement funds are subject to Regulation 28 and will allow a 10% allocation in hedge funds. Post-retirement portfolios, such as living annuities or discretionary portfolios, are not subject to Regulation 28 and have no asset class limits.

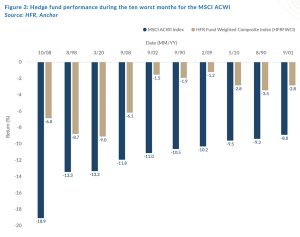

One of the most significant risks to your retirement plan is a major drawdown in value with limited time to recover these losses. Hedge funds can be used to smooth the volatility, avoid large drawdowns and de-risk the possibility of permanently impairing the capital base that has been built up.

As shown in Figure 3 below, hedge funds have delivered significantly lower drawdowns when compared to the overall market during the ten worst months for the MSCI All Country World Index (MSCI ACWI) historically.

Another factor to consider when constructing your portfolio is the Sharpe ratio. The Sharpe ratio is an important measure of an investment’s risk-adjusted performance. The higher the Sharpe ratio, the better the return achieved per unit of risk. For the past five years, the average Sharpe ratio across SA retail hedge funds was significantly higher than the average of large SA balanced funds.

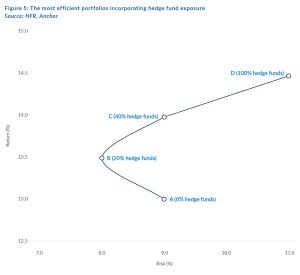

The efficient frontier explains the relationship between risk and return in investment portfolios and should be used to select the most efficient portfolio incorporating hedge fund exposure. The optimal portfolio would be B (in Figure 5 below) for living annuities and discretionary portfolios; this point represents the lowest risk with an optimal amount of hedge fund exposure.

Conclusion

With the benefit of hindsight, having had a 10% allocation in your retirement fund and a 20% exposure in living annuities (or discretionary portfolio) over the long term would have significantly altered the outcome for someone entering this pre- or post-retirement phase and who is reliant on their hard-earned retirement plan. Given the outlook for equities, it may be a good time for advisors and investors to consider allocating to hedge funds in a multi-asset, balanced mandate to realise the benefits that hedge funds offer.

Investors need to do their homework and understand the fund, the management style and the fees when selecting hedge funds for their portfolios. Helpful resources to look to when selecting hedge funds are manager monthly newsletters, fact sheets and HedgeNews Africa, or you can contact your Anchor wealth and investment manager to assist.