The October Effect is the psychological phenomenon where investors believe that markets and equities tend to decline during October. While investors may be more nervous during October because some historic market crashes occurred in the month, it has also often been a strong month for stocks, albeit known for its volatility.

Unfortunately, this year saw the so-called October Effect in full swing. While some major indices recorded new highs during the month (before retreating), most major global markets and the JSE had a torrid time, ending a rollercoaster ride of a month in the red (MSCI World -2.0% MoM). US markets had a difficult start to October, retreating for most of the first week. This was primarily due to profit-taking following a solid 3Q24 and geopolitical tensions after Iran fired missiles at Israel. However, we saw a rebound by mid-month as buy-the-dip interest supported the market, and upside momentum acted as a catalyst, driving US equities higher before a bumpy last week of October saw markets slide again.

On Halloween eve, a tech stock sell-off wiped out Wall Street’s October gains as investor optimism for a big tech-driven stock market boost faltered following disappointing quarterly earnings from Meta and Microsoft. Other factors that supported the market’s negative bias and weighed on sentiment for most of the month included concerns that the US Federal Reserve (Fed) may not be as aggressive in its rate cuts as previously anticipated following solid US economic data releases. The tightly contested US Presidential Election also weighed on sentiment, with gold rising to a record high as jitters over the close US presidential race supported the metal.

In the US, the three major indices ended October down despite reaching record highs during a volatile month. On 31 October, the Nasdaq and the S&P 500 posted their most significant one-day declines since 3 September as the market digested discouraging quarterly reports from mega-cap tech counters. Meta’s user growth fell short of expectations, and Microsoft’s revenue guidance was underwhelming, while Apple declined after reporting weaker-than-anticipated sales in China. The Dow lost 1.3% MoM (+10.8% YTD), while the S&P 500 ended the month 1.0% in the red (+19.6% YTD) – both had surged to new highs earlier in the month. The tech-heavy Nasdaq, which had climbed to an all-time high on 25 October, retreated by 0.5% MoM (+20.5% YTD).

In US economic data, September inflation printed slightly higher than expected, with headline inflation, as measured by the Consumer Price Index (CPI), at 2.4 % YoY vs August’s 2.5%. Core CPI, excluding the erratic food and energy components, accelerated to 3.3 % YoY from 3.2% in August. MoM, September headline and core inflation rose 0.2% and 0.3%, respectively. September US retail sales exceeded expectations, rising 0.4% MoM vs August’s 0.1% increase. YoY, retail sales advanced by 1.7% compared to August’s revised 2.2% rise. US 3Q24 GDP rose at a 2.8% annualised rate (its tenth consecutive quarterly gain), slightly softer than expected and below 2Q24’s 3.0% reading. Consumer spending and federal government outlays were the most significant contributors to GDP growth. The core personal consumption expenditure (PCE) price index, excluding food and energy, a key Fed inflation gauge, advanced in line with expectations – up 2.7% in September (unchanged from August’s print). MoM, core PCE was up a modest 0.3 %.

Major European equity markets were initially buoyed by the European Central Bank’s (ECB) third rate cut for the year (by 25 bps) but ended a torrid month lower. Germany’s DAX was down 1.3% (+13.9% YTD), while France’s CAC fell 3.7 % MoM (-2.6% YTD). In economic data, September eurozone headline inflation dropped to 1.8% YoY (below the ECB’s target of 2% due to falling energy prices) from 2.2 % in August, while core inflation, excluding energy, food, alcohol, and tobacco prices, eased to 2.7% YoY from August’s 2.8 % YoY print. In Germany, September inflation fell to 1.8% YoY from 2.0% in August, while French inflation dropped sharply to 1.5% YoY from August’s 2.7% print. The euro area’s economy expanded more robustly than expected in 3Q24, rising 0.4% QoQ vs expectations of a 0.2% print. Germany, Europe’s biggest economy, avoided a recession, while Spain and Ireland recorded the strongest growth rates. The Paris Olympics boosted France’s economy, with 3Q24 GDP up 0.4% QoQ, faster than 2Q24’s 0.2% print and ahead of the 0.3% consensus forecast.

The UK market was down for a second month, with the blue-chip FTSE-100 1.5% lower (+4.9% YTD). UK inflation dropped sharply in September to 1.7% YoY (below the Bank of England’s [BoE] 2.0% target rate) vs 2.2% in August. September services inflation, a component closely watched by the BoE given its dominant position in the UK economy, eased significantly to 4.9% (its lowest rate since May 2022) after increasing to 5.6% YoY in August. Core inflation printed at 3.2 % YoY, down from August’s 3.6 % print. Meanwhile, the UK’s new Chancellor of the Exchequer, Rachel Reeves, announced the biggest tax increases in 30 years in her first budget, saying she needed to spend heavily to repair the UK’s public services, which she described as “broken”. Many market commentators believe the tax hikes (which will fuel inflation) could see the BoE holding rates steady at its November meeting.

In Asia, China’s equity markets have rallied following a slate of high-profile stimulus announcements over the past several weeks (starting in late September) intended to jumpstart its sluggish economy. However, the rally ran out of steam, with the Shanghai Composite down 1.7% (+10.2% YTD) and Hong Kong’s Hang Seng closing 3.9% lower MoM (+19.2% YTD). September retail sales (+3.2% YoY—a four-month high) and industrial production (+5.4% YoY) came in better than expected, while inflation unexpectedly eased, advancing by just 0.4% YoY, its slowest increase in three months (August inflation +0.6% YoY). China’s economy also grew at its slowest pace since early 2023 in 3Q24, with GDP rising 4.6% YoY, slightly above the 4.5% consensus forecast but below 2Q24’s 4.7% YoY print (China’s annual growth target is c. 5%). The October manufacturing purchasing managers’ index (PMI) printed at 50.1 – expanding for the first time since April. It was also higher than August’s 49.8 and better than the Reuters consensus forecast of 49.9. The official October non-manufacturing PMI, measuring business sentiment in the services and construction sectors, came in at 50.2, accelerating from 50 in September. The 50-point mark separates expansion from contraction.

Japan’s benchmark Nikkei was one of the few major indices to end October higher – +3.1% MoM (+16.8% YTD). Japan’s ruling Liberal Democratic Party lost its parliamentary majority for the first time since 2009 after voters cast their ballots on 27 October. In economic data, headline CPI fell to 2.5% vs August’s 10-month high of 3.0%. Core inflation (including oil products but excluding fresh food prices) printed at 2.4 % YoY vs 2.8% in August. The slowdown was primarily due to the government’s rollout of temporary subsidies to curb utility bills, which is expected to weigh on inflation in the coming months. At its October meeting, the Bank of Japan kept its benchmark rate steady at c. 0.25%. Japan’s new prime minister, Shigeru Ishiba, recently said the country was not ready for another rate hike.

On the commodities front, after three consecutive monthly declines, Brent crude gained 1.9% in October (-5.0% YTD) on reports that OPEC+ may delay its planned output boost and a pick up in US gasoline demand. Precious metals climbed, with gold reaching new peaks amid US election uncertainties and global tensions. The gold price crossed the US$2,700/oz level for the first time on 18 October and closed at US$2,743/oz on 31 October. Escalating tensions in the Middle East and the build-up to the US Presidential Election have seen demand for safe-haven assets soar, with gold already having gained c. 33% YTD (+4.2% MoM). The gold rally has also been fueled by robust central bank buying and expectations of US interest-rate cuts, with lower rates often seen as bullish for non-interest-bearing gold. Among the platinum group metals (PGMs), platinum gained 1.3% MoM (+0.3% YTD), palladium soared 11.6% MoM (+1.8% YTD), but rhodium was down 1.6 % MoM (+5.6% YTD). After a substantial 5.2% gain in September, iron ore prices fell 6.8% MoM (-27.1% YTD), weighed down by disappointing global steel demand forecasts. The World Steel Association downgraded its short-term forecast for global steel demand in 2024 to -0.9% YoY (1.75bn tonnes), while for China, the world’s largest iron ore market, demand is expected to fall by 3% YoY.

In South Africa (SA), overall sentiment towards JSE-listed equities remained positive for most of October, driven by the smooth transition to a Government of National Unity (GNU), seen as more inclusive and focused on structural economic reform, and by more robust earnings prospects for domestically focused companies (so-called SA Inc. shares). Unfortunately, the local bourse tracked weaker global markets on Thursday (31 October) as investors digested corporate earnings reports from the mega-tech companies. The FTSE JSE All Share Index fell by 1.6% on the day – its biggest one-day drop in over four weeks to close at 85,384.82 on 31 October – down 1.3% MoM (+11.0% YTD). The Capped SWIX was down 0.9% MoM (+14.9% YTD). The SA Listed Property Index, which has been an outperformer this year, dropped by 4.4% MoM (+20.2% YTD), while industrial counters, as measured by the Indi-25, declined 3.1% MoM (+12.0% YTD) as Prosus and Naspers (both with large weightings in the index) closed 2.5% and 1.2% lower MoM. A surge in commodity prices, specifically PGMs and gold, pushed the Resi-10 2.3% higher MoM (+2.9% YTD). The Fini-15 lost 1.6% MoM but is still up 16.9% YTD.

Highlighting October’s share price performances of the largest JSE-listed shares by market cap, BHP Group, the biggest share on the exchange, fell by 8.8%, wiping out most of its September gains. Last week, BHP said that comments by its chair at the Group AGM did not mean it has ruled out a renewed offer for Anglo American. In May, BHP walked away from a US$49bn bid to acquire Anglo after its advances were rejected three times. The second and third-biggest shares on the bourse – Anheuser-Busch InBev (AB InBev) and Prosus were down 7.9% and 2.5% MoM, respectively. The rand weakened 1.9% against the US dollar in October but is up 4.3% YTD.

Local economic data showed that September headline inflation eased further to 3.8% YoY from 4.4% in August, marking the lowest headline inflation rate since March 2021 and boosting hopes for continued monetary policy easing. A significant factor behind the slowdown was softer transport inflation, notably lower fuel prices, which pushed the transport category into deflation for the first time in 13 months (annual transport inflation dropped from 2.8% in August to -1.1% in September). Core inflation (excluding food, fuel, and electricity) was unchanged from August’s 4.1% YoY print, indicating a continued easing in price pressures. August retail trade sales increased by 3.2% YoY and advanced by 0.5% MoM (-0.2% MoM in July).

On 30 October, the minister of finance delivered the 2024 Medium Term Budget Policy Statement (MTBPS) amid a slightly improved economic outlook and the establishment of the GNU, which has pledged its commitment to prudent fiscal policy to stabilise debt. The MTBPS provided continuity from the February Budget, reiterating the National Treasury’s (NT) commitment to fiscal consolidation and stabilising SA’s debt-to-GDP ratio by 2025/2026. The primary surplus for the main budget is expected to grow over the medium term to support debt stabilisation, with the main budget deficit projected to decline from 4.7% of GDP in 2024/2025 to 3.4% by 2027/2028. Some revisions were made to the February 2024 Budget forecasts, with fiscal ratios likely to be weaker due to an expected shortfall in tax receipts and a slight increase in spending. SA’s growth forecast was also lowered to 1.1% for 2024, down from the February Budget’s 1.3%.

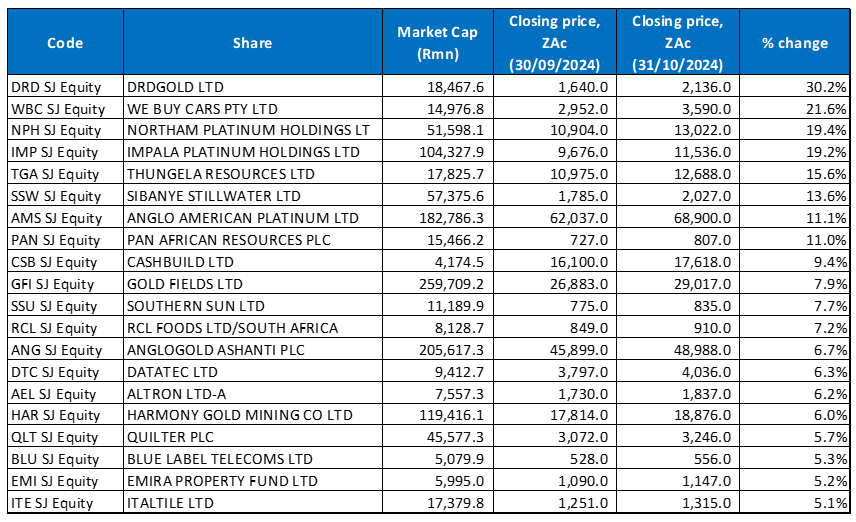

Figure 1: October 2024 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

The gold price soared to a new high of US$2,778.79/oz on 30 October as investor caution ahead of the US election and gold’s safe-haven appeal buoyed demand for the yellow metal. However, the price then retreated slightly to end October at US$2,743/oz (+4.2% MoM). While many JSE-listed gold miners posted share price gains on the back of the record gold price, DRDGold (+30.2% MoM) was last month’s best-performing gold share and the overall winner among shares on the JSE. DRD’s share price rose the most in about a month on 17 October after it reported an improved performance (driven by higher gold prices and improved cost efficiency) across key metrics in its operating update for the quarter ending 30 September. Adjusted earnings before interest, taxes, depreciation, and amortisation (EBITDA) increased 17% QoQ to R680.8mn, “underpinned by a 2% increase in the average gold price received”. Its financial position strengthened, with cash and cash equivalents increasing by R72.7mn to R594.2mn. DRD’s quarterly gold production rose 7% to 1,319 kg, driven by a 13% increase in ore milled, while operating profit rose 14% to R2.1bn, with revenue up a similar margin to R6.2bn. This was thanks to a 20% increase in the average rand gold price received during the period.

DRD was followed by WeBuyCars (+21.6% MoM) in second place. WeBuyCars was spun out of Transaction Capital and listed on the JSE on 11 April. It released a trading statement in October for its year ended 30 September 2024. The company said its core headline earnings grew by 21% to 26% YoY, while headline earnings, including the impact of transaction costs and various once-offs, combined with the additional number of shares in issue, were down 55%-60% YoY. Since it was listed on 31 October, the share price has soared 76%.

PGMs were October’s shining stars, especially palladium (+11.6% MoM), which has been in a solid long-term downtrend (from highs above US$3,000/oz in July 2022). Reports that the US had asked its G7 allies to consider placing sanctions on Russia’s supply of the precious metal (as well as titanium) was the catalyst for palladium’s gains. Russia is a top palladium and titanium producer, and both metals were excluded from Western-led sanctions imposed after Russia invaded Ukraine in February 2022. Russia accounts for c. 41% of global palladium supply and thus has an outsized influence on PGM markets. News of possible sanctions saw the palladium price soar above US$1,200/oz as fears of supply constraints grew. It ended October 11.6% higher MoM at c. US$1,119.85 (+1.8% YTD). While palladium demand has fallen over recent years, it continues to outstrip supply. PGM miners’ share prices rose the most in October, with four of the ten best-performing JSE shares for the month being PGM miners.

Northam Platinum (Northam) and Impala Platinum (Implats) were in the third and fourth spots, respectively, gaining 19.4% and 19.2% MoM, respectively. In its 1Q25 production update, Implats revealed lower production for the quarter to 30 September, reflecting guided changes in operational parameters at several of its assets and the effect of furnace commissioning at Zimplats. Production volumes for its first quarter were down 5% to 947,000 oz. It also reported a 6% decline in managed volumes to 751,000 oz, a 3% gain from joint ventures to 145,000 oz, and a 19% decline in third-party receipts to 50,000 oz.

Implats was followed by Thungela Resources, Sibanye Stillwater, and Anglo American Platinum (Amplats), with MoM share price gains of 15.6%, 13.6%, and 11.1%. Sibanye’s share price was buoyed by recent changes to US mining regulations, which will reduce costs for PGM miners in the country. These changes stem from the US Treasury’s Inflation Reduction Act (IRA), which aims to grow US domestic production of clean energy components. Under the new regulations, platinum and palladium producers can claim back 10% of their production costs. CEO Neal Froneman said it would provide “essential financial support for our US PGM operations”, which have been under tremendous pressure. There is a double benefit for Sibanye-Stillwater as the IRA incentive also relates to lithium production, and recently, US federal authorities approved an environmental permit for the Rhyolite Ridge lithium/boron mine in which Sibanye has the option to invest.

Amplats released its 3Q24 production update last month, and while its total PGM production was down 10% YoY, the miner raised its production guidance for refined PGMs after their output shot up 22% in the quarter. Moreover, PGM sales volumes rose 16.0% to 1,102,200 ounces, supported by higher refined production. Amplats also said that it has delivered c. R8bn of its targeted R10bn cost and capital reduction programme, and the consultation process for its section 189A restructuring has concluded with 90% of the exits finalised and the remainder to be completed by the end of 2024.

Gold miner Pan African Resources (+11.0% MoM) has commissioned its new tailings retreatment plant, which is expected to boost the Group’s output by at least 50% once steady-state production is reached in December. According to the company, the Mogale Tailings Retreatment (MTR) plant was commissioned in early October, below its R2.5bn budget and ahead of schedule. The facility is expected to add 50,000-60,000 ounces to the combined 100,000 ounces of gold produced annually from the Group’s surface re-mining operations, setting it on course to achieve its output guidance of 220,000 ounces p.a. by the end of its FY25.

Rounding out October’s ten best-performing shares were building materials retailer Cashbuild and Gold Fields Ltd – up 9.4% and 7.9% MoM, respectively. In its 1Q25 operational update, Cashbuild revealed that its revenue increased by 5.0% YoY and sales volumes rose 3.0% YoY. The company closed one underperforming store, refurbished three, and relocated one store during the quarter. The total number of Cashbuild stores trading at the end of the quarter was 321.

In October, Gold Fields said it had completed the acquisition of Osisko Mining’s stake in the Windfall Project after all conditions of the transaction were met. The deal, announced in August, enables Gold Fields to consolidate 100% ownership of the Windfall Project and the surrounding exploration district in Québec, Canada. Gold Fields paid c. R24.6bn net of cash received as a settlement using cash on hand, undrawn debt facilities, and liquidity facilities totalling US$750mn executed in October. Like other gold miners, Gold Fields has benefitted from the stronger US dollar gold price.

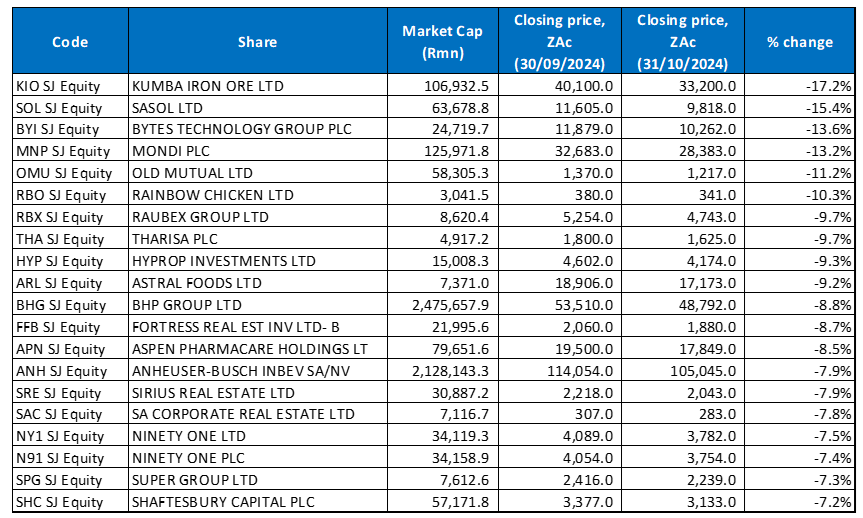

Figure 2: October 2024 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

Steel manufacturer Kumba Iron Ore (Kumba) was October’s worst-performing share, dropping 17.2% MoM. In its 3Q24 production and sales update, Kumba said that iron ore production fell 3% YoY in the quarter, while sales rose 2% YoY, reflecting improved port equipment performance. However, the ore railed to port dropped 8.0% YoY to 9.1mn tonnes due to the cumulative impact of derailments, rail breakages, and speed restrictions. The iron ore price has been under enormous pressure this year (down 27.1% to the end of October), with low demand for steel, high iron ore supply levels, and elevated inventories at China’s ports weighing on the steel-making ingredient’s price. The iron ore price had a brief respite in September (+5.2% MoM) after China, the world’s largest iron ore market, announced far-reaching fiscal stimulus measures to kickstart its economy. Unfortunately, these higher price levels did not last long, and the price of iron ore fell 6.8% in October.

Kumba was followed by Sasol (-15.4% MoM) in second place. In a trading statement last month, Sasol said its FY25 market guidance remained intact and only its crude oil refinery Natref was trading below guidance (Sasol revised guidance for Natref downwards). The petrochemicals firm also foresees lower fuel sales volumes. In 1Q25, fuel production at the refinery was 24% higher QoQ but 27% lower YoY, mainly due to the planned shutdown and start-up delays during the quarter under review. Sasol attributed this to “operational challenges” experienced at the end of 1Q25, which resulted in an expected volume increase of only 0%-10% YoY, down from previous guidance. Mining production declined 4.0%YoY, impacted by coal quality and operational challenges, while its Secunda Operations’ production volumes dropped 2.0% YoY. In its Chemicals business, total sales fell by 6.0% YoY. In Mozambique, gas production increased by 3.0% YoY despite the planned shutdown at the central processing facility (CPF). Sasol said its overall business performance in the quarter was negatively impacted by the stronger rand (vs the US dollar), oil price volatility, and lower refining margins. According to Sasol, global chemical markets remained oversupplied, with higher input costs, chemical prices, and demand impacting the Group’s margins.

Bytes Technology Group (-13.6% MoM) was October’s third-worst-performing share. Its 1H25 results showed that the IT company recorded a revenue decline of 2.9% YoY to GBP105.47mn, while its headline EPS increased 19.5% YoY to GBp12.67. Gross profit rose 9% YoY to GBP82.1mn, and its cash balance ended the period 38.3% higher, at GBP71.5mn. The share price is also down 28.3% YTD.

Bytes was followed by Mondi Plc, Old Mutual Plc, Rainbow Chicken Ltd, and Raubex, with MoM price declines of 13.2%, 11.2%, 10.3%, and 9.7%, respectively. In a 3Q24 trading update, paper and packaging company Mondi revealed that its underlying EBITDA fell to EUR223.00mn (down 36% QoQ) primarily due to more planned maintenance shuts, a forestry fair value loss, softer seasonal demand, and higher input costs.

Tharisa Plc, which is involved in the mining, processing, exploration, beneficiation and logistics of PGMs and chrome concentrates, was also down 9.7% MoM. In its 4Q24 and FY24 production report, Tharisa revealed that PGM production amounted to slightly above 145,000 ounces compared to 144,700 ounces in 2023 (for 4Q24, it produced 37,100 ounces). Chrome production stood at 1.7mn tonnes – higher compared to 1.5mn tonnes in FY23, with 4Q24 delivering 426,800 tonnes. While the PGM prices it received were 28% lower, the chrome concentrate prices were 13.7% higher at US$299/tonne. During the period under review, its cash on hand of US$217.5mn and debt of US$108.8mn resulted in an increased net cash position of US$108.7mn vs US$92.2mn at the end of June. For FY25, Tharisa set production guidance of 140,000 and 160,000 ounces of PGMs and 1.65mn to 1.8mn tonnes of chrome concentrates. The company said it is continuing plant construction at its Karo Platinum Project in Zimbabwe even though average annual PGM prices have decreased by 28% to US$1,362/oz in FY24.

Hyprop Investments and Astral Foods rounded out October’s worst performers, with MoM declines of 9.3% and 9.2%, respectively. In its FY24 trading update, Astral said it expects full-year headline EPS to rise by as much as 240%-250% YoY to between R18.53 and R19.85. Astral recorded the first loss in its 24-year history (of R13.24/share) in FY23 due to loadshedding and SA’s worst-ever bird-flu outbreak. According to Astral, it is now in a solid and healthy financial position due to the focused turnaround strategy it implemented in the current (FY24) financial year.

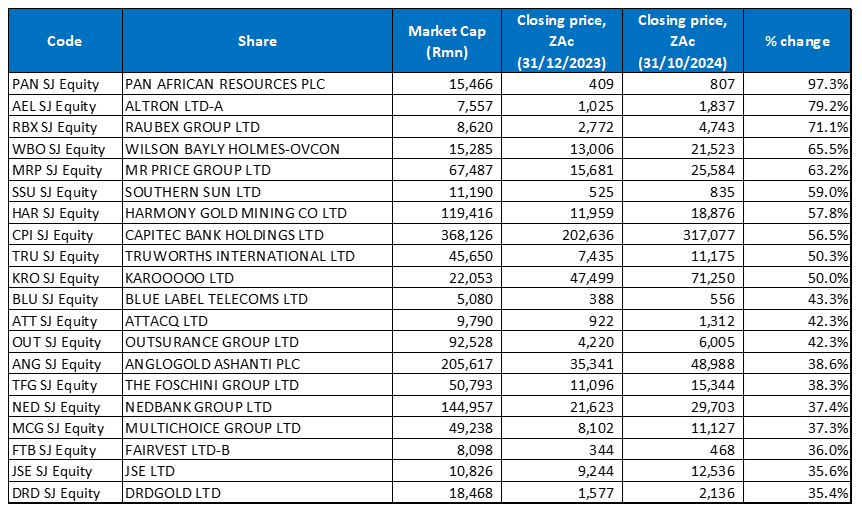

Figure 3: Top-20 best-performing shares, YTD

Source: Anchor, Bloomberg

The YTD best-performing shares featured sixteen of the year-to-end September’s best performers, with four new shares entering the top-20 in October – AngloGold Ashanti, Multichoice, Fairvest Ltd -B-, and DRDGold.

Construction and infrastructure development company Raubex (+71.1% YTD) moved to third place after being the top YTD performer for two consecutive months. Raubex’s share price declined in October, weighing on its YTD performance. The mid-tier gold producer Pan African Resources (+97.3% YTD; discussed earlier) moved to first place in the year to the end of October. Its share price has soared this year, partly due to an improvement in the gold price (+33.0% YTD) and the prospect of increased production. Pan African has guided to a 21% YoY increase in gold production in the current financial year – equal to 215,000 and 225,000 ounces. If achieved, this would exceed its 2022 production record of just above 200,000 ounces. In late September, Pan African was included in the influential VanEck Gold Miners ETF (GDX). The company qualified due to its market cap now being above US$700mn and its liquidity improving to US$1mn a day.

Altron (+79.2% YTD) moved from fifth to second spot after its share price rose 6.2% in October. Investors appear more bullish about the company’s strategy and management amid steadying sentiment towards the business after a period of uncertainty following its unbundling of Bytes Technology in the UK.

Altron was followed by another construction firm, WBHO (+65.5% YTD), Mr Price Group (+63.2% YTD), and Southern Sun (+59.0% YTD). Last month, Southern Sun (+7.7% in October) said it had secured a 50-year lease to redevelop hotels along Durban’s Golden Mile. The agreement, reached after extensive consultation with the Ethekwini municipality, will result in a R1bn investment to revitalise the city’s beachfront. Southern Sun Hotel Group’s lease renewal will cover the redevelopment of the flagship 734-room Elangeni and Maharani, along with the refurbishment of Garden Court South Beach and The Edwards hotels.

Harmony Gold, Capitec Bank, and Truworths followed Altron with YTD gains of 57.8%, 56.5%, and 50.3%, respectively. In October, Capitec, SA’s largest retail bank by customer numbers, released 1H24 results, which showed that its headline earnings increased by 36% YoY to R6.4bn, while net transaction and commission income rose 19% YoY to R6.9bn. Its banking app clients rose by 21% YoY to 12.4mn. Capitec wants to grow its international footprint after its investments in technology helped drive market-share gains in its value-added service offering. Capitec said it aims to grow Avafin, the bank’s global online consumer loan offering, after increasing its shareholding to 97.69% from 40.66% in March 2024. Avafin operates in Poland, Latvia, Spain, the Czech Republic, and Mexico. It contributed R66mn to the Group’s net profit in the six months ended August 2024.

Karooooo Ltd (+50.0% YTD) rounded out the top ten YTD performers. Last month, the mobility software-as-a-service (SaaS) platform company and owner of Cartrack released its 1H25 results, which showed a revenue increase of 7.4% YoY to R2.19bn. Karooooo grew its operating profit by 28% YoY to R602mn while basic and diluted EPS rose to R14.02, compared with R10.70 recorded in 1H24. Cartrack’s operating profit rose by 20% YoY to R580mn, while Karooooo Logistics’ operating profit soared 78% YoY to R22mn.

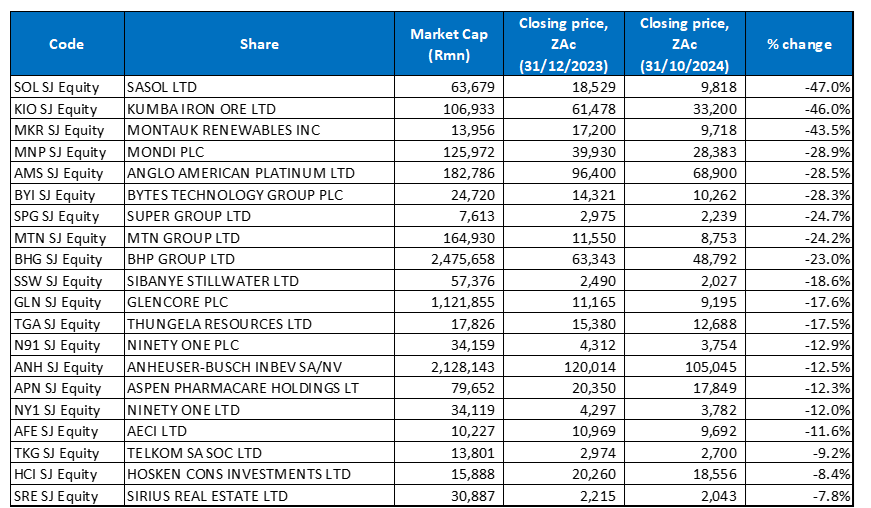

Figure 4: Bottom-20 worst-performing shares, YTD

Source: Anchor, Bloomberg

There was some overlap between the year to end-September’s worst-performing shares and the worst-performers to the end of October (YTD), with fifteen shares unchanged and five new entrants to the grouping – Mondi Plc, AB InBev, Aspen Pharmacare, Ninety One Ltd, and Sirius Real Estate.

Sasol (-47.0% YTD; discussed earlier) bumped Montauk from the worst-performing share YTD spot. Sasol was followed by steel manufacturer Kumba (-46.0% YTD; discussed earlier), with Montauk now in third position and a YTD decline of 43.5%.

Mondi Plc, Amplats, Bytes Technology (discussed earlier), and Super Group followed with YTD losses of 28.9%, 28.5%, 28.3%, and 24.7%, respectively.

MTN Group, BHP Group (discussed earlier), and Sibanye Stillwater (discussed earlier) rounded out the ten worst-performing shares with YTD declines of 24.2%, 23.0%, and 18.6%, respectively. MTN has had a difficult 2024. It reported dismal 1H24 results in August, with revenue coming in at R90.84bn, a 19.8% YoY decrease, and a diluted loss per share of ZAc409 vs EPS of ZAc225 reported in 1H23 due to other African currency devaluations, and the weak macro-economic environment. The Group’s service revenue dropped 20% YoY from R107bn to R85bn in 1H24. Although SA service revenue rose 3.3% YoY to R21bn, Nigerian service revenue fell by 52.9% YoY – from R43bn in the prior period to R20.5bn, meaning it recorded a loss per share of ZAc409, a 278% YoY drop. Headline EPS declined by 198.5% YoY to a headline loss of ZAc256/share, and MTN did not declare a dividend.