The challenges of shifting rate cut expectations, political uncertainty in the UK and Europe, and a slowing US economy saw a mixed month for major global markets (MSCI World +2.1% MoM/+12.0% YTD/+2.8% in 2Q24). However, while some global markets stuttered, others, including the US, Japan, and SA, recorded buoyant June performances. While the latest US economic data, indicating slowing inflation (a positive sign) and better-than-expected consumer sentiment, played a role, the timing and the pace of US monetary policy easing remains uncertain. The European Central Bank (ECB) cut rates in June and several US inflation readings showed that price pressures might be receding, which boosted hopes that the US Federal Reserve (Fed) would cut rates by at least 25 bps in September (at its June meeting, it held rates steady, adjusting its projections to only one rate cut in 2024). Fed Chair Jerome Powell has also said that policymakers will not raise rates until the US economy sends a clear signal that something else is needed – either through a more convincing decline in price pressures or a jump in the unemployment rate.

The three major US indices all posted gains in June. However, MoM and for 2Q24, the Dow Jones Industrial Average (Dow) was the underperformer, rising by 1.1% in June and recording a 1.7% decline in 2Q24 (the index is up 3.8% YTD). The S&P 500 ended June 3.5% higher (+14.5% YTD/+3.9% in 2Q24). The tech-heavy Nasdaq rallied c. 6.0% MoM (+18.1% YTD/+8.3% in 2Q24) on the back of the AI optimism and a big run in Nvidia’s share price (up c. 150% YTD). Both the S&P 500 and the Nasdaq remain close to their all-time highs.

In US economic data, May headline inflation, as measured by the Consumer Price Index (CPI), advanced by a less-than-expected 3.3% YoY vs April’s 3.4% print. May core CPI, excluding the erratic food and energy components, rose 3.4% YoY vs April’s 3.6% reading. MoM, headline and core inflation were up 0.3% and 0.2%, respectively. May US retail sales rose just 0.1% MoM (below market expectations) vs April’s downwardly revised 0.2% MoM gain. YoY, retail sales increased by 2.3% in May. Core personal consumption expenditure (PCE), excluding food and energy, a key Fed inflation barometer, increased by 2.6% YoY in May vs April’s 2.8% rise – the lowest annual rate since March 2021. MoM, it rose 0.1% vs April’s 0.2%.

In Europe, major equity markets closed lower in June and for the quarter. MoM, Germany’s DAX was down 1.4% (+8.9% YTD, -1.4% in 2Q24), while France’s CAC ended the month 6.4% in the red (-0.8% YTD, -8.9% in 2Q24). French markets faltered earlier in June as the prospect of significant gains for France’s far-right and hard left in the upcoming snap parliamentary elections sparked the bourse’s biggest sell-off in years. Commentators have warned that market turmoil could continue if polling shows the far-right Rassemblement National and its allies will attain an absolute majority in parliament. In economic data, euro area inflation came in at 2.6%, slightly above April’s 2.4% print, while May core inflation, excluding prices for energy, food, alcohol and tobacco, rose to 2.9% from 2.7%. Germany’s May inflation rate advanced to 2.4% YoY vs April’s 2.2% reading, while France’s May inflation rose to 2.3% YoY vs April’s 2.2% print, driven by higher energy and food prices. The ECB cut rates in June, its first in c. five years, taking the benchmark rate in the 20 countries that use the euro down to 3.75% from an all-time high of 4.0%.

The UK stock market ended in the red (ahead of the country’s 4 July election), with the blue-chip FTSE-100 Index down 1.3% MoM (+5.6% YTD/+2.7% in 2Q24). May UK inflation declined to 2.0% YoY vs April’s 2.3% print, falling to the Bank of England’s (BoE) 2% target for the first time in c. three years. May core inflation (excluding energy, food, alcohol, and tobacco) dipped to 3.5% from 3.9% in April. Unlike the ECB, the BoE kept rates on hold for a seventh consecutive time when it met last month – at 5.25%.

China’s equity markets again disappointed, lagging their regional peers. Doubts over an economic recovery and a potential trade war with the West (after China flagged possible retaliatory measures over European tariffs on Chinese electric vehicle [EV] imports) weighed on sentiment. In addition, more measures to boost its beleaguered property market failed to lift equity market sentiment, with Beijing being the latest city to cut minimum downpayment ratios and mortgage rates to help the property sector, following other cities that have taken similar measures. The move is in line with national policies aimed at enticing buyers back into a market that has been in the doldrums since the government cracked down on excessive borrowing by developers. The Shanghai Composite closed June 3.9% lower (-0.3% YTD/-2.4% in 2Q24), while Hong Kong’s Hang Seng lost 2.0% MoM (+3.9% YTD/+7.1% in 2Q24). China’s official June Manufacturing PMI printed at 49.5 – unchanged from May. The official non-manufacturing PMI, measuring business sentiment in the services and construction sectors, declined to 50.5 in June, vs May’s 51.1 print. The 50-point mark separates expansion from contraction.

In Japan, the benchmark Nikkei, ended June 2.8% higher, and the index has risen by 18.3% YTD but is down 1.9% in 2Q24. In economic data, May headline CPI rose to 2.8% YoY, up from April’s 2.5% print. However, Japan’s core-core inflation (which is considered by the Bank of Japan’s [BoJ] when formulating monetary policy and which excludes fresh food and energy prices) printed lower – coming in at 2.1% in May, lower than April’s 2.4% print and moving closer towards the BoJ’s target rate of 2%.

Commodity prices were mixed in June, and among platinum group metals (PGMs), platinum fell by 4.1% MoM (+0.4% YTD), palladium rose by 6.6% MoM (-11.2% YTD), and rhodium fell by 1.6% MoM (+5.1% YTD). The gold price ended June basically unchanged, while the yellow metal has advanced by 12.8% YTD and by 4.3% in 2Q24 (its third consecutive quarterly gain). After its May decline, Brent crude rose 5.9% in June (+12.2% YTD/-1.2% in 2Q24) amid signs of strengthening US gasoline demand and geopolitical tensions flaring again over recent weeks in the Middle East between Israel and the Iran-backed militia group Hezbollah. Iron ore was down 5.7% MoM (-22.7% YTD/+7.4% in 2Q24) as demand in China, its biggest consumer, continues to face headwinds on the back of a beleaguered property sector and as the global seaborne market remains in an iron ore surplus.

In South Africa (SA), the JSE gained momentum in June following the 2024 National and Provincial Elections (NPEs) results, which ushered in a new era of coalitions in local politics. The announcement of the formation of a government of national unity (GNU), initially partnering the ANC with its biggest political opponent, the DA, proved to be one of the more market-friendly outcomes. Initially, five parties signed the statement of intent to participate in the GNU, including the ANC, the DA, the IFP, GOOD, and the PA. Collectively, this grouping represented 273 seats in the National Assembly or 68% of total seats. The election outcome has seen several weeks of ongoing negotiations to form a GNU to govern SA for the next five years, with the Cabinet announcement finally being made late on Sunday, 30 June. The rand recorded substantial gains last month, firming to below R18/US$1 earlier in June before closing the month c. 3.3% firmer vs the greenback (YTD +0.9%/2Q24 +3.8%).

We saw some volatility on the local bourse as the JSE remained anxious over uncertainty surrounding the GNU amid prolonged negotiations, particularly between the ANC and the DA. Still, the FTSE JSE All Share Index broke through the key 81,000 level, hitting a record high on 19 June, before retreating again to end the month at 79,707.1. MoM, the index posted an impressive 3.9% gain (+3.7% YTD/+6.9% in 2Q24), while the Capped SWIX rose by 4.2% MoM (+5.7% YTD/+8.2% in 2Q24). Resources counters were the worst performers (Resi-10 -3.7% MoM/+2.7% YTD/+3.2% in 2Q24), while financial stocks outperformed and the Fini-15 soared 14.5% MoM (+5.6% YTD/+14.3% in 2Q24). The SA Listed Property Index jumped 5.1% MoM (+6.3% YTD/+2.3% in 2Q24). At the same time, industrial counters, as measured by the Indi-25, rose 1.4% (+4.4% YTD/+4.1% 2Q24), Highlighting the June share price performances of the biggest JSE-listed shares by market cap, rand-hedge counters were under pressure as a stronger rand weighed on their performance. BHP Group fell 5.8% MoM while the second and third-biggest JSE-listed shares – Anheuser-Busch InBev (AB InBev) and Prosus were down 9.3% and 3.6% MoM, respectively.

In economic data, SA May headline CPI printed at 5.2% YoY – unchanged from April. MoM, headline CPI slowed slightly to 0.2% in May vs April’s 0.3%. Core inflation (excluding food, fuel, and electricity) was also unchanged from the prior month at 4.6% YoY. This latest reading shows that underlying inflationary pressures remained close to the 4.5% midpoint of the SA Reserve Bank’s (SARB’s) target band of 3% to 6%, where it prefers to anchor expectations. SA retail trade sales rose for a second consecutive month in April, again beating expectations. YoY, retail sales rose 0.6% vs a 2.3% YoY gain in March, while MoM retail sales advanced by 0.5% in April vs 1.3% in the prior month. This latest print shows resilience in consumer spending despite SA’s various economic, political, and structural challenges. The post-election market optimism is only likely to filter through to later prints, i.e., from June onwards. SA’s anaemic economy again found itself in negative territory after surprising slightly on the downside, with 1Q24 GDP contracting by 0.1% QoQ.

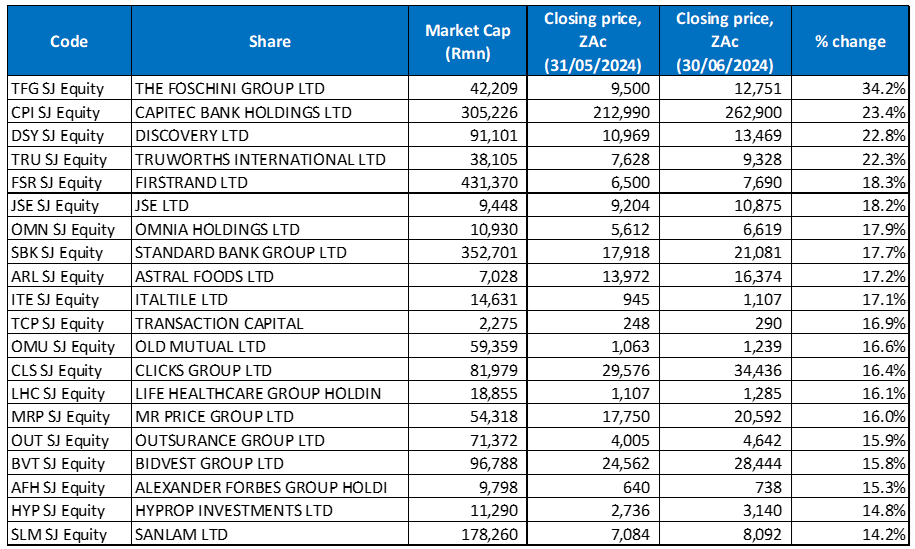

Figure 1: June 2024 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

So-called SA Inc. stocks, or those shares with earnings linked to the local economy, such as banks, insurers, retailers, etc., were the best performers in June following the NPE results and the post-election GNU announcement. A stronger rand and a possible interest rate cut later this year should provide further support for clothing/apparel retailers such as Foschini, Truworths, Pepkor, and Mr Price. The Foschini Group (+34.2% MoM) was June’s best-performing share. The clothing retailer reported impressive FY24 results with Group turnover growth of 8.9% YoY to a record R60.1bn in a challenging local operating environment. The share price jumped 11.3% on 7 July after its results announcement. Foschini said that its FY24 online turnover surged (by 22.0% YoY) to R5.6bn despite the challenging economic and operating environment. Retail turnover increased 8.6% YoY to R56.2bn, driven by TFG Africa’s impressive 10.4% YoY growth across its major merchandise categories. Gross profit rose 8.6% YoY to a record R27.0bn, with TFG Africa recovering its gross margin to 41.1% in 2H24.

Foschini was followed by Capitec Bank in second place, with a 23.4% MoM share price gain. Capitec’s share price was buoyed by positive sentiment around the GNU, but the bank also said it would launch its previously flagged life insurance products soon by tapping into its 22mn-strong customer base and branch network countrywide to give it the edge in a hotly contested industry. CEO Gerrie Fourie told shareholders that SA’s largest bank, by customer numbers, was well positioned to win market share in the life insurance business.

Discovery (+22.8% MoM) was third. Its share price was down 8.8% in May, but we saw a significant turnaround in June as the NPE results seemed to eclipse the spectre of a National Health Insurance (NHI) bill in its current form.

Truworths, FirstRand, and JSE Ltd followed with MoM gains of 22.3%, 18.3% and 18.2%, respectively. In its FY24 trading update, FirstRand said it produced a stronger 2H24 underlying performance than anticipated, given the challenging operating environment. That said, the Group’s earnings growth is being offset by its decision to raise an accounting provision for the disclosed UK motor commissions review process. Amidst prevailing uncertainty, FirstRand is raising this provision based on its probability-weighted scenario principles (constructed from its data analysis). As a result of the provision, it updated the ranges for its earnings growth, with headline EPS now expected to be 1.0%-5.0% higher YoY or between ZAc661.2 and ZAc687.4.

In June, the chemicals, fertiliser, and explosives business Omnia Holdings (+17.9% MoM) reported FY24 results. Group revenue decreased to R22.2bn from R26.6bn posted in the previous year, while its diluted EPS rose 0.6% YoY to ZAc696.0. However, despite volatile market conditions and lower commodity prices, the company reported strong cash generation, improved margins and sustained profitability (it recorded an FY24 operating profit of R1.7bn). With its global ventures gaining traction, Omnia said that its strategy to invest in high-growth international markets is paying off, and it is readying to further expand internationally through organic expansion, partnerships, and mergers & acquisitions.

Standard Bank Group (+17.7% MoM), also buoyed by positive momentum from the GNU announcement, released a trading update for the first five months of 2024, which revealed that its headline earnings grew by low-to-mid single digits – a better-than-expected result. It said its income growth was supported by higher average interest rates and client transactional volumes but dampened by lower trading revenues. As expected, credit impairment charges were marginally higher, with higher charges in Business & Commercial Banking and Personal & Private Banking, partially offset by lower charges in Corporate & Investment Banking (CIB).

Poultry producer Astral Foods and tiles, bathroom ware and related products manufacturer Italtile rounded out June’s ten best-performing shares with MoM gains of 17.2% and 17.1%, respectively. Towards the end of May, Astral reported improved results for the six months ended 31 March 2024, on the back of its “reset, refocus and restart campaign”. The campaign was launched in response to its significant losses from loadshedding and avian influenza in FY23. The Group reported a 4% YoY FY24 revenue increase and a 461% YoY jump in operating profit to R550mn. HEPS for the period came in at R8.84 vs R1.63 in the same period of the prior year.

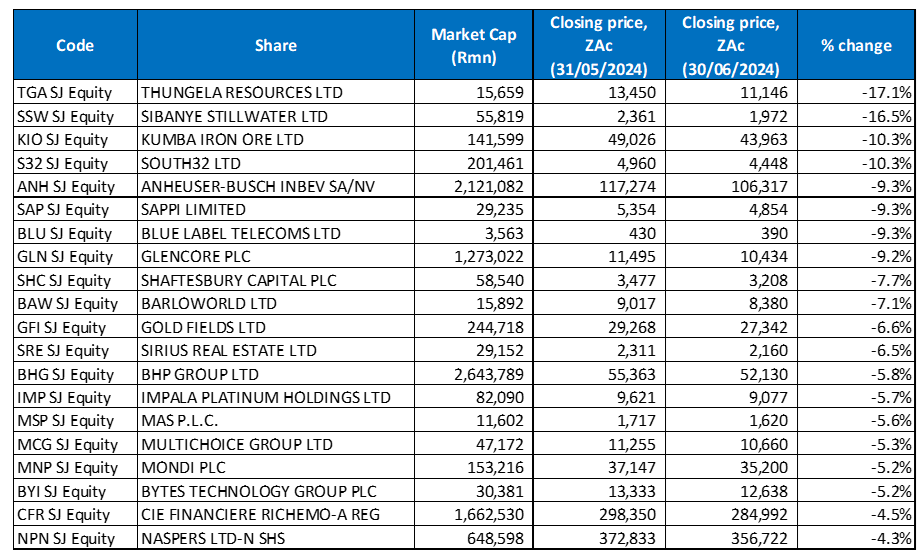

Figure 2: June 2024 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

With resources (basic materials) under pressure in June, most of the counters among the worst performers for the month came from this sector. Coal miner Thungela Resources was June’s worst-performing share, falling by 17.1% MoM. In its trading update for the six months ending 30 June 2024, Thungela said that it expects to report lower first-half earnings due to a decrease in benchmark coal prices, a drawdown on stockpiles from December 2023, and an increase in lower-quality coal in its export sales mix. The coal miner forecast HEPS for the six months to end-June to be 55%-69% lower YoY at between R7 and R10 vs R22.46 recorded in the previous year. It noted that the underlying operating environment remained uncertain as macroeconomic and geopolitical headwinds persisted, with rail performance challenges in SA also impacting its performance.

Thungela was followed by Sibanye Stillwater, which was down 16.5% MoM. The Sibanye-Stillwater CEO said last week that it may close a metals streaming, or prepayment, deal to raise the cash it needs to boost its balance sheet in 3Q24. The PGM producer is looking to raise more than US$500mn to shore up its balance sheet after earnings plunged due to a rout in metal prices. In 2023, Sibanye Stillwater’s profit tumbled by US$2bn due to lower prices and after it reported US$2.6bn of impairments at its US palladium mines, a nickel operation in France and an SA gold operation. In June, Sibanye also said that all of its lenders had agreed to raise its debt threshold on all facilities in a move that could help strengthen its balance sheet.

Kumba Iron Ore was June’s third worst-performing share, with a 10.3% MoM decline as iron ore prices remain under pressure. At the end of December, iron ore traded at c. US$136/tonne before falling to a 2024 low of US$97/tonne in April. By the end of June, prices had recovered to c. US$106.50/tonne (down 5.7% MoM), but this still marks a c. 22.7% YTD decline in the price. This is due to an ongoing slump in steel demand from property and construction sectors, especially iron ore’s biggest consumer, China and its troubled property sector. In early June, China’s government announced stimulus measures in its real estate sector worth CNY1trn (c. US$138bn). Although this gave iron ore prices a short-term boost, it did not last long as the support did not translate to an immediate impact on steel consumption.

Kumba was followed by South32, Anheuser Busch InBev (AB InBev), and Sappi, with MoM declines of 10.3% and 9.3% (for both AB InBev and Sappi), respectively. Last month, South32 said that it would not pay a premium for control of the two manganese mines in the Northern Cape, which it shares in a joint venture (JV) with Anglo American (South32 owns a controlling 60% stake in these assets). Anglo is selling assets in a major restructuring, which the company unveiled in May to spotlight the potential of its copper. While the Anglo CEO did not specifically say its manganese mines are for sale, he has made a statement of intent in setting down plans to sell Anglo’s 85% stake in De Beers and unbundle its 79.2% stake in Anglo American Platinum (Amplats).

Blue Label Telecoms (-9.3% MoM), Glencore (-9.2% MoM), Shaftesbury Capital (-7.7% MoM) and Barloworld (-7.1% MoM) rounded out June’s worst performers. Last month, Legal and General Investment Management (LGIM) said it would sell some of its Glencore shares due to concerns over Glencore’s coal production and the company’s commitment to reducing its carbon emissions.

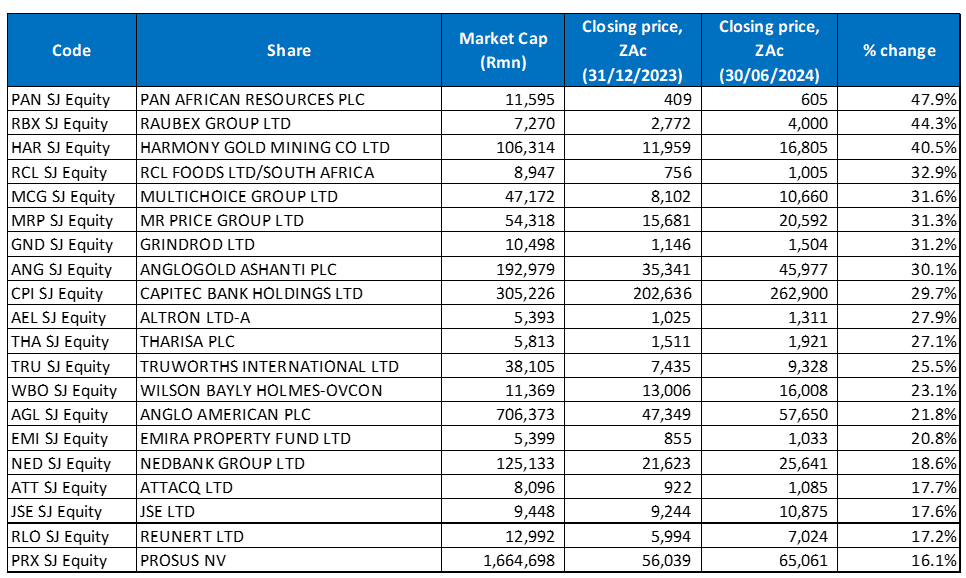

Figure 3: Top-20 best-performing shares, YTD

Source: Anchor, Bloomberg

YTD, the best-performing shares featured twelve of the year-to-end May’s best performers, with eight shares entering the best performers club in June – Mr Price Group, Capitec Bank, Tharisa PLC, Truworths, Emira Property Fund, Nedbank, Attacq, and JSE Ltd.

Mid-tier gold producer Pan African Resources reigned supreme for a second consecutive month with a 47.9% YTD gain after its share price rose a further 0.7% in June. Last month, the miner said it had concluded a milestone five-year wage agreement (for wage increases and other conditions of service) with the National Union of Mineworkers at its Barberton Mines operations. Raubex (+44.3% YTD) moved to the second spot after gaining 11.9% MoM in June and was followed in third place by gold miner Harmony (+40.5% YTD).

RCL Foods Ltd followed with a 32.9% YTD gain. RCL recorded an impressive c. 12.0% MoM gain in June after it announced early last month that it would list Rainbow Chicken Ltd (Rainbow) on the JSE in the coming weeks. The unbundling was initially proposed in March and will see Rainbow listed on the JSE’s main board. Shareholders will be given 1 Rainbow share for every no-par value RCL Foods share held. RCL said the effective date of the unbundling is anticipated to be on or about 1 July 2024. Rainbow was listed on the bourse on 26 June.

Multichoice (+31.6% YTD) moved to the fifth spot after declining 5.3% in June. In its FY24 results, released last month, Multichoice reported a 5.9% YoY revenue decline to R54.99bn and a headline loss per share of ZAc715. The Group’s share price would have likely slumped more following these results if French broadcaster Canal+’s cash offer of R125/share had not underpinned it. In February, Canal+, which at that stage owned a 35.01% stake in Multichoice, submitted a non-binding offer (of R105/share) to acquire all of MultiChoice’s issued ordinary shares that it does not already own (subject to obtaining the necessary regulatory approvals). However, MultiChoice rebuffed the offer as undervaluing the business before asking Canal+ to sweeten the deal. Canal+ then raised its offer to R125/share on 5 March, valuing the deal at c. R35bn. Canal+ has continued buying Multichoice shares, increasing to the 50% mark. The current Canal+ offer is with the MultiChoice board and is awaiting approval.

Multichoice was followed by Mr Price Group, Grindrod Ltd, and AngloGold Ashanti, which recorded YTD gains of 31.3%, 31.2% and 30.1%, respectively. Retailer Mr Price released its FY24 results in June, reporting a 15.5% YoY revenue jump to R37.9bn from R32.9bn in FY23, while its diluted headline EPS grew 6.3% YoY to ZAc1,252.6. The share was up 16.0% in June.

Capitec Bank (discussed earlier) and tech company Altron Ltd rounded out the ten best-performing shares YTD, with gains of 29.7% and 27.9%, respectively.

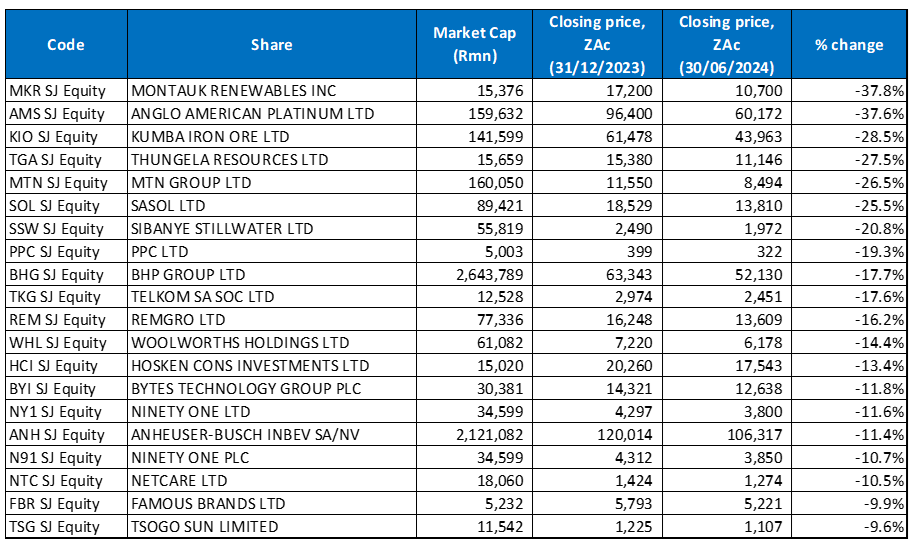

Figure 4: Bottom-20 worst-performing shares, YTD

Source: Anchor, Bloomberg

YTD, there was some overlap between May’s worst-performing shares and the worst-performers to end June, with eleven shares remaining and nine new entrants to the worst-performers grouping, including Thungela, Sibanye Stillwater, BHP Group, Bytes Technology Group, Ninety One Ltd, AbInBev, Ninety One Plc, Famous Brands, and Tsogo Sun. Montauk remained the worst performer YTD, declining by 37.8%, although its share price rose 7.0% in June. Montauk was followed by Amplats (-37.6% YTD), which recorded another poor share price performance in June – down a further 1.5% MoM. Kumba (discussed earlier) came in third – down 28.5% YTD. Kumba was June’s third worst-performing share, with a 10.3% MoM drop in its share price.

Kumba was followed by Thungela, MTN Group, Sasol, and Sibanye Stillwater (discussed earlier), which recorded YTD declines of 27.5%, 26.5%, 25.5%, and 20.8%, respectively. Sasol’s (+11.3% MoM in June) said last month that the High Court had awarded its R6.2bn in damages against Transnet. The High Court found Transnet had overcharged Sasol (and Total) for transporting crude oil to the Natref Refinery (which Sasol and Total jointly own) over several years. Transnet has said it will appeal the judgment.

PPC, BHP Group, and Telkom SA rounded out the ten worst-performing shares with YTD declines of 19.3%, 17.7%, and 17.6%, respectively. Despite a strong performance from its Zimbabwean operation, which helped cement manufacturer PPC return to profitability in FY24, the share price sank 3.9% in June. In its FY24 results, released last month, PPC reported that its revenue rose 20.6% YoY to R10.1bn, while its headline EPS stood at ZAc19.0, compared with a loss per share of ZAc20.0 recorded in FY23. Meanwhile, Telkom’s (+3.2% MoM) share price soared c. 7% on 18 June after the company reported FY24 results, which showed that its revenue rose 1.6% YoY to R42.46bn (from R41.84bn). Its headline EPS jumped to ZAc376.0 from ZAc124.8 in FY23.