South Africa’s (SA) economy exhibited modest growth in 4Q24, with gross domestic product (GDP) expanding by 0.6% QoQ. This followed a slight contraction of 0.1% in 3Q24, reflecting the country’s ongoing economic challenges and sectoral variances. For the fourth quarter, only three industries expanded- agriculture, forestry, and fishing; trade, catering, and accommodation; and the finance, real estate, and business services industry. GDP grew by 0.6% for the full year, slightly below the 0.7% growth recorded in 2023. This latest GDP print highlights the persistent fragility of SA’s economic landscape, influenced by internal structural issues and external global pressures.

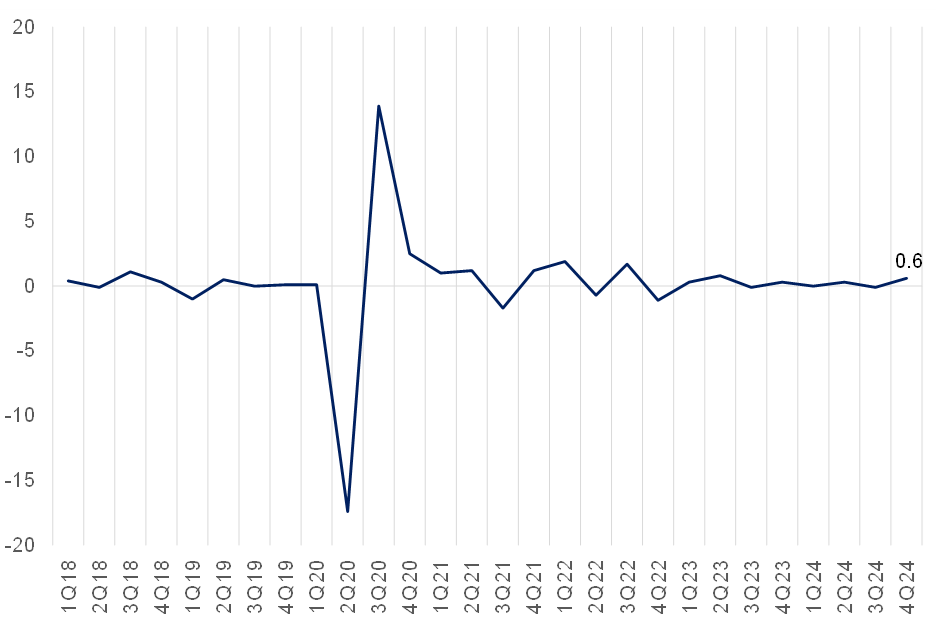

Figure 1: SA GDP growth QoQ % change

Source: Stats SA, Anchor

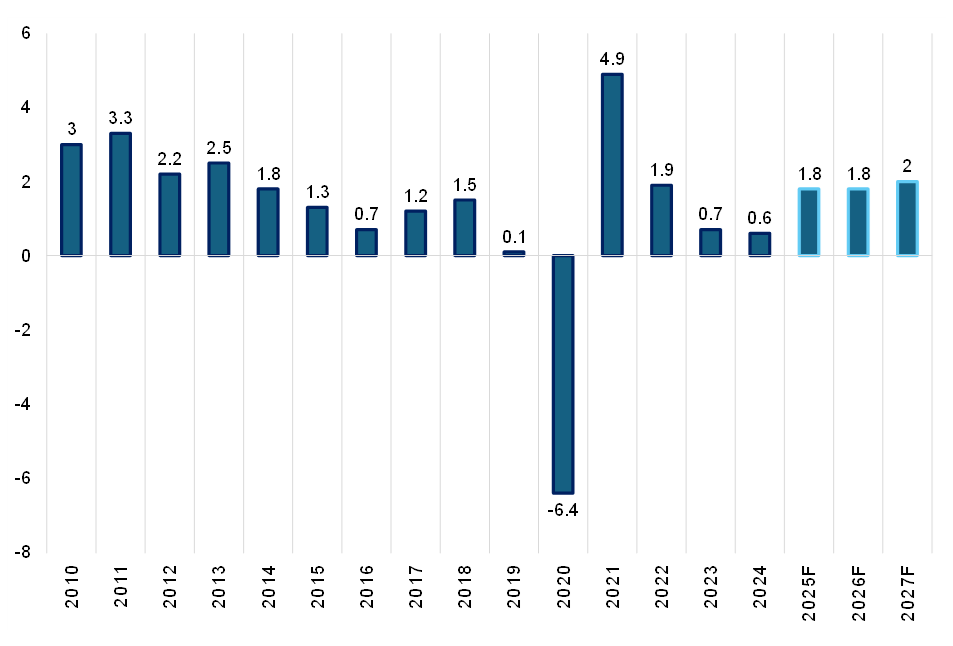

Figure 2: SA GDP annual growth rate, YoY % change

Source: Stats SA, SARB, Anchor

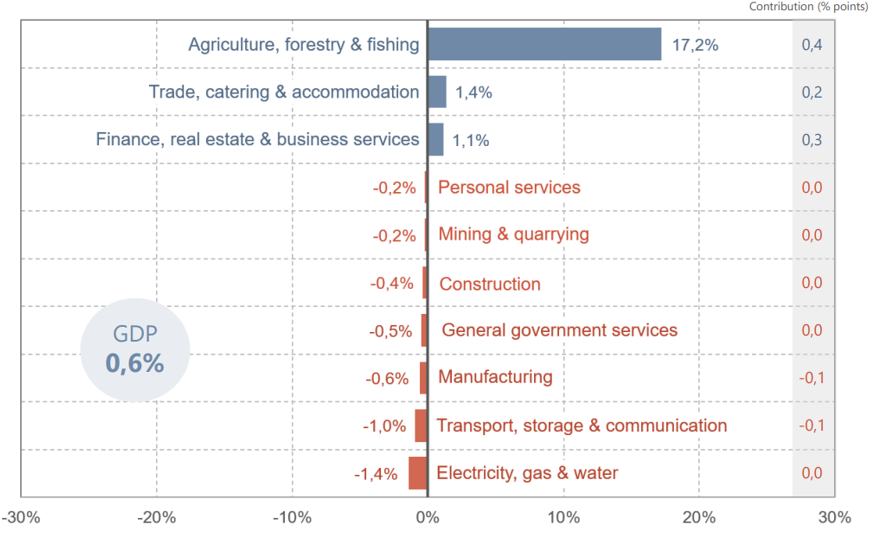

The agriculture, forestry, and fishing industry demonstrated remarkable growth, expanding by 17.2% QoQ in 4Q24. This sector was the most significant positive contributor to GDP, adding 0.4 ppts to overall growth, primarily driven by higher economic activities in field crops and animal products. Despite challenges such as fluctuating weather conditions and high input costs, the sector remained resilient and played a key role in the economy’s overall performance. The most significant revision in the previous 3Q24 data came from the agricultural sector, where the contraction was adjusted upward, as anticipated, to a still substantial decline of 19.7% QoQ, an improvement from the initially reported -28.8%.

The second-biggest contribution to the production side of the economy came from the finance, real estate, and business services industry, growing by 1.1% and contributing 0.3 ppts to GDP. This growth was supported by increased activities in financial intermediation, real estate transactions, and various business services, reinforcing the sector’s critical role in the SA economy. Its sustained expansion highlights the increasing reliance on financial services and business innovation to drive economic momentum.

The trade, catering, and accommodation industry also recorded growth, increasing by 1.4% and contributing 0.2 ppts to GDP growth. This sector benefitted from heightened wholesale, retail, and motor trade activities, suggesting a gradual consumer demand and spending recovery. The boost in economic activity within this industry indicates that consumer confidence is slowly improving despite the broader economic challenges. With lower inflation, reduced interest rates, and a boost from withdrawals under the two-pot retirement system, market expectations had pointed to a strong performance from consumer-linked industries in 4Q24. However, their growth was insufficient to offset the contractions observed across other sectors.

Several key industries contracted in 4Q24, highlighting the uneven economic recovery. Transport, storage, and communication declined by 1.0% QoQ due to inefficiencies in land transport. Manufacturing shrank by 0.6% QoQ, with major losses in metal and transport equipment production, reflecting supply chain challenges and weak demand. The electricity sector fell by 1.4% QoQ, driven by loadshedding and infrastructure issues, while mining declined by 0.2% QoQ due to lower manganese and iron ore output. General government services dropped by 0.5% as employment in public institutions decreased amid fiscal constraints.

Figure 3: Industry growth rates, 4Q24 vs 3Q24

Source: Stats SA

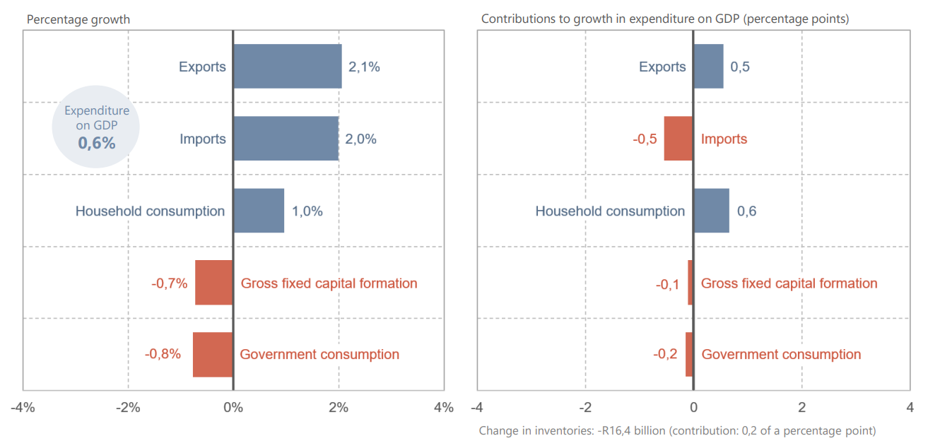

On the expenditure side of the economy, gross fixed capital formation (GFCF), a key indicator of investment in capital assets, fell by 0.7% QoQ. The weakness in capital investment points to ongoing uncertainties in the business environment, as investors remain wary of policy instability, infrastructure bottlenecks, and economic volatility. Exports of goods and services increased by 2.1% QoQ, driven by heightened trade in precious metals and chemical products. Meanwhile, imports grew by 2.0% QoQ, mainly due to increased demand for transport equipment, vegetable products, and machinery. However, the overall net exports contribution to GDP remained neutral, reflecting a balance in trade activities.

Figure 4: QoQ % change in expenditure components and contributions to expenditure on GDP

Source: Stats SA

Overall, SA’s economic performance in 4Q24 reflects a delicate balance between resilience and persistent structural challenges. While the finance, trade, and agriculture sectors contributed positively to GDP growth, these gains were offset mainly by contractions in manufacturing, energy, transport, and government services. The economy recorded a modest annual GDP increase of 0.6%, falling short of the 0.7% YoY growth seen in 2023, signalling an economy struggling to gain momentum amid domestic constraints and global uncertainties. This underscores the urgent need for continued, accelerated structural reforms to stimulate growth and improve economic prospects.

The lower growth rate in 2024 compared to the previous year was disappointing. Business surveys indicate that economic activity was largely subdued in the lead-up to the National and Provincial Elections (NPEs) in May, with many companies delaying major investment decisions. Although business sentiment improved post-election, this optimism has yet to translate into tangible economic acceleration. Additionally, persistent logistical constraints, such as those within SA’s state-owned freight transport and logistics company, Transnet, weighed heavily on business operations throughout the year. The slight recovery in exports during 4Q24 offers hope that external trade could drive more substantial growth in the future. However, ongoing inefficiencies within Transnet remain a significant concern, with progress often advancing inconsistently.

It remains concerning that the absence of severe loadshedding in 2024, compared to the record levels the country experienced in 2023, did not deliver a more pronounced boost to economic activity. While the mining sector managed a slight 0.3% annual expansion, the manufacturing industry continued to contract, highlighting broader industrial challenges. Businesses and consumers took time to adjust to a more stable power supply, but the recent reemergence of stage six loadshedding underscores the fragile state of the electricity grid. This lingering uncertainty likely continues to weigh on investor confidence and broader economic activity.

Moreover, the domestic economy has shown minimal growth over the past five years, remaining marginally larger than before the COVID-19 pandemic. The initial 5% rebound in 2021 following the severe 6.2% YoY contraction in 2020 has given way to a steady deceleration in growth each subsequent year. Historically, significant job creation in the local economy has only occurred when GDP growth approaches 3% p.a. With current growth levels falling far short of this benchmark, the economy is simply not expanding sufficiently to drive sustainable employment gains or significantly improve long-term economic prospects for South Africans. Addressing structural constraints, restoring investor confidence, and implementing reforms to enhance productivity will be crucial in reversing this sluggish trajectory.