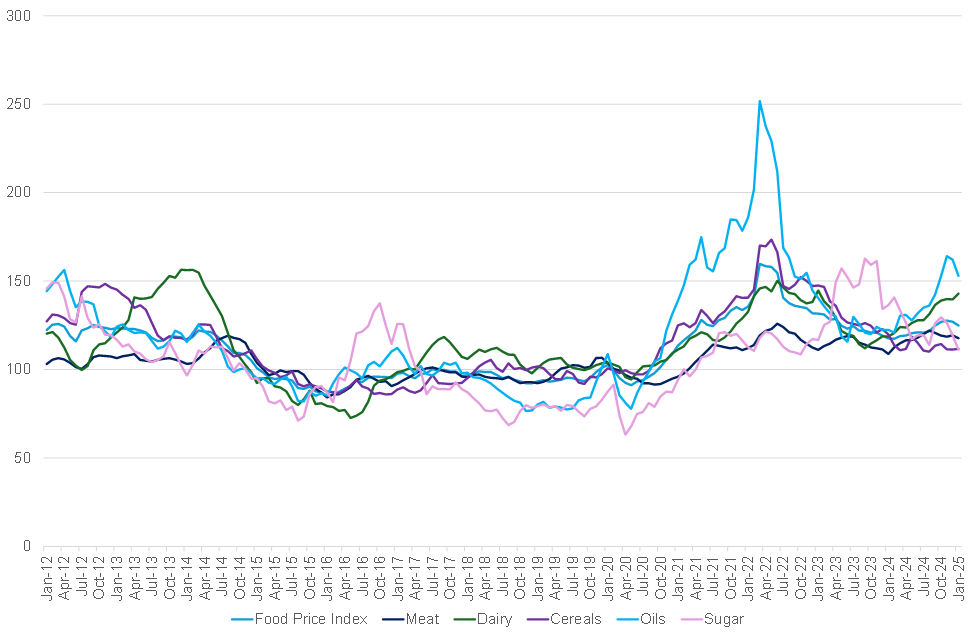

In January 2025, the Food and Agriculture Organization (FAO) of the United Nations reported that its Global Food Price Index (FFPI), a key measure of global food commodity prices, averaged 124.9 points for the month. This represented a 1.6% decline compared to the revised December 2024 level, primarily driven by decreases in sugar, vegetable oil, and meat prices. However, these declines were partially offset by rising prices in dairy products and cereals. Despite the monthly drop, the overall index remained 6.2% higher than in January 2024, reflecting persistent food price pressures over the past year. Nevertheless, food prices were still 22.0% lower than the peak recorded in March 2022, when global food markets faced extreme volatility due to supply chain disruptions and geopolitical tensions.

Figure 1: FAO Global Food Price Index, January 2012 to January 2025

Source: FAO, Anchor

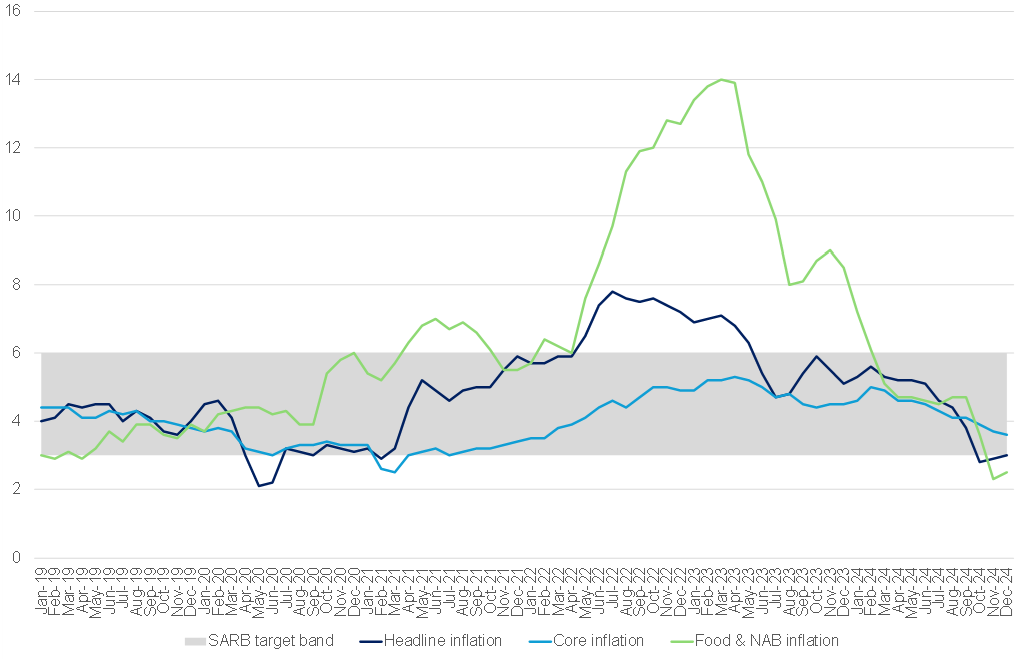

South Africa’s (SA) inflation rate, as measured by the Consumer Price Index (CPI), saw inflationary pressures remain subdued in December. Headline CPI inflation ticked slightly higher from 2.9% YoY in November 2024 to 3.0%, falling short of the consensus forecast of 3.2%. Core inflation, which excludes the more volatile food and energy components to reflect underlying price trends better, declined for the third consecutive month, easing to 3.6% YoY in December from 3.7% in November. This highlights weak underlying price pressures on the demand side. The widely debated exchange rate pass-through appears minimal, while the spillover effects from higher logistics and electricity costs had little influence on this inflation reading. Instead, these data strongly reflect the impact of the current contractionary monetary policy stance. The decline in inflation was broad-based, with most subcategories continuing to show downward pressure.

Figure 2: SA inflation, January 2019 to December 2024 (YoY, % change)

Source: Stats SA, Anchor

As anticipated, food prices rose slightly in December. Still, the more notable trend was the broad-based cooling across key categories such as housing and utilities, household goods, healthcare, dining out, and recreation, which posted softer inflation prints. Food and non-alcoholic beverages inflation edged up to 2.5% YoY in December from November’s 2.3% print, driven by modest increases in food prices. With the December data finalising the year’s figures, annual inflation averaged 4.4% YoY for 2024, slightly below the SA Reserve Bank (SARB) Monetary Policy Committee’s (MPC) forecast of 4.5%. The primary drivers throughout the year were consistent, with the slowing pace of price increases in fuel, food and non-alcoholic beverages, and core categories remaining key contributors.

Figure 3: YoY inflation on prominent food products in SA, 2024

Source: Stats SA, Anchor

Taking a retrospective view of 2024, global food commodity prices exhibited mixed trends. Cereal and sugar prices decreased, with the cereal price index falling due to softer wheat and coarse grain prices. Adverse weather conditions, particularly in major maize-producing countries like Brazil, the EU, the US, and Russia, disrupted maize production and kept prices high for several months. However, positive production prospects saw prices ease towards the end of last year. Sugar prices dropped primarily due to record exports from Brazil and an optimistic supply outlook for the 2024/2025 season. Meanwhile, prices for vegetable oils, dairy, and meat increased by 10%, 5.8%, and 2.7% YoY, respectively, driven by factors such as tight global palm oil supply, geopolitical tensions, and disruptions in the supply chains of dairy products and meat.

Locally, the effects of global market trends, exchange rates, and supply-demand dynamics played a significant role in shaping commodity prices in 2024. El Niño-induced weather events led to a drop in maize production, mainly white maize, which saw price increases due to lower local supply and higher demand from Southern Africa. Yellow maize imports helped to alleviate the local shortfall. Meat prices were influenced by factors such as animal diseases, exchange rates, and seasonal supply fluctuations, with poultry prices easing after an avian influenza recovery, while pig meat prices saw a marginal rise. A strong export performance and rising global prices boosted local prices in the beef sector. Dairy prices eased as a stable electricity supply enabled increased milk production, while seasonal factors and extreme weather conditions influenced fruit and vegetable prices.

Given the current low levels of food inflation and the uncertainty surrounding SA’s summer crop due to a challenging start to the season, prices for grain and oilseed products are expected to remain high throughout 1Q25. This price elevation will likely contribute to some increase in food inflation, although the rise will be relatively modest due to the low inflation starting point. However, the duration of these elevated prices will be primarily influenced by the size and performance of the summer crop. If the widespread rains that fell in January continue through February and March, it is anticipated that food inflation will begin to stabilise in 2Q25 as crop yields improve and supply conditions normalise.

Beyond crop performance, the exchange rate also plays a critical role in shaping food inflation, affecting the cost of products heavily traded in the global market. Since the inauguration of US President Donald Trump, there has been increased global uncertainty, which, combined with Trump’s recent attacks on SA government policies and concerns about the stability of SA’s Government of National Unity (GNU), has put pressure on the rand vs US dollar exchange rate. If pressure on the local currency intensifies, food inflation could increase, as imported goods and global commodity prices would become more expensive. Conversely, if the rand strengthens further, it could ease pressure on food prices and help reduce inflationary pressures in the domestic food sector. Thus, the direction of the exchange rate will be a key determinant of how SA food inflation evolves over the coming months.