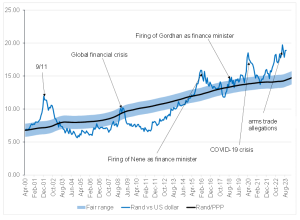

Figure 1: Rand vs the US dollar

Source: Anchor

World markets and the JSE have fluctuated recently, with the US remaining the only game in town. We have seen persistent US dollar strength, as that country’s economic data have been significantly better than those from other regions. US economic growth has proven resilient while inflation trickles toward the US Federal Reserve’s (Fed) target level of 2%. The US labour market is less tight, and broadly speaking, the US economy has hit its purple patch. Bond traders do not expect a rate hike when the US Fed’s Federal Open Market Committee (FOMC) meets on 19-20 September and are split on whether or not a final rate hike will occur in November. Against this background, European economic growth data have been weak, while core inflation remains high.

Meanwhile, China continues to struggle as the loss of confidence in its property market is sapping economic growth. Former Fed Chair Ben Bernanke famously said he would take a bazooka to the markets with a massive stimulus. Instead, China has been using a machine gun with many small bullets. China’s interventions include a 0.1% rate cut in June, another in August, refinancing some government debt here and there, and maybe some pressure from the government to deliver unbuilt apartments, etc. On the margin, this approach of many tiny incremental steps has been positive, but the machine gun approach has nevertheless proven far less effective than the Bernanke Bazooka. The Chinese economy continues to languish. So, if you do not want to invest in China (and, by extension, many other emerging markets [EMs]), you also do not want to invest in Europe, and the US stands to benefit. Thus, the US dollar is stronger.

While the economic winds are blowing for a stronger US dollar, the US fiscal budget looks a little less rosy. Interest rates at c. 4% to 5% mean that the fiscus faces meaningful interest bills while government spending continues to outpace tax collection. Debt issuances are rapidly increasing, and questions about who will buy all this debt are being asked. We are also seeing US bond yields inching higher and higher as markets digest the increased supply of US government bonds. A stronger US dollar environment with bond yields trending higher is, unfortunately, rather negative for the South African (SA) rand.

Domestically, we are asking a similar question to the US as the SA National Treasury sounds the alarm bells about a shortfall in tax revenue and an extremely limited appetite from investors to increase lending to the government. The government will need to rein in spending so close to an election year (which will be highly unpopular with the politicians) in an attempt to keep the ship afloat. Increasing taxation in an already highly taxed country with poor government service delivery will be difficult, but we should expect the government to try. Watch the Medium Term Budget Policy Statement (MTBPS) on 1 November for signs of tax increases and feeble promises of cutting expenditure and leveraging up the country (particularly with US dollar-denominated debt). Finance Minister Enoch Godongwana has a difficult balancing act, and the market will react extremely negatively to any budget based on wishful thinking and promises of economic growth that the government has been unable to deliver for over a decade.

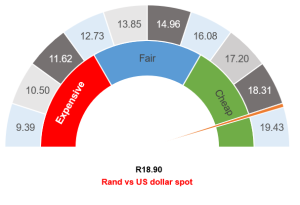

Yes, global factors are weighing down the rand, but so are domestic factors. The local unit is currently (14 September) trading around R18.90/US$1, which is in stark contrast to our R15.00/US$1 purchasing power parity value. We estimate that about half of the current rand weakness can be ascribed to global factors, while the other half is due to domestic failures coming home to roost. We do not see a material improvement in global support for the rand over the next while. Thus, we believe the local currency is probably range-bound at current levels. We maintain that a fair range for the rand is R17.50-R18.50/US$1, although it has been a couple of cents weaker for the last month or so. We are maintaining a neutral stance on the rand at these levels. If you are waiting to externalise your investments, we would certainly do it when the currency trades close to R18.00/US$1 or lower. At current levels, we would stagger our externalisation of wealth over time. The current exchange rate is a reasonable level at which to buy some of your US dollars.

Figure 2: Actual rand/US$ vs rand PPP model

Source: Thomson Reuters, Anchor