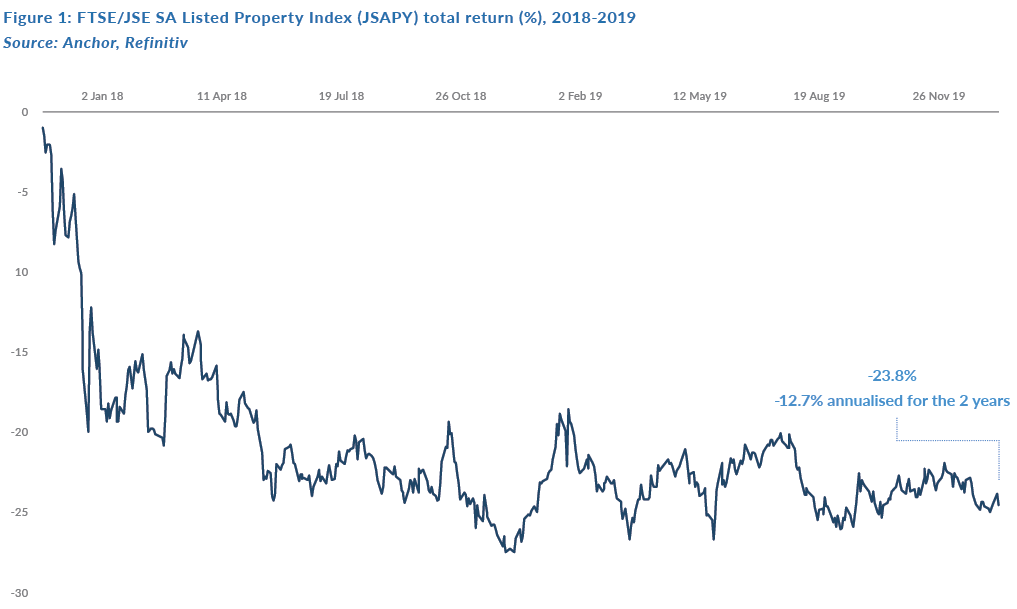

SA listed property was a poor performing sector going into the COVID-19 pandemic. It lost its position on the podium at the end of 2017, when some of the corporate finance “magic” in the sector was exposed, and this was followed by further deterioration due to the steady and visible downturn in the SA economy. This resulted in the uninterrupted growth in distributions over the prior 10 years to falter in 2018/2019 and led to investors scrutinising all the fundamental reasons to own property shares. The bottom-line conclusion was that some did not like what they saw and headed for the exits.

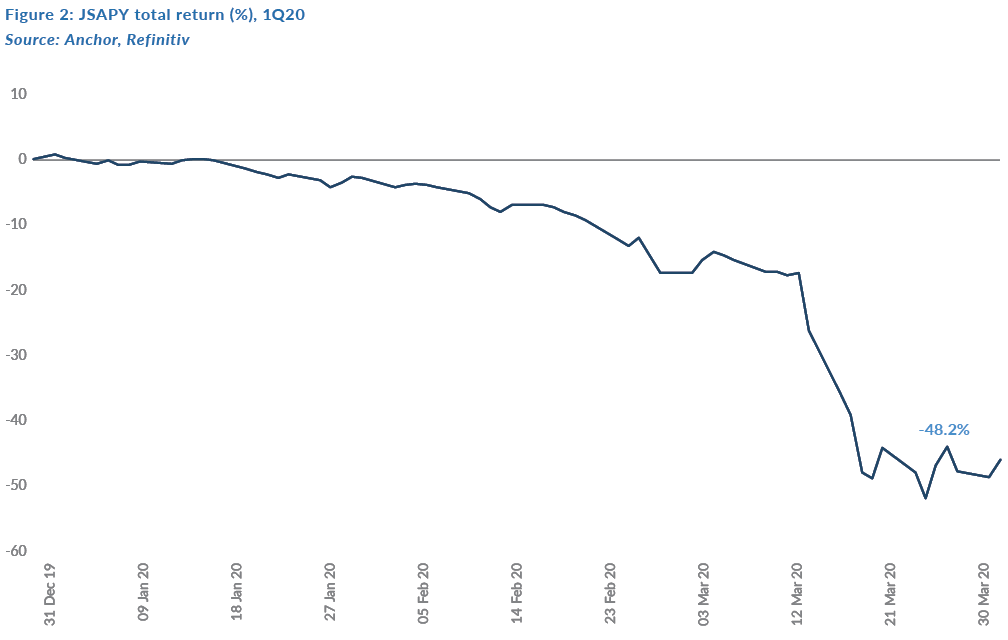

As 2020 started there was some optimism about the sector once again. This was based on what looked to be very attractive yields on offer, even with the understanding that leverage in the sector remained a concern and that some property companies were better placed than others. The tide, to the extent that it did rise, would not lift all ships, and investors knew that. But at least the tide should turn …. Unfortunately, COVID-19 has impacted all and sundry and, at the time of writing, its impacts are very difficult to try and forecast. This was followed by Moody’s downgrading SA’s only remaining investment grade rating to junk, some 24 hours after a countrywide lockdown, instituted by government because of the virus, started. As the Chair of the recently formed Property Industry Group (PIG) said in a conference call recently “… don’t worry about storm, this is a perfect hurricane.”

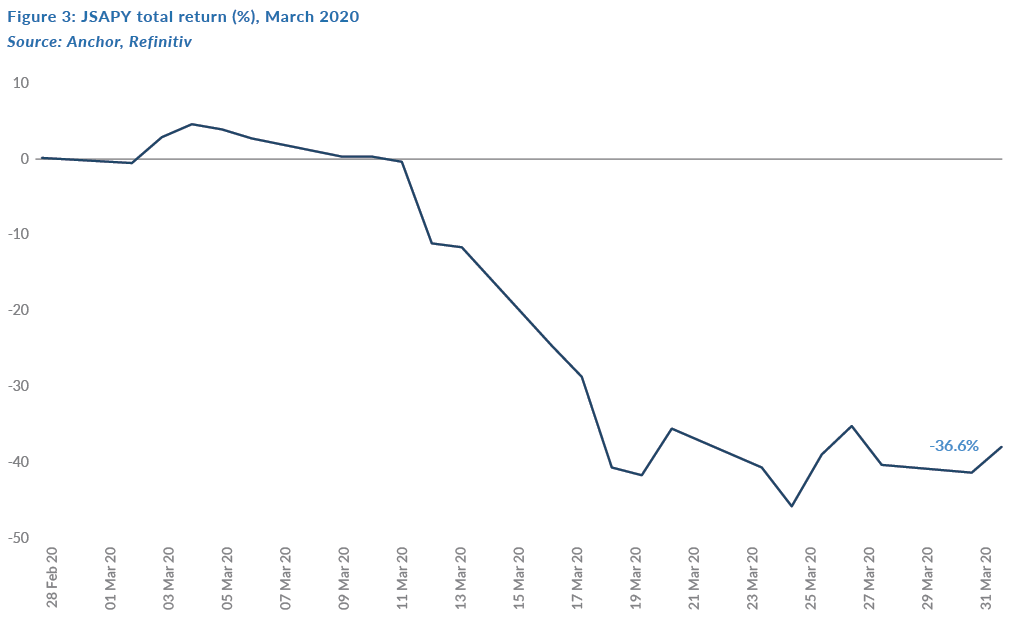

After falling over 36% in March and nearly 50% in 2020 YTD, the JSAPY Index, the primary benchmark for SA listed property shares, is now down 60% in 27 months!

So, what can we expect going forward? Because of the current environment, there are a lot of moving parts that make the short-term movement of property share prices difficult to guesstimate (and this is not only confined to the property sector). Therefore, we believe that the focus should be on any potential changes in trends and established practices within the industry. To the extent that these changes occur, they will shape investment indicators and dictate valuations. In addition, any analysis of a property company will now need to include influences that other players have in the industry rather than just focusing on standalone income statements and balance sheets. At the top of this list are valuers, funders and regulators.

Valuations – independent valuers’ role

COVID-19 has caused (or forced) behaviour to change, the best example being the closure/lockdown of most stores servicing the economy. This has a direct impact on income streams for most rent-paying tenants and will lead to instances where landlords will lose rental income. This could result in a reduction in asset valuation of some kind but will more likely lead to property transactions drying up – a complete lack of liquidity in what was already an illiquid market to start with. Valuers will react by qualifying valuations with a “material uncertainty” stamp, effectively meaning that no reliance can be placed on the valuation. This means that, for a period, until normality returns, the best evidence of a physical property’s value – what a buyer is willing to pay and what the seller is willing to receive – is not available.

Upon the return to normality, the result should be investor awareness of the valuer’s role, based on transparency via documented methodologies of independent valuations of the property portfolio.

Banks and funders

Investor focus on dividend payments and dividend growth prospects, and the property companies’ ability to provide these, meant that capital structure, particularly leverage, were not critical to the investment decision. If interest payments were covered adequately, loan-to-value (LTV) ratios were unlikely to be problematic. However, income statements have now come under pressure. This means that property values will fall and, in those markets where liquidity in the physical market has been affected and asset sales cannot happen, the LTV ratio will be difficult to correct. In the very short term, as we look to combat COVID-19, banks may provide some respite if LTV covenants occur. But, longer term, capital structure and leverage will be significant. Below, we highlight what we look for in a property company in this regard:

- The company should not be overleveraged but have a prudent LTV ratio with a debt profile that is not divorced from lease expiries as well as realistic cap rates.

- Debt being adequately serviced:

- An interest coverage ratio (ICR), but even better NRI/interest; and

- The net debt/NRI ratio should be the second check after the LTV ratio.

Regulators and taxation

PIG will be meeting with regulators (the JSE and National Treasury), concerning the issues that the current environment is causing to the rules of companies retaining their real estate investment trust (REIT) status. In summary, these are:

- That 75% of income needs to be traditional rental income;

- That 75% of distributable income needs to be distributed to shareholders as dividends; and

- LTVs should not exceed 60%.

If these parameters are breached, a property company’s REIT status can be withdrawn and the tax-free status that these companies have via the legislation is lost. What PIG will try and attain is a holiday/redemption from these parameters for a period of time or at least as long as the COVID-19 crisis lasts, including its “hangover” effects. Our best estimates are currently 12–24 months (with the caveat being that this is a moving target). This will mean that property companies will not have to pay dividends, and, for that period, these companies will not lose their REIT status.

We highlight that recent news reports have indicated that Estienne De Klerk, Chairman of the SA REIT Association and PIG, has applied to National Treasury to provisionally relax REIT tax rules and allow a two-year reprieve from paying out dividends.

It is clear to us that the property sector will be reset after panic around the virus has subsided. The good news is that these big property companies generally have good management teams to navigate this change. SA banks, which will have a large influence on the sector over the next few months, have strong balance sheets and we believe that they will be co-operative in working with property companies to navigate the way through the current crisis. Focus will turn from LTVs to interest cover, cash flow and sustainability. It is not in the interests of the banks to “pull the plug” on some of their biggest clients and, if they did, the income statement impact for them would be damaging. Banks have a vested interest. Therefore, we expect property companies to work their way through this scenario together with the banks, with “reset” value emerging.

So, given what has happened, is the loss in value permanent? We conclude that in a base case scenario, the values are well-below current book values, but higher than the share prices. Among the quality counters, these companies are fundamentally worth 50%-100% more than their current share prices (unless Armageddon prevails!). But there remains a high risk of shareholders not getting paid dividends for one, or even two, years.