Woolworths reported 1H21 results on 25 February, with adjusted HEPS up 19.4% YoY to ZAc193.7, coming in at the mid-point of recent company guidance. Group turnover grew by 5.8% YoY to R39.6bn. Among its operating segments Woolworths Food was the star performer, growing turnover by 12.1% YoY, while Woolworths Fashion, Beauty and Home (FBH) continues to struggle with this segment’s turnover declining by 11.2% YoY. The Group’s Australian venture, David Jones saw a good recovery, with turnover rising by 5.3% YoY in rand terms. However, we note that this performance was aided by coming from a very low base due to store refurbishments in the prior period and some rand weakness. In Australian dollar terms, turnover declined 8.8% YoY. Country Road recorded a rise in turnover of 9.4% YoY in rand terms due to currency tailwinds, but in Australian dollar terms, turnover declined by 5.2% YoY.

The gross profit margin contracted by 2.6% to 32.4%, impacted by clearance sales. In Australia, government grant initiatives and rental relief reduced trading expenses materially over the period under review. Group profit before tax (PBT) rose 24.6% YoY, and by segment FBH saw PBT decline 40% YoY, while Food performed strongly with PBT growth of 23.2% YoY. David Jones also recorded a PBT increase of 42.6% in rand terms and 33.3% YoY in Australian dollar terms, with Country Road posting PBT growth of 64.6% YoY in rand and 44.6% YoY in Australian dollar terms.

Debt was substantially reduced (by R5bn YoY) to R6.7bn. This is before the sale and lease back transaction of Elizabeth Street, which should lower Woolworths’ debt even further. The cash generation from the business was probably the highlight of the period. More importantly, management confirmed on the results presentation call that the sale of Elizabeth Street has allowed them to break any covenants or other legal obligations between Country Road and David Jones. This provides Woolworths management with far greater freedom in choosing the right course of action regarding the future of David Jones.

The positives

- The Food segment continues to perform incredibly well and there is not much to complain about in this part of the business. The division managed to gain market share, while also maintaining or expanding its gross profit margin and managing its operating expenses extremely well. One can only imagine the valuation that this business would be trading at, were it listed separately.

- Woolworths’ cash flow profile looking forward appears to be much improved. The roll-off of the capital expenditure that was required for the renovation at Elizabeth Street and other David Jones stores is a large contributor to this but very tight working capital management and good operating cash flow also contributed meaningfully.

- The massive reduction in debt and subsequent break between David Jones and Country Road are very positive developments, in our view. This allows Woolworths management more freedom to make decisions regarding the future of the two Australian business units and the market should now be willing to place a value, or a minimum value of zero, on David Jones. We believe that, in the past, the market may have placed a negative value on David Jones as the covenants would have forced Woolworths to plough more money into the business regardless of its prospects.

- Management have committed to the Australian business remaining self-funded, saying that no additional investments will be sent from the SA balance sheet to support its Australian divisions.

The negatives

- The beat on HEPS was driven predominantly by government support and rental relief in Australia. Our rough estimate is that, excluding these support measures, operating profit would have declined by c. 12% YoY. It is uncertain how long these measures will remain in place and the next 12 to 18 months will be difficult to forecast since it is unclear whether sales growth will recover fast enough to offset the discontinuation of these support measures.

- FBH continues to struggle. Although management have stated that they are taking drastic steps by dropping some labels and bringing in other strategic third-party labels, the segment’s performance remains a concern. We believe that it has lost touch with its core target market and it will be challenging, and probably expensive, to regain customers’ trust. Womenswear and menswear are the key problem areas, while kids clothing, and babywear performed extremely well.

- David Jones Food recorded a loss of AUD12mn and management have committed to deciding on this division’s future by Woolworths financial year-end.

- Turnover growth deteriorated over the first 7 weeks of 2H21, with FBH down 8.3% YoY (worse than the 6.9% YoY decline reported by Truworths), Food is up 10% YoY, David Jones is down 3.3%, and Country Road is up 3% YoY.

Interesting trends to watch

- Woolworths is going to be on a drive to reduce space in its Country Road, David Jones, and FBH divisions over the next 18 months. Although we commend management for taking this tough decision, it will be difficult to grow sales meaningfully in the current uncertain economic environment and it will be interesting to see how the Group’s cost-to-sales ratio changes as this unprofitable space is exited.

- Head of FBH Manie Maritz, gave a very honest and sober assessment of the division’s performance, noting that it is “at the start” of a journey to regain the trust of consumers. He also highlighted the intention to overhaul the segment’s strategy and processes. It will be interesting to see how these changes manifest themselves, but execution risk will remain as this journey plays itself out.

Valuation

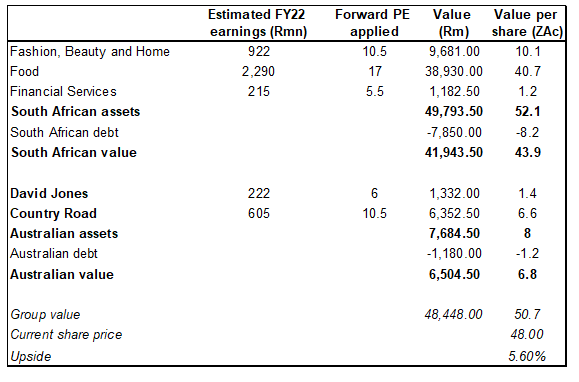

We believe that the best way to value Woolworths is on a sum-of-the-parts (SoTPs) methodology. The view on the share is very sensitive to the value ascribed to David Jones. At present, we are reluctant to place a meaningful value on this division and hence we do not see great upside from current trading levels, although we are comfortable to hold it with a c. 10% potential upside.

Figure 1: Woolworths retail sales by segment, FY22E

Source: Company data, Anchor estimates

Conclusion

Woolworths’ 1H21 results were somewhat of a mixed bag, with some divisions performing exceptionally well, while other segments continued to struggle. Food was again the star performer, growing operating profit 23% YoY. On the other hand, FBH continues to struggle, with management committing to taking the tough decisions required to turn this business around.

The Australian operations performed well, but this was mainly due to government support measures and the rental relief received. The sale of Elizabeth Street and the subsequent break in legal ties between David Jones and Country Road were significant events that have changed the outlook for the business. Nevertheless, we think that most of this upside is already in the price, with a c. 10% upside to our target price from current share price levels.