Shortly after US President Donald Trump’s initial tariff announcement on 2 April 2025, a financial advisor called me in a panic. One of his clients, rattled by a 6% drop in their portfolio, wanted to liquidate everything. I spoke to the client and convinced him to stay invested, but the episode revealed an apparent misalignment between his risk appetite and portfolio structure.

The term ‘diversification’ is often misunderstood. It is more than just spreading investments around—it is about aligning risk with client comfort and expectations. This article revisits diversification by asking:

1. What is diversification?

2. How should a portfolio be diversified?

3. Does it still make sense in the age of stock market superstars?

What is diversification?

The classic definition—”don’t put all your eggs in one basket”—holds. Spreading investments across different asset classes or regions reduces the risk of one poor performer derailing your entire portfolio. It also balances capturing upside during bull markets with protecting downside during bear phases.

For SA investors, global diversification is especially vital. Our domestic market is small, and adding foreign equities can reduce country-specific risks. For US and UK investors, whose domestic shares already provide broad international exposure, additional global diversification offers diminishing benefits.

Understanding client risk appetite

Diversification should align with the client’s risk profile. If risk tolerance is not adequately assessed, clients may panic during market downturns, like the one described above.

Advisors should consider both quantitative (age, income, assets) and qualitative (attitudes, experience) factors. Questionnaires are helpful, though imperfect, tools to gauge risk tolerance. Crucially, client risk perceptions evolve, especially after crises like the 2008 financial collapse. A client once comfortable with risk may turn conservative. Portfolios must adapt accordingly.

How should advisors diversify a client’s portfolio?

Start with asset classes:

- Equities for growth.

- Bonds for income and stability.

- Property or commodities (like gold) as inflation hedges.

Then diversify across:

1. Geographies: This reduces country-specific risks.

2. Sectors: To mitigate the risk of downturns in specific industries.

3. Investment styles: Balances different performance cycles (e.g., growth vs value).

Studies show diversification benefits peak at around 15–20 shares across multiple industries. Simply increasing the number of holdings can dilute returns without reducing risk.

With unit trusts, mixing managers does not always equal diversification. SA’s limited market often leads to overlapping holdings, undermining true diversification.

The power of correlation in diversification

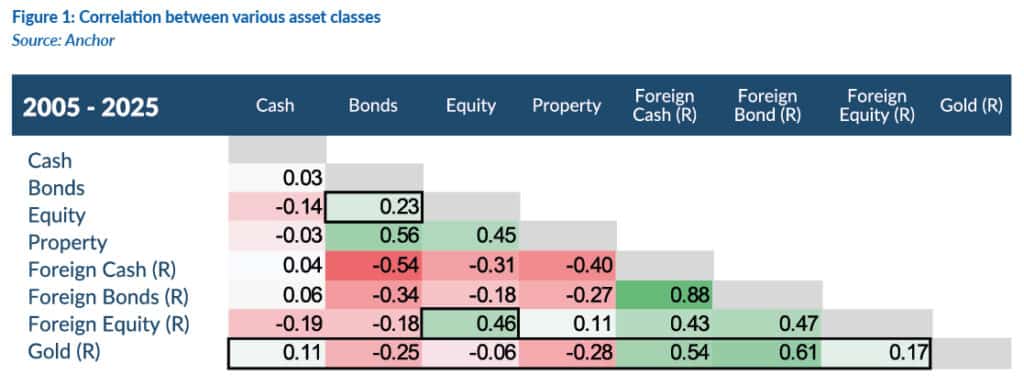

Effective diversification relies on low correlation between assets—how similarly they move. For example, as the table below shows, local equities and bonds have a low correlation (0.23), meaning one may rise when the other falls. Similarly, offshore and local equities (0.46) and gold (with its low correlation to different asset classes) can stabilise portfolios due to their distinct movements relative to local assets. Understanding and utilising these correlations can help in building more resilient portfolios.

A common mistake is combining multiple unit trust funds with similar holdings, especially within the same market. Without underlying asset diversity, you risk synchronised losses during downturns.

Diversification during bull vs bear markets

Diversification’s true value shows during bear markets. While bull runs tempt investors to concentrate on winners like Nvidia or Netflix, that strategy carries huge downside risks.

A R1mn investment in Nvidia 10 years ago would be worth R374mn today. Netflix? R20mn. These results are impressive, but only visible in hindsight. Nobody can predict which companies will become runaway winners.

Diversification widens the net, boosting your chances of capturing some winners while protecting against severe losses. It may limit some upside but shields against rash decisions in downturns, preserving long-term wealth and peace of mind.

Smart portfolio managers size positions so that failures do not hurt much, but winners make a significant impact.

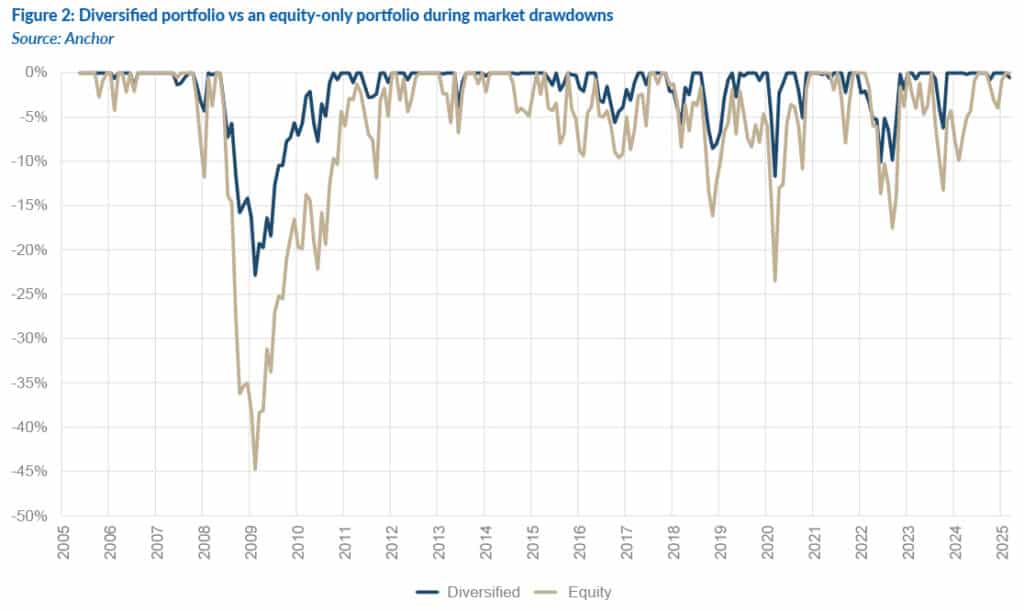

For example, during the 2008 global financial crisis (GFC) and the COVID-19 crash in 2020, a diversified portfolio (35% local equities, 20% bonds, 30% global equities, 5% property, 5% foreign cash, 5% local cash) experienced significantly smaller losses than an equity-only portfolio, as Figure 2 shows. Over time, it also showed lower volatility, resulting in a smoother investment journey.

As markets grow more interconnected, correlations have increased. But with geopolitical shifts and rising nationalism, future decoupling is possible, which would make diversification even more valuable.

Key takeaways:

- Diversification reduces risk and volatility.

- Spread your investments across asset classes, sectors, geographies, and styles.

- Use correlation insights to build more resilient portfolios.

- Avoid excessive concentration—even in high-performing shares.

Final thoughts: Why diversification still makes sense

Diversification remains essential, even when superstar shares dominate the headlines. It provides a safety net in uncertain markets and aligns portfolios with client risk profiles.

Ultimately, investing is not about hitting home runs—it is about building sustainable, long-term wealth that can weather market uncertainties and provide a secure financial future.