Wilson Bayly Holmes-Ovcon Limited (WBHO) released 1H21 results (to 31 December 2020) on 3 March, moving back to profitability (a R44mn attributable profit vs a R508mn loss in FY20) for the period, on the back of solid results from its UK and Africa segments. However, its Australian Western Roads Upgrade (WRU) project’s losses continued to be a pain point in these results, as the construction Group had to account for further provisions amounting to AUD28mn. We note that the WRU project is now physically complete. The WBHO team is processing quality handover certification and commercial acceptance for the project, although the contractual date for achieving commercial acceptance is at risk and delays in handing over the project on time could result in penalties against WBHO. Management have indicated that the company has accounted for additional costs because of a further two-month extension of the project (due to the onerous process of receiving the certificate of completion for the WRU), but we think this could present further risks in the next six months (2H21).

Key takeaways

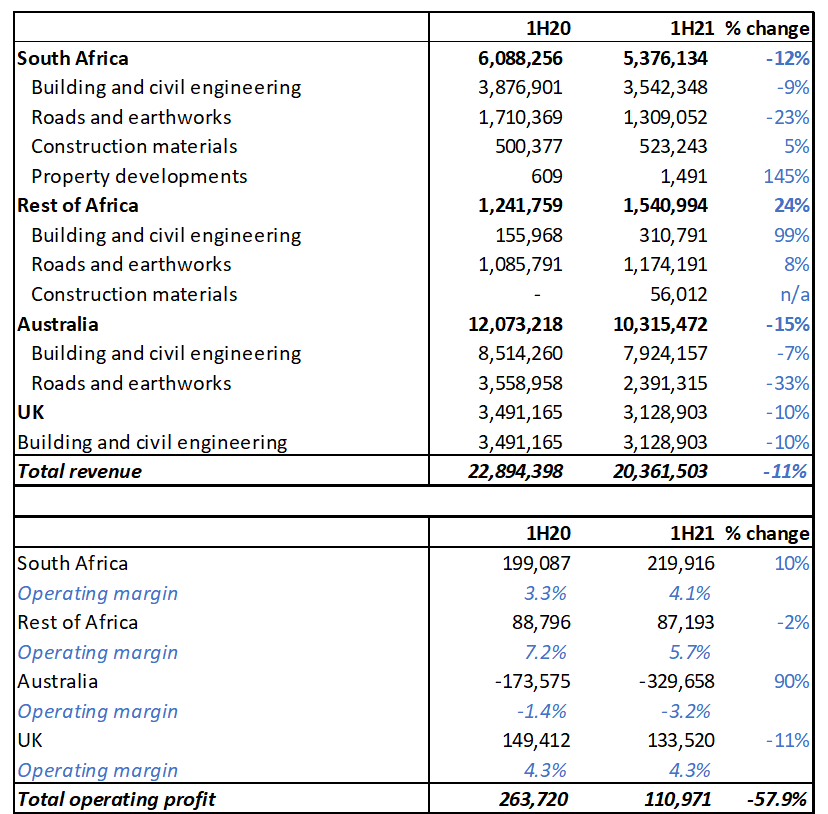

- WBHO Group revenue declined 11% YoY to R20.4bn, from R22.9 bn in 1H20.

- Operating profit before non-trading items fell 57.95% YoY to R111mn (from R264mn in 1H20, the decline was driven by the COVID-19 pandemic impacting its Australian business and an additional loss of AUD28mn from the WRU).

- The operating margin declined to 0.6% from 1.2% in the prior period.

- The operating margin stood at 2.1% if the impact of the WRU loss is excluded (WBHO targets a 3% operating margin).

- Earnings per share (EPS) declined 92% YoY to ZAc32, from ZAc412.

- HEPS fell 80% YoY to ZAc82 vs ZAc411 in

- No dividend was declared.

- The balance sheet remains healthy.

Geographical performance

- Within WBHO’s Africa operations, the 12% YoY revenue drop in South Africa (SA) was offset by a 24% YoY revenue increase from the Rest of Africa segment, largely on the back of robust activity in Mozambique.

- Revenue from Australia fell 15% YoY, in part due to lockdown restrictions in Melbourne and strict project selection to secure more manageable and lower-risk projects.

- The UK operations recorded a 10% YoY revenue decline. We note that the impact of lower foreign revenues was somewhat mitigated by the weaker rand, which resulted in a positive foreign currency translation effect on revenue of R1.9bn.

Figure 1: WBHO geographical revenue and operating profit performance, 1H21 vs 1H20, R’000

Source: Company data, Anchor

Order book

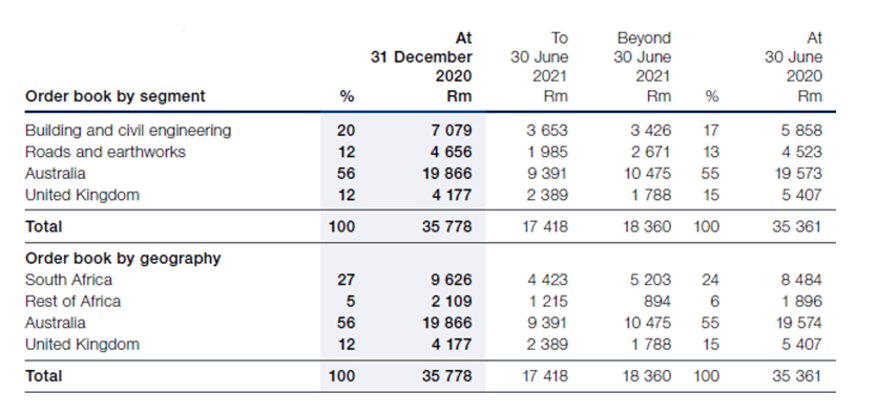

Although WBHO’s order book was flat from FY20 (30 June 2020) to 1H21, the African order book increased by 13% YoY, encompassing a 14% YoY increase in SA and an 11% YoY increase in the Rest of Africa segment. However, this was somewhat offset by a 23% YoY decline in the UK operations’ order book. During the earnings call, management emphasised that future work prospects in the UK were promising. Management also said that locally there was a “noticeable increase” in the availability of new projects from state-owned enterprise (SOEs) such as the South African National Roads Agency (SANRAL), Eskom, Transnet, etc., as well as in public-private partnership projects (PPPs).

Figure 2: WBHO order book and outlook by segment and geography, 1H21 to 2H21

Source: Company data

Developments post-December 2020

- WBHO recently won a large-scale industrial building project from the Ford Motor Corporation and a PPP contract for the design, build, operation, and maintenance of a new serviced working environment for the Department of Agriculture, Land Reform and Rural Development. Both projects are valued at c. R2bn and this will bolster the company’s order book further.

- The company is awaiting approval of c. R5bn worth of projects from SANRAL, which is to be adjudicated upon. Management noted that SANRAL has been slow in awarding contracts.

- Mining companies have also started putting work out for tender as they expand some of their existing mines. WBHO won two mining contracts recently, and management commented that they were able to negotiate one of the contracts at good margins.

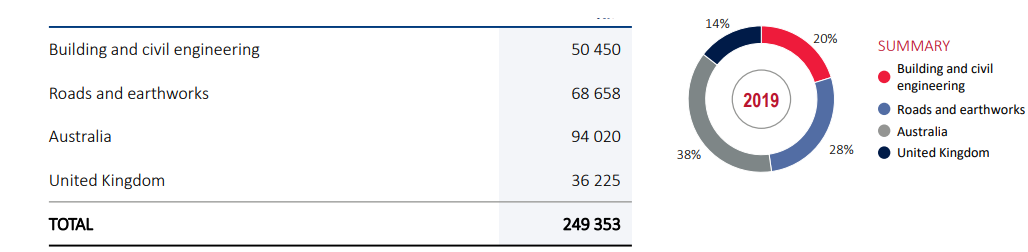

WBHO’s project pipeline for next 24 months looks very promising

- Regarding the UK order book and project pipeline, management indicated that future work prospects remain promising.

- Management highlighted developments relating to the UK order book and outlook, which includes:

- Byrne Bros, in which WBHO has an 80% stake, maintaining its strong relationships with the various engineering, procurement, and construction (EPC) contractors responsible for construction of a massive project and WBHO is expecting to be awarded its first contract in this regard over the coming weeks.

- Byrne Bros has also secured a further GBP20mn of work, since the end of WBHO’s reporting period.

- Ellmer Construction (a subsidiary within Byrne) has tendered for three new packages on the existing 1-5 Grosvenor project and is also bidding on new projects adjacent to the Nine Elms project on which Byrne Bros also has a presence.

- In addition, a new GBP60mn hotel project in Marylebone (London) has commenced under a letter of limited authority and it is expected that the contract will be signed in the coming months.

Figure 3: WBHO project pipeline summary, Rmn

Source: WBHO results presentation

*Note that the project pipeline consists of targeted projects expected to be adjudicated and awarded within 24 months.

Conclusion

Once WRU is out of the base, we expect a better operational performance from WBHO going forward. Overall, we think the worst from the WRU project is coming to an end and, although the order book was broadly flat in December vs June 2020, WBHO’s project pipeline is very promising and starting to gather good momentum locally and in the UK. We think the market is currently looking past WRU’s short-term risks and views the positive momentum in WBHO’s project pipeline in a favourable light. At current levels, we recommend holding the share.