Truworths released its 1H21 results (to 27 December 2020) on 18 February, reporting a 7% YoY decline in diluted HEPS to ZAc339/share. Group sales were down 9% YoY, while the local retail division’s sales fell by 7% YoY and sales in Office UK declined by 25% YoY in British pound terms, with physical store sales plummeting 53% YoY. However, we note that online performed very well in the UK. The Group’s gross profit margin was down by a 100 bpts to 51.5%, with the South African (SA) gross profit margin falling by 150 bpts to 54.7%, due to a very weak performance over November 2020, that Truworths could not make up for in December. This led to greater markdowns than management had expected, which impacted the gross margin negatively. The gross profit margin in its UK Office segment held up slightly better – down only 70 bpts to 42.3%. Operating expenses were extremely well maintained with employment and occupancy costs remaining almost flat over the period. This good cost management and the release of the bad debt provision led to the Group’s trading margin being more resilient and dropping by only 60 bpts to 16.5%.

Truworths continues to impress us with its strong cash generation – R2.6bn in operating cash flow for the period under review. The Group now has a net cash balance of R1.64bn or just below 8% of its total market cap, enabling Truworths to continue with its share buyback programme. In FY20, the company bought 10.1mn shares for R352mn and it has continued to buy back shares in the market since its financial year-end (December 2020), buying back a further 2.2mn shares, and with this programme expected to continue. The Group’s ROE continued to improve (to 40%) after impairing the Office asset in 2018, while ROA remained constant at 26%. Encouragingly, asset turnover also continued to improve to 1.3x from a low of 0.9x in 2018.

The positives

- Truworths’ cash generation cannot be overemphasised. We believe that if Truworths remains true to its current business model,sells or divests from Office and does not do another significant acquisition, investors can expect even greater cash returns in the not-too-distant future.

- The quality of the credit book was surprising:

- The credit book is in better shape at present than it was pre-COVID, predominantly due to far-stricter approval ratings for credit applicants.

- The gross book size decreased by 14% over the period.

- This after the risk approval rate dropped to 23%, from an already low 26%.

- However, we note that “active account holders able to purchase” was at 85% – similar to pre-COVID levels.

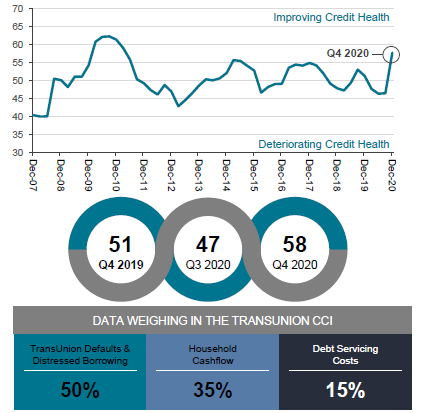

- The TransUnion SA Consumer Credit Index (CCI) hit a 10-year high of 58 in 4Q20. The index measures consumer credit health with 50.0 being the breakeven level between improvement and deterioration. This is a fascinating development since such a sharp rise during a period of difficult economic conditions for consumers seems nonsensical. However, it is likely that the full effects of the significant SA interest rate cuts in early-2020 and incomes recovering later in 2020 have supported consumers and consequently the index. Nevertheless, it is something that we will monitor closely going forward.

Figure 1: The TransUnion CCI measures consumer credit health – 50.0 is the break-even level between improvement and deterioration

Source: TransUnion

- Truworths’ succession planning has been a key concern for investors after its long-serving CEO Michael Mark made his intention of retiring clear to the market. We believe that last week’s results presentation, allayed much of this fear as CEO-designate, Sarah Proudfoot, was introduced.

- The cost management at Truworths was exceptional.

- Most of its rentals have been renegotiated and are now on 5-year agreements. The company also managed to get an average rental reversion of 18%!

- The shorter leases will allow Truworths management more flexibility in managing its store portfolio as c. 20% of all stores will be up for renewal every year.

- This year, Truworths was able to close a net 21 stores in SA, but lost only 1% of total trading space, leading to very good cost savings.

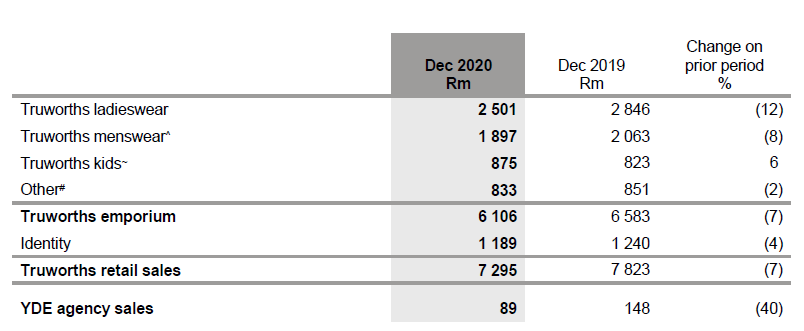

- Truworths is developing a niche in the childrens’ segment of the clothing retail market.

- Its childrens’ wear was the only segment that reported positive sales growth for the period under review.

Figure 2: Truworths divisional retail sales

Source: Truworths

^ Truworths Man, Uzzi, Daniel Hechter Mens and LTD Mens, ~ LTD Kids, Earthchild and Naartjie, # Cellular, Truworths Jewellery, Cosmetics, Office London (South Africa) and Loads of Living divisions.

The negatives

- We remain concerned about the poor topline performance.

- Until management can remedy this trend and report consistent topline growth, we will remain cautious on the share.

- Truworths remains very dependent on credit.

- Credit sales accounted for 68% of its total SA sales (down from 71% in FY19).

- Although this can be a positive, and we do understand Truworths’ position of using credit as an enabler, we are concerned that it will struggle to regain lost market share in the current environment, especially relative to the more cash-focused and lower-priced retailers.

- Office remains a headache!

- Management have indicated that it will take c. 5 years to close all the loss-making stores in Office.

- Truworths has closed 19 stores in the period under review, but the company is looking to close another c. 35 stores as their leases come up for renewal.

Interesting developments to keep an eye on

Truworths is trying actively to diversify its product offering and, over the next few months, it will be launching five new initiatives. These are:

- Identity is being expanded to offer greater e-commerce abilities and to have its own “cheaper” emporiums.

- Truworths is launching a youth streetwear brand called Fuel.

- The retailer is entering the value segment of the market with Primark (not to be confused with the UK version – this will have nothing to do with Primark in the rest of the world).

- Truworths is also expanding its kids offering.

- It is also launching the Hey Betty brand in Truworths stores.

It will be interesting to see how the market reacts to these new initiatives.

- Truworths is also consolidating its supply chain:

- The Group now owns three of its biggest local suppliers.

- This equates to c. 45% of its fast fashion being manufactured locally and in-house.

Valuation

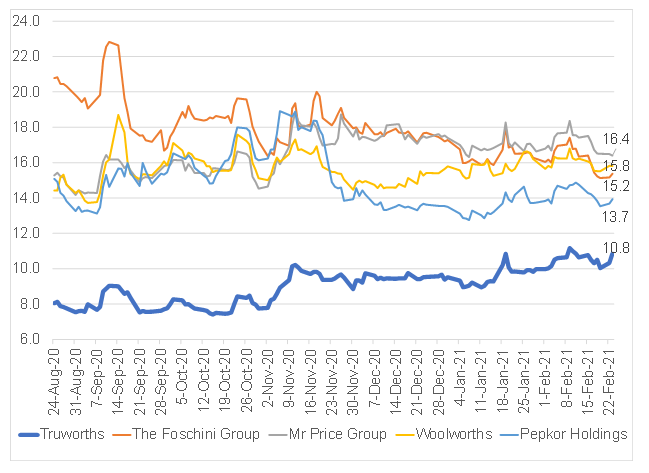

Truworths continues to trade at a discount to other SA discretionary retailers. It is currently trading on c. 10.8x forward PE ratio and is on a 7% dividend yield (see Figure 3).

Figure 3: Truworths vs the peer group BEst P/E ratio (blended 12 months)

Source: Bloomberg, Anchor

Conclusion

Truworths’ results came in at the mid-point of the company’s recent guidance – down c. 7% YoY. The retailer maintained its dividend policy of 1.5x cover and declared a final dividend of ZAc232. Although management must be commended for a good performance in a very tough operating environment, the quality of these numbers does not inspire us with confidence. The stronger-than-expected result was driven mainly by a significant unwind in the provision for bad debts.

Although we acknowledge that, at the face of it, Truworths’ credit book looks to be in rather good shape, it is debatable whether it is appropriate to unwind the provision as aggressively, especially in the current economic climate. Truworths is still struggling to get sales momentum going in its businesses, with sales in the first six-weeks of 2H21, declining by 6.9% and 38% YoY, in SA and in the UK, respectively. These sales trends result in us remaining cautious on the company and, although the valuation appears attractive relative to other SA retailers, we currently prefer to remain on the sidelines.