Tiger Brands (TBS) released its 1H21 results on 20 May, with the Group’s operating profit performance flattered by very good cost containment measures across most of its segments. Management described the company’s 1H21 performance as a tale of two quarters – 1Q21 experienced exceptional volume performance and 2Q21 recorded volume declines due to consumer pressures and increased competition on pricing. In our view, TBS will continue to face increased volume declines and competitive pressures on pricing as the challenging local economic backdrop drives a protracted value economy. Although TBS is piloting a hedging programme to try and stabilise margins (and it has been significantly reducing raw material costs within its grains business), we remain cautious on this segment of the business due to elevated soft commodity prices and margin cyclicality within the division.

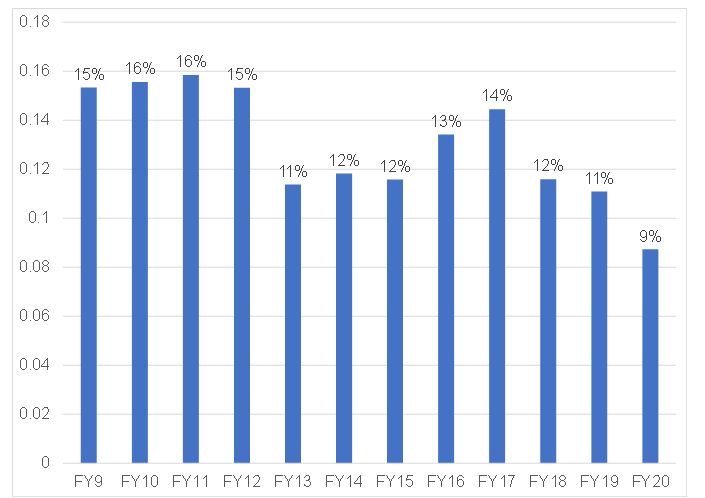

Figure 1: TBS operating profit margin history, FY09 to FY20

Source: Anchor, Company data

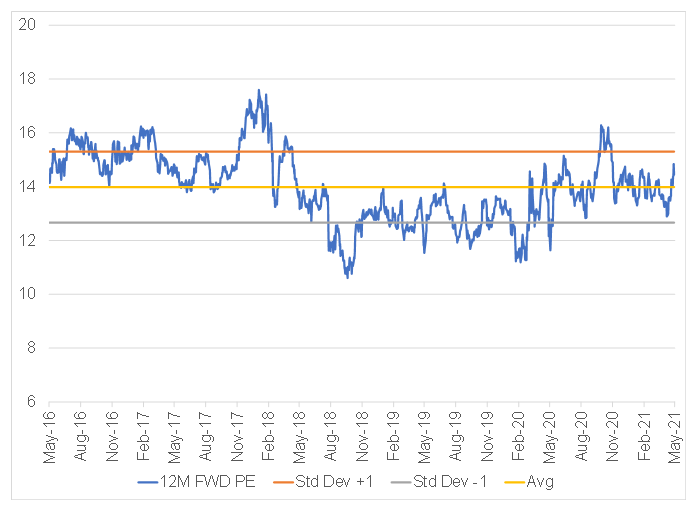

Figure 2: Tiger Brands 12M FWD PE

Source: Anchor, Bloomberg

Key 1H21 results takeaways

- Revenue grew by 8% YoY to R16.4bn.

- Operating profit increased by 16% YoY to R1.6bn.

- The operating profit margin for continued operations advanced from 6.8% to 9.5%.

- HEPS soared by 51.5% YoY to ZAc741.2 from ZAc489.1 in 1H20.

- Diluted HEPS jumped 50.8% YoY to ZAc733.1 from ZAc486.1 in 1H20.

- TBS announced an interim dividend of ZAc320.

Segmental overview

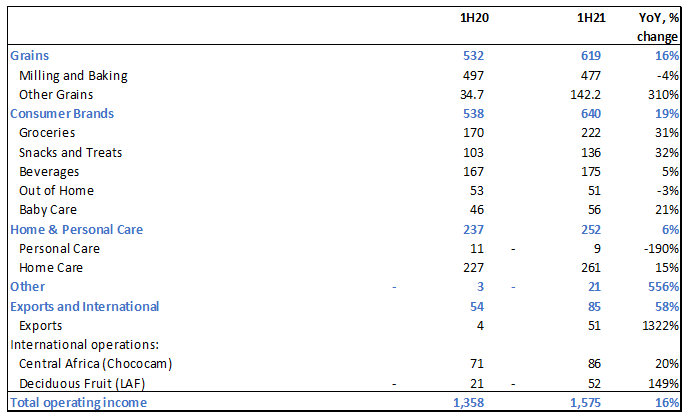

Grains: Revenue increased by 10% YoY (inflation +14% YoY, volumes declined by 4% YoY). Operating profit rose by 16% YoY, driven by price increases and cost containment measures. There were also improved performances within the Jungle Oats, rice, and pasta segments of this business.

Consumer Brands: Revenue grew by 4% YoY, while operating profit jumped 19% YoY driven by price increases, cost containment measures, and improved factory efficiencies. The groceries segment experienced increased competitive pressures and subdued seasonal demand, while Snacks & Treats recovered nicely, growing it revenue 10% during the period (with price inflation of 7% YoY and volume growth of 3% YoY). Beverages’ revenue performance was mostly flat, while operating income improved by 5% YoY because of distribution efficiencies. The Baby Care segment also recovered well as its revenue increased by 14% YoY and its operating income rose 21% YoY, driven by cost-containment measures and product mix.

Home & Personal Care: Home & Personal Care increased its revenue by 6% YoY and was driven by a stronger performance in home care. The personal care segment was loss making during the period due to muted revenue growth and increased costs.

Exports & international: Revenue increased by 18% YoY, driven by the performance of Central Africa (Chococam) and improved exports in powdered soft drinks and seasoning. Operating profit jumped by 58% YoY, despite the loss in the deciduous fruits category.

Figure 3: Tiger Brands operating income by segment, Rmn unless otherwise indicated

Source: Anchor, Bloomberg

Other: It is interesting to note that TBS will establish a venture capital fund to access growth opportunities in beverage and food start-ups. Our key takeaway here is that it will target businesses that are in its area of operation or in technologies that are linked to the company’s operations. On private label opportunities, management said that these came in slower than expected – the private label opportunities that TBS is pursuing will only be a value-add to its existing brands.

Outlook

The overall short-term outlook, according to management, is that TBS is at an inflection point in terms of the Group’s turnaround story. Although good progress has been made with cost saving initiatives, these initiatives are expected to intensify further. Management is confident that TBS will experience operational improvements but expect margin uplift to be challenging in the near term (management expect margins to be flat). Deciduous Fruit, and UAC are currently under review for a category fit within the portfolio, and the decision on both of these segments’ futures in the TBS portfolio will be made soon. Management’s immediate focus is on addressing commercial pressures and steering the company in a better direction.

Conclusion

We believe that TBS has made good progress in its cost containment measures, but margin cyclicality in the grains business, structural volume pressures, and the downward trend in margins are concerning. We are looking for margin expansion and improved sales volumes going forward to regain confidence in the share. Still, we think that the share is fairly valued at its current levels of around ZAc2,1979 (its closing price on 21 May). TBS is trading on a 12M FWD PE of 14.2x vs a 5-year average PE of 13.9x.