Tiger Brands released its FY20 results on 20 November. These results represented a tough operating environment and reflected the many operational headwinds that Tiger Brands faced during the period under review. Most of the Group’s operating segments saw material volume declines and were also impacted by significant raw material cost increases. The Grains business, in particular, was seriously affected by significant raw material costs and foreign exchange headwinds. Regulatory pricing constraints and market pressures also resulted in marginal price increases during the period. However, these price increases were not enough to offset cost increases and margins declined as a result.

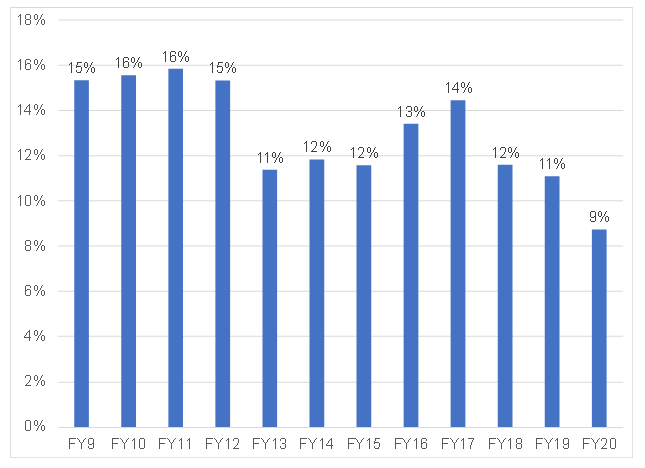

FY20 revenue increased by 4% YoY, while operating profit declined by 18% YoY. The operating profit margin for continued operations declined from 11.1% to 8.7%. Diluted HEPS fell by 29% YoY to ZAc933 from ZAc1,318 (FY19). Tiger Brands announced a normal dividend of ZAc537/share and a special dividend of ZAc133/share (the total FY20 dividend was ZAc670/share). The recent sale proceeds of the value-added meat products business and favourable balance sheet position resulted in the special dividend being declared

Figure 1: Tiger Brands operating profit margin history

Source: Company reports, Anchor

Figure 2: Tiger Brands 12-month FWD PE

Source: Bloomberg, Anchor

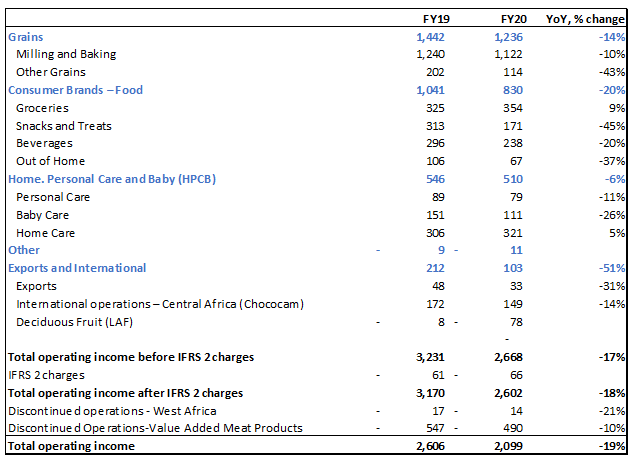

Segmental commentary

- Grains

- Price increases within this segment were unable to offset raw material cost increases. There was a meaningful recovery in Jungle and pasta in 2H20, and the baking segment stabilised, while maize was affected by cost increases and adverse competition. Despite inflation increases of 20% in rice, it continued to be loss-making in the second half.

- Consumer Brands

- Groceries performed well as a result of a favourable product mix and cost containment. Snacks and Treats, however, recorded an adverse performance due to volume declines that were negatively impacted by reduced shopping purchases during lockdown. Beverages had an unfavourable product mix that ultimately affected the segment’s operating profit.

- Home, Personal Care and Baby (HPCB)

- In this segment, home care recorded better sales volumes than the personal care and baby care segments, as the latter were negatively affected by COVID-19 restrictions in 1H20.

- Exports and international

- Profitability in this division was negatively impacted by a significant increase in raw material costs and a 5% excise duty tax that was implemented earlier in the financial year.

Figure 3: Tiger Brands operating income, Rmn

Source: Company reports, Anchor

Outlook

The overall short-term outlook, according to management, is that Tiger Brands is at an inflection point with its turnaround story. Key management personnel have been appointed in each of the various divisions to deliver a much-needed turnaround in each of these segments. Tiger brands said it will continue to invest in its brands and, while not much information was given regarding its private label opportunities, the company did say that a number of these opportunities do exist within its Grains, Baby, Snacks and Treats as well as Air care segments, but the opportunities it is pursuing here will only be as a value-add to its existing brands. Management’s immediate focus is on addressing commercial pressures and steering the company in a better direction.

Conclusion

Although management did say it is seeing signs of a recovery, we remain cautious on Tiger Brands, especially given the margin decline within its Grains business. The Grains segment is important as it contributes c. 50% to the Group’s total operating profit. Incoming CFO Deepa Sita mentioned the adoption of a hedging programme for raw material costs within the Grains business. We believe that, if management can stabilise margins and significantly reduce raw material costs, it will be very positive for the Grains business and the Group’s overall profitability. However, the positive extent of the hedging programme remains to be seen and we await evidence of an improvement in the company’s next reporting period (1H21).

Significant cost containment measures within its Grains business and margin expansion in Tiger Brands’ other segments will be crucial for its turnaround story to be successful. Going forwards, we are looking for margin expansion and improved sales volumes to regain confidence in the share. Tiger Brands is currently trading above its 10-year average and the share price looks expensive relative to its history. We prefer AVI over Tiger Brands in the food producer space.