US and global equity markets (MSCI World +6.0% MoM/+5.2% YTD) ended a volatile month stronger despite bumps along the way as investors looked past trade policy confusion. Markets cheered as the US and China announced a 90-day larger-than-expected reduction in tariffs on 12 May, sparking widespread buying. However, following the China relief rally, Moody’s downgraded the US’s credit rating on 16 May, triggering a broad selloff. Then, in late May, US President Donald Trump’s actions briefly derailed markets again as he threatened to slap 50% tariffs on EU goods just one day after the EU signed a minerals deal with Greenland. True to form for the Trump administration, the EU tariffs were postponed to 9 July to allow for trade negotiations, again boosting market optimism. In another blow to the Trump administration, a US trade court on 28 May blocked most of his tariffs in a sweeping ruling which found he had overstepped his authority by imposing across-the-board duties on imports from US trading partners. The court said that the Constitution gives Congress exclusive authority to regulate commerce with other countries, and the judgment saw equity markets surge again. On 29 May, an appeals court granted a stay allowing the duties to remain in place until this week, further complicating matters. By Friday (30 May), whipsawing US markets were down again on the day after US-China trade frictions resurfaced, with Trump claiming in a social media post that China had violated its preliminary trade agreement.

A Financial Times columnist coined the term TACO (Trump Always Chickens Out) trade to describe the US president’s tendency to threaten high tariffs, only to retreat later or lower tariffs. This has become a recognisable pattern – stocks initially plummet when Trump makes tariff threats, then rebound when he backs off – a cycle that has repeated multiple times throughout his second term.

After declining for three straight months, the S&P 500 jumped 6.3% in May (+1.1% YTD), logging its biggest MoM increase since November 2023. The Dow was up 3.9% MoM (-0.6% YTD), while the tech-heavy Nasdaq surged by 9.6% MoM (-1.0% YTD), its biggest monthly gain since November 2023 and its best May performance since 1997. The VIX, which measures the US stock market’s expectation of volatility and is also known as the “fear gauge”, closed the month at 18.57, well below the 52.33 level it reached on 8 April but slightly above the 17.35 level it reached on 31 December 2024.

US April headline inflation, as measured by the Consumer Price Index (CPI), printed better-than-expected, at 2.3% YoY vs March’s 2.4%. Core CPI, excluding food and energy, rose 2.8% YoY (the lowest core inflation rate since March 2021). Following five consecutive months of declines due to tariff anxiety, US consumer confidence improved in May, rising to 98 from April’s 85.7 print. May’s core personal consumption expenditure (PCE), excluding food and energy, the Fed’s preferred inflation gauge, rose 2.5% YoY, in line with expectations and down from April’s 2.7%. At its 7 May meeting, the US Federal Reserve (Fed) kept rates unchanged, citing uncertainty about the potential impact of tariffs on the US economy.

European equity markets ended May in the green despite a still uncertain trade environment, buoyed by Germany’s historic fiscal spending plans, resilient corporate earnings and attractive valuations, which are making the region an attractive investment destination amid ongoing trade war concerns and runaway US fiscal debt (US$35trn-plus). Germany’s DAX rose 6.7% in May (+20.5% YTD), while France’s CAC closed 2.1% higher (+5.0% YTD). Eurozone headline inflation was unchanged at 2.2% in April, while core inflation accelerated to 2.7% vs March’s 2.4% print.

The UK market also ended higher in May, with the FTSE 100 up 3.3% (+7.3% YTD). April UK inflation rose unexpectedly to 3.5% (its highest level in more than 12 months) from 2.6% in March, while core inflation increased by 3.8% vs March’s 3.4%.

Global trade uncertainties (and the Trump administration’s plan to broaden its restrictions on China’s tech sector) weighed on sentiment towards China. However, markets received a mid-month boost after it was announced that China and the US would materially lower tariffs for three months to allow for negotiations. Hong Kong’s Hang Seng rose 5.3% (+16.1% YTD), while the Shanghai Composite was up 2.1% (-0.1% YTD). China’s official May manufacturing PMI improved to 49.5 vs April’s 49.0 but remained below the 50-mark separating expansion from contraction. The non-manufacturing PMI, which includes services and construction, also fell to 50.3 from 50.4 in the prior month.

Japan’s benchmark Nikkei ended May 5.3% higher (-4.8% YTD) despite ongoing concerns over the adverse impact of US tariffs on the country’s economy. Japan’s April core inflation accelerated, printing at 3.5% YoY (the highest level since 2023) vs March’s 3.2%.

Among commodities, after a strong performance YTD (+25.3%), bullion advanced by only 0.01% MoM. Among platinum group metals (PGMs), platinum surged to a two-year high in May (+9.1% MoM/+16.6% YTD), buoyed by a sharp rise in Chinese imports, the prospect of a third annual supply deficit and renewed investor interest in the metal, which is used in catalytic converters. Palladium was up 3.2% MoM (+6.7% YTD), and rhodium rose 1.4% MoM (+19.1% YTD). Brent crude (+1.2% MoM/-14.4% YTD) recorded gains amid supply concerns following news of a decline in the US crude stockpile.

In South Africa (SA), the JSE followed global markets higher in May. The FTSE JSE All Share Index rose 3.0% (+12.2% YTD), with broad-based gains, while the Capped SWIX also ended May 3.0% higher (+13.7% YTD). The industrial sector was the star performer (Indi-25 +3.9% MoM/+13.1% YTD) with the largest contributor being Naspers/Prosus, which soared c. 6% MoM in aggregate as China’s Tencent Holdings reported a better-than-expected 13% YoY rise in sales. Industrials were followed by resources counters (Resi-10 +2.2% MoM/+38.3% YTD), primarily due to the PGM counters, as the gold price paused its run. The Listed Property Index rose 1.9% MoM (+4.0% YTD), while financials (Fini-15) gained 1.8% MoM (+2.3% YTD). The rand strengthened by 3.2% MoM against the US dollar (+4.4% YTD).

In domestic economic data, April headline inflation edged slightly higher, coming in at 2.8% YoY vs March’s 2.7% print. Despite this uptick, core inflation eased, slowing to 3.0% YoY in April, down from 3.1% YoY in March, suggesting a continued easing in underlying inflationary pressures across the domestic economy. At its meeting on 29 May, the South African Reserve Bank (SARB) announced it would cut the repo rate by 25 bpts, meaning that the prime lending rate is now at 7.25%

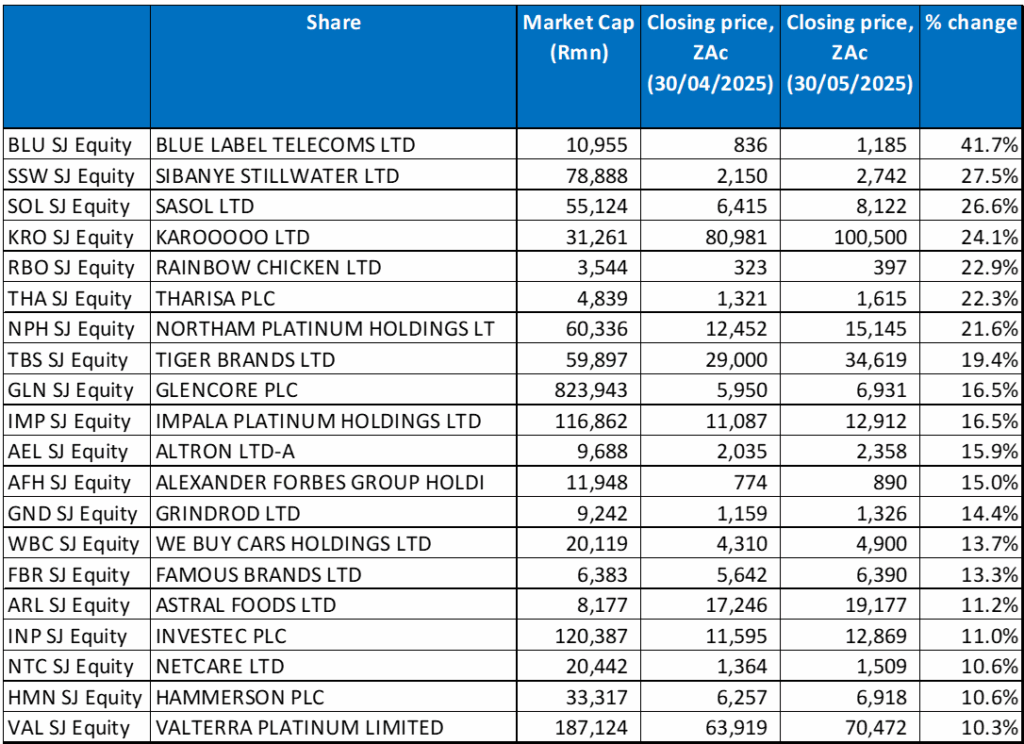

Figure 1: May 2025’s 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

Blue Label Telecoms was May’s best-performing share by far, recording an impressive 41.7% MoM gain as investors cheered news of the company’s plans to list its subsidiary Cell C on the JSE. According to Blue Label’s management, the proposal to list Cell C, which has only recently been restored to a sustainable growth and profitability path, came about due to their desire to restructure Blue Label’s investments and unlock value for its shareholders. News of the proposed restructuring saw Blue Label’s share price soar 11.6% on the day (16 May) – its biggest daily gain in c. a decade. Cell C is SA’s fourth-largest mobile network operator. Blue Label plans to list Cell C on the prime board/segment of the JSE — indicating that it places a multibillion-rand valuation on the mobile operator. Blue Label first invested in Cell C in 2017 in a R5.5bn deal, and it has already recapitalised the company twice since its initial investment.

Sibanye Stillwater (+27.5% MoM) was in second position as growing market interest pushed the share price higher. The company’s improving financial metrics have positioned it as a strong performer in the mining sector, hinting at potential benefits for investors. Some market commentators have also attributed the upswing in its share price to Sibanye’s strategic operations and expansion plans, which have aroused investors’ interest.

In third place, Sasol’s long-languishing share price outperformed in May (+26.6% MoM). The company’s share price surged following its capital markets presentation, where Sasol outlined a (well-received) three-year turnaround strategy aimed at restoring its operations to optimal performance. Sasol CEO Simon Baloyi admitted in his presentation that Sasol’s performance has been below par over the past four years, but introduced a three-year turnaround plan that has been formulated to lower debt, restore the local operations and position its international chemicals business for potential further value unlock initiatives by the end of this decade. The Sasol share price was also boosted by news last week that it would receive a R5bn settlement from Transnet in June.

Sasol was followed by Karooooo Ltd (the owner of Cartrack), Rainbow Chicken, and Tharisa Plc, which recorded MoM gains of 24.1%, 22.9% and 22.3%, respectively. Karooooo’s share price soared after it reported more subscribers, revenue growth, a 26% YoY jump in its full-year operating profit to R1.3bn, and a 33% increase in adjusted EPS to R31.67. In SA (its primary market), Cartrack subscribers increased by 16% YoY to 1.73mn by 28 February, while subscription revenue grew by 15% YoY.

Northam Platinum and Tiger Brands’ share prices rose by 21.5% and 19.4% MoM, respectively. With the platinum price up 9.1% in May, miners of the metal continued to climb, with companies such as Northam and Impala Platinum (Implats) posting good gains. Meanwhile, Tiger’s share price jumped to a seven-year high on 28 May after it reported better-than-expected interim results, including a 34% YoY rise in headline EPS to R10.21 and a 1.9% YoY increase in revenue to R18.5bn. The food producer also boosted its interim dividend and announced a special dividend, following a 34% YoY surge in profit.

Glencore Plc and Impala Platinum (Implats) rounded out May’s best-performing shares, with both ending the month 16.5% higher.

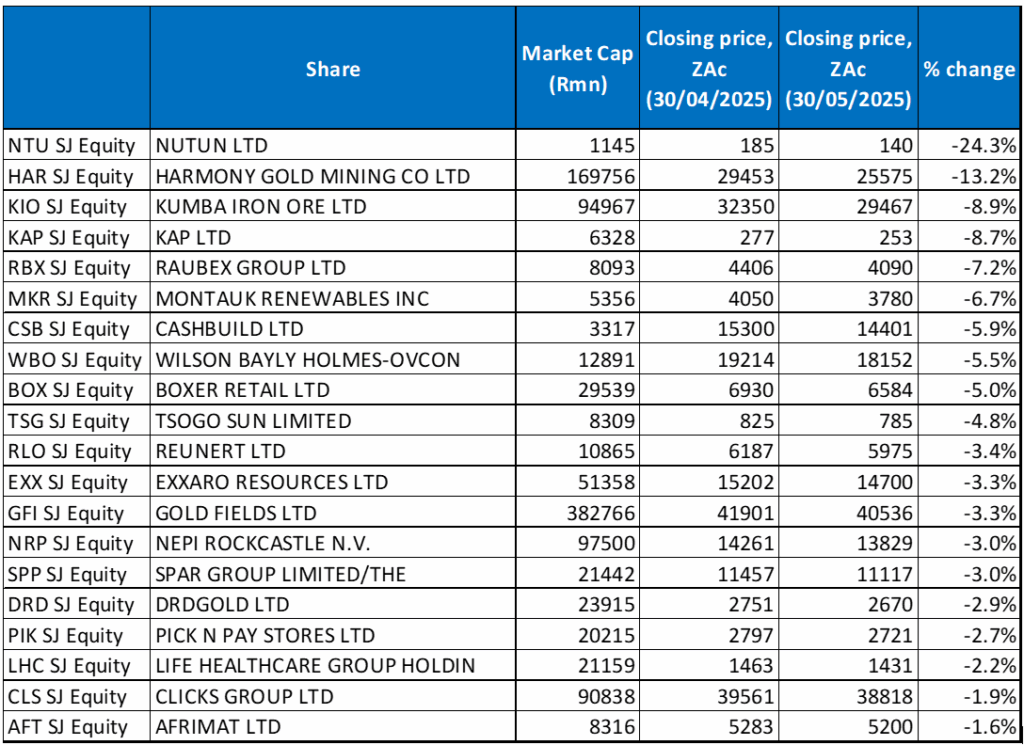

Figure 2: May 2025’s 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

Nutun Limited (formerly Transaction Capital) is undergoing a two-year restructuring and was May’s worst-performing share, declining by 24.3% MoM. Nutun underwent comprehensive reorganisation last year and now trades as a global specialist business process outsourcing (BPO) operator and provider of collection and debt acquisition services in SA. Last month, Nutun reported interim results to the end of March 2025, which showed a revenue decline of 4% YoY to R1.48bn due to a reduced non-performing loans portfolio (NPL) acquisitions in 2024 and 1H25 and the impact on consumer payment behaviour of the adverse local economic environment. Its earnings before interest, tax, depreciation and amortisation (EBITDA) were down 17% at R615mn. However, the core loss from continuing operations narrowed to R71mn vs R104mn in 1H24, and it reported a headline loss per share which improved to ZAc17.2 from a loss of ZAc231.2 during the same period of 2024. The company has suspended its dividend payments until the restructuring is completed.

Nutun was followed by Harmony Gold and Kumba Iron Ore (Kumba) with MoM losses of 13.2% and 8.9%. Harmony’s share price took a hit after the gold miner said that it is set to acquire MAC Copper Ltd for a cash price of US$1.03bn (c. R18.5bn). Through the Australian firm, it would accelerate its strategic shift into the copper industry. Under the terms of the transaction, Harmony would buy MAC Copper’s shares for US$12.25/share – a 21% premium from its closing price before the announcement. A lower gold price in May has also weighed on the share. Kumba’s share price has been under pressure, primarily due to lower iron ore prices (-2.9% YTD/-14.3% YoY) and softer sales volumes, impacting its earnings. These factors, combined with challenges in SA rail logistics and overall economic uncertainties, have contributed to the downturn in the share price.

Kumba was followed by Kap Ltd, Raubex Group, and Montauk Renewables with MoM losses of 8.7%, 7.2% and 6.7% respectively. Raubex’s results were delayed on 9 May to allow for an investigation into an anonymous whistleblower report that contained allegations of improper conduct (the group said on 2 June that a detailed fact-finding exercise by independent external advisors had been conducted, and no evidence of unlawful conduct was found). JSE- and Nasdaq-listed alternative energy company Montauk’s share price decline has been due to a combination of factors, including a weaker-than-expected financial performance, higher operating expenses, and a dispute over the Blue Granite RNG facility and the overall decline in Renewable Identification Number (RIN) prices (by c. one-third), as the Trump administration clamps down on the alternative energy sector, have contributed to the share’s underperformance.

Cashbuild, Wilson Bayly Holmes-Ovcon (WBHO), Boxer Retail and Tsogo Sun rounded out the ten worst-performing shares, recording MoM losses of 5.9%, 5.5%, 5.0%, and 4.8%, respectively. Construction Group WBHO’s share price has been negatively impacted by the general market sentiment towards, and the performance of, other companies in the construction sector. Retailer Boxer’s shares slipped after the discount supermarket operator reported a 12% YoY decline in headline EPS, weighed down by the dilution of new shares issued when it listed in November 2024. Still, it did report YoY turnover growth of 13.2% to R42.3bn for its FY25 results (the 53 weeks to 2 March 2025). Boxer also delivered strong FY25 trading profit growth of 9.9% YoY to R2.3bn. Finally, hospitality and gaming Group Tsogo Sun released disappointing FY25 results with income down 3% YoY and costs up 1% YoY. Headline EPS took a 16% YoY knock to ZAc142, and the final dividend per share was down 25% YoY to ZAc30 vs ZAc40 in the same period of last year.

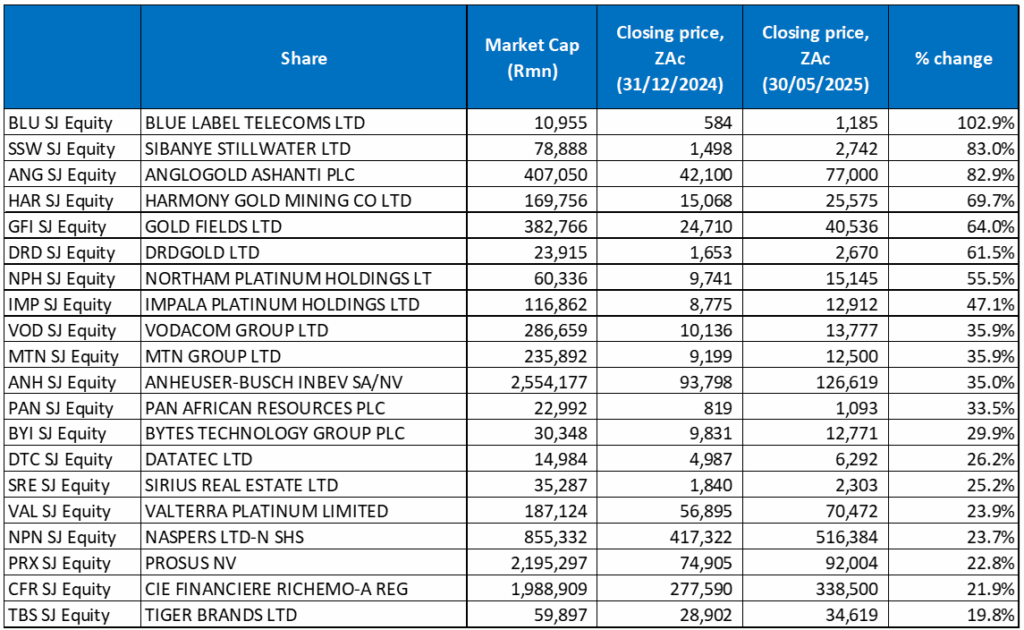

Figure 3: Top-20 best-performing shares, YTD

Source: Anchor, Bloomberg

The YTD best-performing shares (to end May) overlapped with those to the end of April as gold miners, whose prices have soared this year despite the gold price running out of steam in May, again featured prominently among the YTD top performers. Eighteen of the year-to-end April’s 20 best performers remained in the year-to-end May, with only two new shares entering the top 20 – Valterra Platinum (previously Anglo American Platinum) and Tiger Brands.

After soaring in May, Blue Label Telecoms (discussed earlier) bumped Harmony out of the top spot with a gain of 102.9% YTD. It was followed by Sibanye Stillwater (discussed earlier), AngloGold Ashanti, Harmony Gold, Gold Fields, and DRDGold with YTD increases of 83.0%, 82.9%, 69.7%64.0%, and 61.5%, respectively. While these gold companies (except for Sibanye) were all down in May, their strong performances thus far in 2025 have made sure they remain high up among the year’s best-performing shares.

Northam and Implats (both discussed earlier) recorded YTD advances of 55.5% and 47.1%, as a 16.6% YTD gain in the platinum price supported their performances.

Mobile operators Vodacom and MTN Group rounded out the ten best-performing shares YTD, with both up 35.9%. Vodacom reported FY25 results last month, which showed that its revenue rose 1.1% YoY to R152.23bn despite what it termed “significant foreign exchange headwinds”, and its Headline EPS came in at ZAc857/share, with strong growth in the second half. Meanwhile, in its 1Q25 trading update, MTN said that Group service revenue increased by 10.4% YoY, with total subscribers rising by 4.7% to 296.8mn. Also, active data subscribers grew by 9.1 % to 161.70mn. Furthermore, in the fintech business, Mobile Money (MoMo) monthly active users (MAU) increased by 1.1% to 62.20mn. MTN SA delivered resilient service revenue growth of 2.6%, driven mainly by growth in the consumer postpaid, wholesale and enterprise segments. Total subscribers grew by 5.6% to 39.20mn, with postpaid customers up by 6.7% to 4.40mn, buoyed by a more substantial uptake of integrated voice and data plans, as well as home propositions.

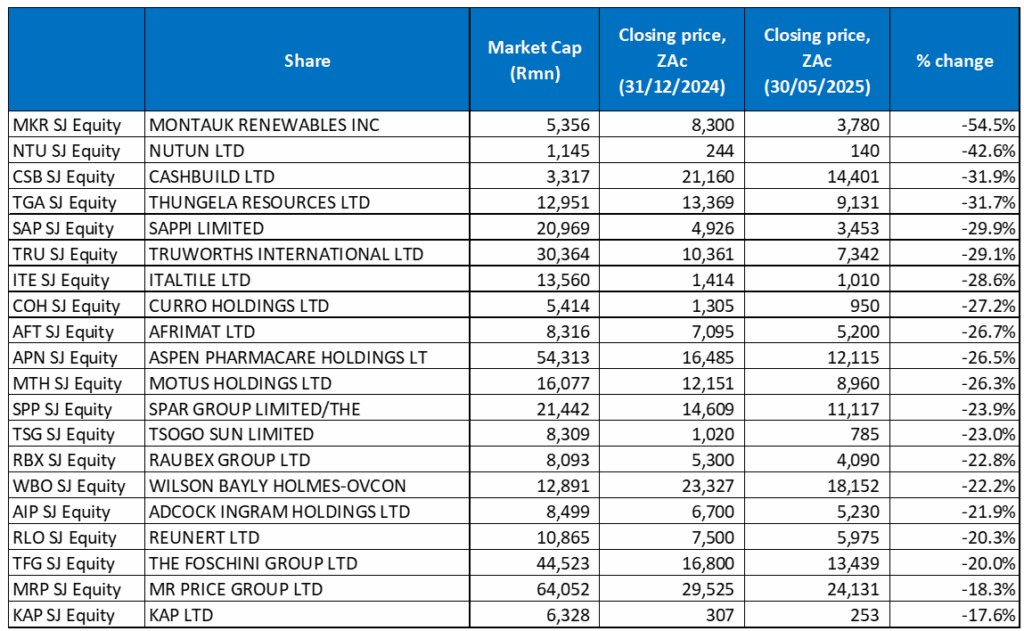

Figure 4: Bottom-20 worst-performing shares, YTD

Source: Anchor, Bloomberg

There was also an overlap between the year to end-April’s worst-performing shares and the worst-performers to the end of May (YTD), with fifteen shares unchanged and five new entrants to the grouping – Tsogo Sun, Raubex, WBHO, Reunert and KAP Ltd.

Montauk Renewables (-54.5%) remained the worst performer YTD for a third consecutive month, with its share price recording a 6.7% MoM decline in May. Montauk was followed by Nutun (-42.6% YTD) in second place and Cashbuild (-31.9% YTD) in third place. Cashbuild’s (-5.9% in May) share price has been on a downward trajectory due to a combination of factors, including a slowdown in the construction sector, economic headwinds, weaker consumer spending, and operational disruptions tied to SA’s rising crime rates.

Cashbuild was followed by thermal coal producer and exporter Thungela Resources (-31.7% YTD), Sappi (-29.9% YTD), Truworths (-29.1% YTD), Italtile (-28.6% YTD), and Curro Holdings (-27.2% YTD). Thungela’s share price has been under pressure due to lower-than-expected energy demand in Europe and Asia, which has led to lower thermal coal demand and prices. Since 2023, China and India have bought less thermal coal, weighing on Thungela’s revenues. Challenges with Transnet Freight Rail’s performance, which is a key constraint in their ability to export coal, have also weighed on its performance. Meanwhile, Italtile (+4.0% MoM) said in May that it managed to increase system-wide turnover by 1% YoY to R6.1bn in a challenging operating environment, and its 211 stores remained profitable in the six months to 31 December. Still, factors impacting consumer confidence and discretionary spending, particularly in the building and construction sectors (making renovation and new build projects less affordable), continued to weigh on the business.

Finally, mid-tier mining and materials company Afrimat (-26.7% YTD) and Aspen (-26.5% YTD) rounded out the ten worst-performing shares. In May, Afrimat said that lower iron ore prices (-1.3% MoM/-2.9% YTD) and the underperformance of SA’s export rail lines had resulted in its annual earnings plummeting. Afrimat’s FY25 HEPS dropped by 685% YoY to ZAc72 from ZAc567. Pharma group Aspen’s share price has fallen due to a combination of factors, including a “material contractual dispute” impacting its manufacturing and technology agreement, and concerns about potential losses from its investment in mRNA technology.