In this note, we reflect on the South African (SA) banking sector and our positioning in this segment of the market following the latest half-year results from three of the big-four banks – Nedbank (NED), Standard Bank (SBK) and the ABSA Group (ABG). To provide context, we highlight that SA banks were expected to deliver anaemic growth. Not since the beginning of 2018, when analysts started extrapolating President Cyril Ramaphosa’s ‘New Dawn’, have we seen any meaningful upgrades to the banking sector’s growth drivers (the big-four banks’ EPS expectations have continuously trended lower since around April/May 2018). So, with that in mind, the 3.0%, 3.7% and 5.7% YoY earnings per share (EPS) growth delivered by ABSA, Nedbank and Standard Bank, respectively, were all relatively in line with the market’s (and our own) expectations, although the moving parts in each case can be interrogated further for varying degrees of quality.

The overriding themes we identified from these results are:

- Local banking earnings (i.e. those segments of each bank’s operations located in SA) are flat to down across all three of the banks that reported;

- their respective Rest of Africa (RoA) segments, however, made the difference between delivering flat or positive earnings growth;

- all three banks grew pre-provision operating profit (i.e. the amount earned prior to considering funds set aside to provide for future bad debts);

- all three also experienced an uptick in their credit loss ratio (CLR); and

- all three are guiding towards full-year (FY19) EPS growth. However, here we note that this was already baked into analyst expectations and, looking at FY20 consensus forecasts, we suspect some downgrades might still be on the cards.

Below, we look at each of the three banks that reported results in more detail:

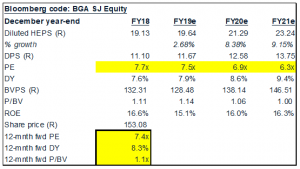

ABSA (Earnings: SA 78%; RoA 22%). ABSA’s 1H19 results showed flat SA earnings growth, while earnings from the RoA rose by 8% YoY. In terms of business segments, Retail Banking earnings were up 4% YoY and Corporate and Investment Banking (CIB) recorded a 10% YoY decline. Pre-provision operating profit was up 6.2% YoY, while total income advanced 6% YoY and total costs also rose 6% YoY (ongoing costs were up 2% YoY). The CLR moved up from 0.75% to 0.79% and total earnings grew 3% YoY. NAV/share increased to R123.35 (up 7% YoY). ABSA reported HEPS of R9.77 and a dividend of R5.05/share.

Figure 1: The ABSA Group metrics and forecasts:

Source: Bloomberg, Anchor. Share price as at close on 21 August 2019

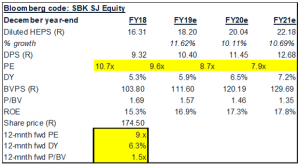

Standard Bank 1H19 results (Earnings: SA 70%; RoA 30%). SA earnings rose 3% YoY, while earnings from the RoA jumped 15% YoY in rand terms. By segment, the Retail division’s earnings were flat, CIB’s were not provided, and Liberty’s rose 2% YoY. The bank reported total HEPs growth of 6% YoY, with the Banking segment’s earnings increasing by 10% YoY. Pre-provision operating profit was up 7% YoY, while total income advanced 6.3% YoY. Total costs rose by 5.5% YoY. CLR moved up from 0.62% to 0.76%. NAV/ share increased 8% YoY to R105.51. Return on equity (ROE; a measure of a business’ profitability) came in at 16.2% vs 16.8% in 1H18. HEPS was R8.37, with an interim dividend of R4.54/share (+6% YoY).

Figure 2: Standard Bank metrics and forecasts:

Source: Bloomberg, Anchor. Share price as at close on 21 August 2019

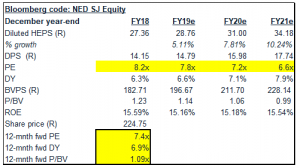

Nedbank 1H19 results (Earnings: SA c.95%; RoA c.5%): SA earnings rose 2% YoY, with earnings from the RoA soaring by 20% YoY. Nedbank’s Retail and CIB segments were flat, while its Wealth division was down 12% YoY. Total diluted HEPs grew 3.7% YoY. Pre-provision operating profit increased by 7% YoY with total income rising by 6.3% YoY. Total costs were up 5.5% YoY. CLR moved higher – from 0.53% to 0.7%. NAV/share increased 4% YoY to R177.94. ROE came in at 16.8% – it has been flat since December 2018. HEPS stood at R14.11 and a dividend of R7.20/share (+3.6% YoY) was declared.

Figure 3: Nedbank metrics and forecasts:

Source: Bloomberg, Anchor. Share price as at close on 21 August 2019.

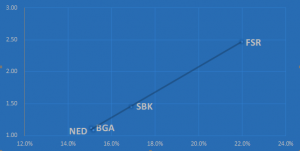

Figure 4: F – Price/Book value relative to ROE:

Source: Bloomberg, Anchor

From the above simple regression (Figure 4), there doesn’t appear to be any obvious company specific relative valuation opportunities, instead its more about whether we believe the market’s current earnings (and ROE) expectations are achievable. The 8% and 12% YoY earnings growth, which the market expects for ABSA and Standard Bank, respectively, is probably too high in our view. However, we suspect that the market is discounting some more EPS downgrades from the banks and there has been a slight repositioning ahead of such possible downgrades (in addition to the general anxiety fuelled by selling out of risk assets).

Over the past six weeks we’ve seen a meaningful pullback across the sector (although we do concede that this sell-off wasn’t isolated to local banks) and, with most of the SA banking counters expected to still deliver marginally positive earnings growth, we have become more constructive due to their relatively cheap valuations.

In terms of building portfolios which maintain some upside optionality to a generally improving domestic environment over the medium term, we think SA banks are probably a less risky building block to be used. While our portfolio may be skewed towards a deteriorating local environment (at present, we are 12% underweight shares we consider to be domestically exposed), the exposure that we have maintained is skewed towards the banks.

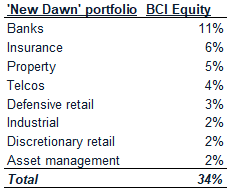

Figure 5: Anchor ‘New Dawn’ portfolio

Source: Bloomberg, Anchor. Note the total may differ due to rounding.

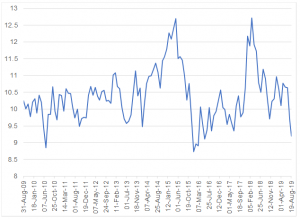

Figure 6: SA banks forward PE ratio:

Source: Bloomberg, Anchor

Looking at the SA banks’ forward dividend yield (DY), we note that the last time investors could buy local banks at a 6% DY, the SA 10-year bond was yielding more than 10% – currently it is yielding 9%. In terms of the SA banks’ reported ROEs, we point out that a healthy spread remains vs the cost of equity (COE), which is likely in the region of 13% (the local banking sector’s justified P/BV is now around 1.6x-1.8x). Assuming a 2% reduction in ROEs generated by the SA banking sector stocks (i.e. EPS going backwards but supposing that the current dividend cover is kept) and the SA 10-year bond goes to 9.5%, what would our expected outcome on the sector be (all other market variables being equal and the currency likely to be trading at over R16/$1)? We believe the justified price to book would then be in the range of 1.2x-1.4x, signifying capital downside of c. 15%–25% from current levels. This would likely also mean that the ABSA Group and Nedbank would be trading at well below book value, while Standard Bank would be trading closer to 1.1x-1.2x book and FirstRand closer to 2x book value.

The bigger question for us, in this instance, is around what needs to happen for the SA banks’ share prices to rise?

- EPS expectations are all trending marginally lower (although we believe it is unlikely that earnings have bottomed, especially considering that the profitability of the sector is likely to be structurally lower over time); and

- ROEs will likely not rise, especially with our base-case scenario being that the SA economic environment will ‘muddle along’ (i.e. no big pro -cyclical, short-term recovery expected [we hope that we are wrong about this]).

So, why would we expect local banking shares to rerate, especially considering that SA is heading into a possible sovereign downgrade and against a very volatile global equity backdrop? We don’t have all the answers (SA bonds are cheap and could provide valuation support) but, on a risk-reward basis, we nevertheless believe that, at current levels, an attractive scenario is playing out. We continue to favour FirstRand and Standard Bank, although we view the recent ABSA results, especially from its domestic retail bank, as possibly signalling the start of a nice recovery after many years of underperformance for the Group. In addition, we think that company specific factors are probably not as important as the bigger-picture variables such as domestic economic growth, constructive economic policy (currently the direction is very poor here), emerging market asset flows and the cost of money tied to global macro factors.