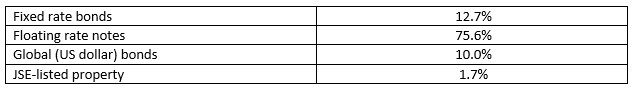

The risk-off swing has been particularly pernicious this time around and global investors raising money for margin calls have seen global funds selling anything they can to find cash. No asset class has been immune to the current sell-off and even gold, once a safe-haven mainstay, has seen its value decline. Unfortunately, South African (SA) bonds have also come under pressure. We have seen fixed-rate bonds lose up to 20% of their value as yields rocketed to between 11% and 13%. Domestic floating rate notes have been more defensive, with their values off only slightly despite becoming illiquid. Meanwhile, locally listed property has been particularly hard hit and is down by about 38% on a month-to-date (to 25 March) basis. Using a broad-brush approach, our portfolio construction of the Anchor BCI Flexible Income Fund is highlighted in Figure 1 below.

Figure 1: Anchor BCI Flexible Income Fund

Source: Anchor

The recent SA Reserve Bank (SARB) interest rate cut has seen the yield on money market portfolios cut to below 6%. This will decline towards 5% as further rate cuts are certainly on the cards (the next SARB Monetary Policy Committee meeting is scheduled for 19-21 May, though an emergency meeting certainly is plausible).

In line with the interest rate cut, we have seen the yield on our floating rate notes decline towards 7.4%. In contrast, the yield on the remaining portion of the portfolio has increased materially. As a result, the current portfolio yield is about 8.80%, which is slightly above where it was before the start of the new coronavirus (COVID-19) crisis. The interest rate cut reduced our portfolio yield, while the fixed-rate bond sell-off has pushed it back up. For now, we are seeing a slightly higher yield.

The dislocation is particularly severe in the fixed-rate bond segment of the market as foreigners have sold R52bn of SA bonds on a month-to-date basis. Under SA regulations the nine market makers are obliged to make prices in bonds and every time they show a bid, no matter how ludicrous, they are sold more bonds. As market makers’ balance sheets fill up with fixed-rate bonds, we see increasingly ridiculous prices being shown. The craziness will however stop. At its height, foreigners were selling R10bn worth of SA bonds per day. Then R5bn and, for a few days, R3bn, then R2bn. On Friday (20 March), it declined to below R2bn for the first time this month. As we see foreign selling taper off, we can reasonably expect some recovery in bond prices. We would have expected this to continue for the remainder of this week (of 23 March), but selling pressure is clearly running out of steam.

Each crisis is different, but there are also some common threads. Historically, bonds have been the first asset class to recover. Thus, it is reasonable to expect that this will be the case in 2020 as well and that we need a liquid and functioning bond market before the other asset classes also recover. We could not hazard a guess as to when we will see some recovery, although it is likely to be between the end of March and the end of the year. We are upset at how this has played out, however, but nevertheless take solace in the knowledge that this asset class should be the first to recover. If any of the views from JP Morgan, Goldman Sachs, or the like hold, then the recovery will happen sooner rather than later. We also take comfort in knowing that we have seen interest rate cuts and record-breaking stimulus packages. These mean that the fair yield on bonds will in future be lower than their historic levels. The fair price will also be higher. In the short term, bond prices have gone down, while their fundamental fair value has gone up. We can expect the recovery in this asset class, when it does come, to repair all the short-term, mark-to-market losses that we have seen and it will likely also result in additional capital gains over and above the recovery.

Bonds are mathematical instruments. Their short-term pricing is random, yet their long-term performance can be predicted with certainty. The recovery is assured. We have been gradually accumulating bonds at 11% yields, and we will continue to do so while this opportunity presents itself. Approximately 25% of the portfolio is sitting in bank deposits and we are keeping an eye on the liquidity of the portfolio as things develop. We will maintain a large liquidity buffer, whilst taking advantage of the opportunities that we do see.

When asked what the expected return on the Anchor BCI Flexible Income Fund will be for the next 12 months starting from Wednesday (25 March), we note that, realistically, our starting point is a portfolio yield of 8.80%. Add to this the expected recovery in the market and we think that 4% is reasonable. However, we will low ball this and say at a 2% recovery, which is ultra conservative. Added together, this portfolio should return about 10.8% before fees – maybe a little more. This is about double the outlook for money market funds and it also has some significant upside above our conservative estimates. The fund is a low-risk access point for investors that want to buy the dip.

The market has been difficult, and we are all bruised. We cannot predict the timing and we also know that it can get worse before it gets better. Nevertheless, if we look through the short-term noise, then the outlook for the portfolio is immensely attractive from current levels. We are receiving daily calls about the timing of coming into this portfolio. Honestly, while markets are volatile, we cannot accurately predict the day-to-day performance. Once the event risk of Moody’s credit rating announcement is out of the way on Friday (28 March), then any day would be a good day to lock-in some of the current opportunities.

Moody’s is also coming up in conversations a lot. The way we look at it, the bond sell-off has been so severe that we would expect a recovery to lower yields irrespective of Moody’s decision. In the event of no downgrade, then the fair yield on the R186 bonds is about 7.5%, giving a return of c. 16% from Wednesday’s prices. In the event of a downgrade, the fair yield will probably be closer to 8.50%, giving a return of c. 13% from current prices. Either way, there is a material recovery in bonds. It will just be a little more and a slightly faster should we avoid the downgrade.

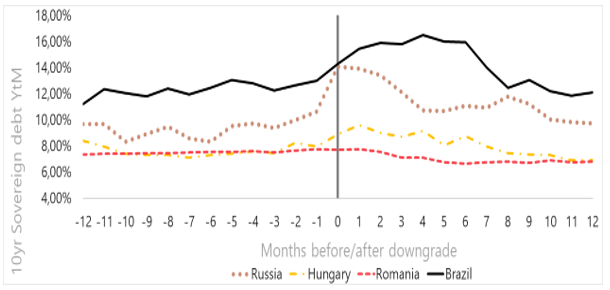

I am a football fan and enjoy watching the English Premiership. A downgrade is just like a relegation to a lower league. The team in question will survive and the players will continue to play the game, the stadium is just a little emptier. The club in question survives. SA will also survive a downgrade. The nature of investors in our bonds and country will change, but we will survive in the same way that Brazil, Russia and every other country that has ever been downgraded has survived. We may well even prosper again.

Remember, as bond yields go up, their prices go down. In Figure 2 below, we show the bond yields of several countries at the time that these countries were downgraded to junk. This is time 0 in Figure 2 below. The bonds yields for each of these country are then shown for the 12 months leading up to the downgrade, and the 12 months following the downgrade. Clearly, bond yields do rise at the time of the downgrade, and bond prices go down. This effect is, however, short lived and in all the cases below, the bond yields and bond prices all recover within a year. We have no reason to believe that SA will be any different, our bonds will recover from a downgrade and, at current levels, the downgrade is certainly priced-in.

Figure 2: The bond yields of various countries at the time of/and after a downgrade to junk status

Source: Anchor, Thomson Reuters

All told, it has been an unprecedented time for all of us. Nevertheless, we continue to manage the safe portion of our clients’ portfolios within the current market environment. The portfolio will remain conservatively invested as we seek to take a little advantage of the opportunities that we see in the market. However, the forward outlook for the portfolio is particularly attractive as a low-risk way of locking-in some of the opportunities that we see out there.