After an impressive rebound in July, most major global markets closed August weaker (MSCI World -4.1% MoM/-17.5% YTD) on the back of fears that more aggressive interest rate hikes from central banks to curb inflation will result in a global economic downturn. At the Jackson Hole Economic Symposium, which ended last week, US Federal Reserve (Fed) Chair Jerome Powel took a decidedly hawkish stance in his speech and signalled that interest rates would be kept higher for longer to curb runaway inflation. Markets were expecting limited interest rate increases and faster rate cuts, but Powell’s speech made it clear that future hikes would be bigger and any rate cuts would be delayed – a message global equity markets did not like at all. China is also struggling to emerge from the sluggish growth seen in the June quarter, with a flare-up of COVID-19 cases in several Chinese cities last month and the country’s zero-COVID policy not boding well for growth. In addition, geopolitical risks, including tensions between China and the US over Taiwan and Russia’s ongoing war in Ukraine, are darkening the global growth outlook.

What started as a relatively strong month for the three major US averages ended with a whimper as the US blue-chip S&P 500 declined by 4.2% in August (-17.0% YTD), while the Dow closed the month 4.1% lower (YTD, the Dow is down 13.3%). The tech-heavy Nasdaq fell 4.6% MoM (-24.5% YTD). On the US economic data front, July inflation (released in August) slowed to 8.7% YoY (vs June’s 9.1%), and while economists’ forecasts expected core inflation (excluding the volatile food and energy prices categories) to increase from 5.9% YoY in June to 6.1% YoY in July, the July figure remained at 5.9% YoY. Retail sales came in higher than expected, with retail sales excluding auto and gas increasing by 0.7% MoM in July compared to an anticipated 0.4% MoM figure. We note that most of this increase was due to higher prices rather than increased sales/spending. The Fed’s preferred inflation gauge, core personal consumption expenditure (PCE), which strips out the volatile food and energy categories, rose 4.6% YoY in July – down from June’s 4.8% print. Moreover, personal income and spending rose less than expected in July, despite cooling inflation. However, US consumer confidence rose by more than forecast in August to its highest level since May, suggesting that Americans are growing more optimistic about the economy amid falling gas prices.

In Germany, the DAX closed the month 4.8% lower (-19.2% YTD), while the eurozone’s second-biggest economy, France’s CAC Index, ended August 5.0% in the red (-14.4% YTD). In economic data, July eurozone headline inflation reached a record high of 8.9% YoY (the highest since the euro was created in 1999) vs June’s 8.6% print. This was the thirteenth consecutive rise in inflation for the region. Germany’s August inflation rocketed to its highest level in c. 50 years at 8.8% YoY (vs July’s 7.5% YoY rise), beating a previous high set in May (8.7% YoY) and strengthening the likelihood of the European Central Bank (ECB) announcing a hefty rate hike at its meeting on 8 September. Energy prices were the main culprit, soaring more than 35% YoY. France’s inflation rate, however, eased more than expected to 5.8% YoY in August vs July’s 6.1%, which was the highest level since 1985. Spain’s August inflation rate also eased slightly (10.3% YoY) on the back of lower fuel prices.

In the UK, the blue-chip FTSE-100 Index closed August 1.9% lower (-1.4% YTD). In UK economic data, July UK inflation, released last month, came in at a new 40-year high of 10.1% YoY (vs June’s 9.4% YoY print) as food and energy prices continued to surge.

China’s markets disappointed as more big cities in the country again ramped up COVID-19 curbs amid fresh outbreaks in August. Investor sentiment was further dented by data showing factory activity had extended declines as the worst heatwaves in decades, an embattled real estate sector and new COVID-19 infections weighed on production. Hong Kong’s Hang Seng Index posted a 1.0% MoM loss (-14.7% YTD), while the Shanghai Composite Index retreated 1.6% MoM (-12.0% YTD). On the economic data front, China’s official manufacturing purchasing managers index (PMI) contracted to 49.4 in August compared with July’s 49.0 print and Reuters consensus expectations of 49.2. The official non-manufacturing PMI, which measures business sentiment in the services and construction sectors, fell to 52.6 in August vs 53.8 in July (the 50-point mark separates expansion from contraction). Despite lifted lockdowns, Chinese retail sales data disappointed, with July retail sales increasing by 2.7% YoY compared to the anticipated 4.9% YoY figure and considering that the run-rate pre-pandemic was 8%-10% YoY.

Japanese equities recorded their second straight MoM gain, with the benchmark Nikkei rising 1.0% MoM in August (-2.4% YTD). On the economic data front, Japan’s economy grew an annualised 2.2% in 2Q22 on the back of robust private consumption, which accounts for more than half of Japan’s GDP as dining out, leisure, and travel rebounded following the lifting of the pandemic curbs in March. In 1Q22, GDP grew just 0.1%.

Recession fears also weighed on commodity prices. Brent crude oil dropped for a third straight month (-12.3% MoM/+24.1% YTD) to below US$90/bbl by around mid-month before a slight turnaround saw it ending August at c. US$96.49/bbl on the prospect of output cuts by the Organisation of the Petroleum Exporting Countries and their allies (OPEC+) and demand worries in a struggling global economy. Iron ore continued to slump (-8.7% MoM/-16.5% YTD) and the gold price recorded its fifth MoM decline (-3.1% MoM/-6.5% YTD), as solid US data and hawkish Fed comments pointing to an aggressive interest rate path, dented gold’s appeal. The price of platinum fell 5.6% MoM (-12.4% YTD), while palladium lost 2.0% MoM (+9.6% YTD).

After rebounding in July, the JSE followed global markets lower in August as South Africa’s (SA’s) FTSE JSE All Share Index closed the month 2.4% down (-8.8% YTD), and the FTSE JSE Capped SWIX declined by 1.3% MoM (-3.2% YTD) led by losses in resources sector stocks (Resi-10 -6.1% MoM/-15.0% YTD) and amid concerns over higher interest rates and a possible recession. The SA Listed Property Index was down 5.4% MoM (-13.3% YTD), followed by the Fini-15 (-2.6% MoM/+0.5% YTD) and the Indi-25, which declined 0.7% MoM (-12.6% YTD). Highlighting August’s best-performing shares by market cap, British American Tobacco and ABSA rose 4.7%, while Naspers gained 2.9%, and Capitec ended the month 2.6% higher. BHP Group, the largest company on the JSE by market cap, was down 3.4% MoM, while Prosus, the second-biggest, JSE-listed company, declined 1.5% MoM. The rand continued to retreat, weakening by a further 2.9% against the greenback (-6.8% YTD) as the US dollar hit 20-year highs against a basket of its peers.

On the local economic data front, annual July headline inflation, as measured by the consumer price index (CPI), printed at a 13-year high of 7.8% – up from 7.4% in June. Once again, the main contributors to the higher annual inflation rate were food and non-alcoholic beverages, housing and utilities, and transport categories. The introduction of higher electricity rates from municipalities – which took effect in July – also contributed to the higher number. Core inflation (excluding the volatile categories of food and energy costs) crept up to 4.6%, from 4.4% the month before, as second-round effects start pulling through to the greater CPI basket, an issue that remains a prime concern for the SA Reserve Bank (SARB). The 2Q22 Quarterly Labour Force Survey (QLFS), released in August, showed that SA’s official unemployment rate decreased marginally by 0.6 of a percentage point from 34.5% in 1Q22 to 33.9% in 2Q22. Despite these positive decreases, SA’s official unemployment rate remains the highest on a list of 82 countries monitored by Bloomberg. In addition, strict labour laws, stagnant productivity, bureaucratic hurdles, and a skills shortage have reduced local companies’ ability to hire additional workers. June retail sales fell 2.5% YoY vs May’s 0.1% YoY increase. This was the steepest decline in retail activity since January 2021 as higher interest rates and inflation weighed on consumers.

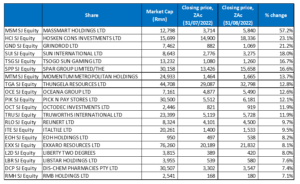

Figure 1: August 2022’s 20 best-performing shares, % change

Source: Bloomberg, Anchor

Massmart was by far the best-performing share in August – soaring 57.2% MoM. The share price surged c. 44% on 29 August after US retail giant Walmart announced an offer to buy 47% of the shares in Massmart that it does not already own for R6.4bn. Shareholders will be offered R62/share in cash and, if approved by shareholders, Massmart will be delisted from the JSE. Massmart said that the ownership and delisting will allow it to stick to its turnaround strategy, announced in 2019, with its divestment from non-core assets. The Group added that it remained focused on its strategy to strengthen its core business and is investing in e-commerce, home improvement, general merchandise, and wholesale food and liquor growth. In its half-year results, Massmart reported a headline loss of more than R903mn vs a loss of R359mn in the same period last year, while sales grew c. 2% YoY to c. R39bn. Massmart’s disappointing results reflected a challenging macroeconomic environment and its impact on the Group’s core operations. On the positive side, Massmart is starting to see tiny green shoots from its turnaround strategy. Buying out Massmart will allow Walmart to continue to provide overweight support to the company as the growth phase of Massmart’s turnaround strategy requires increased operational intervention and significant financial investment.

Hosken Consolidated Investments (HCI) was August’s second best-performing share, gaining 23.1% MoM as its participation in the Venus oil and gas discovery off the Namibian coast (Impact Oil, which has a 20% stake in the Venus deposit, is 49.9% held by HCI.) has fuelled a rise in HCI’s share price this year. At its AGM in August, the HCI CEO noted that shareholders in the Venus block (including energy giant TotalEnergies with a 40% stake) might ultimately need to pay between US$50bn and US$80bn to participate fully in the discovery, adding that “HCI is a US$800mn company. The US$10bn-US$15bn needed for Impact to participate in Venus is not in our ballpark.”

In third place, Grindrod Ltd rose 21.2% MoM. Last week, the logistics and financial services company reported a 53% YoY increase in its 1H22 core headline earnings to R529mn, supported by stronger global demand for commodities such as coal. Grindrod also reported a robust performance in its core operations, which include the Port and Terminals, Logistics and Grindrod Bank businesses. Revenue from core operations rose 31% YoY to R3.1bn, while diluted EPS stood at ZAc57.7, compared with a loss per share of ZAc63.1 recorded in 1H21.

Grindrod was followed by Sun International (+18.0% MoM), which also released 1H22 results that showed its earnings increasing significantly (almost doubling from 1H21, which was impacted by the effects of the COVID-19 pandemic). In 2019 (pre-COVID), Sun International made R3bn in EBITDA for the full year, and management’s target was to get above that level in 2022. For 1H22, EBITDA came in at R1.5bn which is quite an achievement given that its costs are up c. 20%, and the local economy has not grown since 2019. 1H22 EPS came in at R1.77, and the company will pay a dividend of R0.88/share (the first in six years).

Meanwhile, Tsogo Sun Gaming, which owns casinos such as Gold Reef City and Montecasino, recorded a 16.7% MoM rise in its share price. In early August, Tsogo Sun Gaming added another asset to its portfolio after the Competition Tribunal approved the merger of the consortium it leads of Emerald Hotel Resort & Casino. The acquisition of Emerald will mean that Tsogo Sun Gaming controls four of the seven casino licences in Gauteng.

Almost one-third of retailers in Poland that buy food from wholesaler Spar cancelled their contracts in response to new terms requiring them to buy c. 40% of their goods from Spar. Spar bought distributor Piotr i Paweł out of business rescue in 2019, after which it bought the Polish Spar wholesale licence, and it has been trying to turn the unprofitable operations around since. Spar said this would place it in a better position working with outlets that bought sufficient goods from it rather than losing money supplying those outlets that did not. Spar is also closing its Warsaw warehouse, which the company believes will cut costs, leaving it with two distribution centres – one in the north and one in the south. Polish revenue accounts for c. 1.9% of the Group’s total, but its debt equals c. 16% of the JSE-listed entity’s debt. The market reacted positively to the news, and Spar’s share price was up 16.6% in August.

Spar was followed by Momentum Metropolitan Holdings (MMH) and Thungela Resources, with gains of 13.7% and 12.8% MoM, respectively. MMH said in August that it expects its FY22 HEPS to accelerate by between 855% and 875% YoY to ZAc295-ZAc301 as it recovers from the impact of the COVID-19 pandemic. The Group said that its FY21 was severely affected by the pandemic, including a net negative mortality and longevity experience variance of R1.7bn and a net increase in additional COVID-19 provisions of R1.1bn.

Rounding out August’s best-performing shares were Oceana Group and Pick n Pay Stores, with MoM share price rises of 12.6% and 12.1%. Last month, Pick n Pay launched its new supermarket brand called Pick n Pay QualiSave, which is aimed at the growing SA middle class and will offer customers a range of c. 8,000 products with an emphasis on essentials. The retailer now has three banners – Boxer for aspirational customers with tight budgets, Pick n Pay QualiSave for the growing middle market and Pick n Pay at the higher end. In addition, around 40% of existing Pick n Pay company-owned supermarkets will be converted to Pick n Pay QualiSave stores.

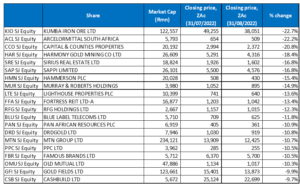

Figure 2: August 2022’s worst-performing shares, % change

Source: Bloomberg, Anchor

August saw broad-based losses in mining sector stocks, with diversified miner and Anglo subsidiary Kumba Iron Ore (-22.7% MoM) emerging as last month’s worst-performing share as the downward trend in metal prices weighed on sentiment. In July, Kumba had reported a 50.5% YoY drop in 1H22 profit to R15.15bn, with revenue down almost one-third and headline EPS at R36.13 vs R72.78 recorded in 1H21. The biggest driver of the decline is the iron ore price, which has plummeted 16.5% YTD. The 2021 average iron ore price of US$161/tonne was the second-highest price going back to 2011, but the iron ore price dropped to below US$100/tonne at the end of August on signs that the crisis in China’s steel industry is worsening. Steel price losses were further aggravated after several Chinese cities, including Shenzhen and Dalian, escalated COVID-19 restrictions to contain the latest outbreaks. In addition, banks in China are facing the spectre of losses as mortgage boycotts sweep the property sector, which is crucial to steel demand. Kumba was followed by SA’s biggest steel producer ArcelorMittal SA, with its share price plunging by 22.2% MoM on similar concerns as Kumba.

In the third spot, Capital & Counties Properties (Capco) recorded a share price drop of 20.8% in August. The real estate company reported 1H22 results early last month, which showed that its revenue had declined to GBP33.9mn vs the GBP34.6mn reported in 1H21. At the same time, its basic and diluted loss per share stood at GBp1.30 vs a loss per share of GBp12.20 posted in the corresponding period of the prior year.

Capco was followed by Harmony Gold Mining, down 18.4% in August. Harmony’s share price plunged 11.1% on 30 August after it reported a drop in its FY22 profit amid lower production and higher costs. HEPS were R4.99/share, a significant decrease from the R9.87/share reported in FY21. The gold miner also recorded a net loss of R1bn after net profit decreased 120% YoY from R5.1bn. Its annual production declined by 3% YoY to 1,487mn ounces compared to 1,535mn ounces last year.

Sirius Real Estate and Sappi recorded share price declines of 16.8% MoM. Pulp and paper Group, Sappi was down after a strong share price run this year and despite releasing good 3Q22 results in August, which showed that it had had a very strong year to date. Revenue increased to US$1.82bn from US$1.39bn posted in the corresponding period of 2021, while diluted EPS stood at USc33 compared with USc3 recorded in 3Q21. Still, we believe that these results will likely be the peak for Sappi earnings in this earning cycle. Most of the earnings growth came from its Printing and Writing Papers (Graphics) business. Due to the pandemic, supply is exceptionally tight, and, as a result, pricing is very high, which has resulted in this segment achieving record 3Q22 profits. Structurally, however, it is important to bear in mind that this industry (and, by extension, this segment) is expected to decline by c. 5% p.a. We also remain concerned about the sustainability of current margins (of c. 13%) in this segment. Management noted that although 4Q22 results are expected to be below 3Q22, they still expect good results for the quarter.

Sappi was followed by JSE-listed, UK-based property Group Hammerson Plc (-15.4% MoM) and Murray & Roberts (-14.9% MoM). Hammerson, which owns premium retail properties and venues in Europe, was up 33% in July but has come down from this high base, weighed down by the increased cost of living (mortgages, energy etc.), higher funding costs for property companies, and recession fears in Europe. Engineering and mining contracting company Murray & Roberts, in its FY22 results, reported a revenue increase to R29.9bn, compared with R21.9bn posted in FY21, while its diluted EPS stood at ZAc61 compared with ZAc18 recorded in the previous year. However, its share price slumped on the back of the subdued performance in the Group’s African businesses due to the cancellation of two large contracts, falling investment and supply-chain disruptions.

Rounding out the ten worst-performing shares for August were Lighthouse Properties and Fortress REIT -A-, which recorded MoM declines of 13.6% and 13.4%, respectively. Fortress’ proposal to collapse its A and B dual share class structure did not obtain the requisite level of shareholder support (at the meeting on 17 August). Subsequently, Fortress communicated that it would be unable to pay a distribution given the provisions within the companies’ MOI and, therefore, it would be unable to comply with the minimum distribution requirements of a real estate investment trust (REIT) and is engaging with the JSE to manage the process.

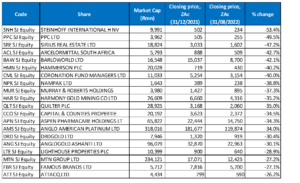

Figure 3: Top-20 August 2022, YTD

Source: Anchor, Bloomberg

Fifteen out of August’s top-20 YTD best-performing shares also featured among the top-20 performers for the year to end July, with Pick n Pay Stores (+17.8% YTD), ABSA (+16.7% YTD), Sun International (+15.1% YTD), Octodec (+12.1% YTD), and Shoprite (+11.4% YTD) replacing Sappi, Vukile Property Fund, Datatec, Standard Bank, and Hudaco.

Coal miner Thungela Resources (+288.0% YTD) remained at the top spot for the seventh month. Thungela recorded a further 12.8% share price jump in August after it reported fantastic 1H22 results on 15 August. The results were buoyed by soaring coal prices which have reached record highs following Russia’s invasion of Ukraine. The resultant sanctions on Russia, a major European gas supplier, have seen increased gas to coal switching. Thungela posted a profit of R9.6bn vs a R351mn profit in the same period of 2021, and its cash soared 70% YoY to R14.8bn. It also declared an R60/share dividend – a payout of R8.2bn, or c. 92% of adjusted operating free cash flow. We expect second-half earnings to be more robust than what Thungela has just reported for 1H22. Thungela has reduced its volume guidance, which has led to higher unit cost guidance but, for now, high coal prices mean unit cost inflation can be overcome. We believe Thungela will produce more robust earnings in 2H22, thanks to higher volumes and coal prices. Thungela has also reached terms with Transnet, which commits the rail operator to haul a minimum of 60.0mn tonnes for its year to end March 2023.

HCI (+147.8% YTD) remained in second place for the second consecutive month, with the HCI share price gaining 23.1% in August (as discussed earlier). HCI was once again followed by Grindrod (+116.0% YTD and discussed earlier), which stayed in the third spot for the fourth month running.

Healthcare Group, Mediclinic remained the fourth best-performing share YTD – its share price gained 1.9% in August, and it is now up 45.2% YTD amid a takeover offer by a consortium led by Remgro’s Johann Rupert. Last month, Mediclinic said it had agreed to the latest in a series of offers from the consortium valuing the hospital operator at GBP3.7bn (c. US$4.5bn). Remgro, already Mediclinic’s majority shareholder with a 44.6% stake, is partnering with MSC Mediterranean Shipping Company SA to pay GBp504/share for the shares in Mediclinic it does not already own. Mediclinic has healthcare facilities in Switzerland and the UAE, as well as a dual listing in SA.

Mediclinic was followed by Exxaro Resources, Sasol, and Fortress REIT -B- with YTD gains of 42.8%, 28.1% and 25.5%, respectively. Sasol reported FY22 results on 23 August, which showed that its adjusted core profit soared 48% YoY to R71.8bn. Earnings before interest and tax (EBIT) of R61.4bn increased significantly from FY21’s R16.62bn, while headline earnings grew 21% YoY to R29.73bn. The chemicals and energy Group benefitted from improved demand and a c. 70% jump in the US dollar oil price, offsetting various issues Sasol experienced, including coal quality and export sales (-12% YoY, due to operational challenges on SA’s port and rail network), shutdowns, and safety. The dividend was also reinstated following a c. two-year pause.

Rounding out the YTD 10 best-performing shares were Blue Label Telecoms, RMB Holdings, and Astral Foods, with YTD gains of 22.8%, 20.0% and 19.9%, respectively. In its FY22 results, released last month, Blue Label said that its revenue decreased to R17.81bn, compared with R18.82bn posted in FY21, while its headline EPS stood at ZAc117 vs ZAc86 recorded for the same period of the previous year.

Figure 4: Bottom-20 August 2022, YTD

Source: Anchor, Bloomberg

Among the YTD worst-performing shares, 14 of the 20 shares for the year to end-August were also among the 20 worst performers for the year to end-July. Harmony Gold (-35.2% YTD), Quilter Plc (-35.0% YTD), Capco (-34.5% YTD), Lighthouse Properties (-28.9% YTD), MTN Group (-27.2% YTD), and Famous Brands (-27.1% YTD) were the newcomers last month, replacing Massmart, EOH, City Lodge, MMH, Reunert, and Mondi.

For a fifth month running, Steinhoff (-53.4% YTD) was the worst-performing share YTD after recording a further 8.6% MoM decline in August. On 30 August, the company released a nine-month trading update to the end of June, showing that it had raised revenue by 12% to EUR7.7bn. Steinhoff also said that it is facing challenges in restructuring its EUR10bn corporate debt owed to various investor classes that have different rights and obligations, with the company noting that the situation has been worsened by the current global economic environment that has driven up rates and seen rising fears of an economic downturn.

Steinhoff was again followed by PPC (-49.5% YTD) in the second position, with Sirius Real Estate (-47.2%) taking the third worst-performing share spot for the year to end-August.

After Sirius came ArcelorMittal SA (-42.7% YTD), Barloworld (-42.1% YTD), Hammerson Plc (-40.2% YTD), and Coronation Fund Managers (-40.0% YTD).

Packaging Group, Nampak, Murray & Roberts, and Harmony Gold rounded out the ten worst-performing shares with YTD losses of 38.8%, 37.3%, and 35.2%.