Most major global stock markets overcame the ongoing US/ China trade war, a murky global macro-economic outlook, geopolitical issues (including ongoing Hong Kong protests, the August government crisis in Italy etc.) and continued Brexit delays to post healthy rises in December and for 2019. Some of the large European and Asian markets recorded impressive gains in 2019, while major US indices ended the year sharply higher – a welcome change from 2018 when many global markets suffered their worst year in c. a decade.

On 26 December, the Nasdaq topped the 9,000 level for the first time, as equities were buoyed by reports of strong holiday sales, with e-commerce sales, especially, surging. A solid rebound for November industrial firms’ profits in China also buoyed sentiment, with investors now likely to be looking to the US/China trade deal to sustain these gains into 2020. This after US President Donald Trump said that he would sign a “very large and comprehensive” bilateral so-called “Phase One” deal to avert a new round of tariffs scheduled to be implemented on 15 January. Among the large US indices, the Dow Jones added 22.3% YoY (+1.7% MoM) in 2019, but the broader-based S&P 500 and the tech-focused Nasdaq did even better, rising 28.9% (+2.9% MoM) and 35.2% YoY (+3.5% MoM), respectively.

In terms of US economic data, the Conference Board’s consumer confidence index dipped again in December (its fifth consecutive decline), coming in at 126.5 – down from 126.8 in November, and below the Reuters consensus expectation of 128.2. Meanwhile, the Institute for Supply Management (ISM) said its manufacturing index slid to 47.2% last month vs 48.1% in November, marking the fifth straight month of contraction and its softest reading since June 2009.

The European economy had a rather mixed year, but was cheered in November by news that Germany, the region’s largest economy, had narrowly avoided a recession. For a fourth month running, major European equity markets closed in the black. Germany’s DAX advanced slightly (+0.1% MoM), but YoY the index is up 25.5%, while France’s CAC rose 1.2% MoM, but closed 2019, 26.4% higher YoY. The latest OECD economic data show that exports and imports fell across all major European economies on the back of the US-China trade war, Brexit uncertainty and the economic downturn in Germany. According to the OECD, EU exports dropped 1.8% QoQ in 3Q19, while imports fell 0.4% QoQ. The European Commission also warned of “a protracted period of subdued growth and low inflation in the context of high uncertainty,” as the above-mentioned factors combine to impact nearly every sector of the eurozone’s economy.

Meanwhile, in the UK, where Prime Minister Boris Johnson’s election victory early in December confirmed that the country would leave the EU on 31 January, the FTSE 100 ended the year 12.1% higher (+2.7% MoM) – its biggest annual gain since 2016, according to the BBC.

In Asia, China’s Shanghai Composite index rose 22.3% YoY (+6.2% MoM), while Hong Kong’s Hang Seng ended the year 9.1% in the green (+7.0% MoM), despite several ups and downs during the year. Hong Kong had a difficult 2019 economically as several months of anti-government protests took their toll, with GDP contracting by an alarming 3.2% in 3Q19, pushing the territory into a recession.

On the commodity front, the price of Brent crude oil closed December c. 5.7% higher (+22.7% YoY) after OPEC announced better-than-expected supply cuts and a plan to force better compliance to production limits. After an impressive October run, but a lacklustre November, the gold price once again recorded good gains in December, ending 3.6% higher MoM, after moving above the major psychological level of $1,500/oz at year’s end. The yellow metal was up an impressive 18.3% in 2019. Benchmark iron ore prices rose c. 7.5% MoM (+32.3% YoY), exceeding market expectations after the shortage in supply due to Brazil’s Vale dam disaster in January. In addition, the big four Australian iron ore miners have had operational issues which put pressure on their shipments, so supply was relatively tight last year. The price of platinum jumped c. 8.5% MoM (+18.1% YoY), while palladium (which together with platinum, rhodium and three other metals forms part of the platinum group metals [PGM] basket) continued to rise – up c. 8.0% MoM and a staggering 58.4% higher YoY. The rand strengthened 4.6% MoM against the dollar and is 2.6% stronger YoY vs the greenback.

South Africa (SA) had a relatively gloomy 2019, although the JSE did close the year over 8% higher. Despite an uptick in 2Q19 GDP growth data (which surprised on the upside), 3Q19 again saw a GDP decline (-0.6%), leaving unadjusted real GDP growth at c. 0.1% YoY (excluding 4Q19 data). After a decade of mismanagement and corruption under ex-President Jacob Zuma’s administration, state-owned enterprises (SOEs) remained the key challenge for government and SOEs’ financial woes dominated headlines throughout the year. South African Airways (SAA) was placed under voluntary business rescue last month, while the first week of December saw Eskom institute nearly a week of loadshedding, even reaching a previously unprecedented stage-6 level on 9 December. Eskom said this was as a result of the system being “extremely vulnerable and volatile” as a perfect storm of breakdowns and week-long, widespread rain hit the power grid. This is not only devastating for the SA economy (as we will likely see in 4Q19 GDP data), but also for growth and jobs.

After a turnaround in October, and a retreat in November, the FTSE JSE All Share Index closed December 3.1% higher MoM (+8.2% YoY). With strong commodity prices, the Resi-10 recorded good MoM gains – rising by 6.9% and buoying the overall market. YoY, the Resi-20 is up 20.0%. The Indi-25 posted a 2.2% MoM gain and is up 8.8% YoY, while the Fini-15 continued to lag with a MoM advance of only 0.6% – YoY the index is down 4.3%. Strong gains from market-cap heavyweights such as Anglo American Platinum (Amplats: +7.8% MoM), Naspers N (+9.4% MoM), Prosus NV (+5.4% MoM), Anglo American (+3.5% MoM), and British American Tobacco (BAT; +3.4% MoM) negated losses from other large cap counters such as Anheuser-Busch InBev (AB InBev; -0.5%), Richemont (-1.7% MoM) and Glencore (-6.7% MoM).

On the local economic data front, annual consumer price inflation (CPI) decreased to 3.6% in November from 3.7% in October. This was the lowest annual CPI level since December 2010 when it stood a 3.5%. It was also the third consecutive month that CPI fell. The latest October retail sales data showed only a modest 0.3% YoY rise vs September’s revised 04% YoY gain, while MoM, sales declined by 0.2% but rose 0.6% in the three months to the end of October vs the same period of 2018. The November trade surplus widened to R6.1bn compared with a revised R2.75bn October surplus, according to the latest SA Revenue Service (SARS) data. The trade account now has a positive balance of R10.54bn for 11M19, compared with a deficit of R1.24bn for the same period in 2018.

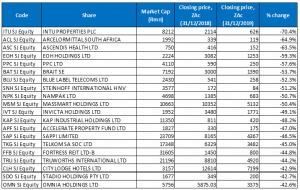

The 20 top-performing shares in 2019:

Source: Bloomberg, Anchor

Commodity counters rallied in 2019, with more than half of 2019’s best-performing shares coming from the sector. This came about as key locally produced PGMs, gold and iron ore came back in favour, despite the sector still being plagued by policy uncertainty, loadshedding and ongoing labour disputes.

Impala Platinum Holdings (Implats) was the best-performing share on the JSE, with its share price rocketing by 291.3% YoY. While a rising platinum price (+21.1% YoY) was the main driver, last year also saw a rally in the price of palladium (+54% YoY), which closed the year at $1,954.35/oz. Palladium is used in petrol-powered vehicles’ emission-controlling catalytic converters, while platinum is required mainly for the same gear in diesel-powered vehicles. Palladium’s supply deficit is expected to persist for the next few years, while many commentators are also of the view that the platinum price underperformed other industrial metals prices last year and could have some catching up to do in 2020.

The Sibanye Gold share price jumped 258.2% YoY, making it 2019’s second-best performer. An 18.3% rise in the price of gold and a higher platinum price (Sibanye also has PGM operations), helped buoy the counter. In addition, November saw the Group’s share price rise sharply after it reported a 240% YoY increase in earnings before interest tax, depreciation and amortisation (ebitda) to R5.5bn in the quarter to end-September 2019. Sibanye’s SA-based PGM operations contributed R2.9bn to ebitda, the US PGM operations R1.8bn and its local gold operations R843mn, the firm said.

In third spot, Northam Platinum (Northam) recorded a YoY gain of 185.8%. For the full year to end-June, Northam reported a record operating profit of R2.4bn – up from R823mn – and representing a YoY increase of 192.7%. Revenue surged 41.0% YoY to R10.6bn, while net income stood at R71.4mn, vs a loss of R705.4mn in 2018. Other gold counters to benefit from the stronger bullion price included DRD Gold (+139.6% YoY), Harmony (+103.2% YoY), Gold Fields (+94.3% YoY) and AngloGold Ashanti (+74.1% YoY), which all recorded strong share price rallies.

2018’s top-performing share, Anglo American Platinum (Amplats) took fourth place last year, with a YoY gain of 143.0%. In July, Amplats reported buoyant interim results which showed that the firm had increased ebitda by 82% YoY to R12.4bn and it also announced a cash dividend of R11/ share. Again, the key contributors to this impressive performance has been strong price fundamentals in the PGM basket and it came despite Eskom power outages which had put a damper on production in 1Q19. Headline earnings per share (EPS) jumped 120% YoY to R28.15.

With nine commodity and mining companies among the top-10 performers in 2019, fleet management and car-tracking firm, Cartrack (+69.4% YoY) slipped into tenth spot, despite recording a 9.9% MoM decline in December. In October, the share shot up 31.7% MoM after the company said that it had achieved robust growth of 20%-plus YoY, largely due to a growing demand for telematics services both globally and in SA. The firm delivered impressive growth in a strong set of interim results, showing that it had reached 1mn subscribers for the first time and grew its headline EPS by 28% YoY. Subscription revenue climbed 26% YoY to R897mn, while total revenue came in at R938mn, and cash generated from operations rose an impressive 70% YoY. Regions outside SA now account for 27% of Group revenue.

The 20 worst-performing shares in 2019

Source: Bloomberg, Anchor

The majority of 2019 decliners were property, retail and industrial counters. JSE-listed, UK real estate investment trusts (REITs) came under pressure because of a weakening pound, a struggling UK retail sector and continued Brexit uncertainty, with Intu being one of the worst affected – down 70.4% YoY. The UK-based mall owner’s share price plunged further after a trading statement said it has a plan to “fix the balance sheet,” which included a capital raising. Intu, which owns 17 of the largest shopping centres in the UK and a few Spanish malls, said it would be disposing of underperforming assets in Spain to reduce debt and it also suspended its dividend payment to retain cash in the business.

Steel giant, ArcelorMittal (AMSA; -64.9% YoY) has been under significant pressure this past year due to a downturn in global steel prices, which have fallen much faster and steeper than raw material prices. This has caused substantial margin erosion for AMSA, according to its CEO Koos Verster. The global steel industry is experiencing ‘its most challenging time since the global financial crisis (GFC)” and locally, Verster said, the situation was being exacerbated “by continued weak economic growth, especially in steel and steel-consuming sectors, with apparent steel consumption at a 10-year low,”. In November, AMSA announced that it would close its operations at Saldanha Steel following an operational review of its assets because it could no longer compete in export markets.

Last year’s third-worst performing share was health and wellness firm, Ascendis Health which is down 63.5% YoY. Ascendis finally released twice-delayed FY19 results in late October, which showed that it had swung into a normalised loss after tax of R459mn vs a profit of R93mn previously. Revenue advanced 1.0% YoY to R5.6bn, while normalised operating profit stood at R58.0mn. The firm’s share price took another knock last month, falling c. 19% on 17 December after it announced that it had terminated negotiations with the preferred bidder for the disposal of its subsidiary, Cyprus-based pharmaceutical firm, Remedica. Ascendis was urgently pursuing the sale of what it termed its crown jewel, after suffering write-downs that are more than twice its market cap. Ascendis cited a failure to agree on key terms for the transaction as the reason for terminating negotiations.

EOH Holdings (-59.3% YoY) has had a tough year, mired in controversy. The share price was battered at the start of 2019 when Microsoft ended its partnership agreement with EOH following a whistle-blower report into alleged malfeasance involving a government contract. CEO Stephen van Coller took the helm at EOH in September 2018 and has drawn up a recovery plan for the business including selling assets and improving corporate governance standards. In October, EOH blacklisted 50 companies from doing business with it after an investigation into previous corrupt dealings, and van Coller said the firm would structure its operations into three units and sell assets that do not fit within the revised set up. EOH set an initial target of R1bn in disposals in 2019, but with the sale of its stake in Denis Group last month, the company said that it has “exceeded this target and as at 13 December 2019 has entered into agreements with a cumulative value in excess of this amount”.

PPC, Brait SE and Blue Label recorded YoY losses of 57.6%, 53.7% and 52.3%, respectively. PPC’s share price has been under pressure for some time, but in November the cement manufacturer revealed in its 1H19 results that revenue declined 12.0% YoY to R4.95bn, while headline EPS stood at ZAc6.00, vs ZAc21.00 recorded in 1H18. The company blamed the slump on a weak building market in SA, the rand remaining under pressure, a devaluation of the Zimbabwean dollar and hyperinflation in Zimbabwe. Meanwhile, Brait’s value and prospects were destroyed by the acquisition of UK-retailer New Look, which is effectively valued at zero in the Brait share price and has dragged the company into the doldrums. A R5.5bn investment for 45% of mobile operator Cell C, has seen Blue Label’s share price suffer. Although Cell C has reportedly made progress in turning around its fortunes, including signing an expanded roaming agreement with MTN, Blue Label’s share price has remained under pressure.

In August, The Financial Sector Conduct Authority (FSCA) levied its largest fine to date against beleaguered, Steinhoff (-51.2% YoY) -– a record R1.5bn for misrepresenting its finances to the market. However, Steinhoff will only need to pay R53mn of the fine, with the FCSA noting the retailer’s current financial position and co-operation with authorities, according to Business Day.

Rounding out the ten-worst performing share of 2019, were Nampak (-50.7% YoY) and Massmart (-50.4% YoY). In November, Nampak reported worse-than-expected results which saw its share price plummet to a more than 20-year low. The packaging firm reported a FY19 net loss of R390mn (down 132% YoY) vs FY18’s profit of R1.2bn, while headline EPS declined by more than two-thirds (-69% YoY) from ZAc173.3 to ZAc54.1. Revenue fell 8% YoY from R15.9bn to R14.6bn. Zimbabwe and Angola, which have weighed on Nampak’s earnings in the past, were again the main reasons for the declines. SA’s lacklustre economy, high unemployment (at c. 29%) and difficult macro-economic environment has hit most retailers, but Massmart was the worst impacted as the firm reported 1H19 results in August which revealed its first loss in c. 20 years.

Top-20 December 2019 MoM performers

Source: Bloomberg, Anchor

Although December is usually a quiet month in SA, robust commodity prices saw six of the YoY best-performing shares also appear among the top-10 monthly performers. This was despite Eskom’s week-long loadshedding interrupting production at mining companies such as Sibanye Gold, Impala Platinum, Harmony Gold etc. Impala (discussed earlier) rose 27.5% MoM in December to take top spot. It was followed by Gold Fields, with a 24.6% MoM gain, and Sibanye Gold, which ended the month 24.3% higher, in third position.

Nampak, which features prominently among the year’s worst-performing shares, recorded a 24.2% uptick in its share price in December. The company said last month that it had entered into an agreement for the sale of Nampak Plastics Europe Ltd for an undisclosed amount to Bellcave. The sale is unconditional and effective immediately and includes the pension fund liability. Nampak also announced in mid-December that former Bevcan executive Erik Smuts will assume the role of CEO, after previous CEO Andre de Ruyter left to tend to the crisis at Eskom .

Nampak was followed by DRD Gold, Massmart and Northam Platinum with gains of 22.7%, 19.9% and 15.5% MoM. Massmart was the only retail share among the top-20 performers in December although we note that its gains were from a relatively low base.

AngloGold Ashanti (+15.5% MoM), Motus Holdings (+15.2% MoM), the automotive unit that unbundled from Imperial Holdings in 2018, and Sasol (+15.0% MoM) accounted for the remainder of December’s top-10 performers. Business Report writes that Sasol’s share price surged c. 11.7% on 17 December (marking its largest single-day gain since 28 October, when the company announced its joint CEOs were stepping down), after it reported improved production levels at its Lake Charles chemicals project in the US.

Bottom-20 shares: December 2019 MoM performance

Source: Bloomberg, Anchor

Several counters featured among the YoY worst-performing shares also popped up among December’s worst performers including Ascendis Health, which was down 53.8% MoM and took the top spot, and ArcelorMittal, which lost 30.4% of its value, to take second place. After the share price initially came under pressure following a profit warning in early November, it continued this trajectory post-results and into December. Telkom SA (-25.7% MoM) was December’s third-worst performing share. It dropped to a c. five-year low during the month on concerns relating to its cash flow, and pressure on data prices following the Competition Commission’s findings in early December. In terms of results, Telkom’s half-year profit slumped 36% YoY, driven down by a surge in finance costs and unfavourable foreign exchange shifts. In addition, compared to a restated figure for 1H18, Telkom’s HEPS dropped 44% YoY, although revenue increased 4.7% YoY to R21.5bn despite “the challenging operating environment.”

Blue Label Telecoms (discussed earlier), Invicta Holdings and PPC followed, with MoM declines of 20.4%, 19.5% and 17.5%, respectively. Industrial holding company, Invicta recorded a good run in late November following the release of its 1H19 results, before coming under pressure again in December. Its 1H19 results revealed that revenue came in at R5.28bn (essentially flat), but diluted EPS stood at ZAc149 vs the ZAc13 recorded in the corresponding period of 2018. However, load-shedding and a lack of big projects continued to weigh on its performance. The firm also said that it won’t pay dividend until its debt is lowered and cash flows improve.

Both Steinhoff and Brait (discussed earlier) also featured among the 10-worst performing shares for December with MoM declines of 15.2% and 11.6% MoM, respectively. Rhodes Food Group recorded a MoM decline of 12.2% in December. In late November the company reported a c. 25% YoY rise in FY19 operating profit. Total Group turnover increased 8.5% YoY to R5.4bn, while headline EPS rose 33.3% YoY to ZAc84.

Finally, City Lodge was down 11.1% MoM in December. The company has been under pressure over the past year or so with occupancy levels low. In August, City Lodge attributed the difficult trading conditions it faced to low levels of business and consumer confidence, high unemployment, uncertainty around Eskom, the issue of land expropriation, as well as the negative growth SA experienced in 1Q19.