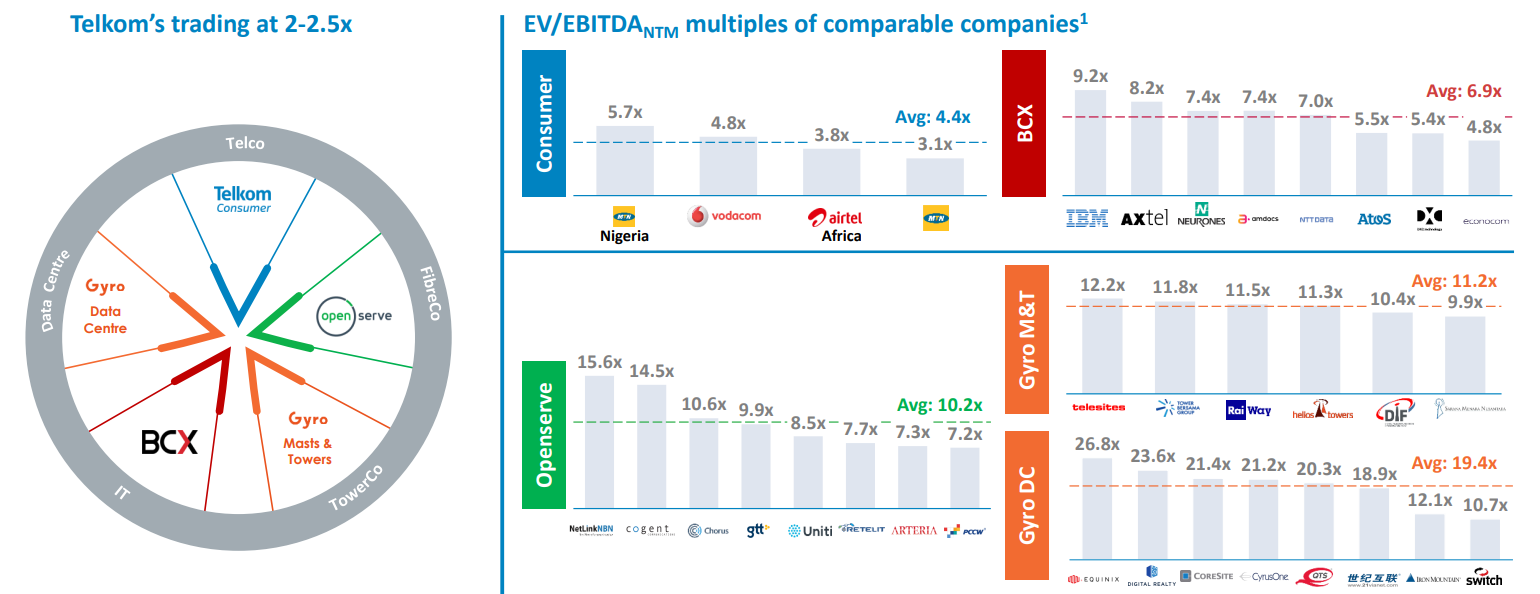

On Tuesday (21 September), Telkom SA SOC Ltd. published a SENS notice saying that it intends to list its Masts & Towers business, held by subsidiary Gyro and to be called Swiftnet, separately on the JSE as part of its value unlock strategy. Telkom said that it currently has 6,225 towers across South Africa (SA) and is SA’s “largest independently run tower portfolio”. In Figure 1 below, we highlight a slide that Telkom showed at the time of its interim results presentation (for the six months ended 30 September 2020) in November 2020. The item to focus on here is Gyro M&T.

Figure 1: Telkom trades at a large discount to listed peers of its divisions

Source: Delta Partners analysis and calculation provided on a non-reliance basis and based on publicly available information extracted from third-party sources. 1. As of 6 November 2020

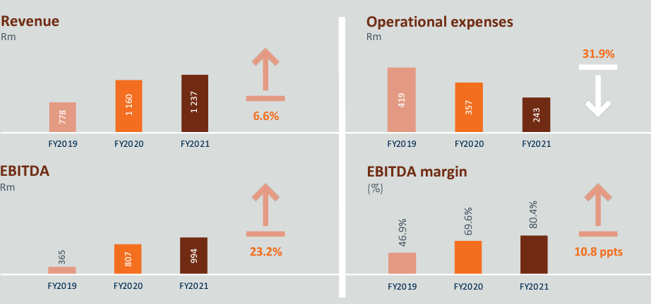

Currently, Telkom is trading at an EV/EBITDA multiple of 2.6x, based on estimated FY22 EBITDA (to March 2022). In FY21, Gyro M&T generated an EBITDA of just under R1bn – Figure 2 shows how it has been growing as Telkom improves the tenancy on its tower network and expanded it. Gyro M&T accounts for 8.3% of Group EBITDA but investors need to be cautious with that number as a fair portion of Gyro M&T’s earnings come from internal transfers – if one adds up all the EBITDA of the various Telkom divisions, it comes to more than 100% of the total Group EBITDA and there is a negative reconciling item at the centre.

Figure 2: Commercialising the M&T portfolio

Source: Telkom

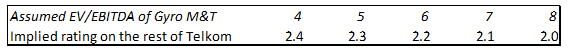

Previously, the market expected Telkom to sell off c. 50% of Gyro M&T to investors and it was thought to be quite well advanced with the process of identifying buyers. The decision to list this business suggests to us that Telkom may have run into problems finding investors able to meet the stringent BEE requirements and pay an appropriate price. Figure 1 above gives some sense as to what tower businesses trade on. If we assume various EV/EBITDA multiples that Gyro M&T might trade at, Figure 3 below highlights what it would imply happens to the rating of the Telkom “rump” (currently on an EV/EBITDA of 2.6x, as mentioned above).

Figure 3: The impact of assumed EV/EBITDA multiples of Gyro M&T on the “rump” of Telkom

Source: Bloomberg, Anchor

Conclusion

We believe that Telkom was cheap before this announcement, and the move to list Gyro M&T is certainly a positive step, in our view. However, we also highlight the following issues that investors should consider:

- Conglomerate structures trade at large discounts to NAV (35% for PSG, 56% for Naspers etc.). While on paper this will likely make the rump look even cheaper than it did before, it is less than 10% of Telkom and it is very possible that the market will not care much about its separate listing.

- It is probably going to take a fair while for Telkom to get through the process of listing Gyro M&T.

- It is not yet clear what proportion of this business Telkom plans to place. We assume that Telkom will use the proceeds to reduce its debt and to fund the upcoming spectrum auction.

- As can be seen in Figure 1, there are other parts of the Telkom Group from which Telkom is positioning itself to extract value. Openserve (its wholesale networks division) is also an interesting utility-type business that Telkom might look to extract value from over the medium term.

We think that Telkom was looking very cheap before this announcement. While the listing of Swiftnet does not in itself look like a transformative step to us, it does reveal the optionality in the Group for those investors prepared to be a bit patient. We believe that there could be some further upside in the Telkom share price over the short term as the value unlock story comes back on the table and investors relook at the company.