Telkom reported solid 1H21 results on 10 November, an extremely difficult period for what is a more commercial/corporate orientated business than most people realise (although this is changing as its mobile segment grows). The areas most exposed to this corporate market (information technology sold by BCX and fixed services, for example) experienced significant pressure as corporates deferred spend and adapted to work-from-home. On the flip side, its mobile segment was a significant beneficiary of lockdown, enabling it to sustain its strong growth momentum. Below we highlight the main points from the results:

- Headline earnings per share (HEPS) were up 25.4% YoY to ZAc219.

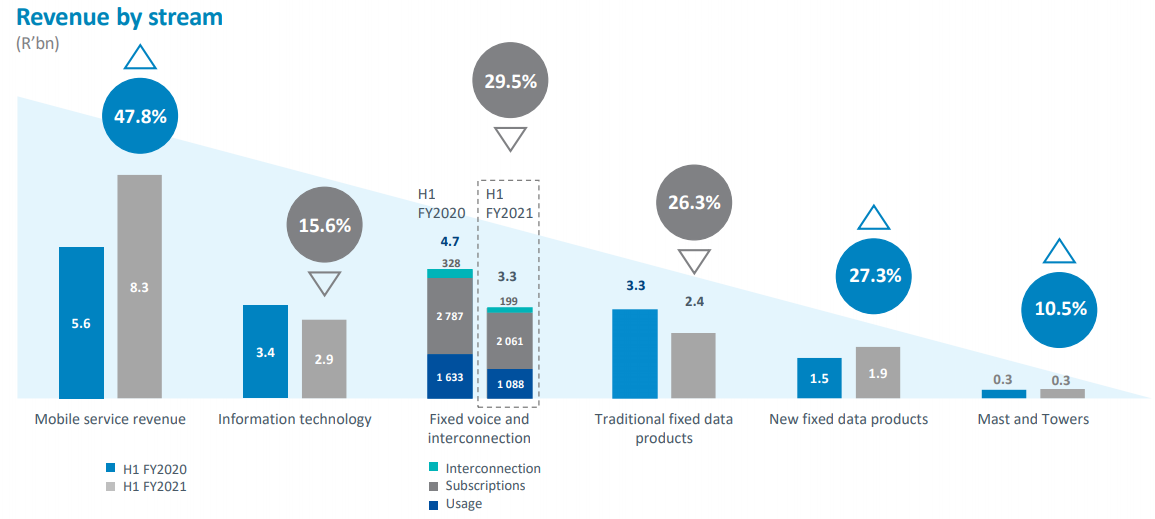

- Revenue was down 0.4% YoY, while EBITDA was up 6.3% YoY. Although revenue was slightly disappointing against Telkom’s own “aspiration” to grow revenue by the low mid-single digits, in part the weakness was due to low levels of hardware sales. This is very low margin and part of the reason why EBITDA grew ahead of revenue. Revenue was also negatively impacted by corporate/commercial exposure, for which lockdown proved to be a significant operational headwind, although we note that this was somewhat offset by another very strong performance from Telkom’s mobile business (see Figure 1 below), which recorded service revenue growth of 47.8% YoY, supported by accelerated data revenue growth of 53.8% YoY.

- In terms of company guidance, we highlight that the comment was made that Telkom expects the corporate/commercial component of the business, that was hit particularly hard during the lockdown, to rebound in 2H20. It was also pointed out that the comparative base for the mobile business in 2H20 becomes more demanding and thus its growth is likely to moderate – both seem reasonable to us.

Figure 1: Telkom’s revenue streams

Source: Telkom

- Aside from the impact of reduced low-margin hardware sales, operating expenditure was well contained, and it benefited to the tune of R400mn from phase-1 of the headcount cuts done very early in 1H20. Telkom is now busy with phase 2, with the BCX reductions currently happening followed by head office etc. being done in early FY22. Telkom says it is on track to deliver R1bn-R2bn of cost savings this year.

- From a quality perspective, investors can rightly point to the absence of topline growth making Telkom reliant on cost-cutting to drive its bottom line as being unsustainable. As Tom Peters put it, “you can’t shrink your way to greatness”. However, one needs to see this concern in the context of the undemanding rating of the share at the moment – trading at just 5.5x its expected earnings for the year to March 2022.

- On the balance sheet side, Telkom has made good progress on releasing cash. The company is promising to release upwards of R1bn this year, through optimising working capital and shifting the financing of handsets to financial institutions. In our view, it is critical that the progress Telkom has made thus far effectively eliminates the risk that has existed that the Group would have to raise capital to finance the purchase of spectrum – this has certainly weighed on the share price, but we believe it is now no longer a concern.

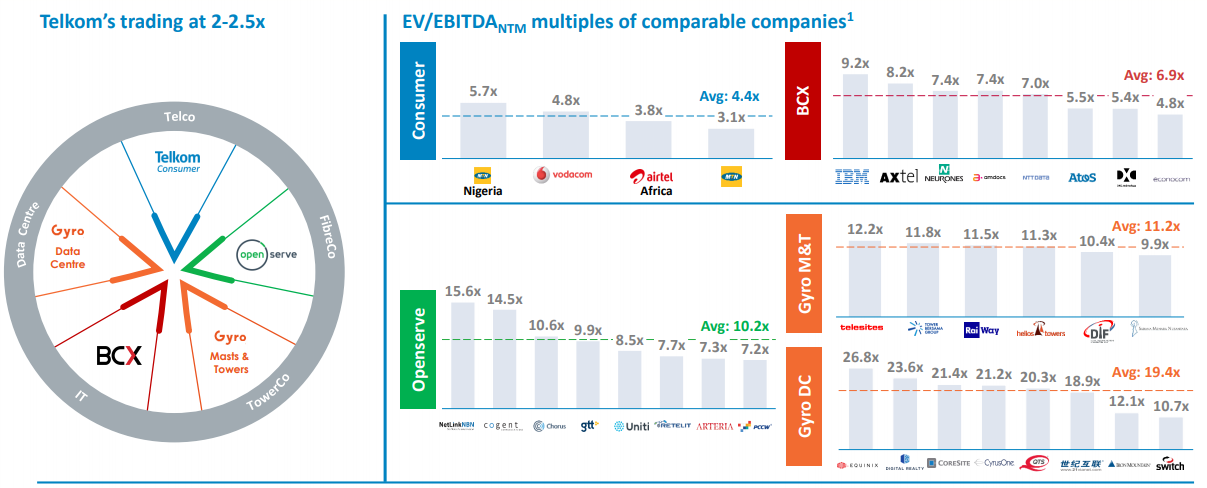

Aside from the results themselves, a particularly important area of focus for us was what management had to say on the company’s progress to realise value. We think management is getting close now to pulling the trigger on a number of things. We have believed for a long time Telkom has been methodically restructuring itself in such a way that the conglomerate could be broken up to release value to shareholders. It currently operates under several different brands (Openserve – the wholesale network/infrastructure provider; BCX – the corporate/commercial client-facing business; Gyro – towers/property and data centres; Telkom – the consumer client facing part), which Maseko says are each “self-sustaining” businesses with their own management structures. It all depends how much of management’s comments the market is prepared to believe here but, as per Telkom’s own presentation, the share is now trading at 2x to 2.5x EBITDA as a conglomerate, where peers of each of its sub-components are on much higher ratings.

Figure 2: Telkom remains undervalued

1.As of 6 November 2020

Source: Telkom, Delta Partners analysis and calculation provided on a non-reliance basis and based on publicly available information extracted from third party sources

- At the company’s last results (FY20) presentation, Telkom’s plan to do a tower deal, which we have seen estimates of value at R16/share, was raised. Maseko says the process of marketing this to potential bidders has already happened and the company is evaluating the responses it has received. Management expects the disposal of a significant minority (49%?) stake to be concluded by the Group’s March year end.

- In this set of results, Maseko discussed spinning out Telkom’s data centre business, followed by the spin-out of Openserve. Separating Openserve’s balance sheet from the rest of Telkom seems to be the final step, at which point Openserve can be more accurately valued as a stand-alone entity – this process has almost been concluded.

In summary, the above “special situation” is what we believe to be the main investment attraction in Telkom. However, risk remains that it could take longer to execute than investors might be prepared to accept. Still, we believe it is now quite close to delivering on at least some of this.

In our view, all things considered, Telkom remains an interesting opportunity for those with the right risk appetite. Questions about its ability to sustain growth in the longer term, when material cost-cutting opportunities have been exhausted, as well as risk around the timing and execution of corporate action aimed at releasing value, mean it may not suit all investors. However, we do believe that the current valuation is very undemanding to compensate for these issues. Telkom is currently trading at c. 7.3x and 5.5x earnings to March 2021 and March 2022, respectively.