Does tax matter?

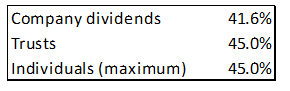

In South Africa (SA), tax rates have increased for several years. Personal tax rates have increased, and even structures such as trusts and companies are now heavily taxed.

Figure 1: SA effective tax rates

Source: Anchor, SARS

Companies, trusts and individuals pay almost half of all declared income to tax. An individual at the maximum income bracket pays ZAc45 in tax for every rand earned. Now, more than ever, tax efficiency makes a material difference to your overall investment return. In fact, any tax saving is equivalent to an increased investment return. So, just how much difference can tax efficiency make?

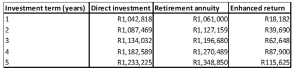

As an example, we will run two simple R1mn cash portfolios side-by-side. The one portfolio is invested in an individual’s hands, in a simple interest-bearing bank account or money market fund. The second portfolio is also invested in a money market fund but with one crucial difference – it is housed within a retirement annuity (RA). Assume a 30% average tax rate for the individual with the interest exemption already fully utilised. The growth inside the RA is tax-free. Let us assume a return of 6% p.a. on the investment. So, what is the difference?

In the individual’s hands, the 6% p.a. return is reduced by tax to become only a 4.2% after-tax return. The RA earns the full 6%. After one year, the tax saving equals an enhanced return of R18,182 inside the RA. After two years, the saving is R39,690. If you track the two portfolios over five years, the RA outperforms the direct investment by R115,625. That sort of number is nothing to scoff at. It equates to 9.4% more in your pocket at the end of five years.

Figure 2: After-tax returns

Source: Anchor, SARS

Are there restrictions on my money?

One of the main concerns around structuring investments is the restrictions on your capital – exit penalties, access to capital, increased costs and inadequate reporting are often noted (quite rightly) as investor concerns.

RAs, in particular, have been the focus of many of these queries. Restrictions on access to capital before age 55 and limits on underlying investment flexibility should be clearly understood when housing investments inside an RA. The proposed two-pot retirement system (effective 1 March 2024) does allow for early withdrawals from retirement funds, including RAs. Still, we note that any withdrawals will be limited, as the aim of the new system is to strike a balance between maximising retirement savings and minimising early withdrawals.

Tell me about the fees

As the adage goes, “nothing is for nothing”. Structures have associated fees, and the effects must be assessed against potential tax savings. Structures such as endowments and RAs have been under intense scrutiny by modern investors. New-generation products such as modern endowments have done a lot to address the concerns around fees – with exit penalties removed, capital liquidity created through the issue of multiple policies (not applicable to RAs), and drastically reduced fees. These structures now merit a place in an overall investment portfolio.

What about estate duty?

South African (SA) taxpayers with assets above the R3.5mn exemption are subject to estate duty (death taxes) at a flat rate of 20%. The rate then increases to 25% for any assets above R30mn. It is important to realise that your beneficiaries will only receive their inheritance after your estate has settled its bill with the South African Revenue Service (SARS). Without proper planning, your estate could be handing the tax man up to one-fifth of all your assets. As daunting as this may seem, there are tools available for estate planning purposes.

A simple and zero-cost method of reducing estate duty is to leave assets to your surviving spouse. Any assets left to your spouse are currently exempt from estate duty, and this preserves the R3.5mn tax exemption, which can be used later in your spouse’s estate. This means that on death, your spouse will benefit from a full R7mn estate duty exemption (R3.5mn exemption x 2).

Do you have any assets held offshore? Beware of offshore death taxes such as situs tax. This is a tax levied for assets offshore, such as property and equities. The threshold before this tax applies differs from country to country. For example, the UK allows the first GBP325,000 free of inheritance tax. In the US, the first US$60,000 is exempt. The balance in both cases is then taxed at a flat 40%. This is double SA estate duty.

Again, there are tools available to address this issue. For example, investing within an offshore insurance wrapper has the advantage of not attracting situs tax, even while holding the same underlying taxable assets. That is a 40% boost to your heirs on your death. Beneficiary nominations on these structures will assist further by avoiding the executor’s fees (another 4% saving).

Which structure is the right one?

For simple investing, often, a single structure may be appropriate. More complex portfolios may require several structures, including trusts, companies, endowments, RAs, etc.

An important note around any investment structuring is to update your will as required. There may even be a need for two wills – one for local assets and one for offshore assets. Specialist advice should always be sought as required. It is essential for any structures to correctly reference any affected assets and take cognisance of applicable legislation and taxes in the relevant jurisdictions.

Who should I be talking to?

Ideally, your accountant, legal council (where applicable) and wealth manager should be aware of any structural changes to your portfolio.

In summary

It is every taxpayer’s right to structure their affairs and investments in the most tax-effective manner possible. Tax is never the sole consideration but instead forms part of the overall investment plan. Smart tax planning is just good investment sense and will affect your returns over the long term.

Disclaimer: The contents of this article are for information purposes only, and the accuracy, completeness, timeliness, or correct sequencing of any of the information contained herein cannot be guaranteed and should thus not be construed as investment advice. Readers should thus only act thereon after having consulted their financial advisor.