Standard Bank released an operational performance update for the three months ended 31 March 2021 (1Q21) on 22 April. On the face of it, 1Q21 was a reasonable quarter (earnings rose 20% YoY), albeit far from an exceptional one, especially when considering that 1H20 was already a low base (1H20 headline earnings were down 43% YoY). The bank said that during 1Q21, the operating environment in South Africa (SA) remained difficult, citing the continuation of electricity supply disruptions and January and February 2021 being negatively impacted by the tighter lockdown restrictions introduced in late December. While these restrictions had eased by March, activity levels remained below those seen in 1Q20 (pre-pandemic).

Below we highlight some of the points coming out of this trading update:

- Mortgage disbursements remained strong and were well ahead of 1Q20. However, the revenue pressures which were experienced in 2H20 continued into 1Q21.

- Vehicle and Asset Finance and Personal Unsecured disbursements were in line with 1Q20.

- Net interest income declined YoY, as higher average interest-earning asset balances were more than offset by lower margins vs 1Q20.

- Non-interest revenue was down due to lower activity-related fees and lower trading revenue vs 1Q20.

- However, operating expenses were well managed and declined only marginally YoY.

- Credit performance in 1Q21 was largely in-line with market expectations. Credit impairment charges were lower than in the comparative period (1Q20), but this was driven principally by lower charges in the bank’s Wholesale Client segment

- YoY, Group headline earnings were buoyed by a stronger performance from Liberty and Industrial and Commercial Bank of China (ICBC) Standard Bank PLC. This more than offset a small decline in banking activities’ headline earnings.

- Earnings attributable to ordinary shareholders rose by 20% YoY.

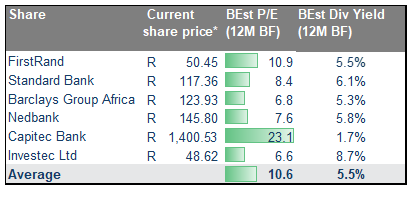

Figure 1: Overview of Standard Bank’s performance vs peer group

Source: Bloomberg, Anchor. * as at 23 April 2021.

SA banks are hardly inspiring at current levels and in the present operating environment. However, we do believe that there is a catch-up trade here for standard Bank, especially after its recent share price underperformance (the share price is down c. 7% YTD and has dropped by c. 18% from10 March 2021 to Monday’s [26 April] close).