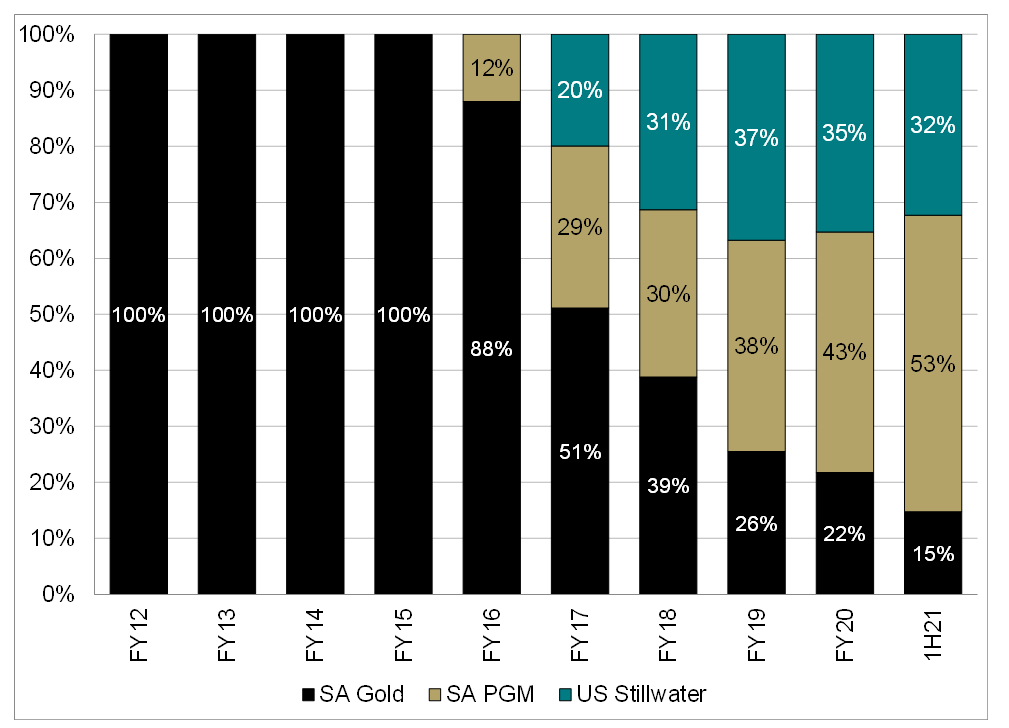

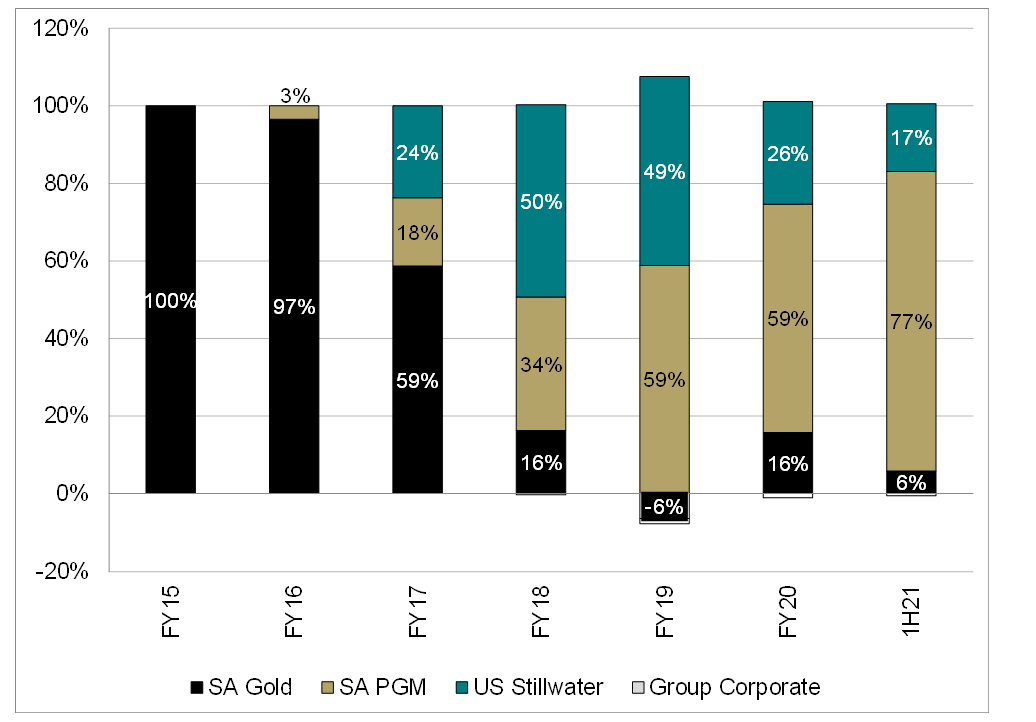

Sibanye-Stillwater reported 1H21 results on Thursday (26 August), with the company recording very strong earnings growth, which was driven by a recovery in SA gold volumes (+29% YoY) and higher SA platinum group metals (PGM) prices and volumes (+42% YoY). Gold now accounts for a very small part of the business at 15% of revenue (see Figure 3) and 6% of adjusted EBITDA (see Figure 3) in 1H21, respectively. Group 1H21 profit more than doubled to R25.32bn vs R9.73bn in 1H20 and was above the previous high of R20.89bn, which was achieved in 2H20. Normalised earnings of R24.41bn soared 176% YoY. Increased output, at its SA PGM and gold operations, reflects a sustained recovery from the COVID-19 disruptions experienced in 2020, although production at the Group’s US PGM operations were flat. Gross debt was reduced by 44% YoY to R15.9bn at the end of June (vs R28.14bn as at 1H20).

The total dividend payout of c. R8.54bn (R2.92/share) was equivalent to 35% of normalised earnings and at the upper end of the range specified in its dividend policy to pay 25%-35% of earnings. In addition, Sibanye, spent R742m or R0.25/share on share buybacks. Nevertheless, we had hoped that the company would be more aggressive in returning cash to shareholders. Some peers in the broader mining sector that have already reported their June 2021 results returned a much higher proportion of their earnings to shareholders.

Given that Sibanye started the year with a net cash position and is generating significant cash (1H21 free cash flow [FCF] per share stood at R5.84), we had hoped to see the company do something similar. That being said, Sibanye would not be generating the huge amount of FCF it is if it had not done its PGM M&A drive a few years ago. So, it is hard to argue that management does not have a good track record in recent years with acquisitions.

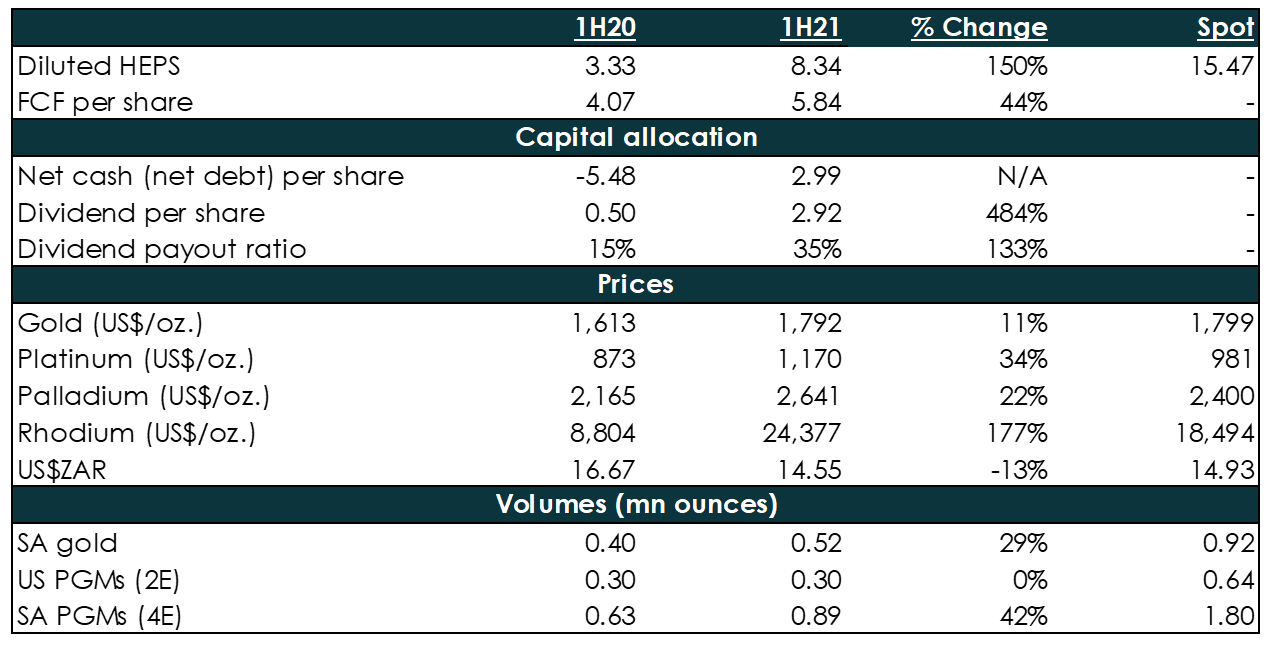

Figure 1: Sibanye-Stillwater 1H21 results overview, in US$bn except per share

Source: Anchor, Bloomberg

Part of the results presentation focused on Sibanye’s ambitions to diversify into a green metals business. Its areas of focus include lithium, nickel, hydrogen, cobalt, copper, manganese, graphite, and uranium (see Figure 2 below). Sibanye has also committed to its acquisition strategy not compromising the dividend.

Figure 2: Putting the puzzle pieces together … positioning Sibanye-Stillwater as a provider of strategic metals for tomorrow’s green technologies

Source: Sibanye-Stillwater

Gold now accounts for 15% of total revenue and c. 6% of adjusted EBITDA

Figure 3: Sibanye-Stillwater revenue by operating segment

Source: Anchor, Bloomberg

Figure 4: Sibanye-Stillwater adjusted EBITDA by operating segment

Source: Anchor, Bloomberg

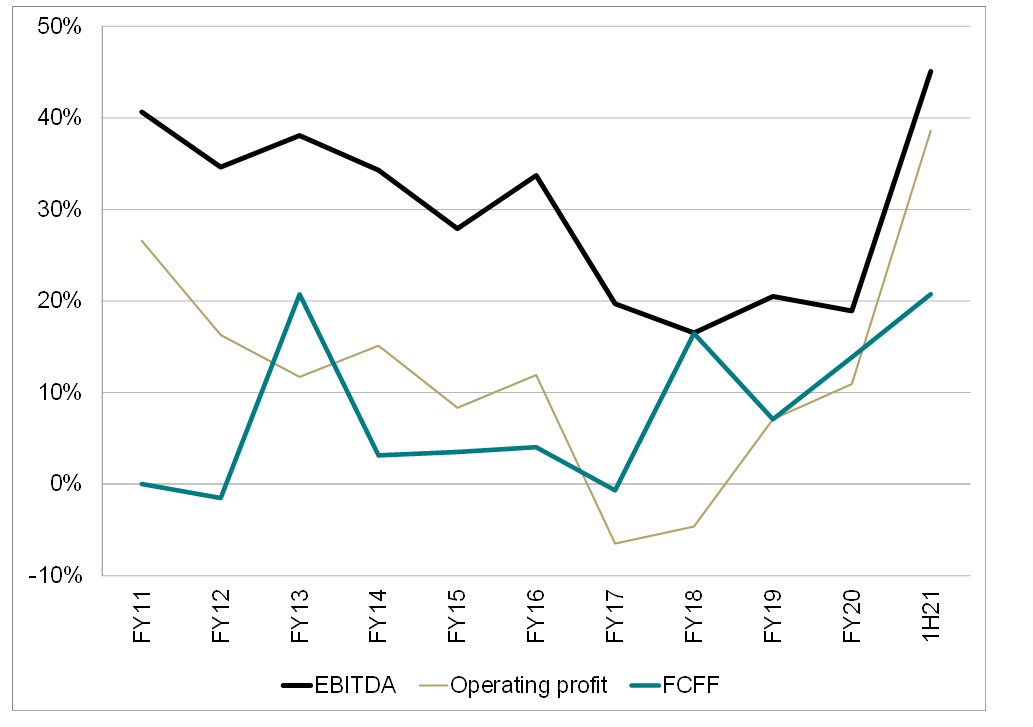

Figure 5: Sibanye-Stillwater margins

Source: Anchor, Bloomberg

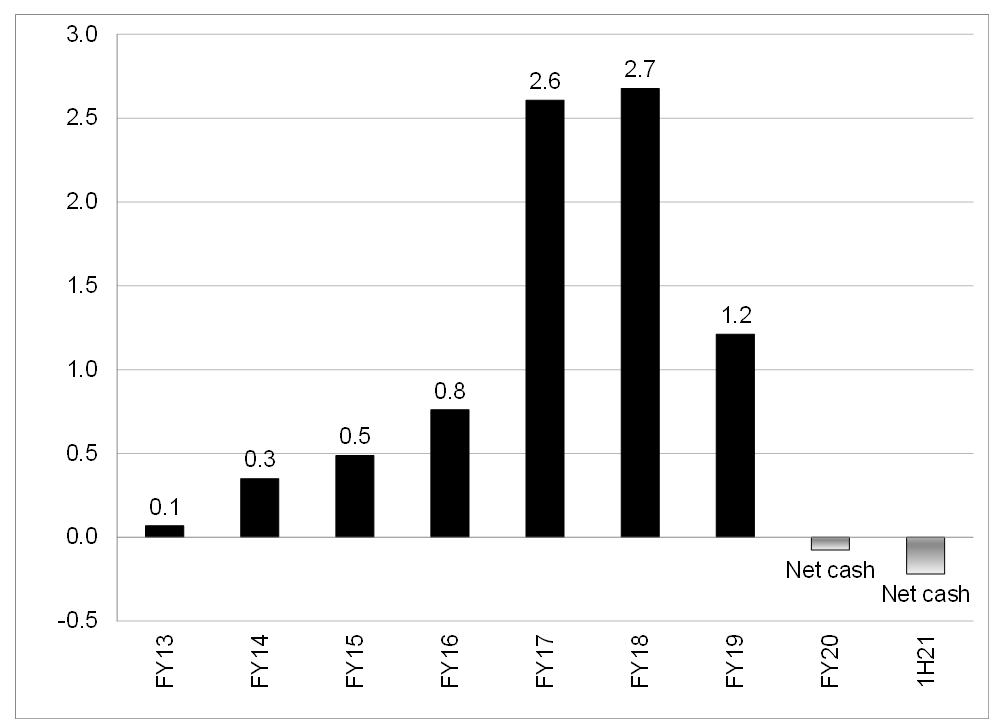

Figure 6: Sibanye-Stillwater net debt/ adjusted EBITDA

Source: Anchor, Bloomberg

We estimate run-rate earnings of R15.42/share at spot prices, putting the share at just under 4x that earnings number. Sibanye’s share price performance this year has been disappointing (YTD [to 27 August’s close] the share is down 0.2%). Management believes that the share is cheap vs its peers and acknowledged that its recent history of high debt and intentions to do acquisitions creates an overhang. There is an investor day scheduled to take place in September, where Sibanye will go into more detail on its green metals strategy. At this stage, we do not know how much capital will be spent on the Group’s green metals drive. Therefore, we would hold the share until the investor day next month, with a view towards exiting if the capital required for this green metals push is too high.